May 2025

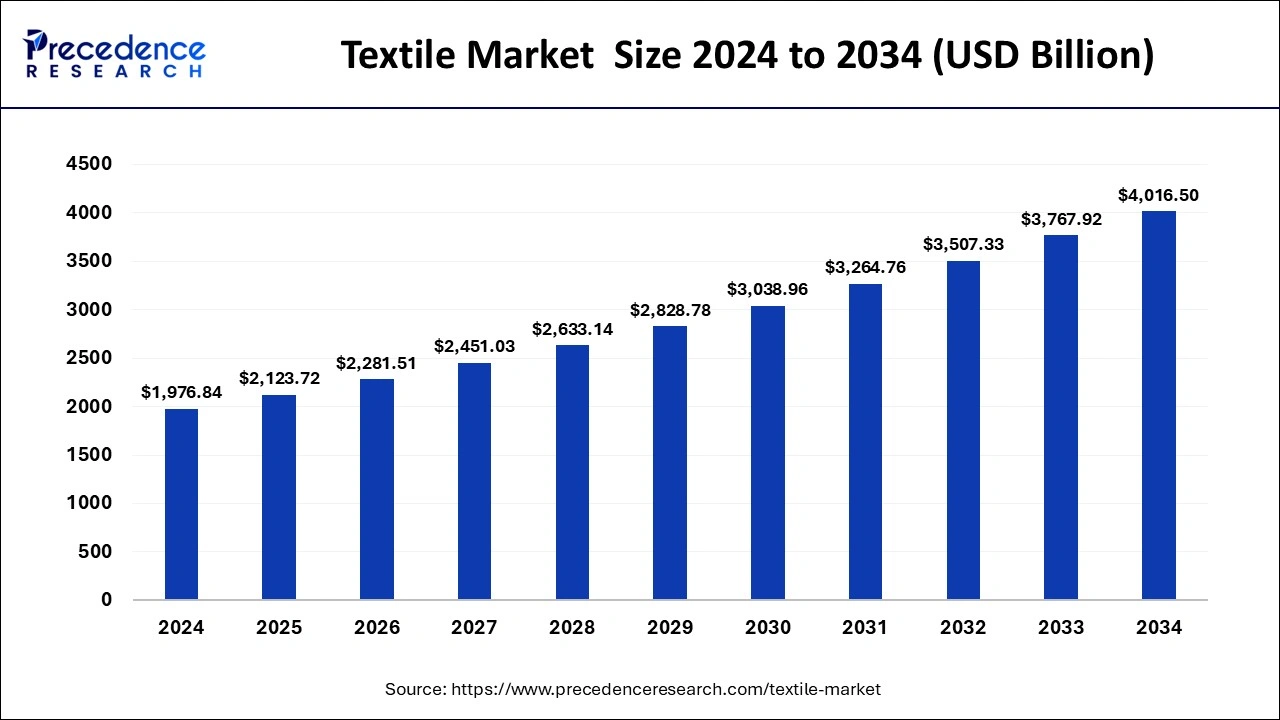

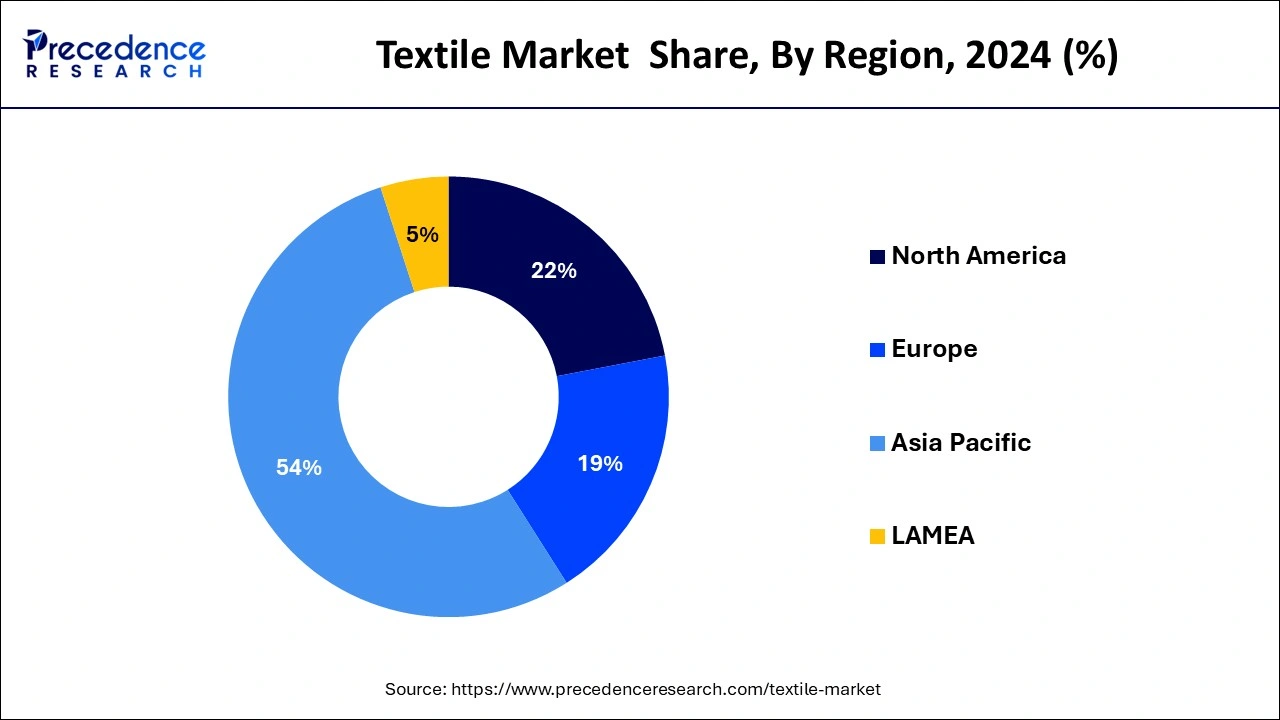

The global textile market size is calculated at USD 2,123.72 billion in 2025 and is forecasted to reach around USD 4,016.50 billion by 2034, accelerating at a CAGR of 7.35% from 2025 to 2034. The Asia Pacific textile market size surpassed USD 1,146.81 billion in 2025 and is expanding at a CAGR of 7.45% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global textile market size was estimated at USD 1,976.84 billion in 2024 and is predicted to increase from USD 2,123.72 billion in 2025 to approximately USD 4,016.50 billion by 2034, expanding at a CAGR of 7.35% from 2025 to 2034. The rising demand for natural fibers globally is driving the growth of the textile market.

