Electric Vehicle Market Size and Forecast 2025 to 2034

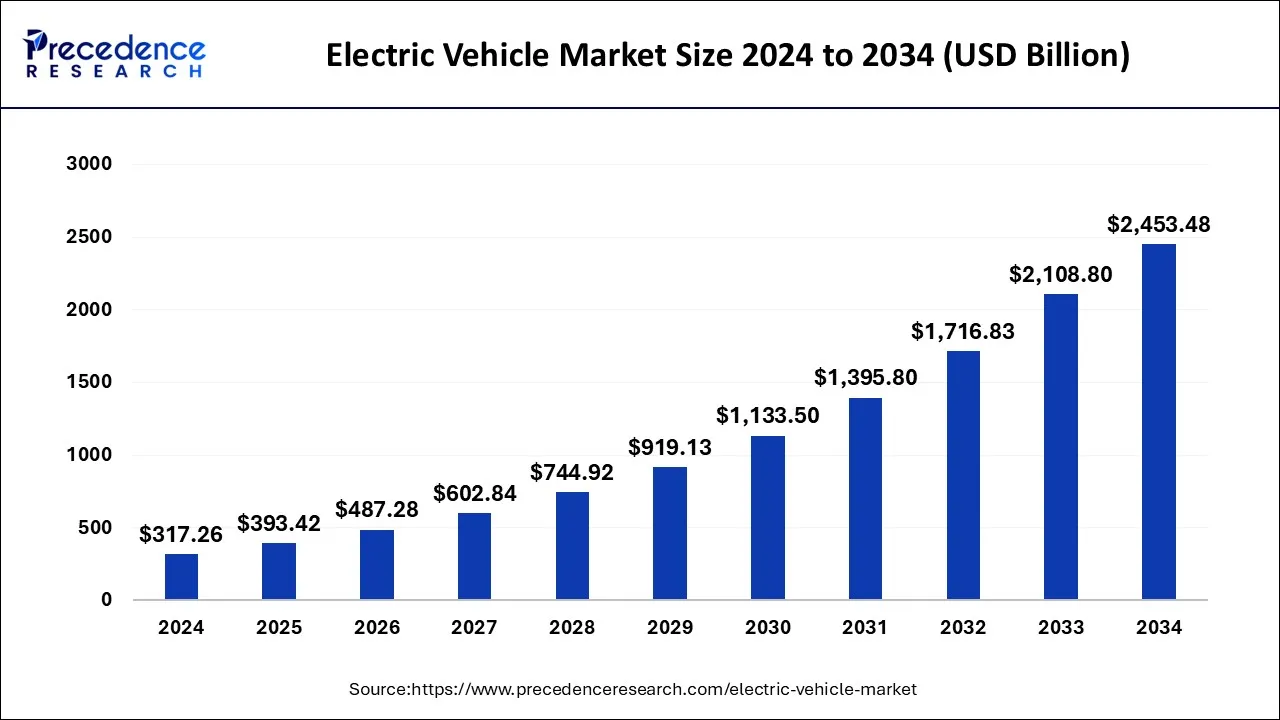

The global electric vehicle market size was estimated at USD 890.72 billion in 2024 and is predicted to increase from USD 988.70 billion in 2025 to approximately USD 2,529.10 billion by 2034, expanding at a CAGR of 11% from 2025 to 2034.

The growing funding and investments by key market players drive the electric vehicle market growth. Ford had previously stated that it would invest $11.5 billion in electrifying its vehicle lineup between now and 2022. It recently claimed that it had upped its spending on driverless and electrified vehicles to help boost vehicle sales in the face of ongoing lockdowns. Mercedes-Benz also confirmed that it will release 25 new plug-in hybrid electric vehicles and entirelyelectric carsby 2025. Companies' diverse product offers have attracted many customers, resulting in an expanding market for electric vehicles.

Electric Vehicle Market Key Takeaways

- In terms of revenue, the EV market is valued at $988.70 billion in 2025.

- It is projected to reach $2,529.10 billion by 2034.

- The market is expected to grow at a CAGR of 11% from 2025 to 2034.

