January 2025

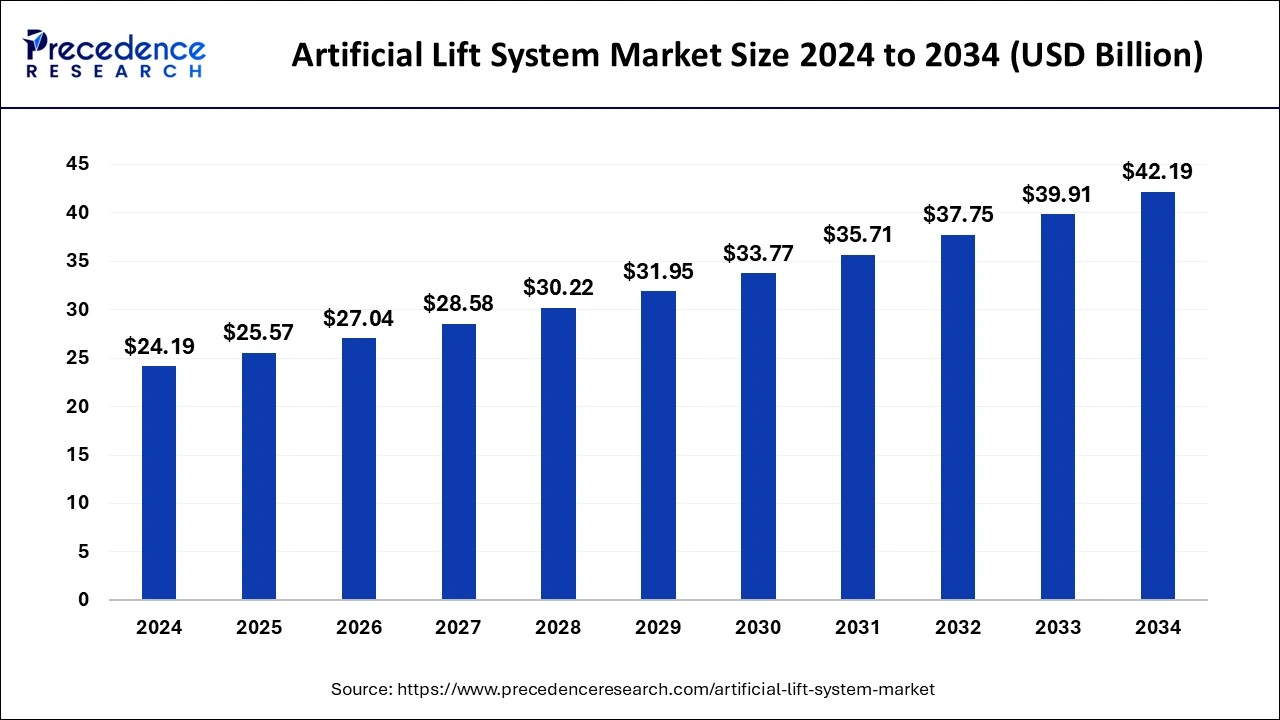

The global artificial lift system market size is calculated at USD 25.57 billion in 2025 and is forecasted to reach around USD 42.19 billion by 2034, accelerating at a CAGR of 5.72% from 2025 to 2034. The North America artificial lift system market size surpassed USD 8.95 billion in 2024 and is expanding at a CAGR of 5.86% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global artificial lift system market size was estimated at USD 24.19 billion in 2024 and is anticipated to reach around USD 42.19 billion by 2034, expanding at a CAGR of 5.72% from 2025 to 2034. The increasing number of matured oilfields in many regions leads to demand for these systems to enhance the productivity of the matured fields which helps the growth of the artificial lift system market.

Artificial Intelligence (AI) algorithms are increasingly used to forecast equipment failures, improve decision-making, boost productivity levels, reduce operational costs, and analyze real-time data. The main benefits of AI in artificial lift systems include excellent capability of handling gas, compression remote from the well site, and ability to operate in deviated wellbores. It also helps to improve sustainability, reduce costs, and minimize downtime which helps the growth of the artificial lift system market.

