February 2025

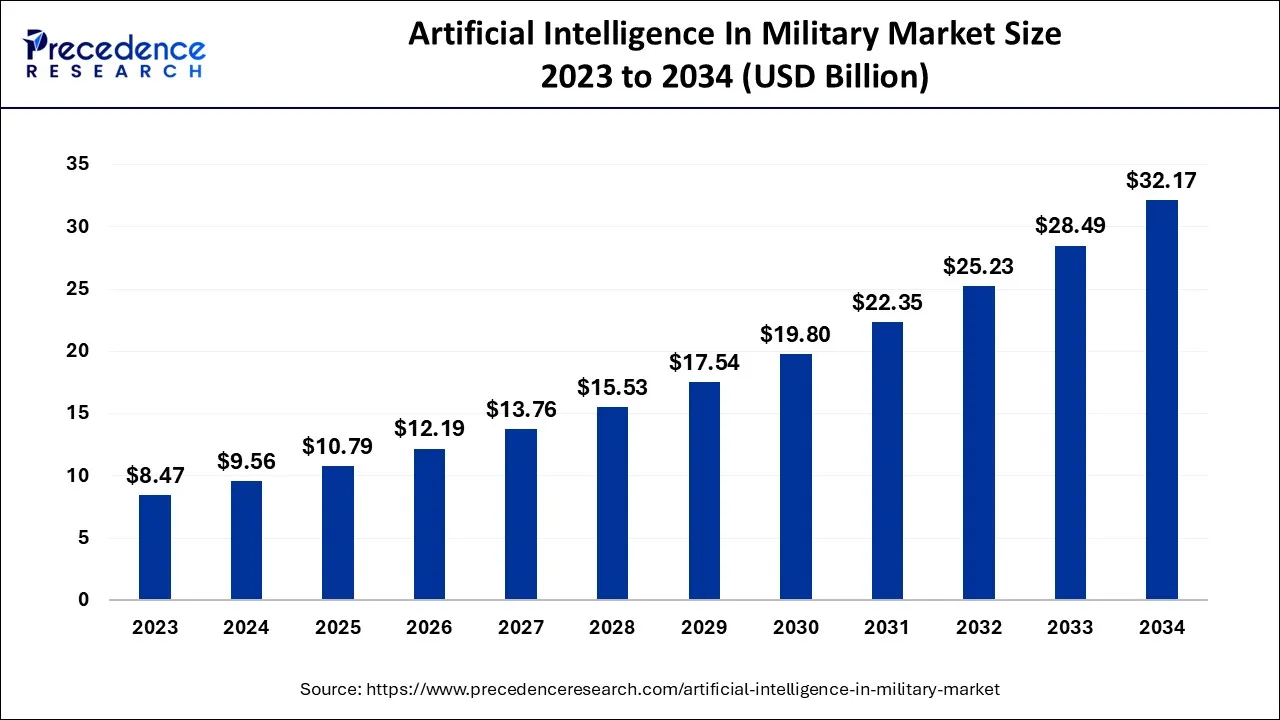

The global artificial intelligence in military market size accounted for USD 9.56 billion in 2024, grew to USD 10.79 billion in 2025 and is expected to be worth around USD 32.17 billion by 2034, registering a CAGR of 12.9% between 2024 and 2034. The North America artificial intelligence in military market size is calculated at USD 3.44 billion in 2024 and is estimated to grow at a CAGR of 13.06% during the forecast period.

The global artificial intelligence in military market size is calculated at USD 9.56 billion in 2024 and is projected to surpass around USD 32.17 billion by 2034, growing at a CAGR of 12.9% from 2024 to 2034.