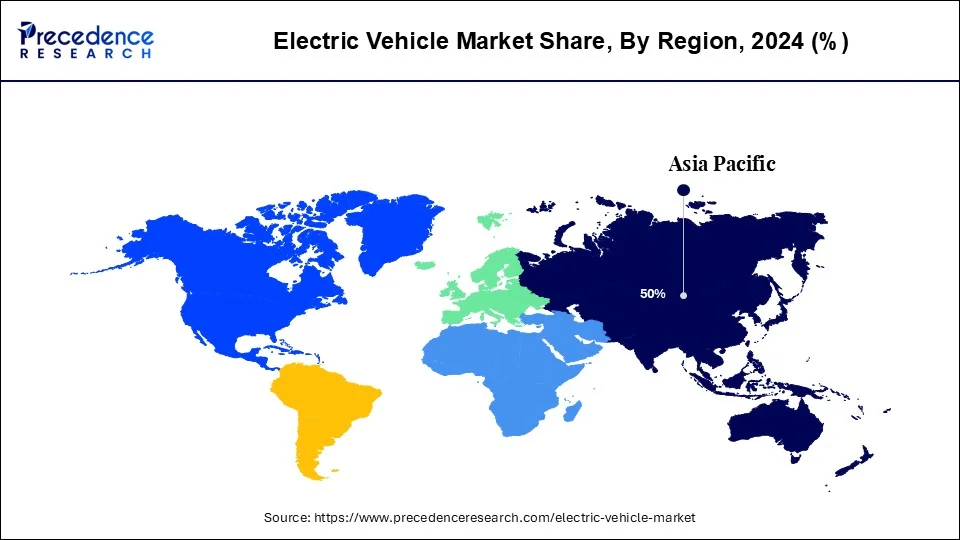

- Asia Pacific dominated the global market with the largest market share of 49% in 2024.

- North America is anticipated to witness the fastest growth in the market during the forecasted years.

- Europe has emerged as a significant player in the global market.

- By Propulsion Type, the Battery Electric Vehicle (BEV) segment held the largest market share in 2024.

- By propulsion type, the Fuel Cell Electric Vehicles (FCEVs) segment is anticipated to show considerable growth in the forecast period.

- By vehicle type, the passenger cars segment dominated with the biggest market share in 2024.

- By vehicle type, the trucks segment is anticipated to show considerable growth over the forecast period.

- By drive type, the Front-wheel Drive (FWD) segment held a significant market share in 2024.

- By drive type, the All-wheel Drive (AWD) segment is anticipated to show considerable growth in the forecast period.

- By vehicle speed, the 100MPH-125MPH segment contributed the highest market share in 2024.

- By vehicle speed, the less than 100 MPH segment is anticipated to show considerable growth in the forecast period.

- By vehicle class, the low-price electric vehicle segment captured the biggest market share in 2024.

- By vehicle class, the mid-price electric vehicle segment is expected to register a moderate CAGR over the forecast period.

- By end-use, the personal segment held the largest market share in 2024.

- By end-use, the commercial segment is projected to witness significant growth in the forecast period.

AI to Transform Electric Vehicle Features?

AI has become a transformative approach in electric vehicles to improve efficiency, safety features, and performance. AI-powered predictive maintenance and process optimization play a crucial role in detecting potential issues and providing decision-making ability to enhance overall vehicle performance. artificial intelligence (AI) in battery management is extending range and enhancing overall battery efficiency. AI-enabled virtual assistance and infotainment systems offer personalized experiences to the drivers. The increased demand for self-driving electric vehicles is experiencing a major shift thanks to AI. AI enables advancements in autonomous driving as well as smart charging infrastructure and vehicle-to-everything communication, to enhance the performance and experience of drivers as well as passengers.

