Athleisure Market (By Type: Mass, Premium; By Product: Yoga Apparels, Shirts, Leggings, Shorts, Others, By End-user: Men, Women, Children; By Distribution Channel: Online, Offline) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

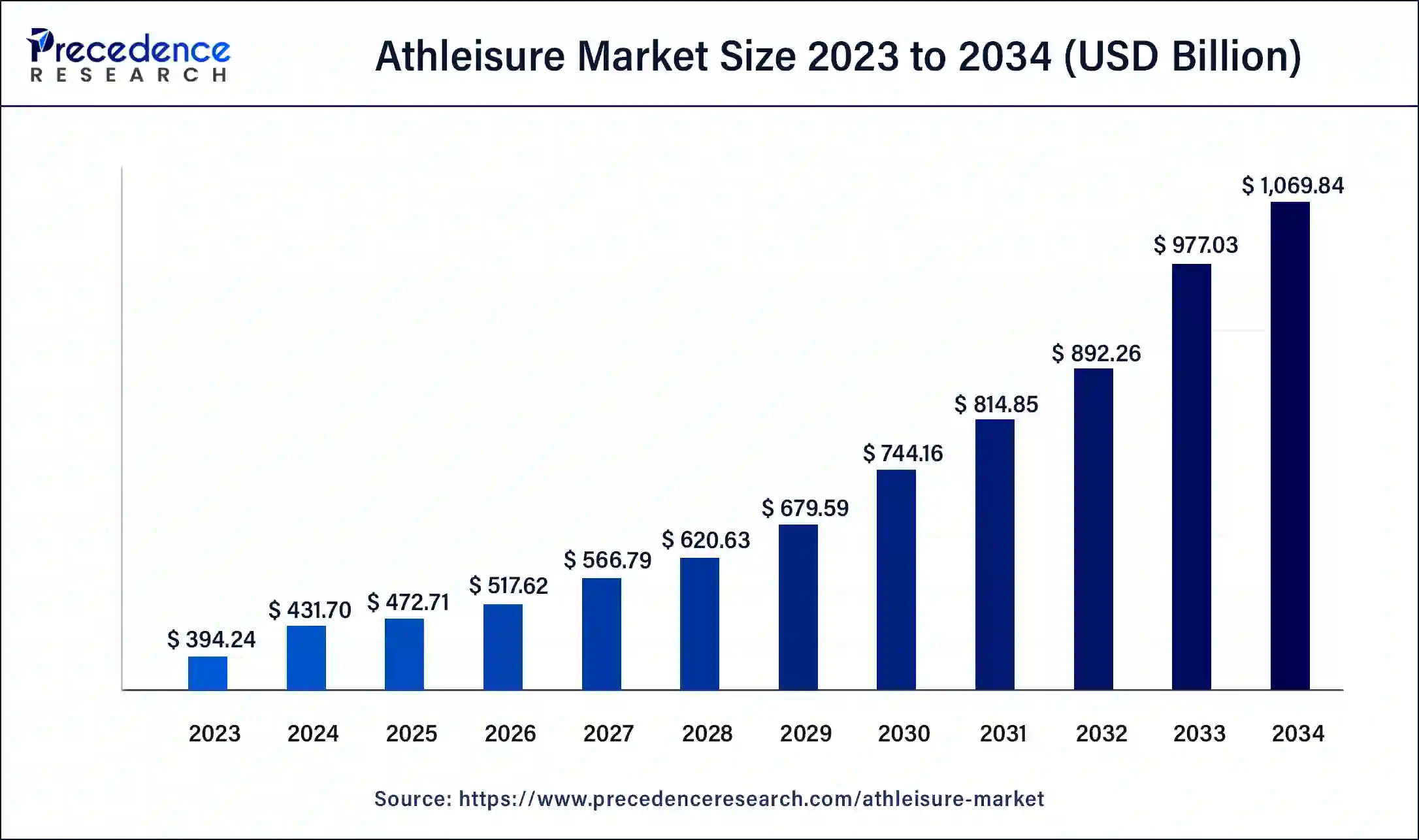

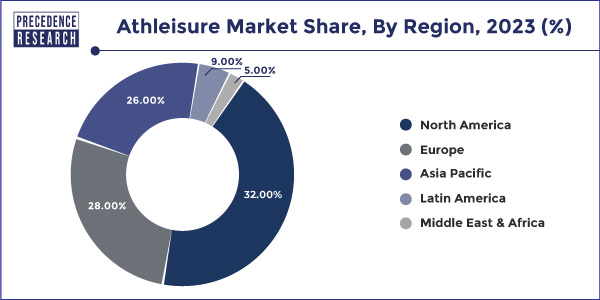

The global athleisure market size was USD 394.24 billion in 2023, accounted for USD 431.70 billion in 2024, and is expected to reach around USD 1,069.84 billion by 2034, expanding at a CAGR of 9.5% from 2024 to 2034. The North America athleisure market size reached USD 126.16 billion in 2023. The athleisure market is driven by the widening of the boundaries between daily wear and athletic apparel.

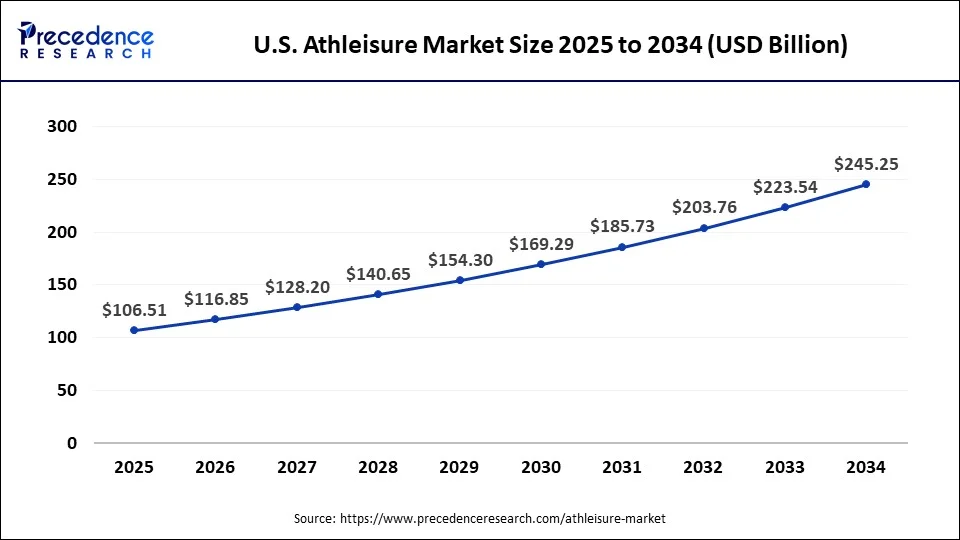

The U.S. athleisure market size was estimated at USD 88.48 billion in 2023 and is predicted to be worth around USD 245.25 billion by 2034, at a CAGR of 9.7% from 2024 to 2034.

North America led the market with the biggest market share of 32% in 2023. The active lifestyle trends popular in North America, where fitness, wellness, and health consciousness are valued highly, are consistent with athleisure. It attracted a broad spectrum of customers looking for adaptable apparel appropriate for various activities by skillfully fusing fashion and function. It boasts many well-known athleisure companies with a devoted following that has solidified reputations for performance, style, and quality.

Asia-Pacific shows significant growth in the athleisure market during the forecast period. An increasing number of people in Asia-Pacific are taking up active lives, as well-being and health are becoming more critical. The need for fashionable and comfy athleisure clothing that can be worn both casually and during workouts is being driven by this trend. Owing to developments in fabric technology, performance-oriented athleisure clothing with features like moisture-wicking, temperature management, and odor control is now available.