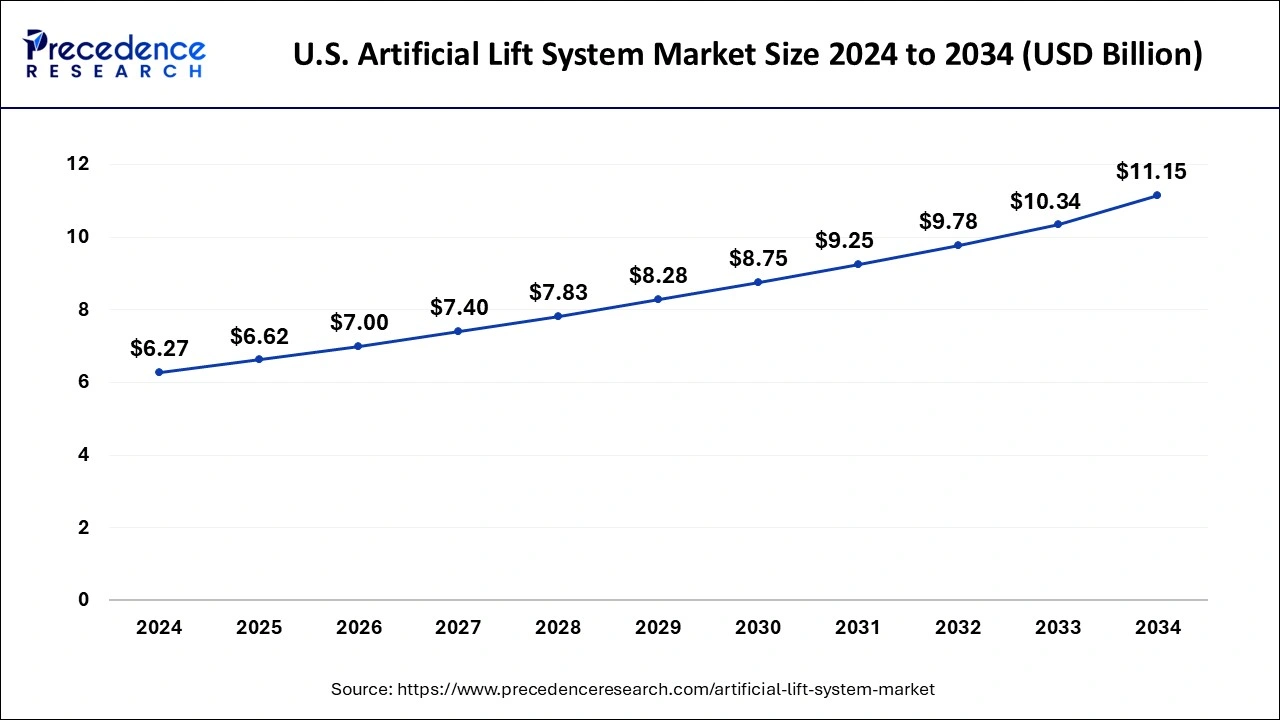

The U.S. artificial lift system market size was evaluated at USD 6.27 billion in 2024 and is predicted to be worth around USD 11.15 billion by 2034, rising at a CAGR of 5.92% from 2025 to 2034.

