January 2025

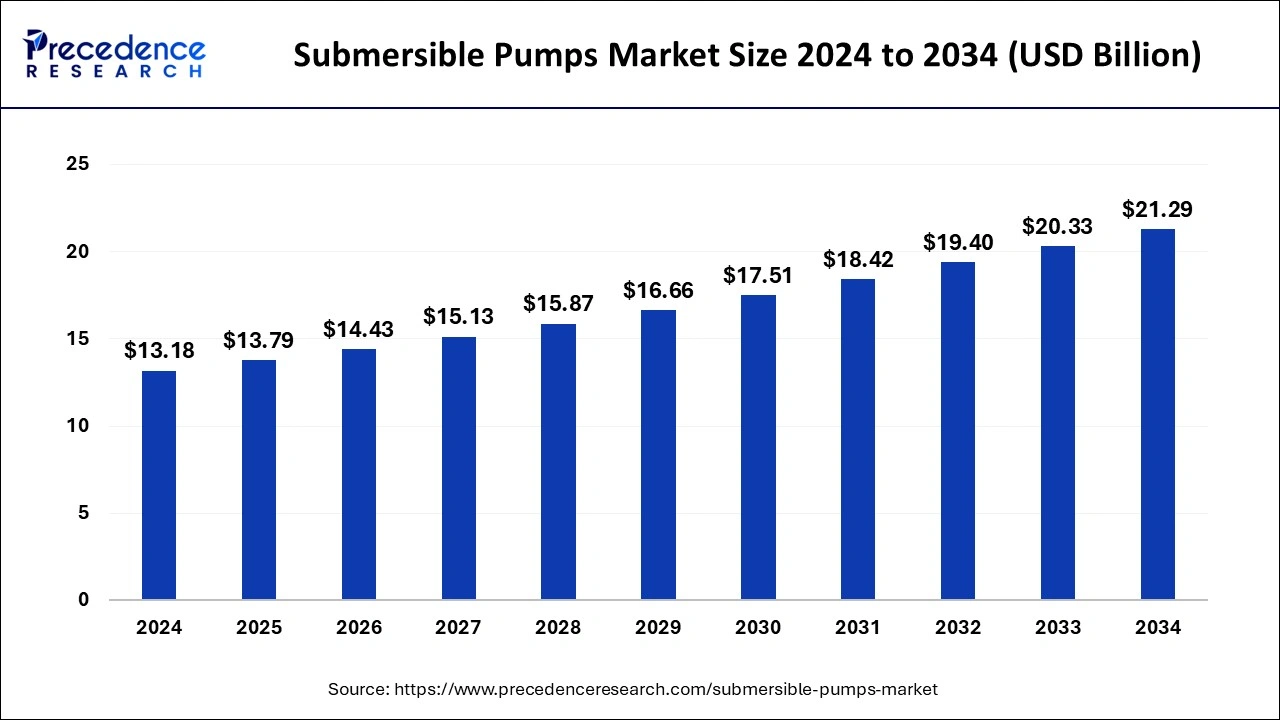

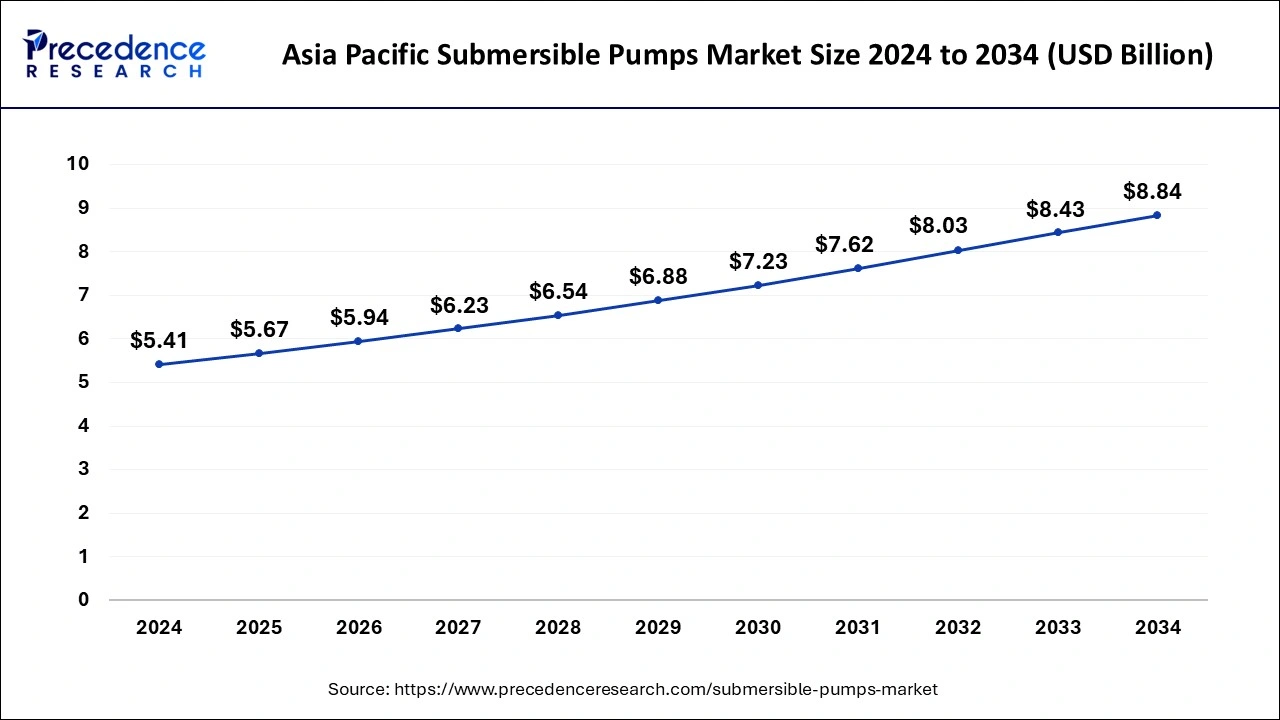

The global submersible pumps market size is accounted at USD 13.79 billion in 2025 and is forecasted to hit around USD 21.29 billion by 2034, representing a CAGR of 4.91% from 2025 to 2034. The Asia Pacific market size was estimated at USD 5.54 billion in 2024 and is expanding at a CAGR of 4.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global submersible pumps market size accounted for USD 13.18 billion in 2024 and is predicted to increase from USD 13.79 billion in 2025 to approximately USD 21.29 billion by 2034, expanding at a CAGR of 4.91% from 2025 to 2034.

The Asia Pacific submersible pumps market size was exhibited at USD 5.41 billion in 2024 and is projected to be worth around USD 8.84 billion by 2034, growing at a CAGR of 5.03% from 2025 to 2034.