Customers searching for attractive, yet functional clothing are drawn to these technical advancements. Choices for living have changed because of rapid urbanization. The desire of urban residents for adaptable, stylish, and comfortable clothing options has caused athleisure apparel sales to soar.

Beyond essential clothing, the athleisure market offers stylish and comfortable solutions for running errands, commuting, or informal socializing. It also appeals to various activities and requirements, including exercise and activity, gaming, esports, and gardening. Flexible and breathable apparel keeps you warm and active when working from a distance. As the athleisure market develops, new applications will appear in tandem with shifting consumer preferences and technology developments.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.5% |

| Global Market Size in 2023 | USD 394.24 Billion |

| Global Market Size in 2024 | USD 431.70 Billion |

| Global Market Size by 2034 | USD 1,069.84 Billion |

| U.S. Market Size in 2023 | USD 88.48 Billion |

| U.S. Market Size by 2034 | USD 245.25 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Product, By End-user, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Upsurge in fitness & health industry

There has been a visible change in how people live, with an increase in people putting wellness first and engaging in physical activity. Consequently, there is an increasing need for apparel that can be worn anywhere, from the gym to daily life. Customers looking for comfort and performance in their clothing selections are catered to by the stylish and functional offerings of athletic wear. The popularity of athleisure has expanded beyond fitness enthusiasts thanks to the fusion of fashionable styles with athletic apparel.

Increased passion for sports and outdoor recreational activities

Athleisure appeals to people who want fashion and utility in their daily wardrobe by fusing features of athletic gear with casual dress. The emphasis on fitness and active lifestyles has increased due to people prioritizing their health and wellness. The desire for adaptable clothing that can be used for both daily wear and exercise is driving up the price of athleisure attire. Athleisure is also becoming increasingly well-known due to the rise of social media influences and celebrity endorsements, solidifying its place in contemporary fashion culture.

Presence of counterfeit and cheap products

The availability of inexpensive, fake substitutes may hamper authentic athleisure product sales. Authentic brands may see declining revenue and growth potential due to consumers purchasing cheaper counterfeit options rather than investing in genuine goods. Popular athleisure brands are frequently imitated by counterfeit goods, confusing consumers and diluting the brand's authenticity. This could damage genuine athleisure brands' standing and perceived worth. The abundance of cheap and fake goods may weaken consumer confidence in the athleisure market. Customers may grow wary of buying athleisure products altogether for concern that they would inadvertently support unethical behavior or purchase counterfeit goods.

Growing approval of wellness culture

More individuals are prioritizing their physical and mental health, and as a result, they are looking for apparel that can be easily transitioned from exercise to everyday activities. Athleisure companies can profit from this trend by providing fashionable yet practical clothing that encourages an active lifestyle and personifies wellness principles. Furthermore, there is a growing need for athleisure clothing that prioritizes comfort and versatility without sacrificing style, given the growing emphasis on self-care and mindfulness. Athleisure firms can increase their consumer base and foster stronger brand loyalty among health-conscious consumers by capitalizing on wellness.

Increasing opportunities for entrepreneurs

The market for athleisure keeps growing as consumers look for fashionable yet comfortable apparel for various occasions, such as casual wear, work-from-home outfits, and workouts. Entrepreneurs can present cutting-edge patterns, materials, and technology that address changing consumer demands, including eco-friendly materials or multipurpose clothing. Entrepreneurs can distinguish their businesses by highlighting distinctive value propositions like inclusive sizing, eco-friendly operations, or community involvement to stand out in a crowded market.

The mass segment dominated the athleisure market with the largest share in 2023. These athleisure firms expanded the reach of their products by distributing them through department stores, specialized shops, and online marketplaces. This made it possible for customers to quickly locate and buy athleisure clothing, free from obstacles related to scarcity or restricted availability.

