August 2024

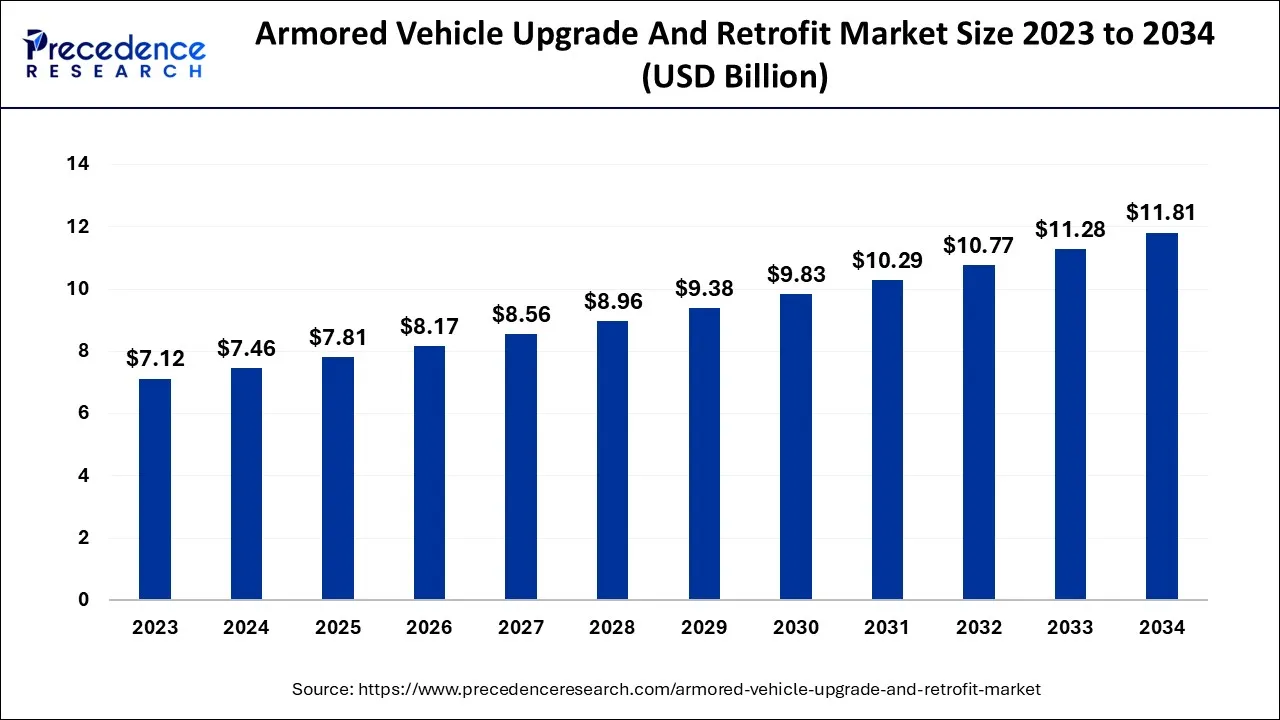

The global armored vehicle upgrade and retrofit market size accounted for USD 7.46 billion in 2024, grew to USD 7.81 billion in 2025, and is expected to be worth around USD 11.81 billion by 2034, poised to grow at a CAGR of 4.7% between 2024 and 2034.

The global armored vehicle upgrade and retrofit market size is expected to be valued at USD 7.46 billion in 2024 and is anticipated to reach around USD 11.81 billion by 2034, expanding at a CAGR of 4.7% over the forecast period from 2024 to 2034.

The transportation and ground combat vehicles used for a variety of offensive and defensive activities are known as armored vehicles. These vehicles are typically used for operations in live battles as well as the transporting of military personnel, equipment, and supplies. These vehicles are outfitted with weaponry and protected by armor from projectiles like bullets and shell shards. The armies of nations benefit greatly from the armored vehicles. They are widely used by military units all over the world.