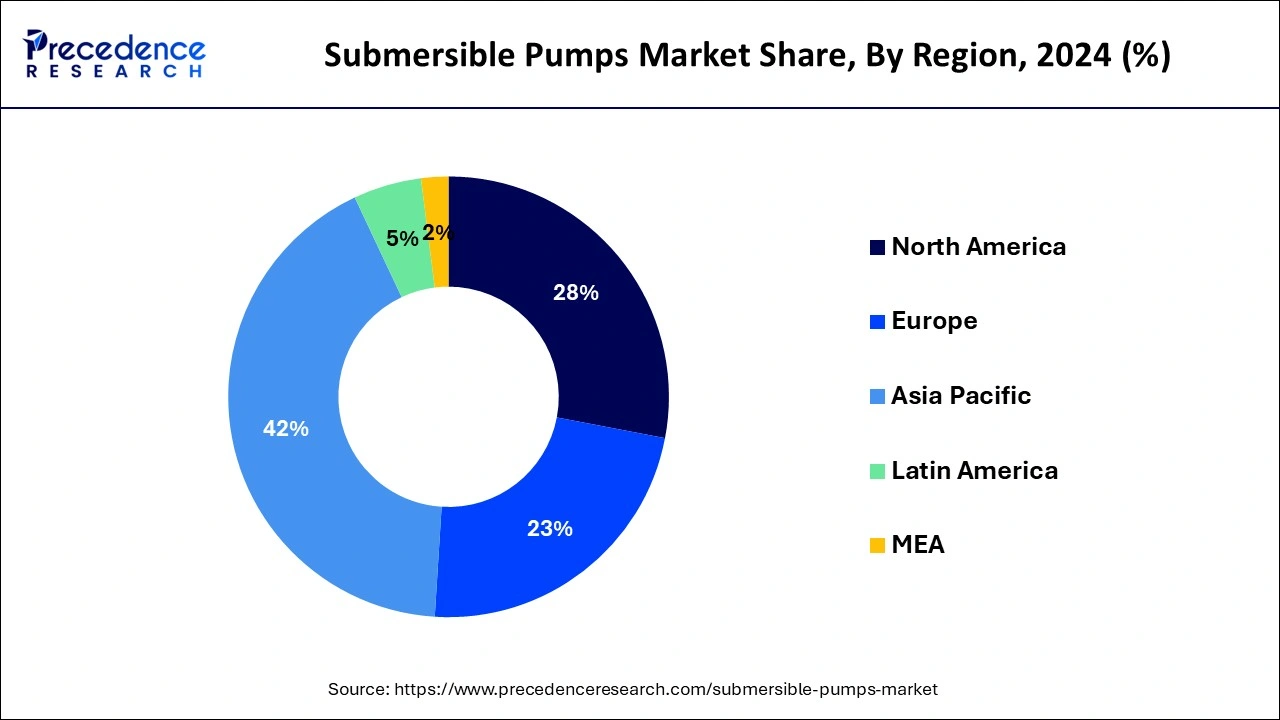

Asia Pacific has held the largest revenue share of 42% in 2024. Asia-Pacific commands a significant share in the submersible pumps market due to rapid industrialization, urbanization, and agricultural expansion. The region's robust economic growth has propelled the demand for efficient water management solutions, with submersible pumps playing a crucial role in various applications. Moreover, increasing infrastructure development projects, particularly in emerging economies, contributes to the substantial market share. As Asia-Pacific nations prioritize modernization across sectors, the need for reliable and versatile submersible pumps continues to grow, sustaining the region's dominant position in the global market.

North America is estimated to witness the highest growth. North America holds a major growth in the submersible pumps market due to robust industrial infrastructure, extensive agricultural practices, and stringent regulations promoting efficient water management. The region's advanced mining and oil exploration activities also drive the demand for submersible pumps. Furthermore, a focus on technological innovation, such as the integration of smart pump technologies, contributes to the market's growth. The region's commitment to sustainability and environmental regulations further propels the adoption of submersible pumps for their energy efficiency and eco-friendly features.

Submersible pumps are specialized devices designed to operate underwater for tasks such as water supply, drainage, and irrigation. These pumps feature a sealed motor and pump unit, positioned beneath the water surface, enabling efficient water movement. Widely utilized in wells, boreholes, and other water sources, submersible pumps are favored for their robustness, energy efficiency, and versatility in handling different liquids, including clean water and corrosive fluids.

Functioning by converting electrical energy into mechanical energy, submersible pumps employ an impeller to propel fluids to the surface. The sealed design ensures the motor remains protected from water ingress, guaranteeing a secure and dependable operation. With applications spanning residential, agricultural, industrial, and municipal contexts, submersible pumps offer a reliable and adaptable solution for diverse water management needs.

| Report Coverage | Details |

| Market Size in 2025 | USD 13.79 Billion |

| Market Size by 2034 | USD 21.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.91% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Drive, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Agricultural expansion and industrial growth

The market demand for submersible pumps sees a notable boost due to the expansion of agriculture and growth in the industrial sector. In agriculture, the increasing use of advanced irrigation methods necessitates efficient water systems, and submersible pumps play a crucial role in ensuring a dependable water supply for optimal crop growth. As global agricultural practices continue to expand to meet growing food demands, the demand for submersible pumps experiences a corresponding increase. Simultaneously, in the industrial landscape, submersible pumps are indispensable for various processes requiring fluid management.

Industries rely on these pumps for tasks such as dewatering in mining operations, water supply for manufacturing processes, and drainage in construction projects. The robust and versatile nature of submersible pumps makes them a preferred choice for industries seeking efficient and reliable solutions for water handling, thereby contributing to the overall surge in market demand.

High initial cost and complex maintenance

The market demand for submersible pumps encounters notable constraints due to the combination of high initial costs and complex maintenance requirements. The upfront investment for acquiring and installing submersible pumps is often substantial, acting as a deterrent for potential buyers, particularly in cost-sensitive markets. This financial barrier can limit the adoption of submersible pumps, hindering their widespread use despite their efficiency and effectiveness in various applications.