Despite charging less for their goods, mass-market athleisure businesses stayed aware of client preferences and fashion trends. They regularly updated their collections with chic patterns, hues, and styles to keep their products current and appealing to customers. These brands sold athleisure clothing for less money than luxury or premium brands. A more comprehensive range of customers, particularly value- and budget-conscious buyers, were drawn to this pricing.

The premium segment shows significant growth in the athleisure market during the forecast period. Premium athleisure products are becoming increasingly expensive, but consumers are prepared to spend more as economies grow and disposable incomes rise.

Customers who are ready to pay more for products that project a particular lifestyle or image tend to be loyal to premium athleisure brands since they often have a certain prestige and status. Customers are prepared to spend more on high-end products that combine design and practicality. This has increased demand for athleisure clothing for everyday use and workouts due to the growing emphasis on health, fitness, and wellness.

The shirts segment dominated the athleisure market with the largest share in 2023. The market for athletic and sportswear has grown as the importance of wellbeing, fitness, and health has grown. The popularity of active lives and exercise activities has led to a rise in the need for fashionable yet useful clothing, such as athleisure shirts. This lifestyle change has helped the athleisure market grow and become more dominant in certain areas, especially shirts. With constant fabric technology and design improvements, athleisure shirts now have improved performance features. Athleisure gear draws in customers looking for fashionable yet practical solutions with features including odor resistance, UV protection, and seamless construction.

The yoga apparel segment is the fastest growing in the athleisure market during the forecast period. Many people are turning to physical and mental well-being practices like yoga due to growing awareness about fitness and health. The need for yoga-specific clothing has increased because of this. People can quickly go from their yoga practice to other activities or daily work thanks to its comfortable and adaptable design. Customers shopping for clothes with multiple uses will find this versatility appealing.

Athleisure, a trend that blends sports and casual clothes, is becoming increasingly popular in the fashion business. Yoga clothing is an excellent fit for this trend, providing fashionable alternatives that can be worn for both daily wear and exercise.

The women segment dominated the athleisure market with the largest share in 2023. Women are frequently the first to adopt new fashion trends, and athleisure clothing has grown in popularity because it combines comfort and style. Several athleisure companies have targeted women in their marketing campaigns since they know their demands and preferences. This focused strategy has successfully connected with female customers.

The children's segment shows notable growth in the athleisure market during the forecast period. Social media platforms and celebrity endorsements influence children's athleisure wear, significantly impacting fashion trends. Parents' demand is fueled by influencers and celebrities who frequently post pictures of their children wearing fashionable athleisure clothing. Parents often model their own style choices after their parents. Athleisure is becoming increasingly common among adults, so kids' fashion choices will follow suit.