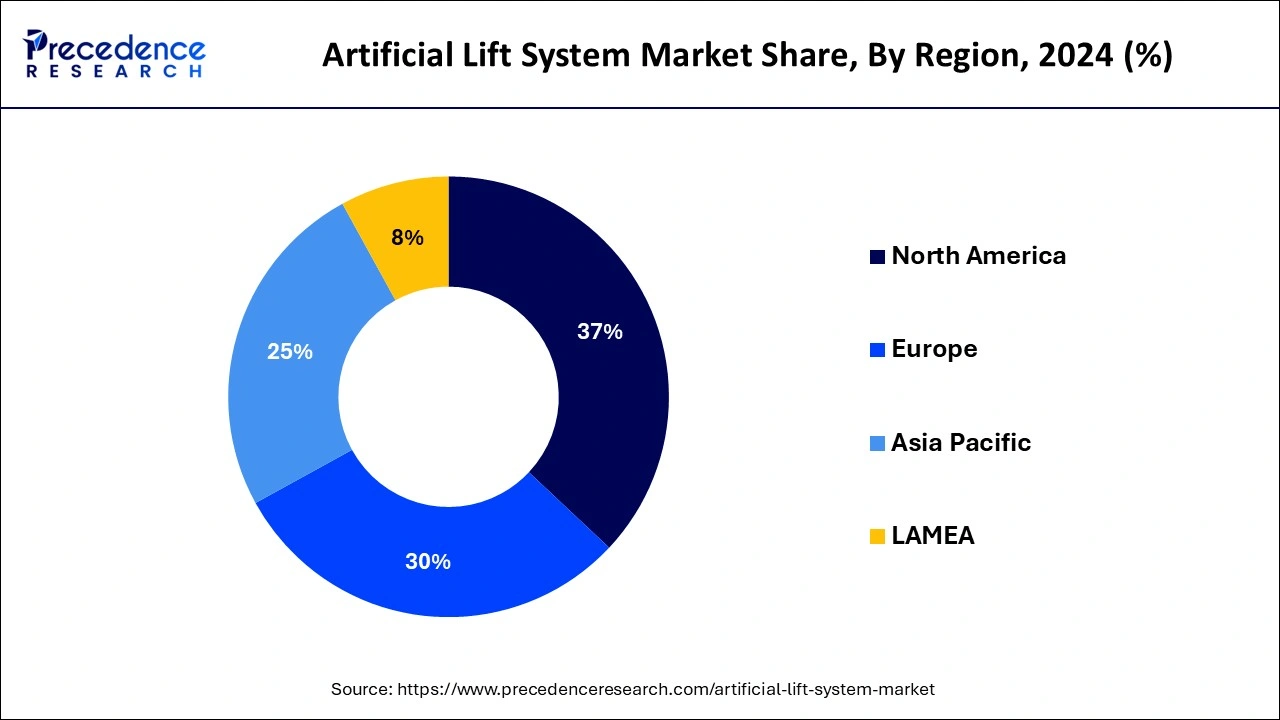

North America dominated the global artificial lift systems market with the largest market share of 37% 2024. The growing demand for artificial lift operations in mature and aging oil wells in the North American region helps the growth of the market. There is a high use of wireless supplies and solutions which help the growth of the market. The United States and Canada are the leading countries for the aged and mature wells in North America.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The rising need for gas in the Asia Pacific region helps to drive the artificial lift system market growth. The increasing populace in countries like China and India is expected to drive energy consumption which result in high exploration efforts and increasing regional demand throughout the forecast period

The artificial lift can be used to produce flow from a well that has no flow or to increase the rate of flow from a well that is already pumping. Many oil wells, as well as some gas wells, require artificial lift at some point throughout their life cycle to remove liquids from the formation and allow gas to flow at a faster pace. The artificial lift systems market is expected to grow in response to rising energy demand, industrialization, and population and urbanization. With increased energy consumption, so does reliance on traditional energy sources. Overexploitation of natural resources has resulted in the depletion of this resource. These reasons have increased the demand for advanced artificial lift systems for oil explorations from reserves, which is projected to drive artificial lift market demand throughout the projection period.

Rising expansion of the industrial manufacturing and transportation sectors oil consumption demand have been increased rapidly globally. To fulfill such rising demand for oil and other natural resource globally the demand for the artificial lift system market. Artificial lift systems are used for nonstop drilling to increase their output. However, the reservoir pressure in current wells is insufficient to bring fluids to the surface. The majority of wells across the world require some help to bring the hydrocarbon to the surface. The artificial lift system is device used for assessment of oil wells during high reservoir’s oil pressure. Artificial lift systems assistance helps to increase the efficiency by 85-90% and helps in supplementing & maintaining reservoir’s pressure.

Various types of artificial lifts are used depending on the well's features and technology availability, resulting in global market expansion in the coming years. Growing global oil consumption, as well as economic expansion in many industries such as transportation, aviation, and power generation, is all projected to contribute to increased hydrocarbon demand, which will lead to an increase in artificial lift demand in the coming years. Moreover, severe rivalry has prompted manufacturers to engage in product development in order to better meet the needs of customers. For example, Baker Hughes developed the LEAP adaptive assembly line in 2016 to increase oil and natural gas output while addressing technical challenges associated with unorthodox production. This method has contributed to increased efficiency, increased ultimate recovery, and optimized production.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.30% |

| Market Size in 2025 | USD 11.74 Billion |

| Market Size by 2034 | USD 22.13 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, Application, Mechanism, Well Type, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rod lift segment dominated to the artificial lift system market by type. Artificial lift system uses surface power source for operating and exploring the downhole’s pumps assembly. Quite a few pieces are used in both the subsurface and surface of the unit. This hoisting mechanism can pump up to 1,000 BPD depending on the size of the equipment. Rod lifts can handle gas and corrosion well during the artificial lift process and provide a high salvage value for downhole equipment. In the next years, such features are set to increase demand for artificial lift. As a result, the rod lift market is being driven by the growing need to avoid gas and corrosion management during artificial lift operations.

The electric submersible pump (ESP) segment is expected to expand at the fastest CAGR during the projected period. For use in large oil wells which have reached or past their peak oil production period, an electric submersible pump (ESP) is the best choice. Furthermore, the offshore electric submersible pump market is predicted to grow as a result of rich resources and increased investment. As a result, the artificial lift market is predicted to grow throughout the forecast period.

