April 2025

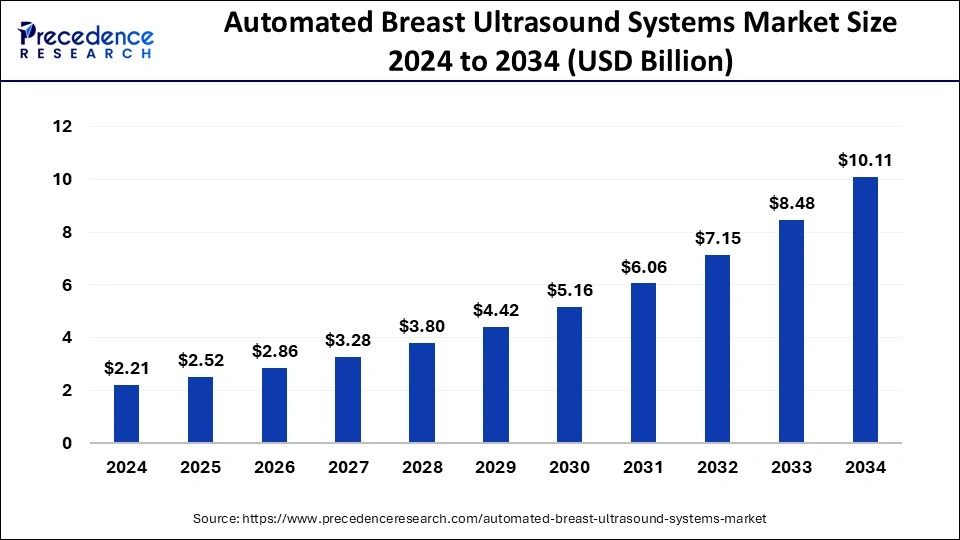

The global automated breast ultrasound systems market size is evaluated at USD 2.52 billion in 2025 and is forecasted to hit around USD 10.11 billion by 2034, growing at a CAGR of 16.70% from 2025 to 2034. The North America market size was accounted at USD 900 million in 2024 and is expanding at a CAGR of xx% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automated breast ultrasound systems market size accounted for USD 2.21 billion in 2024 and is predicted to increase from USD 2.52 billion in 2025 to approximately USD 10.11 billion by 2034, expanding at a CAGR of 16.70% from 2025 to 2034. Rising awareness of breast cancer screening, coupled with the need for more accurate and accessible diagnostic tools, further propels the adoption of ABUS in healthcare settings worldwide.

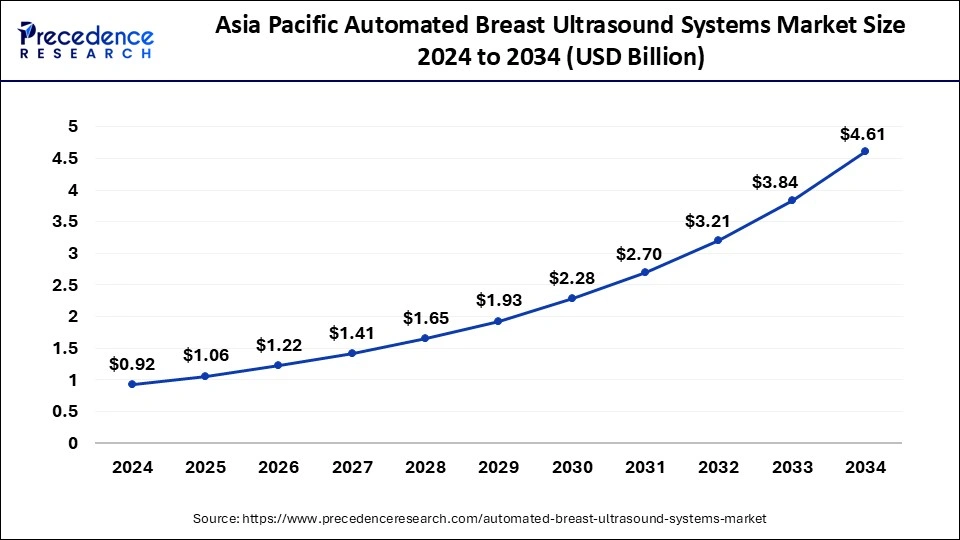

The Asia Pacific automated breast ultrasound systems market size was exhibited at USD 0.92 billion in 2024 and is projected to be worth around USD 4.61 billion by 2034, growing at a CAGR of 17.70% from 2025 to 2034.