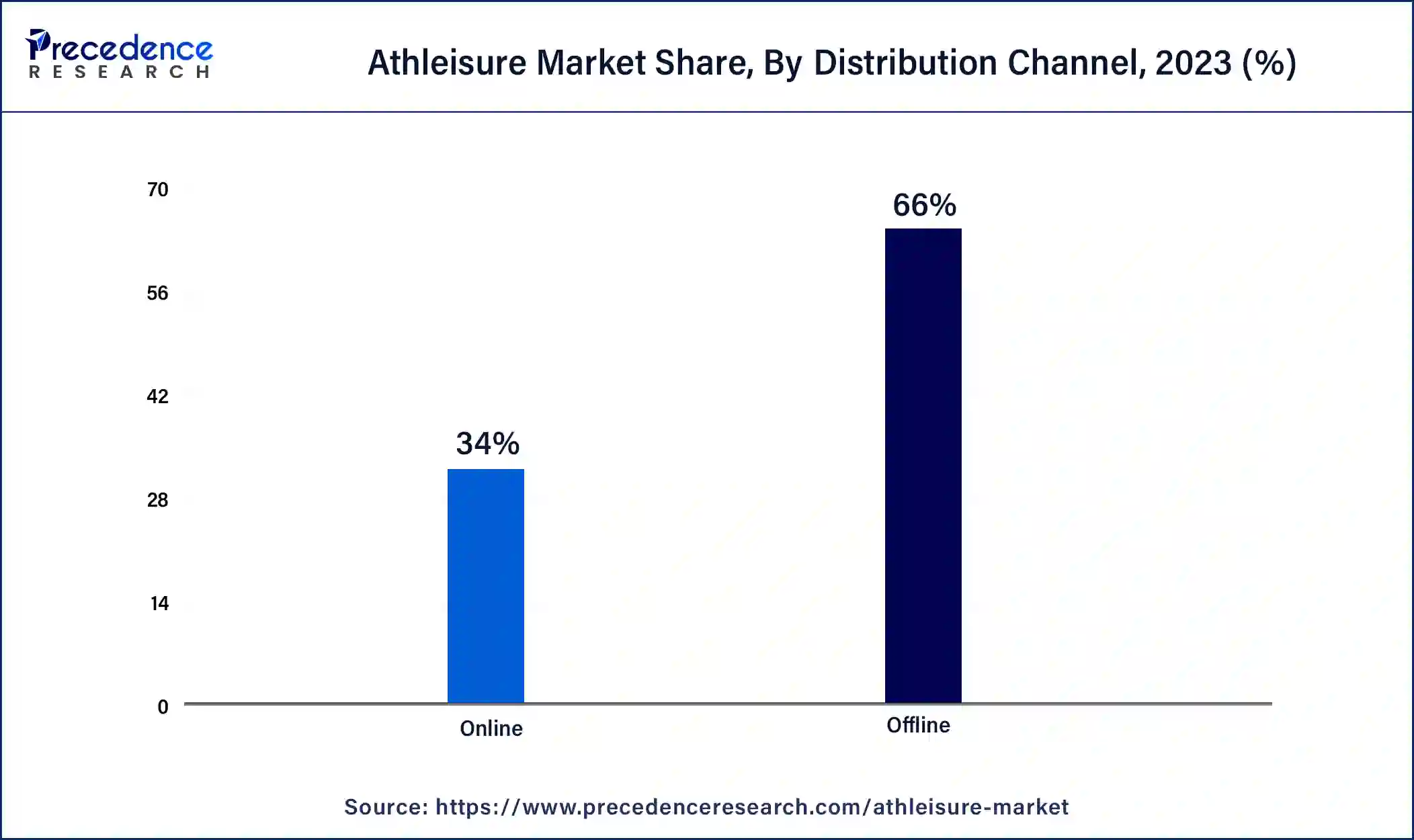

The offline segment dominated the athleisure market in 2023. Online platforms cannot fully mimic offline retailers' distinct purchasing experiences. Before purchasing, customers can physically try on several athleisure garments to evaluate the fit, fabric, and comfort levels. When combined with the help of experienced salespeople, offline shopping's interactive elements improve the customer experience overall and raise the possibility of making a purchase.

Some customers still find that returning or exchanging products in person is more convenient, even with the developments in internet purchasing. Customers can easily handle any problems with their purchases at offline retailers without dealing with the trouble of returning merchandise, which streamlines the process.

The online segment is the fastest growing in the athleisure market during the forecast period. Customers can browse and buy athleisure clothing from the comfort of their homes or while on the go via online shopping, saving them the trouble of going to physical stores. The growth of social media platforms has greatly impacted the athleisure market. Influencers and celebrities frequently promote athleisure clothing on sites like Instagram, which boosts online sales.

It gives access to a broader range of consumers, including those who live in remote locations and may want simple access to physical stores specializing in athleisure clothing, accommodating return policies, and offering customer-friendly services. This can improve the online purchasing experience and boost customer confidence. Furthermore, it provides recommendations based on customers' past purchases and interests, personalizing their shopping experience through data analytics and algorithms.

Segments Covered in the Report

By Type

By Product

By End-user

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client