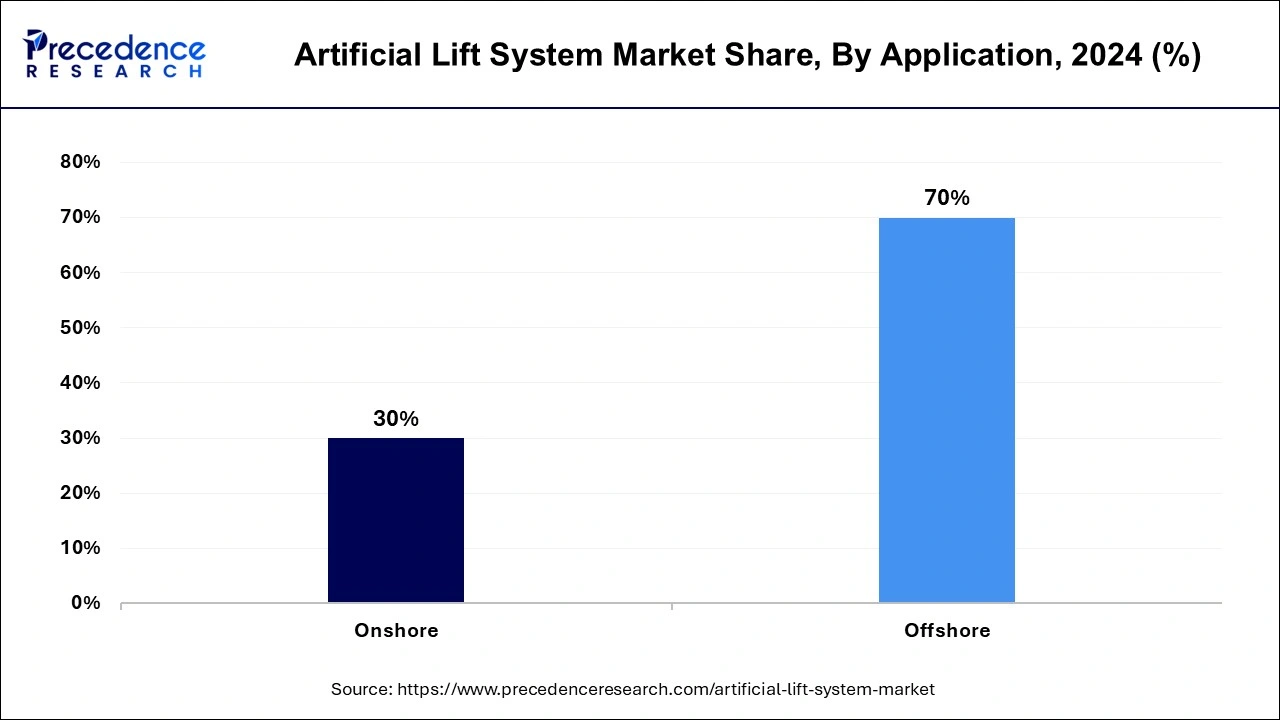

The offshore segment contributed the highest market share of 70% in 2024. The offshore section is likely to rise at the quickest rate over the forecast period. The offshore sector is relied upon to increment at the quickest rate over the forecast period. Artificial lift systems consist of several methods such as hydraulic pumping, ESP, gas lift, and others are widely used for offshore wells. Since offshore holds large unexplored reserves, companies have been looking for offshore areas for oil development. As a result, the offshore market requires more money than the onshore market. According to the IEA, 2,500–3,000 offshore operations will be decommissioned between 2019 and 2040 when they approach the end of their operational lives. The most mature shallow fields are found in the Gulf of Mexico and the North Sea.

The rising number of mature fields in the industry is expected to drive demand for onshore electric submersible pumps. The growing emphasis on heavy oil reservoirs, along with the demand for ESP systems in shale reservoirs, is likely to push corporate growth and the artificial lift industry even further.

The gas lift segment accounted for a major market share in 2024. The prime factor contributing to the market growth includes less maintenance required to the gas lift compared to pump type lifts. In addition, gas lifts also are cost-effective in nature compared to pump lifts and are extensively used across several verticals and end use applications such as mining, oil & gas, and many others.

The horizontal artificial lift systems capture notable revenue share in the global artificial lift system market as well as register the fastest growth over the forthcoming years. The prime factors contributing towards the escalating growth of the segment includes significant discoveries related to shale gas reserves in North America region. North America region has discovered prominent reserve of shale gas in the past few years that contribute positively towards the market growth in present years along with high growth predictions for the future period.

By Type

By Application

By Component

By Mechanism

By Well Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

January 2025