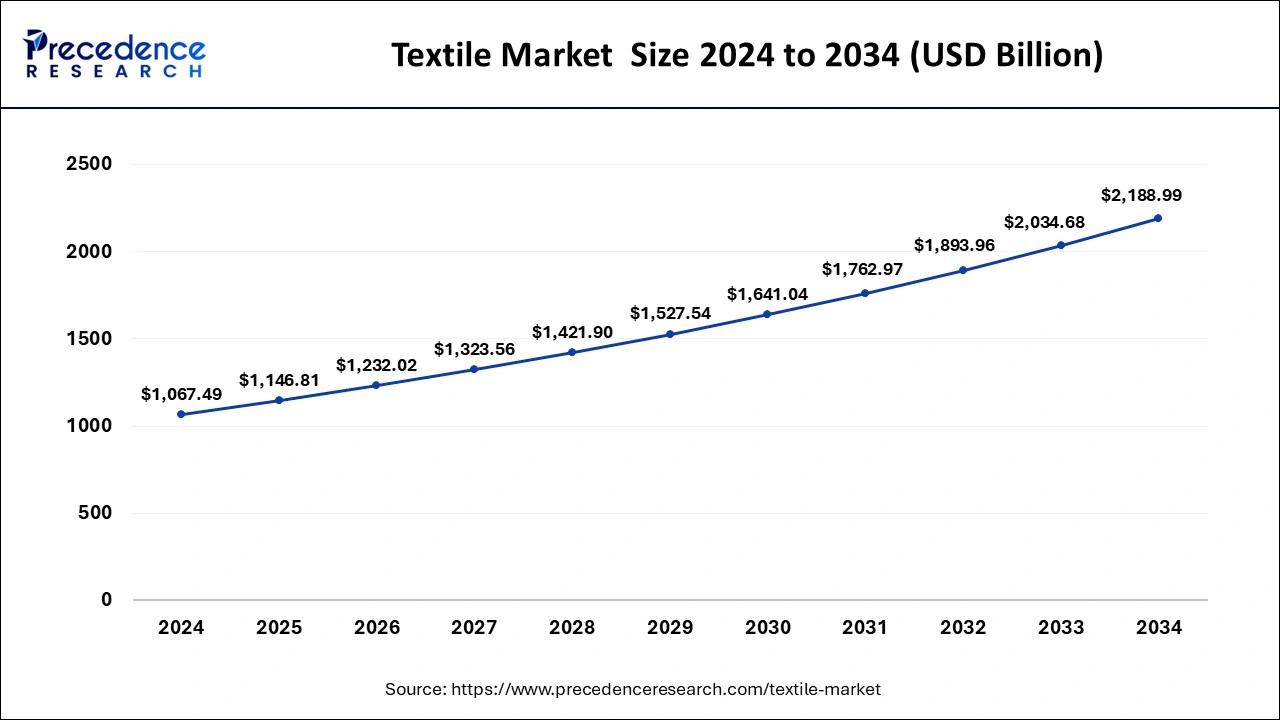

The Asia Pacific textile market size was estimated at USD 1,067.49 billion in 2024 and is predicted to be worth around USD 2,188.99 billion by 2034 at a CAGR of 7.45% from 2025 to 2034.

Asia-Pacific dominated the textile market in 2024. The growth of the market is generally driven by the easy availability of raw silk along with rising demand for fashionable clothes and home furnishing commodities. Moreover, the rising use of e-commerce for buying apparel, along with the rising young age population that tends to buy designer and fashionable clothes, is driving the growth of the textile market. Also, the rising interest of people in modeling and fashion designing, coupled with the increasing trend of wearing imported clothes, further accelerates market growth positively. Additionally, increased investments from the governments of countries such as India, China, Bangladesh, and others have also boosted the market growth. Furthermore, the presence of prominent market players such as Arvind Limited, Vardhman Textiles Ltd., Welspun India Ltd., Reliance Industries Limited (Textiles), Aditya Birla Group (Textiles), Raymond Ltd, and others are adopting strategies to strengthen their customer base and maintain their dominance in the industry.

North America is estimated to be the fastest-growing region during the forecast period. The growth of the market is generally driven by the rising per capita income of people, a large number of warehouses for storage, a high standard of living, an increasing working population, and an upsurge in demand for durable clothes from the armed forces. For instance, in February 2024, GALLS, a leading supplier of America’s military goods, acquired LVI.

This acquisition aimed to deliver clothing and textile functions, military logistics, and supply chain solutions to ensure accurate delivery in tough situations during warfare. Moreover, the availability of raw materials at low prices, along with rising demand for premium clothes from the sports sector and Hollywood, has also driven the market growth.

Europe is estimated to grow at a significant rate during the forecast period. The growth of the market is generally driven by the increasing demand for organic fabrics along with the rising trend of consumers towards online shopping. Moreover, the implementation of government policies and trade agreements such as the Euro-Mediterranean Dialogue and free-trade agreements that are favorable for textile manufacturing, in turn, boost the market growth.

Also, the market's growth can be attributed to factors such as growing awareness regarding the latest fashion trends and an upsurge in demand for designer clothes from the cinema industry. Furthermore, the presence of several market players such as Inditex, Tirotex, Salvatore Ferragamo SpA, Koninklijke Ten Cate NV, Chargeurs SA, and others that are engaged in research & development of textiles and adopting several strategies such as acquisition, product launches, and partnerships to maintain their dominance in the market.