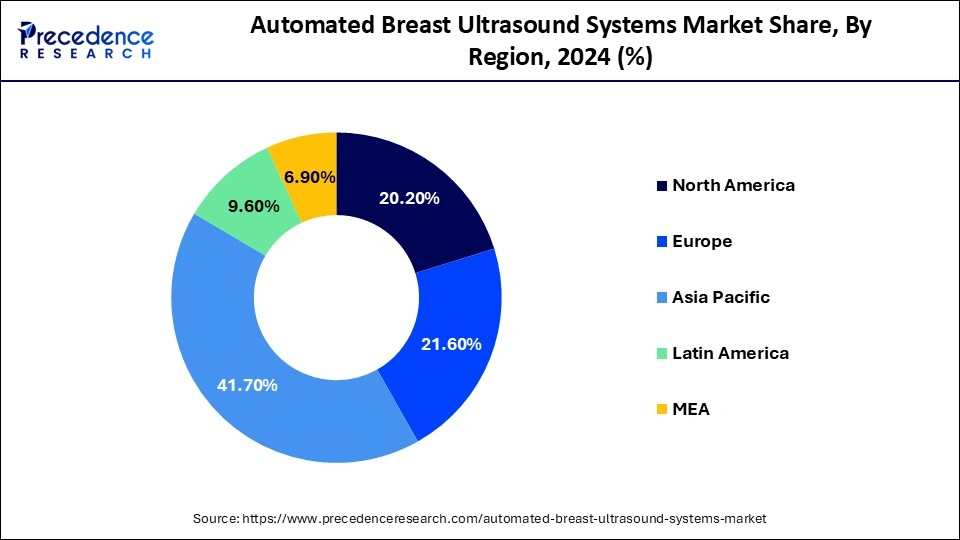

Asia Pacific dominated the automated breast ultrasound systems market with the largest share in 2024. The region has historically dominated the market, driven by factors such as advanced healthcare infrastructure, early adoption of technological innovations, and robust research and development initiatives. The region boasts a high prevalence of breast cancer screening programs, favorable reimbursement policies, and strong collaborations between healthcare institutions and industry players. Consequently, North America has been at the forefront of ABUS adoption, with widespread usage among radiologists, oncologists, and breast surgeons.

North America is expected to witness fast growth in the automated breast ultrasound systems market during the forecast period of 2025-2034. The region is witnessing an emergence in ABUS utilization, driven by rapid economic growth, increasing healthcare spending, and rising awareness about breast cancer screening. Countries like China, Japan, South Korea, and India are leading the charge in ABUS adoption. These nations have significant populations, a growing burden of breast cancer cases, and improving healthcare infrastructure, making them ripe markets for ABUS technologies. Furthermore, initiatives to enhance breast cancer awareness and screening programs are gaining traction, fueling the demand for advanced diagnostic tools like ABUS.

Automated breast ultrasound (ABUS) is an advanced imaging technique designed to enhance the detection of breast cancer, particularly in women with dense breast tissue where traditional mammography may be less effective. ABUS utilizes a transducer to generate high-frequency sound waves, which are then converted into detailed images of the breast tissue. Unlike handheld ultrasound, ABUS operates automatically, scanning the entire breast in a systematic and reproducible process that begins with the patient lying comfortably on a table as the breast is positioned within the ABUS system. The transducer moves across the breast, capturing multiple images from various angles. These images are then analyzed by specialized software to create a comprehensive three-dimensional representation of the breast.

The automated breast ultrasound systems market offers several advantages, including increased sensitivity in detecting small tumors, especially in dense breast tissue, where abnormalities may be obscured on mammograms. It also provides a non-invasive and radiation-free imaging option, making it safe for repeated use. While ABUS is not a replacement for mammography, it serves as a valuable adjunctive screening tool, particularly for women with dense breast tissue or those at higher risk of breast cancer. Its automation streamlines the imaging process, improving efficiency and standardization in breast cancer screening programs.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.70% |

| Market Size in 2025 | USD 2.52 Billion |

| Market Size by 2034 | USD 10.11 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Revolutionizing breast cancer screening

ABUS technology is transforming breast cancer screening by providing a radiation-free, non-invasive alternative to traditional mammography. With its ability to detect tumors in dense breast tissue, ABUS is revolutionizing early detection efforts, especially for high-risk individuals. Its automated scanning process ensures comprehensive coverage, enhancing efficiency and accuracy in diagnosis. As healthcare providers prioritize personalized medicine, services and products of the automated breast ultrasound systems market emerge as vital tools in improving patient outcomes through early detection and intervention.