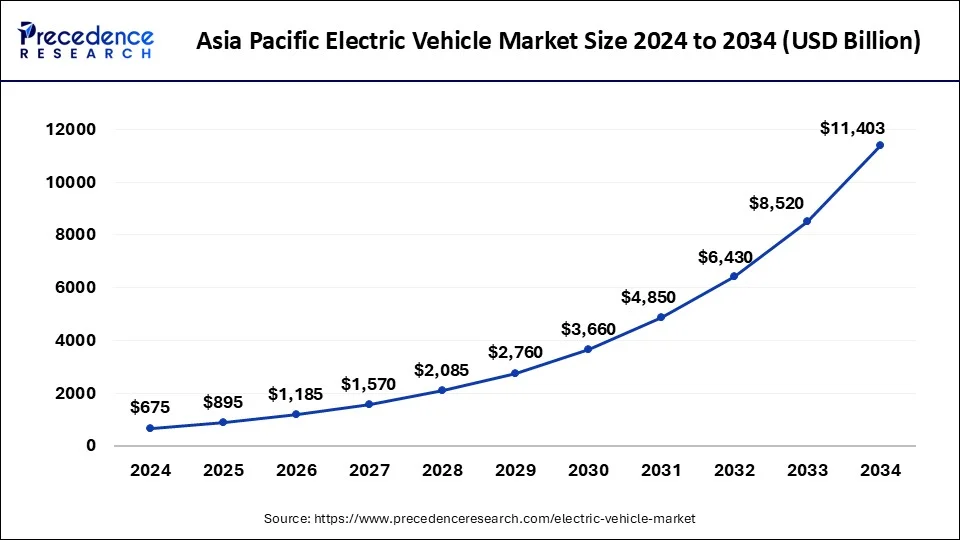

How Big is the Asia Pacific Electric Vehicle Market?

The Asia Pacific electric vehicle market size has been calculated at USD 491.90 billion in 2025 and is anticipated to reach approximately USD 1,377.10 billion by 2034. The EV industry is poised to grow at a double-digit CAGR of 12.10% from 2025 to 2034.

Large Manufacturing Capabilities: to Drive Asian Electric Vehicle Market

The Asia Pacific region dominated the electric vehicle market in 2024 and is anticipated to have the highest CAGR of all the geographies during the forecast period. Asia Pacific is home to most EV battery manufacturers, including China, South Korea, and Japan. The dominance of the battery industry is increasing in China. Countries like Japan, Korea, and India are also opportunistic markets as the governments of these countries are significantly investing in EV startups to promote the manufacturing and sale of EVs across the globe. The governments of developing and developed nations are providing subsidies to market players, and stringent regulations are driving the growth of the electric vehicle market in the Asia-Pacific region

China's government Boosting Electric Vehicle Market

China is primarily attributable to the country's extensive government support and expansion of the infrastructure for charging electric vehicles, improvements in the quality of electric vehicles, and an increase in the number of charging stations. China's Ministry of Transport provides grants and other incentives for developing low-emission bus fleets, affecting the market even more favorably. Chinese manufacturers like CATL and BYD have increased and widened their global market shares due to the government's extensive investments and encouraging regulations.

'Make in India' Initiatives Encouraging Indian Electric Vehicle Manufacturing and Adoption

Indian government's involvement in building a electric vehicle charging infrastructure is also boosting the Asia Pacific EV market. For instance, the FAME II initiative in India provides funding of up to USD 135 million to stimulate investment in EVSE for electric buses. This should pay for one low-power charger and one rapid charger for every ten buses. Thus, the market for electric vehicles in the Asia Pacific area is expanding due to the factors mentioned above. Government initiatives like ‘Make in India' are not only developing countries manufacturing advancements but also providing opportunities for youth.

- In March 2025, the Indian government proposed fully exempting cobalt powder and waste, the scrap of lithium-ion batteries, lead, zinc, and 12 more critical minerals to secure their availability for manufacturing in India and promote more jobs for India's youth in the Union Budget 2025-26.

Japan Electric Vehicles Market Trends

Japan is significantly growing in the electric vehicles market. The high production of lithium-ion batteries fuels the development of electric vehicles. The strong government support for EVs through subsidies and tax reductions helps market growth. The extensive government investment in the charging infrastructure increases the adoption of electric vehicles. The focus on innovation and the presence of a robust automotive sector help the market growth. The increasing use of electric vehicles for commercial purposes, like Honda N-VAN e, and the growing availability of EV models support the overall growth of the market.

Increased Competition and Innovation Boosting North American Electric Vehicle Market

North America is anticipated to witness the fastest growing rate in the electric vehicle market in the forecast period, with increased competition and technological advancements and innovation. Government and companies heavily invest in technological advancements to enhance the performance and efficiency of electric vehicles attracting consumers.