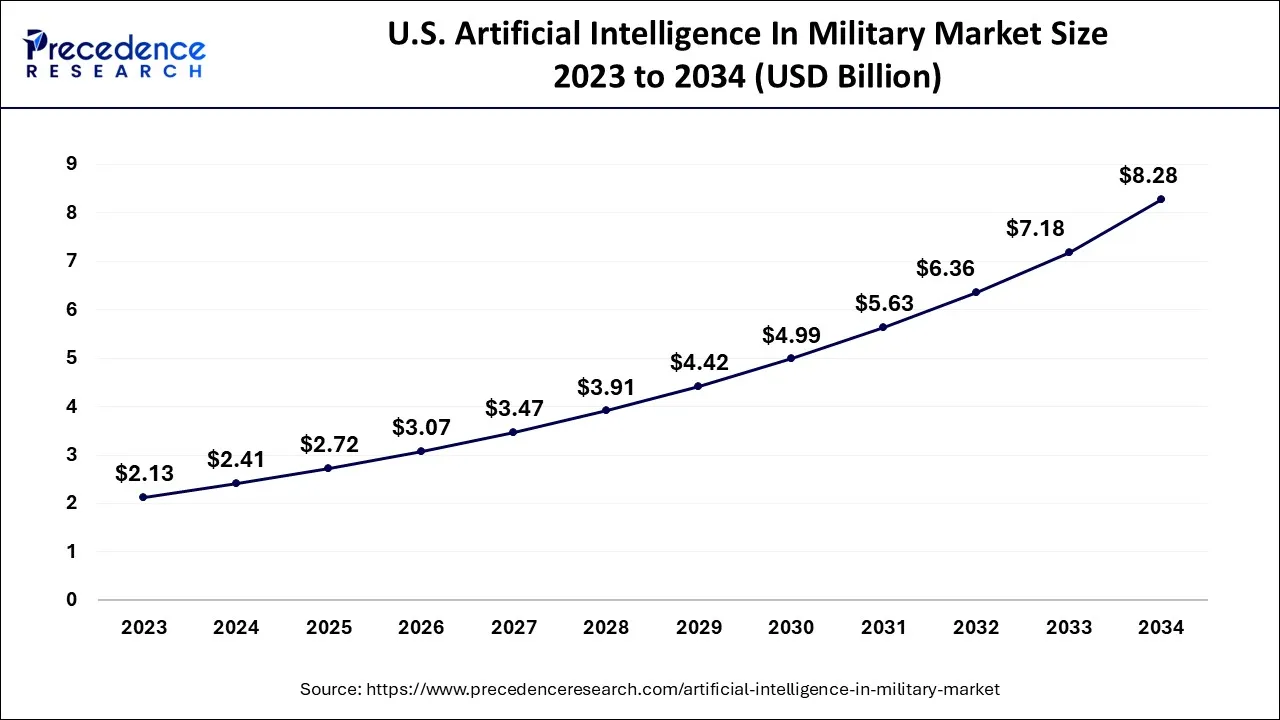

The U.S. artificial intelligence in military market size is exhibited at USD 2.41 billion in 2024 and is projected to be worth around USD 8.28 billion by 2034, growing at a CAGR of 13.14% from 2024 to 2034.