Bridging the gaps in existing technologies

ABUS technology addresses the challenges of breast cancer diagnosis, particularly in populations with dense breast tissue where mammography may be less effective. By providing a detailed, three-dimensional view of the breast, ABUS enhances the detection of abnormalities, improving diagnostic accuracy and reducing the likelihood of false negatives. Its automation streamlines the imaging process, making it more accessible and less operator-dependent. The automated breast ultrasound systems market plays a crucial role in bridging the gap in breast cancer diagnosis, ensuring timely and accurate detection for improved patient outcomes.

Hurdles faced during the implementation of ABUS systems

Despite its potential benefits and the widespread adoption of ABUS, the automated breast ultrasound systems market faces several constraints. Firstly, the cost of ABUS technology remains a significant barrier, limiting accessibility, especially in resource-constrained healthcare settings. Additionally, the need for specialized training to operate and interpret ABUS results adds to the implementation challenges. Moreover, integrating ABUS into existing breast cancer screening programs requires infrastructural investments and workflow modifications, which may encounter resistance from healthcare institutions.

Furthermore, the limited evidence supporting ABUS as a standalone screening modality presents a challenge in gaining acceptance from regulatory bodies and insurance providers. Overcoming these restraints necessitates concerted efforts to reduce costs, expand training opportunities, streamline workflow integration, and generate robust clinical evidence to support the efficacy of ABUS in breast cancer detection. Only through addressing these challenges can ABUS realize its full potential in improving breast cancer screening and diagnosis outcomes.

Telemedicine Integration for Remote Consultations

The integration of ABUS with telemedicine platforms presents a significant opportunity to enhance the automated breast ultrasound systems market services, particularly in remote or underserved areas. By enabling remote consultations between patients and healthcare providers, ABUS can facilitate timely screenings and expert interpretations, reducing barriers to access and improving patient outcomes. This approach also offers the potential for more efficient use of healthcare resources and reduced patient wait times, as consultations can be conducted remotely without the need for in-person visits to specialized facilities.

Telemedicine-enabled education and training programs

Another opportunity for the automated breast ultrasound systems market lies in utilizing telemedicine platforms to provide education and training programs on ABUS technology for healthcare professionals. By offering remote training sessions, webinars, and virtual workshops, healthcare providers can enhance their skills in ABUS interpretation and usage, leading to improved diagnostic accuracy and patient care. Additionally, telemedicine-enabled educational initiatives can help address workforce shortages in certain regions by providing access to training opportunities for healthcare professionals who may not have access to traditional in-person training programs.

The automated breast ultrasound scanner (ABUS) segment dominated the automated breast ultrasound systems market in 2024. In recent times, two specific automated breast ultrasound technologies have emerged as particularly useful for the ABUS and the ABVS. ABUS offers comprehensive imaging of the entire breast, aiding in the detection of abnormalities, especially in dense breast tissue.

During the forecast period, the automated breast volume scanner (ABVS) segment is projected to grow substantially in the automated breast ultrasound systems market. On the other hand, ABVS provides high-resolution, three-dimensional images, enhancing diagnostic accuracy and efficiency. Both technologies offer significant advancements in breast cancer screening, providing clinicians with valuable tools to improve early detection rates and patient outcomes in a more accessible and operator-independent manner.

The radiologist segment dominated the automated breast ultrasound systems market in 2024. In recent times, two key end users who have found the ABUS particularly useful are radiologists and breast surgeons. Radiologists benefit from ABUS's ability to provide detailed, three-dimensional images of breast tissue, aiding in the accurate detection and characterization of abnormalities, especially in patients with dense breast tissue.

The surgeons segment is expected to show notable growth in the automated breast ultrasound systems market during the forecast period. For breast surgeons, ABUS offers enhanced pre-operative assessment, facilitating surgical planning and guiding interventions with greater precision. As ABUS continues to evolve, its utility for these specialists grows, contributing to improved patient care through more accurate diagnosis, treatment planning, and outcomes in breast cancer management.

By Product

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

December 2024

November 2024

November 2024