For instance, to promote electric vehicles in North America, policymakers, automotive manufacturers, and charging network companies have launched a non-profit organization called ‘Veloz.' The organization aimed to attract innovation, investment, marketing, and growth in the electric vehicles market. Electrify America, a U.S.-based electric vehicle manufacturer, announced to invest of USD 2 Bn in Zero Emission Vehicle (ZEV) infrastructure across the U.S. over ten years from 2017 to 2027, out of which USD 800 Mn was invested in California, one of the largest ZEV markets across the world.

U.S. Electric vehicle Market Trends

The U.S. is dominating the electric vehicle market in the North American region, and the rising demand for electric automobiles in the U.S. accounts for this proportion. In addition, Electrify America, a non-profit organization dedicated to promoting electric vehicle adoption, announced intentions to invest $200.0 million in California in 2018. As a result, demand for electric vehicles in North America is expected to rise over the projection period.

European Strict Emigration Regulations in Development of Electric Vehicles

The upsurge in the growth of the electric vehicles market in the European region is highly attributed to the harmonious developments in implementing strict emigration regulations by the European Union and adding a focus on reducing the number of conventional buses. Norway leads the way for electric mobility relinquishment in Europe. The environmental net-zero goals, various regulatory policies, and technological advancements are transforming electric vehicle areas in Europe.

Zero-Emission Vehicle Demands to Drive UK's Market

The UK is leading the market in Europe with its well-established battery electric vehicle manufacturing capabilities. The UK is a leader in the battery electric vehicle (BEV) market. The UK has strong consumer demand for electric vehicles. Government initiatives and investments in electric vehicle production and charging infrastructure expansion are increasing adoption of electric vehicles in the UK. Zero-emission commitments are driving adoption of electric vehicles in the country.

Germany Electric Vehicle Market Trends

Germany is a significant player in the European electric vehicle market. The presence of key vendors, government support, and heavy investments in electric vehicle production and technology are the factors contributing to this growth.

Rapid Urbanization Surge Demand for Electric Vehicles in Latin America

Latin America is growing in the electric vehicles market. The increasing awareness about climate change and the rising demand for cleaner alternatives increases the adoption of electric vehicles. The focus on clean electricity alternatives like renewable sources increases the development of electric vehicles. The rapid urbanization and growing demand for commercial vehicles drive the overall growth of the market.

Market Overview

The electric vehicle market has witnessed spectacular growth due to various factors like increased sustainability concerns, decarbonization commitments, government initiatives, demand for high-performance vehicles, and development of charging infrastructures. Electric car and two-wheeler registration is up year-on-year. Companies are launching novel and innovative modules to attract consumers. Businesses are investing heavily in electric vehicle production and developments to showcase their net-zero commitments. Government support and investments in manufacturing industries are enabling advanced performance and efficiency of electric vehicles. Government policies for consumers that use electric vehicles are further contributing to adoption growth.

- For instance, in February 2025, Madhya Pradesh, India, launched its EV Policy 2025, which provides subsidies ranging from ₹5,000 to ₹10 lakh across various vehicle categories. The five-year policy aims to achieve specific EV adoption targets by 2030, including 15% for four-wheelers and 40% for two-wheelers.

Electric Vehicle Market Growth Factors

- Government Initiatives: A significant number of initiatives taken by the government of various countries, such as tax rebates, subsidies & grants, and other non-financial benefits in car registration and access to carpool lanes expected to drive the sale of electric vehicles. Strict government rules & regulations toward vehicle emigration along with reduction in cost of electric vehicle batteries and adding fuel costs.

- Environmental Concerns: Rising concern over climate change and air pollution is shifting toward adoption of electric vehicles. Stringent environmental regulations and government promotions are fueling adoption range.

- Demand for Self-driving Vehicles: consumers are seeking automated vehicles, fueling developments of automatic-driving electric vehicles for the market. The need for user-friendly, value-added features and the advantages of decreased accident threats are driving the popularity of self-driving vehicles.