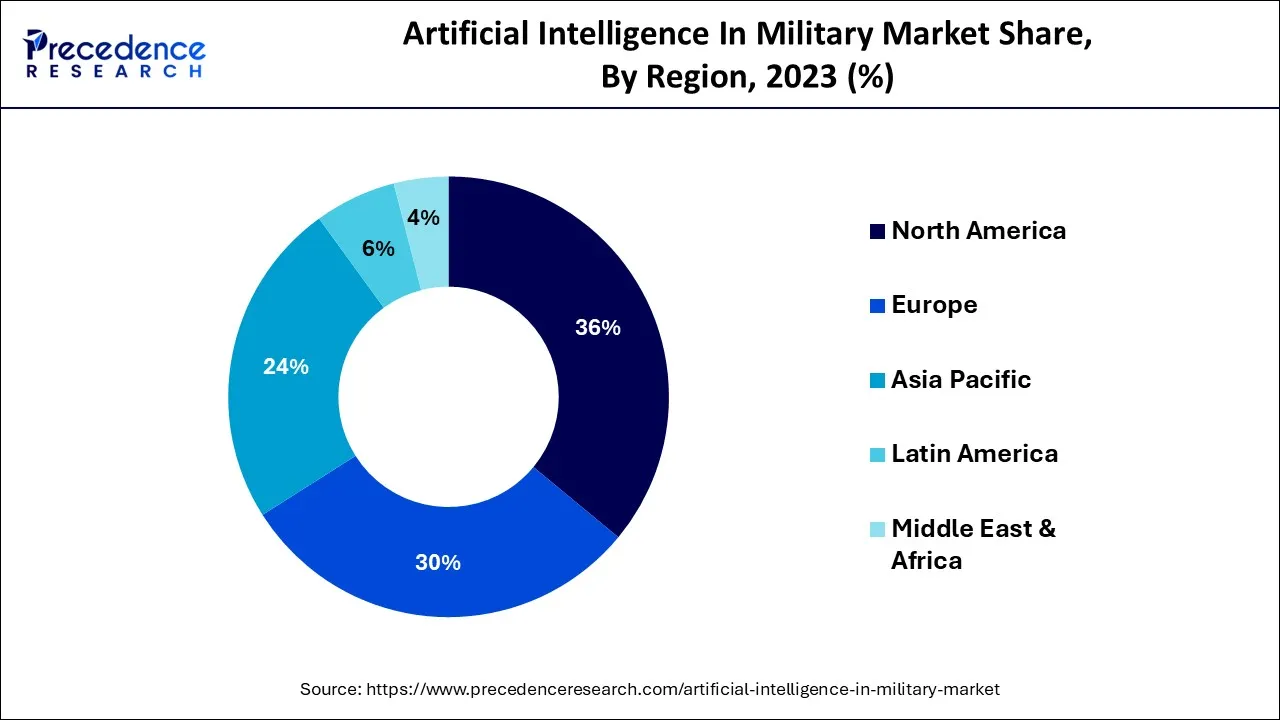

North America has the largest portion of the global military artificial intelligence market. The region's growth is primarily due to greater funding in artificial intelligence technologies by nations such as the United States and Canada. The US is progressively investing in AI systems to preserve combat superiority and overcome the risk of potential threats to communications networks, and the US is planning to increase its defense funding on AI to gain a competitive advantage over other countries.

Asia-Pacific is estimated to observe the fastest expansion in the adoption of AI and machine learning (ML) technologies, as OEMs as well as operators increase their funding in AI integration activities throughout the supply chain. Japan, China, and South Korea have risen as the most innovative countries in the field of AI integration and development. Research is conducted on advanced AI applications in the aviation industry by numerous organizations in the region. Many aircraft and component manufacturing plants in Asia-Pacific have seen consistent benefits from the integration of AI technologies. For instance, the application of adaptive machining as well as cutting-edge robotic inspection techniques at Pratt & Whitney's Singapore facility has resulted in a consistent expansion in productivity volumes in the upcoming years.

Modern warfare now includes artificial intelligence (AI) as a crucial component. AI has the capacity to manage massive amounts of military data effectively. It uses characteristics like computation and decision-making to improve the self-control, self-regulation, and self-actuation abilities of military systems. Additionally, the market has grown as a result of the military increasingly utilizing cloud services. Furthermore, the growing operational performance of autonomous systems may bring profitable changes to the sector. However, businesses are investigating low-cost and cutting-edge hardware solutions that effectively boost AI's performance and rhythm in the military sector; this is a key factor influencing the implementation of artificial intelligence in the military sector in the upcoming years.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.56 Billion |

| Market Size by 2034 | USD 32.17 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Technology, By Platform, By Installation, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased defense spending to enhance AI technologies by the government.

Most governments have established specialized departments or organizations to develop new capabilities and plan, launch, and integrate AI capabilities into military equipment. Moreover, the increasing use of artificial intelligence for predictive maintenance in military systems, as well as the incorporation of quantum mechanics into AI, is primarily responsible for generating an opportunity to develop artificial intelligence in the military sector. As international crises have increased, so have defense services. As a result of these battles, the use of sophisticated AI-enabled weapon systems has grown, and advanced inventions have been incorporated into existing systems to improve efficiency. For instance, the Ministry of Defense (MoD) declared the United Kingdom's Defense AI Strategy in June 2022, which mentioned the safe, ambitious, and responsible use of AI as well as a set of ethical guidelines to govern the military and defense sectors' use of AI. As a result, increased defense spending is propelling the growth of artificial intelligence in the military market.

Concerns about the possibility of errors in complex battle situations

Concerns have been raised as various governments adopt AI-controlled systems for inspection and automation, declaring that human instruction on robots is essential for ensuring authority and humanitarian security. Humanitarian organizations such as Human Rights Watch are also concerned about whether government agencies are expanding "Automated Killer Robots" in order to win the AI weapons competition. Concerns have been raised, with some claiming that human monitoring of robots is required to ensure management and humanitarian protection as national authorities adopt AI-controlled schemes for automated processes and observation. All the aforementioned factors hinder market expansion.

Technological advancement in AI

Technological advancement is a key trend gaining traction in the military market for artificial intelligence. To strengthen their position, major players in the military artificial intelligence market are focusing their efforts on developing innovative technologies. For example, Raytheon Technologies, a US-based aerospace, and defense company, partnered with C3 AI's application platform in July 2022 to deliver next-generation artificial intelligence (AI) as well as machine learning (ML) capabilities for the US Army's Tactical Intelligence Targeting Access Node (TITAN) program. TITAN uses terrestrial and aerial sensors to collect data from high altitudes and space in order to provide targetable data and situational awareness.