The textile market is one of the oldest industries in the world. This industry mainly deals in the production, designing, and distribution of a wide range of materials, such as clothing, fabrics, and yarn. The textile industry has experienced gradual evolution due to cultural influences and technological developments. Globalization has further increased the growth of the textile industry as it allows the buying and selling of textile-based products throughout the globe. This market is highly fragmented due to the presence of large and small market players that deal in the manufacturing of products ranging from apparel and home decor to medicinal fabrics, industrial uses, and others.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.35% |

| Market Size in 2025 | USD 2,123.72 Billion |

| Market Size by 2034 | USD 4,016.50 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw-material, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness of people towards eco-friendly textile products

The rising demand for environmentally friendly and sustainable textiles is a prominent driver that has reshaped the textile industry. With the rising awareness regarding global environmental issues, buyers, regulatory bodies, and companies are adopting sustainable practices to minimize the environmental concerns related to textile production. Consumers have become highly aware of their purchasing choices and are opting for textiles that do not have any environmental impact. Thus, governments of countries such as the USA, India, China, and others have announced strict regulations and standards to encourage textile manufacturers to adopt clean production techniques and reduce chemical usage in the textile industry.

High production cost

The rising prices of raw materials such as natural or synthetic fibers, yarns, and fabrics have negatively impacted the textile market. Also, high labor costs and the rising costs of machinery involved in the textile industry are challenges for market players to sustain in the industry. To maximize profits, companies tend to increase the cost of a finished item. This, in turn, is expected to restrain the growth of the textile market.

Adoption of smart clothing

Smart clothing is also known as e-textile or smart fabric and consists of embedded systems that monitor the functionalities of the human body. The growing adoption of smart clothes integrated with GPS and AI technology in sports and entertainment industries, along with their applications in mining industries, is an ongoing trend. Thus, the advent of smart clothing is expected to create ample growth opportunities for market players in the upcoming years.

The cotton segment dominated the textile market in 2024. This segment is driven by the rising demand for cotton from several industries, such as apparel, medical dressings, and garments industry. Also, the high availability of cotton in countries such as the U.S., India, China, and others is boosting market growth. Moreover, the rise in exports of cotton for various applications such as diapers, home furnishings, and others, along with the rise in research and development projects to support cotton production, has further driven the growth of the textile market.

The wool segment is expected to be the fastest-growing during the forecast period. This growth is mainly driven by several factors, such as the manufacturing of insulation products and their application in carpeting and upholstery. Moreover, the rising use of wool in the manufacturing of musical instruments and the production of tennis balls and sports gear due to its high durability and thermal properties.

The natural fibers segment held the largest market share in 2024. This segment is generally driven by factors such as the rising use of apparel and fashion industry and increasing awareness regarding sustainable clothing. Also, the growing demand for natural fibers for designing the interiors of cars and the rising application of natural fibers for medical usage has also accelerated the growth of the textile market. Moreover, the increasing application of natural fibers for making ropes and paper production further drives the growth of the textile industry.

The polyester segment is expected to grow at a significant rate during the forecast period. The growing demand for polymers due to their cost-effectiveness, resilience, and durability has driven the growth of the market. Also, the rising use of polyester for the production of jackets, sportswear, and gym wear, along with its usage in the production of tires and safety belts for cars, has further boosted the growth of the textile market.

The fashion & clothing segment dominated the market in 2024. The market growth is attributed to factors such as the rising disposable income of people who tend to buy clothes regularly, along with the ongoing trend of wearing branded clothes. Also, the growing demand for formal clothes to wear at office and marriage parties coupled with the rising trend of t-shirts with custom designing has further boosted the fashion & clothing market, which, in turn, has driven the growth of the textile market. Additionally, the growing urbanized population across the world is likely to travel from one place to another, which in turn increases the demand for casual wear, thereby driving the growth of the textile industry.

The technical segment is estimated to be the fastest-growing segment during the forecast period. The growth of this segment can be attributed to factors such as increased demand for textiles with high-performance properties, along with its rising application in transportation, automotive, and protective clothing. Also, rising developments in the production and supply of construction and medical apparel by companies have also boosted the market growth.

By Raw-material

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

September 2024

March 2025