- Technological Advancements: The increase in demand for fuel-efficient, high-performance, & low-emission vehicles has surged for technological advancements, including battery advancements, material science, and improvement of range and cost-effectiveness, making electric vehicles a more ideal option for consumers.

- Growth in Charging Infrastructure: Countries are focusing on expanding charging infrastructure, contributing to electric vehicle market growth. Availability of charging stations reduces range anxiety and enables adoption of electric vehicles.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 988.70 Billion |

| Market Size by 2034 | USD 2,529.10 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Propulsion Type, Components, Vehicle Type, Vehicle Class, Top Speed, Vehicle Drive, EV Charging Point Type, V2G, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Electric Vehicle Market Dynamics

Driver

Global Net-Zero Commitments

The global net-zero commitments are the major factor contributing to promoting the use of electric vehicles. Governments and companies have shifted their decarbonization emphasis with the adoption of electric vehicles. As air pollution occurring due to fossil fuel-based transportation has become a major concern, the shift to electric vehicles has taken opportunities. Government policies for electric vehicle adoption further fuel market expansion. Technological advancements are improving performance, range, and cost-effectiveness, making electric vehicles an ideal solution for consumers. Sustainability trends are making electric vehicles competitive with traditional vehicles, aligning with consumers increased demand for sustainable solutions.

Restraint

Battery Longevity and Replacement Costs

Battery longevity and replacement cost are the major hindrances to the adoption of electric vehicles. Battery degradation and limited driving range influence consumer experiences as well as expenses. Battery longevity concerns hamper electric vehicle adoption for long-distance travel, as they cause a risk of "range anxiety" for potential EV buyers. The high upfront cost and uncertainty around replacement cost have a high impact on the purchasing range.

Opportunity

Development of Charging Infrastructure

Limitation of changing infrastructure was the major restraint in the electric vehicle market. However, increased government and key vendor initiatives and investments in the development of advanced charging infrastructure are enabling high adoption of electric vehicles in various countries. Globally, government bodies are taking the initiative to improve strategies and programs to develop rapid charging infrastructure. Several investments are taking place worldwide to expand commercial charging to support HDVs. For instance, through direct investment, California and a few other US regions are promoting the construction of the infrastructure needed for electric HDVs.

The largest hydrogen refueling network in North America has been supported by the California Energy Commission (CEC) with more than USD 125 million for 62 public stations as part of the state's ambition to establish 200 stations by 2025. Investments have been primarily focused exclusively on LDV refueling infrastructure till 2020. A plan to allocate up to USD 115 million more for hydrogen refueling infrastructure, including fueling for medium- and heavy-duty trucks, was approved later in December 2020. Thus, these initiatives by the government will create lucrative opportunities for the electric vehicle industry.

- In February 2024, Hyundai Motor India expanded its ultra-fast EV charging network with 11 new stations, providing quick and convenient 24/7 charging using advanced technology. The MyHyundai app allows users to discover, navigate, pre-book slots, make payments, and monitor status. Future plans include installing 100 stations by 2027.

V2G Technology:

Vehicle-to-Grid (V2G) technology is the novel approach in the electric vehicle market. The technology allows electric vehicles to supply electricity back to the grid and helps to maintain energy storage and grid stabilization. Bidirectional energy transfer application of V2G technology improves grid reliability and optimizes energy distribution. V2G technology is significant in enhancing renewable energy integration, reducing grid cost, and improving efficiency, making electric vehicles more efficient, high-performing, sustainable, and affordable. V2G technology is also driving innovation in battery technology and charging infrastructure, with improving efficiency, extending lifespan, and biodegradability.

Propulsion TypeInsights

Battery Electric Vehicles (BEV) led the global market and accounted for more than 67.7% of the overall revenue share in 2024. The significant growth of the BEV is mainly due to the potential benefits offered, such as control over greenhouse gas (GHG) emissions, energy security concerns, and control over local pollutants. This can be due to people's growing awareness of the environment and the benefits of battery electric vehicles. The potential benefits of the BEV, including reducing local pollution, energy security issues, and greenhouse gas (GHG) emissions, are primarily responsible for its rapid expansion. This results in people being more conscious of the environment and the advantages of battery-powered cars. In addition, compared to PHEV, the expense of a BEV is more considerable. As a result, battery electric vehicles rule the electric vehicle market.