According to the component, the software sector is projected to be the largest during the forecast period. The importance of artificial intelligence software in developing the IT framework to prevent security infringements is linked to the expansion of this segment. Artificial intelligence technological advancement has resulted in the invention of novel Artificial Intelligence Software and linked software development devices, which are projected to propel AI in the military industry in the upcoming years. The AI software embedded in computers is in charge of performing complicated tasks; it generates information from hardware in order to produce a smart result.

The hardware sector is anticipated to expand significantly during the projected period because of the expanding use of artificial intelligence technology for complex processes and the increased demand for specialized hardware components like AI memory and processors. The processors of artificial intelligence are neuromorphic processing components that are more efficient and faster than conventional processors. For improving artificial intelligence, memory is a key technological advancement. AI along with machine learning generates and analyzes a rising number of mission records in real time, enabling autonomous cognitive digital wars and propelling the hardware segment forward.

Based on the technology, advanced computing is anticipated to hold the largest market share in 2023. AI support in data processing and recognition, intended to allow for timely decisions, is a primary factor driving segment growth. The combination of robotics with artificial intelligence boosts the need for the Military Artificial Intelligence (AI) Market. This artificial intelligence (AI) plans to support the military by proficiently attempting to identify weaknesses as well as facilitating settling human-level problems on the battlefield, which drives segment growth.

On the other hand, the AI system sector is projected to grow at the fastest rate over the projected period. Growing investment in AI technologies has contributed to the growth of the AI market. Many businesses are financing AI start-ups or AI technologies to improve the productivity of software, as AI allows them to execute better decisions as well as accomplish better results. Microsoft, for example, has invested approximately $1 billion in OpenAI, a San Francisco-based company. There is a growing investment in developing applied artificial intelligence systems, as well as a growing use of artificial intelligence technology in a variety of applications. These include robotics, virtual personal assistants, robotics-assisted driving, and autonomous vehicles.

In 2023, the new procurement sector had the highest market share of 51% on the basis of installation. This is due to the government's enhanced push to incorporate AI into the defense industry, as well as the emergence of novel developments in artificial intelligence technology in the war sector. For instance, the National Security Council Secretariat, in December 2021, manages critical political, economic, energy, and security issues, and assisted the Military in establishing the Quantum Lab at India's Military College of Telecommunication Engineering to improve AI training and research.

The AI upgrade is anticipated to expand at the fastest rate over the projected period. Integrating AI into military operations improves administration, logistics, maintenance, personal management, routine exercises or activities, and training which drives the expansion of the AI upgrade sector in the military industry over the predicted years. Moreover, it has the potential to decrease institutional workload as well as free up troops for primary operations. Defense AI advancement is changing war disputes to AI-robotized digitized conflict. Furthermore, worldwide powers are getting prepared for their armed units to use advanced IT to minimize the impact of war.

The warfare sector is anticipated to expand at the largest market share in 2023. The market is expanding due to the rising demand for weapons of mass destruction. The increased testing of nuclear weapons by countries such as North Korea is also contributing to the proliferation of these weapons. As these weapons are biological, radiological, or chemical in nature, they are dangerous. The market is slowly expanding due to rising military demands ranging from intelligence, surveillance, and reconnaissance to offense/defense balances and nuclear weapons systems themselves.

The cybersecurity sector is anticipated to grow at a significantly faster rate over the predicted period. The global rate of cybercrime has increased due to the advancement of novel technologies and tools. State-wise cyberattacks also have increased significantly. Corporations and governments are rapidly adopting AI-based technologies that prevent, predict, and react to cyber risks. Machine learning and Deep learning are enabled by AI to execute predictive analytics; such AI technologies have enormous potential for military sectors and are projected to develop in critical areas which include cyber defense, decision-support systems, risk management, pattern recognition, and virus detection.

The space sector is anticipated to have the highest CAGR of artificial intelligence in the military market over the predicted period, based on the platform. Space artificial intelligence involves numerous artificial satellites that serve as the backbone of various communication technology. The combination of AI and space platforms allows for effective communication between spacecraft and ground stations, which is anticipated to drive the expansion of artificial intelligence in the military market in future years.

Autonomous war vehicles, autonomous war robots, and unmanned ground automobiles are all part of the land segment. During the projected period, the increase in the need for unmanned ground vehicles to execute civilian tasks and reduce risks to human life expectancy drives the growth of the land sector in Artificial intelligence in the military market. In war scenarios, the combination of war vehicles, as well as autonomy, is critical for avoiding fatalities.

By Component

By Technology

By Platform

By Installation

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

December 2024

December 2024