The demand for implementing the most cutting-edge technologies into land vehicles has increased due to the rise in terrorism and hostile actions around the world, which in turn has been fueling the market for armored vehicle upgrades and retrofits. Additionally, the growing fleet of armored vehicles has compelled countries to fund upgrading programs to improve productivity, lethality, and communication. During the projected years, this is expected to be the key factor driving the market for armored vehicle upgrades and retrofits.

Additionally, the development of weapon systems, communication systems, as well as new materials for vehicle protection and armor, will lead to a demand for an upgrade of current armored vehicles, creating anticipated market opportunities for the market for armored vehicle upgrade and retrofit. The major players operating in the market are General Dynamics Corporation, Rheinmetall AG, BAE Systems PLC, Oshkosh Corporation, and Thales Group.

In real terms, the total amount spent on the military worldwide increased by 0.7% in 2021, reaching USD 2113 billion. According to new figures on global military spending provided by the Stockholm International Peace Research Institute (SIPRI), the United States, China, India, the United Kingdom, and Russia jointly accounted for 62% of expenditure in 2021.

The Indian military ranks fourth in terms of firepower, according to the world power index, with a score of 0.0979 (0.0 being the highest possible score). The Indian government has set a USD 25 billion defense production goal by 2025 (including USD 5 billion in exports by that year). With a total outlay of USD 66 billion, India is one of the largest defense spenders in the world. This amount represents 13.31% of the overall budget and represents an increase of USD 5.9 billion above the budget predictions for 2021-2022.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.12 Billion |

| Market Size by 2034 | USD 10.77 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.71% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing military spending

Over the projected period, higher military expenditure is anticipated to drive the market's expansion. Due to their disputes and rivalries with other nations, nations all around the world are spending money on their armed forces. The operation, upkeep, arming, armored vehicle procurement, and military R&D are all covered by military spending. For instance, in April 2022, the total global military spending was anticipated to rise by 0.7% in real terms to $2113 billion, according to the Stockholm International Peace Research Institute (SIPRI), a Sweden-based international research institute on arms control, transfers, and non-proliferation. Spending climbed for the eighth consecutive year in this period. Between 2012 and 2021, American military R&D spending climbed by 24%, while China, the second-largest military spender in the world, spent an estimated $293 billion on its military in 2021, a rise of 4.7% over the previous year. For the past 27 years, China has boosted its military budget.

High cost of armored vehicles

The armored vehicle market is anticipated to grow slowly throughout the forecast period due to the high cost of armored vehicles. Because armored vehicles are fitted with strict attention to quality to offer uncompromised protection while on the route, armored vehicles are expensive. An armed personnel carrier like the Inkas Sentry Civilian, for instance, has a starting price of $350,000. As a result, the armored vehicle market is unable to expand due to its high price.

Emergence of unmanned armored vehicles

Unmanned armored vehicles are a major trend that is becoming more and more popular in the armored vehicle market. Military groups all around the world are experimenting with the deployment of unmanned armored vehicles to better understand what such systems may bring and how they can be best integrated into existing power structures. For instance, the Indian Army was interested in the first unmanned armored vehicle from SOORAN that was able to combat on battlefields and operate from a distance in March 2020.

A multi-terrain artificial intelligence vehicle called Sooran is equipped with a gasoline engine and has three control options: distant teleoperation, mobile control station teleoperation, and autonomous mode. Thus, this is expected to offer a lucrative opportunity for market growth over the forecast period.

Based on the type, the global armored vehicle upgrade and retrofit market is segmented into Armored Personnel Carrier (APC), Infantry Fighting Vehicle (IFV), Mine-resistant Ambush Protected (MRAP), Main Battle Tank (MBT) and Others. The Infantry Fighting Vehicle (IFV) segment is expected to grow at the highest CAGR during the forecast period.