Moreover, the cost associated with BEV is more significant compared to the PHEV. The PHEV is expected to witness the fastest CAGR of around 43.5% owing to numerous benefits over BEV; some are low battery cost with smaller battery size and more extended driving range as they are equipped with liquid fuel tanks and internal combustion engines. Additionally, many EV manufacturers such as Volkswagen Group and General Motors are focusing on multi-platform technology with extensive attention towards PHEVs as they can be refueled at any gas station. At the same time, BEVs can only be charged at public charging stations, and public charging spots are far between and very few in the city. Thus, PHEV offers flexibility and freedom to drivers. In January 2020, Volkswagen AG increased its plug-in electric car sales by 60%, from nearly 50,000 to over 80,000 in 2019.

The fuel cell electric vehicles segment is anticipated to grow at the loftiest CAGR during the cast period. This segment's rapid-fire growth is substantially attributed to the adding demand for vehicles with low carbon emigrations, strict carbon emigration morals, and growing emphasis on the relinquishment of FCEVs owing to benefits associated with fast refueling adding government enterprise and investments for advancing fuel cell technology.

Vehicle Type Insights

The passenger car segment accounted for the largest market share in 2024, with growth driven by increased demand for affordable and compact electric vehicles. Government initiatives, including tax rebates, direct purchase subsidies, and reduced registration fees, are making electric passenger cars more attractive. The increased environmental sustainability concern is driving adoption of electric passenger cars. Additionally, technological advancements are reducing limitations like range anxiety and charging infrastructure, making electric vehicles an attractive option. Technological advancements such as battery technology and performance enhancements are driving consumer surge for adoption of passenger electric cars.

The trucks segment is projected to witness significant growth in the forecast period. Electric trucks are rapidly gaining in popularity. Electric trucks, such as heavy-duty trucks, light-duty trucks, and medium-duty trucks, are majorly being adopted. The increased demand for sustainable solutions in logistics and transportation is driving adoption of electric trucks. The adoption of electric trucks has increased in urban logistics.

Drive Type Insights

The front-wheel drive (FWD) segment leads the market due to its cost-effectiveness, flexibility, and efficiency. Front-wheel drive (FWD) electric vehicles are flexible in design, making space for other components such as large batteries. The adoption of front-wheel drive (FWD) is high in urban areas due to its suitability for urban environments. The ability of front-wheel drive (FWD) to lower manufacturing costs makes it a popular solution.

- In January 2025, the MG M9 made its India debut at the 2025 Bharat Mobility Show by showcasing model features like a 90 kWh lithium battery pack paired to a front axle-mounted electric motor and FWD (front-wheel drive) system. This electric MPV is claimed to offer a WLTP range of 430km on a single charge.

The all-wheel drive (AWD) segment is anticipated to witness notable growth in the upcoming period. All-wheel drive (AWD) provides high vehicle performance and safety features. Technological advancements, including advancements in automotive engineering like electronic stability programs, have enhanced the reliability and performance of all-wheel drive (AWD) systems. Consumers rising awareness about vehicle safety and performance features is driving segment growth.

Vehicle Speed Insights

The 100MPH-125MPH segment dominated the market in 2024, driven by increased demand for sustainable and high-performance electric vehicles. 100MPH-125MPH speed of electric vehicles is moderate speed with practical need of urban transportation. The need for electric vehicles for both city driving and highway driving is driving the 100MPH-125MPH segment.

On the other hand, the less than 100 MPH segment is expected to lead the market in the forecast period due to increased demand for high-speed electric two-wheelers and three-wheelers. India is the major country holding the largest adoption of less than 100 MPH electric vehicles. Consumer need for vehicles for urban-centric transportation and traffic conditions is fueling the segment.

Vehicle Class Insights vehicles

The low-price electric vehicle segment generated the largest market share in 2024. Consumers are seeking affordable electric vehicles. Growing awareness of sustainability and government initiatives in promoting adoption of electric vehicles has surged demand for cost-effective and eco-friendly transportation solutions. Growing charging infrastructure and availability of model options enable adoption of electric vehicles among cost-conscious consumers.