Moreover, the complex maintenance associated with submersible pumps, especially in underwater installations, adds another layer of challenge. The intricacies involved in upkeep, which often necessitate specialized knowledge and tools, can contribute to higher operational costs over the pump's lifecycle. This complexity may discourage some users, particularly those with limited technical expertise, from choosing submersible pumps, impacting their market demand as consumers seek solutions with more straightforward maintenance requirements and lower initial investment burdens.

Renewable energy integration and smart pump technologies

Renewable energy integration and the advancement of smart pump technologies are pivotal opportunities within the submersible pumps market. The increasing emphasis on sustainable practices has opened doors for submersible pumps to integrate with renewable energy sources, particularly through the development of solar-powered systems. This not only aligns with global efforts to reduce reliance on conventional power but also positions submersible pumps as eco-friendly solutions, appealing to environmentally conscious consumers and businesses.

Simultaneously, the rise of smart pump technologies, incorporating features like IoT-enabled sensors and automation, presents a transformative opportunity. These innovations enhance the monitoring and control capabilities of submersible pumps, optimizing performance, reducing downtime, and increasing energy efficiency. The implementation of smart technologies not only improves overall pump functionality but also aligns with the broader trend of Industry 4.0, making submersible pumps more versatile, reliable, and appealing to industries seeking advanced and interconnected solutions for their water management needs.

In 2024, the borewell segment held the highest market share of 39% on the basis of the product. The borewell segment in the submersible pumps market refers to pumps specifically designed for use in boreholes or deep wells. These pumps are crafted to efficiently draw water from substantial depths, catering to agricultural, industrial, and residential water supply needs. A trend in this segment involves the integration of advanced materials and technologies, enhancing pump durability and performance. Additionally, manufacturers are focusing on developing energy-efficient borewell submersible pumps to align with sustainability goals and address the increasing demand for reliable water extraction from deep sources.

The openwell segment is anticipated to witness highest growth at a significant CAGR of 5.5% during the projected period. The openwell segment in the submersible pumps market refers to pumps designed for use in open wells or sumps. These pumps are installed in wells without requiring a separate pump house. A notable trend in this segment is the growing demand for energy-efficient openwell submersible pumps, driven by increased awareness of sustainability. Manufacturers are focusing on designing pumps with improved motor efficiency and advanced features to cater to diverse applications, such as agriculture, residential water supply, and industrial usage, fueling the market's expansion.

According to the drive, the electric segment held 45% of the market share in 2024. In the electric segment of the submersible pumps market, electric-driven pumps play a central role, powered by electrical energy for fluid handling applications. The electric submersible pumps segment is witnessing a trend towards increased energy efficiency, driven by advancements in motor technology and control systems.

Manufacturers are focusing on designing electric pumps with higher power ratings and improved operational reliability. Additionally, there is a growing demand for submersible pumps with smart features, allowing for remote monitoring and control, contributing to the overall modernization of electric-driven submersible pump systems.

The hydraulic segment is anticipated to witness the highest growth over the projected period. The hydraulic drive segment in the submersible pumps market refers to pumps powered by hydraulic energy, commonly used in applications requiring high efficiency and reliability. The hydraulic submersible pumps are favored for their ability to handle varying fluid viscosities and harsh environments. A notable trend in this segment involves the integration of advanced hydraulic drive technologies, enhancing pump performance, energy efficiency, and adaptability to diverse operating conditions. As industries prioritize sustainable and efficient solutions, the hydraulic drive segment continues to evolve, contributing to the market's growth and technological advancements.

According to the end user, the agriculture segment held a 26% market share in 2024. The agriculture segment in the submersible pumps market refers to the end-user category where these pumps find extensive use in irrigating farmlands and ensuring efficient water supply. In this context, the trend is shifting towards the adoption of technologically advanced submersible pumps for precision irrigation, offering farmers greater control over water distribution. The integration of smart technologies, such as sensor-based monitoring, is becoming increasingly prevalent, allowing for optimized water usage, improved crop yields, and sustainable agricultural practices.

The chemical segment is anticipated to witness the highest growth over the projected period. In the submersible pumps market, the chemical segment refers to end-users involved in chemical processing industries. These industries utilize submersible pumps for the transfer, circulation, and handling of various chemicals. A notable trend in this segment is the increasing demand for corrosion-resistant submersible pumps to ensure the safe and efficient movement of corrosive liquids. Manufacturers are focusing on developing pumps with materials and coatings that can withstand the challenges posed by aggressive chemicals, addressing the specific needs of the chemical processing sector.

By Product

By Drive

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

July 2024