The nations have been focusing on enhancing the firepower, ergonomics, and functional features of the outdated infantry fighting vehicles. For instance, in June 2021, PSM GmbH (a 50/50 joint venture between Rheinmetall and Krauss-Maffei Wegmann) was given a contract by the Federal Office for Bundeswehr Equipment, Information Technology, and In-Service Support (BAAINBw) to upgrade the first batch of Puma IFVs owned by the Bundeswehr. The company will modernize 154 vehicles under the terms of the contract, with an option to modernize an additional 143 Puma IFVs.

The contract was awarded as part of the German Bundeswehr objective to maintain a combat-ready, completely digital fleet of IFVs. By 2029, it is anticipated that all vehicles will have undergone modernisation. Similar to this, the Indian government began a local upgrading of BMP-2/2K Sarath infantry combat vehicles (ICVs), which had been in use by the Indian Army since the Soviet era.

The third-generation thermal imager-based gunner sight, the advanced thermal imager-based commander sight, the modernized fire control system, and the automatic target tracker are all upgrades that the Army aims to implement. The growth of the segment is anticipated to speed up throughout the forecast period as a result of these armed force's modernisation plans.

North America is expected to dominate the market during the forecast period. The growth in the region is attributed to the growing defense expenditure in the countries like the United States. According to the SIPRI, US military expenditure accounted for USD 801 billion in 2021. In addition, the US funding for military R&D rose by 24% between 2012 and 2021. Moreover, the presence of major prominent players in the region is expected to drive market growth over the forecast period.

The major players in these industries are General Dynamics Corporation, Bae Systems Plc, Oshkosh Corporation, Textron Inc. and Navistar International Corp. Furthermore, the US defense ministry is focused on deploying armored electric vehicles for efficient operational capabilities, thereby driving the market growth.

The Middle East and Africa are expected to grow at the highest CAGR over the forecast period. The growth in the segment is attributed to the increasing investments of armed forces in the region in the region in the modernization of existing land platforms. Governments in the region have invested in bolstering their armed forces as a result of rising insecurity, violent conflicts, and threats from insurgent groups like the Boko Haram insurgency and al-shabab militants, among others, across several geopolitical zones in recent years.

Algeria has started several armored vehicle improvement schemes in this region. By May 2021, Algeria had converted 360 BMP-2 tracked armored IFVs to BMP-2M IFVs that were standard and had Berezhok turrets that were armed with four Kornet anti-tank guided missiles. To improve target identification accuracy and mission effectiveness, the vehicles also have an advanced target detection system, a laser range finder, and a thermal imaging system.

The first updated M1A2K Abrams main battle tank with a new Auxiliary Cooling and Power System (ACPS) and Counter Sniper Anti Material Mount (CS/AMM) with a 12.7mm M2 heavy machine gun was given to the Kuwaiti Armed Forces in July 2021. In the upcoming years, it is projected that the market will develop as a result of these modernisation efforts.

The Asia Pacific is growing at the fastest rate over the forecast period. The expanding government initiatives to bolster military capability for counterterrorism have been responsible for the industry expansion in the region. The growth of the defense industry is a priority for many government organizations. Otokar, a Turkish bus and military vehicle manufacturer, increased its market reach in the Asia Pacific in March 2022.

At the Defense Services Asia fair in Kuala Lumpur, Malaysia, the company showed its ARMA 66-wheeled armored vehicle and COBRA II tactical armored vehicle. China, South Korea, and India are among the nations making investments in the creation and acquisition of cutting-edge armored vehicles. Asia Pacific manufacturers are investing a lot in research and development to create innovative and hybrid armored vehicles for improved marine and border patrolling.

Throughout the projected period, rising military spending and a rise in the need for medium-sized, light-armored vehicles for patrolling activities are also anticipated to spur market expansion in the region. Elbit Systems Ltd., a multinational high-tech company active in a variety of homeland security, commercial, and military applications, signed a tank and armored vehicle contract with the Asia Pacific government in January 2021. As a prime contractor for the three-year project, the company will provide the Sabrah light tank, a tracked or wheeled light tank based on the tracked ASCOD platform, and the Pandur II eight-wheel drive vehicle.

Segments Covered in the Report

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

January 2025

January 2025