The mid-price electric vehicle segment is the second-largest segment leading the market. Manufacturers are making electric vehicles more accessible to a large consumer base. Government initiatives, charging infrastructure developments, and advancements in battery technology are driving the popularity of electric vehicles. Consumers have increased demand for budget-friendly, feature-rich, and eco-friendly transportation solutions, including electric vehicles.

End-use insights

The personal segment dominated the market in 2024, driven by technological advancements, government initiatives, and developments in charging infrastructure. Changing consumer preference toward transportation due to growing environmental awareness and demand for cost-effective alternatives are driving adoption of electric vehicles for personal use. Additionally, government promotions for electric vehicle adoption and the availability of advanced charging stations are driving consumer demand for electric vehicles for personal use.

The commercial use segment will likely grow at the loftiest CAGR during the forthcoming period. This segment's high growth is credited to the rise in fuel prices and strict emigration morals set by governments, the growing relinquishment of independent delivery vehicles, and the adding relinquishment of electric motorcars and cars. The rapid expansion of this segment can be attributed to rising fuel prices and government-imposed severe emigration morality, the growing relinquishment of independent delivery vehicles, and the increasing relinquishment of electric motorcars and cars.

Electric Vehicle Market Companies

- Ampere Vehicles

- Hyundai Motor Company

- Benling India Energy and Technology Pvt Ltd

- BMW AG

- BYD Company Limited

- Chevrolet Motor Company

- Energica Motor Company S.p.A.

- Ford Motor Company

- General Motors

- Hero Electric

- Karma Automotive

- Kia Corporation

Leader's Announcements

- In January 2025, Tarun Garg, COO of Hyundai Motor India, announced 2025 to be a year of "big change” for the Indian electric car market. He assured Hyundai Motor India will play a critical role in driving adoption in the nascent yet fast-emerging EV space.

Investments

- In July 2025, the UK government announced £63 million to charge Britain's EV infrastructure. The £25 million is used to expand cheaper at-home charging and focus on installing 100000 charging points. The £8 million is used for the electrification of medical fleets and ambulances. (Source: https://www.gov.uk)

- In June 2025, Tata Motors plans to invest up to $4 billion in electric vehicles over the next 5 years. The aim is to sustain the position of top electric vehicle manufacturer. (Source: https://www.business-standard.com)

- In December 2024, the UK's BII is to invest $33.5 million in India's electric vehicle companies. The institution would invest $3.5 million in Vecmocon for the EV component, $15 million in Everest Fleet, and $15 million in TI Clean Mobility for EV manufacturing. The investment focuses on offering affordable financial options and enhancing manufacturing capabilities. (Source:https://economictimes.indiatimes.com)

- In November 2024, Mahindra plans to invest Rs. 4500 crore for the development of electric vehicles, XEV 9e and BE 6e. The investment focuses on increasing 120000 units production capacity in the Chakan facility. (Source: https://auto.hindustantimes.com)

- In March 2015, JSW Group set out to raise Rs. 1487 crore for the development of a new unit in Maharashtra. The new facility has an annual production capacity of 5000 electric trucks and 10000 electric buses. The aim of projects is to support green mobility. (Source:https://www.autocarpro.in)

Recent Developements

- In January 2025, Maruti Suzuki announced the launch of its first electric SUV, the e Vitara, at the Bharat Mobility Global Auto Expo. This launch is expected to be held till the end of April.

- On April 16, 2025, the title of 2025 World Electric Vehicle was given to the Hyundai INSTER at the globally renowned 2025 World Car Awards ceremony, held during the New York International Auto Show (NYIAS).

- On April 22, 2025, Renault announced the launch of two next-gen cars and two new SUVs based on a new platform.

Segment Covered in the Report

By Vehicle Type

- Scooters

- Motorcycles

- Three-Wheelers

- Passenger Cars

- Buses

- Trucks

By Propulsion Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Drive Type

- Front-wheel Drive (FWD)

- Rear-wheel Drive (RWD)

- All-wheel Drive (AWD)

By Vehicle Speed

- Less Than 100 MPH

- 100MPH to 125MPH

- Above 125 MPH

By Vehicle Class

- Low Priced

- Mid-Price

- High Price

By End Use

- Personal

- Commercial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting