List of Contents

- Last Updated : 29 Oct 2025

- Report Code : 1366

- Category : Healthcare

What is the Telemedicine Market Size?

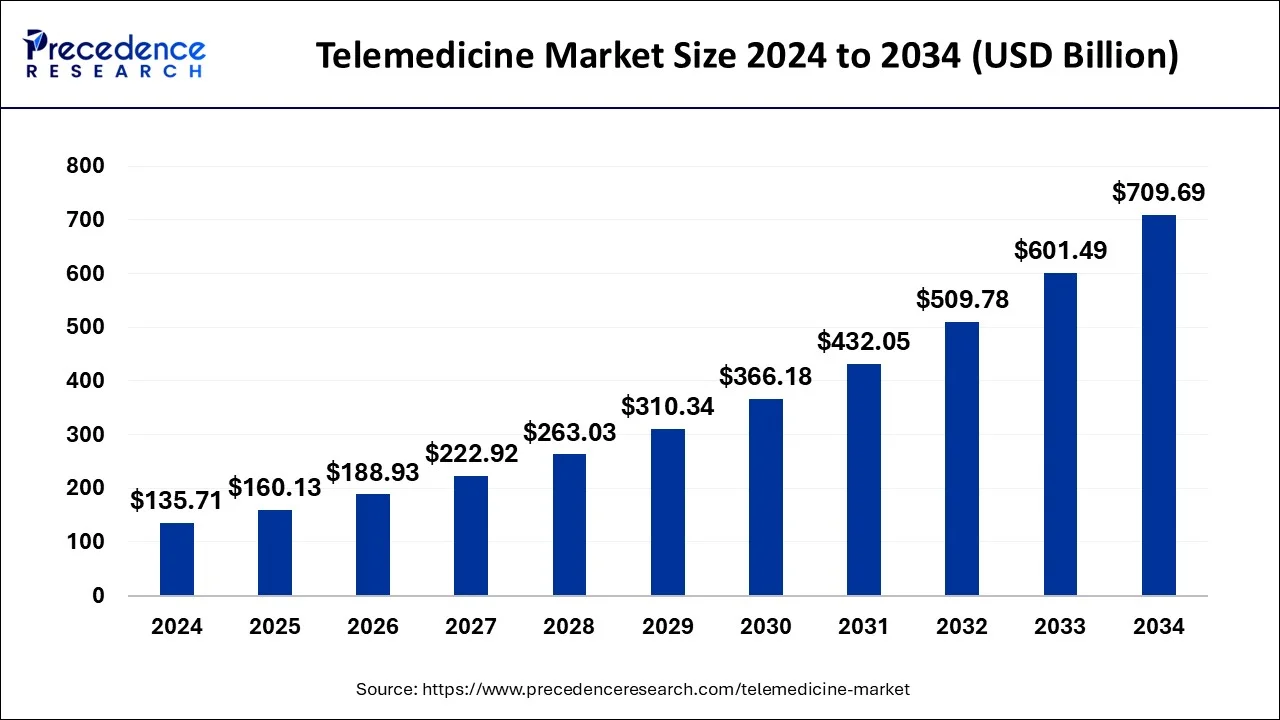

The global telemedicine market size is calculated at USD 160.13 billion in 2025 and is predicted to increase from USD 188.93 billion in 2026 to approximately USD 709.69 billion by 2034, expanding at a CAGR of 17.99% from 2025 to 2034. The telemedicine market is driven by the rising healthcare digitalization, along with the shift towards more flexible, ensuring wider worldwide access to telehealth services.

Market Highlights

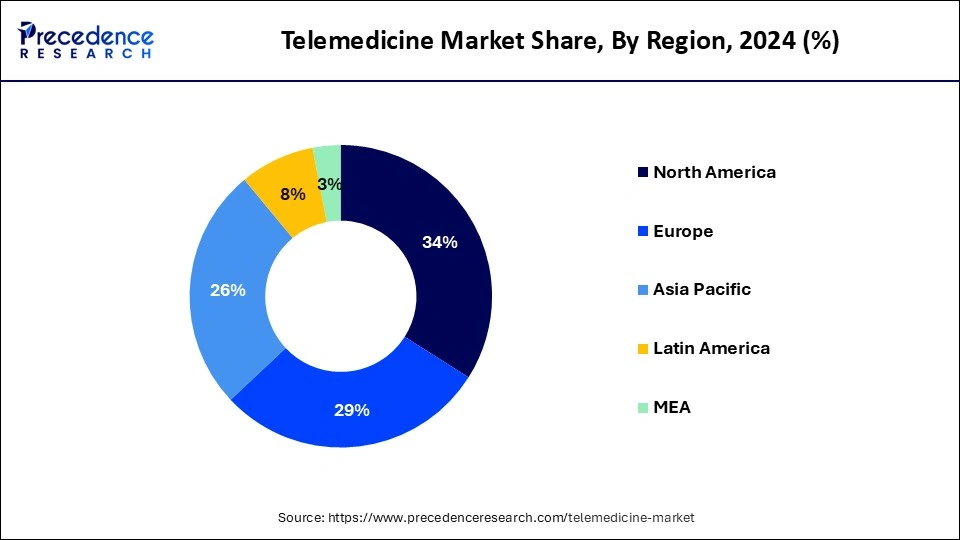

- By region, North America accounted 34% revenue share in 2024.

- By type, The tele-hospital segment accounted largest market share in 2024.

- By component, The product segment accounted significant market share in 2024.

- By application, The teleradiology segment accounted largest revenue share in 2024.

- By end user, The patients segment held a dominant presence in the telemedicine market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 160.13 Billion

- Market Size in 2026: USD 188.93 Billion

- Forecasted Market Size by 2034: USD 709.69 Billion

- CAGR (2025-2034): 17.99%

- Largest Market in 2024: North America

Market Overview

Telemedicine refers to the use of electronic and telecommunication systems for providing remote clinical services. It bridges the communication gap between healthcare professionals and patients, especially those living in remote areas. It offers advanced treatment care to the patients, eliminating the need to physically visit the clinics. Healthcare professionals primarily provide consultancy regarding dosage adjustments, lifestyle regimens, prescription refills, or even just access to group support. The different types of telemedicine services include real-time video communication, remote monitoring of blood pressure, heart rates, and oxygen levels, as well as store-and-forward medical data such as CT scans, MRIs, X-rays, etc. Thus, telemedicine favors advanced treatment in the comfort of the patient’s home.

Impact of AI on the Telemedicine Market

Artificial intelligence (AI) has proved its significance in the healthcare sector. In telemedicine, AI can overcome several potential limitations of conventional telemedicine. AI and machine learning (ML) can aid in personalized treatment plans, predict disease outbreaks, and analyze medical data. AI and ML reduce the burden on healthcare professionals by solving simple issues of the patients. They can also suggest treatment regimens and outcomes through natural language processing (NLP) and conversational AI. AI can also match the availability of care providers with appropriate clinical skills to the need for such skillsets in the immediate vicinity. Additionally, AI can be used to monitor patient’s health remotely using wearable devices and sensors. Thus, AI revolutionizes telemedicine by making it more accessible, affordable, efficient, and effective.

Telemedicine Market Statistics and data

- According to 2024 National Telehealth Survey, 86% of Americas stated that they were fully satisfied with the telehealth appointment. Whereas 84% American believe that they will continue to be a part of telehealth for receiving healthcare advice in the future.

- According to 2024 EY Global Consumer Health Survey, among the US population, 59% were open to utilize telemedicine (virtual assistance) for prescription renewal.

- The Government of Canada announced an investment of $240.5 million to accelerate the use of virtual tools and digital approaches.

- Elsevier Health published in a report of 2024, 56% clinicians think they will use artificial intelligence for offering healthcare services.

- Teladoc, one of the leading telemedicine providers in the US published its revenue report, the revenue of Teladoc Health Integrated Care segment increased by 5% to $360.1 billion in the second quarter of 2024.

- The Indian government launched ‘Heal in India’ campaign to make medical value travel size 13 billion by 2026. India is currently an emerging destination for international patients to connect with healthcare professionals without any geographic boundaries. India currently handles approximately 500000 international patients via telemedicine or telehealth services annually.

Telemedicine Market Growth Factors

- Rising Incidences of Chronic Disorders: The rising incidences of chronic disorders promote the use of telemedicine, potentiating market growth.

- Increasing Geriatric Population: The increasing geriatric population increases the demand for home healthcare. Telemedicine enables effective treatment for the older age population at home.

- Technological Advancements: The advent of advanced technologies streamlines the telemedicine process.

- Rising Adoption of the Internet: The rising adoption of broadband Internet technology globally has made both audio and video calls affordable and available to a wider spectrum of society.

- Increasing Investments: Governments of different countries provide funding to develop IT and telecommunications infrastructure that contributes to market growth.

- Growing Demand for Precision Medicine: Telemedicine favors providing personalized therapy to patients, boosting market growth.

Telehealth market trends in 2025

Collaboration on an international level: Telehealth use across international borders is becoming frequent and is commonly practiced. As networks are becoming stronger and widely available, it is positively impacting the telehealth market and its expansion.

AI integration: The integration of AI with telemedicine has created a wave in the global market, and it is expected to enhance telemedicine facilities with AI support significantly. AI-based diagnostic tools and predictive analytics play a critical role by enabling healthcare professionals to take firm decisions that are purely data-oriented to achieve high precision and optimum results with virtual care.

Hybrid care models: Hybrid care models are referred to as a blend of physical meetings and virtual meetings between patients and professionals. Due to telehealth consulting, more free time is available as it saves time for traveling and occupying OPD waiting for doctor consultants. Many professionals opt to spend their remaining time with other patients consulting who are comfortable with hospital visits.

Mental health services: Since mental health is a taboo in many cultures, and we often deny it as a subjective experience and do not consider it an illness, many people suffer silently without speaking about their mental health. Telepsychiatry is emerging as the best counseling service by avoiding the necessity of physical presence to consult with psychiatrists. According to the data, nearly 51% of European countries are currently offering services for telepsychiatry.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 160.13 Billion |

| Market Size in 2026 | USD 188.93 Billion |

| Market Size by 2034 | USD 709.69 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 17.99% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, Application, Technology, Delivery Mode, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Improved patient convenience

Telemedicine offers more flexible scheduling options, enabling patients to choose appointment times that suit their availability. It is especially helpful for individuals who find it complicated to take time off from work or other responsibilities for a traditional in-person medical appointment. By opting for telemedicine, patients can save money or transportation costs and other expenses required for traveling to any healthcare facility. Telemedicine allows patients to maintain continuous care without interruptions, even when they are away from their regular healthcare provider.

Moreover, telemedicine helps bridge the gap in accessing specialized care, particularly for patients living in regions with limited access to specific medical specialists. Telemedicine has improved the patient's convenience along with patient engagement. Thus, the element acts as a driver for the market’s growth.

Restraint

High cost for adoption of the technology

Implementing telemedicine services requires a robust technological infrastructure, including high-speed internet connectivity, secure data storage and telecommunication networks. These initial setup costs can be substantial and act as a barrier, especially for smaller healthcare providers or those in resource-constrained areas. Healthcare facilities need to invest in telemedicine-specific equipment and devices such as telemedicine carts, remote monitoring tools and video conferencing systems. These can be expensive, adding to the overall cost of adopting telemedicine solutions. Healthcare professionals need proper training to effectively use the technology. All these factors can be time-consuming and costly, that hampers the growth of the market.

Opportunity

Corporate emphasizing on healthcare solutions for employees

With the prevalence of multiple chronic diseases across the globe along with sedentary lifestyles, corporate companies, especially in developed countries have started offering multiple healthcare solutions, services and policies for their employees. This element brings an opportunity for the telemedicine market to grow. Corporate telemedicine solutions introduce telehealth services to a large and captive audience, such as employees of the company. Large corporations with a widespread workforce in different countries or regions often choose such healthcare solutions for employees. As companies seek such services, the collaboration, strategic deals or partnerships between corporates and telemedicine providers are expected to grow. This opens a set of opportunities for the telemedicine market to grow.

Market Challenge

Slower adoption of the technology by underdeveloped areas

Underdeveloped areas often lack the necessary infrastructure, such as reliable internet connectivity and even electricity, which is crucially required to operate telemedicine systems. Without a stable connection of internet, it becomes challenging to conduct video consultation or transfer medical data efficiently, hampering the seamless delivery of telemedicine services. In underdeveloped areas, the penetration of smartphones, tablets or other devices might be low, this also slows down the adoption of telemedicine services. Thus, causes a challenge for the market’s expansion.

Segments Insights

Type Insights

The tele-hospital segment accounted largest market share in 2024. The increased adoption of the telemedicine in the case of emergency has fueled the growth of this segment. The rapid growth of the telemedicine is directly linked to the COVID-19 pandemic. During the pandemic in 2020, the adoption of the telemedicine increased rapidly due to the traveling restrictions and increased adoption of digital technologies.

The tele-home segment is predicted to reach notable growth during the forecast period. The rising preferences of the people to get treatment at their homes, especially the geriatric people and the increased awareness regarding the hospital acquired infections among the population are the major factors that are expected to drive the growth of this segment.

The tele-home segment shows a notable growth rate in the telemedicine market during the forecast period. Due to the increased acceptance of remote patient monitoring apparatus and the rising incidence of chronic diseases. This growth is thus fueled by developments in digital health technologies and even supportive government initiatives. Innovations in wearable devices, secure data transmission platforms, and mobile health applications, have made it easier to gather, transmit, and even determine patient data, thus accelerating the adoption of tele-home care.

Component Insights

The product segment accounted significant market share in 2024. The product includes hardware and software. The hardware consists of wide variety of devices and are extensively used in the hospitals, clinics, and homecare telehealth devices. Various hardware used consists of mobile frame, communication lines, computer systems, therapeutic devices, video feed, and various others. The extensive usage along with the high prices of the hardware has resulted in a huge revenue generated by this segment. Moreover, the rapid development and updates in the software system to enhance the efficiency and effectiveness of the telehealth devices is exponentially boosting the segment growth.

The services segment is projected to reach highest CAGR over the forecast period. The rising adoption of the telemedicine among the consumers and the doctors or physicians is propelling the sales of various services such as e-monitoring, e-consulting, and e-education, which is expected to drive the market growth.

The services segment is the fastest growing in the telemedicine market during the forecast period. This growth is mainly driven by the rising need for remote patient monitoring, virtual consultations, along with other healthcare services delivered via telemedicine platforms. Virtual consultations between doctors and patients, as well as among healthcare providers, are becoming increasingly common, providing convenient and even accessible healthcare solutions. Telemedicine services can be more cost-effective than conventional in-person visits, mainly for routine check-ups along with follow-up appointments.

Application Insights

The teleradiology segment accounted largest revenue share in 2024 and is expected to witness remarkable CAGR over the forecast period. The demand for the teleradiology increased rapidly in the past few years owing to various benefits it offers such as faster diagnostics, clear imaging, lower costs, and elimination of the excess work of the radiologists. This segment accounted for over 25% of the market share in 2020.

The telecardiology segment is expected to be fastest-growing segment during the forecast period. This is attributed to the rising prevalence of cardiovascular diseases among the global population coupled with rising adoption of the telemedicine platforms. Telemedicine provides patient monitoring feature who has a cardiac device implanted. It improves patient care and hence the demand for this segment is expected to grow.

Technology Insights

The store & forward segment accounted largest revenue share in 2024 and is projected to witness remarkable CAGR during the forecast period. The telemedicine app can store the past health records of the users and this information can be communicated to the doctors or the physicians at the time of treatment, which can enhance the patient care and benefit the patients.

The real-time segment is expected to hit largest CAGR over the forecast period. The real-time is very much useful especially at the tele intensive care because it transfers the patient’s data quickly to the intensivist at a distant location and helps the ICU members at the hospital in the treatment of the patient.

The real-time segment is the fastest growing in the telemedicine market during the forecast period. This growth is driven by the increasing requirement for immediate consultations, widespread acceptance of smartphones and even internet access, and the demand for on-demand medical services. The usage of smartphones and enhanced internet connectivity has made real-time telemedicine to be more accessible to a broader population, permitting patients to consult with healthcare professionals from the comfort of their homes.

Delivery Mode Insights

The web/mobile segment led the global telemedicine market in 2024. The increasing use of smartphones and the rising adoption of the Internet augment the segment’s growth. The advancements in telecommunication sectors and broadband internet connectivity also promote the segment’s growth. 5G and 6G technology provides high internet speed, more connectivity, and lower latency than previous networks. The use of web/mobile helps to maintain the privacy of patient health data.

The call centers segment is the fastest growing in the telemedicine market during the forecast period. Call centers are indeed undergoing rapid expansion due to their ability to offer 24/7 access to healthcare data and services. This segment targets the continuous monitoring of individuals with chronic conditions (like diabetes and hypertension). There is a demand for proactive along with personalized care in handling these conditions.

End-User Insights

The patients segment held a dominant presence in the telemedicine market in 2024. The increasing awareness among patients about various tools and software for telemedicine. Several tech giants develop software to connect to patients. This attracts more patients living in remote areas. The growing demand for home healthcare services due to the rising geriatric population potentiates the segment’s growth. The increasing patient satisfaction after telemedicine services propels the demand for telemedicine.

The provider segment is anticipated to grow the fastest during the forecast period. The segment’s growth is attributed to the need for advanced healthcare services, technological advancements, and improved decision support. Healthcare providers can treat numerous patients within a short period and reduce overwhelming emergency room admissions.

Regional Insights

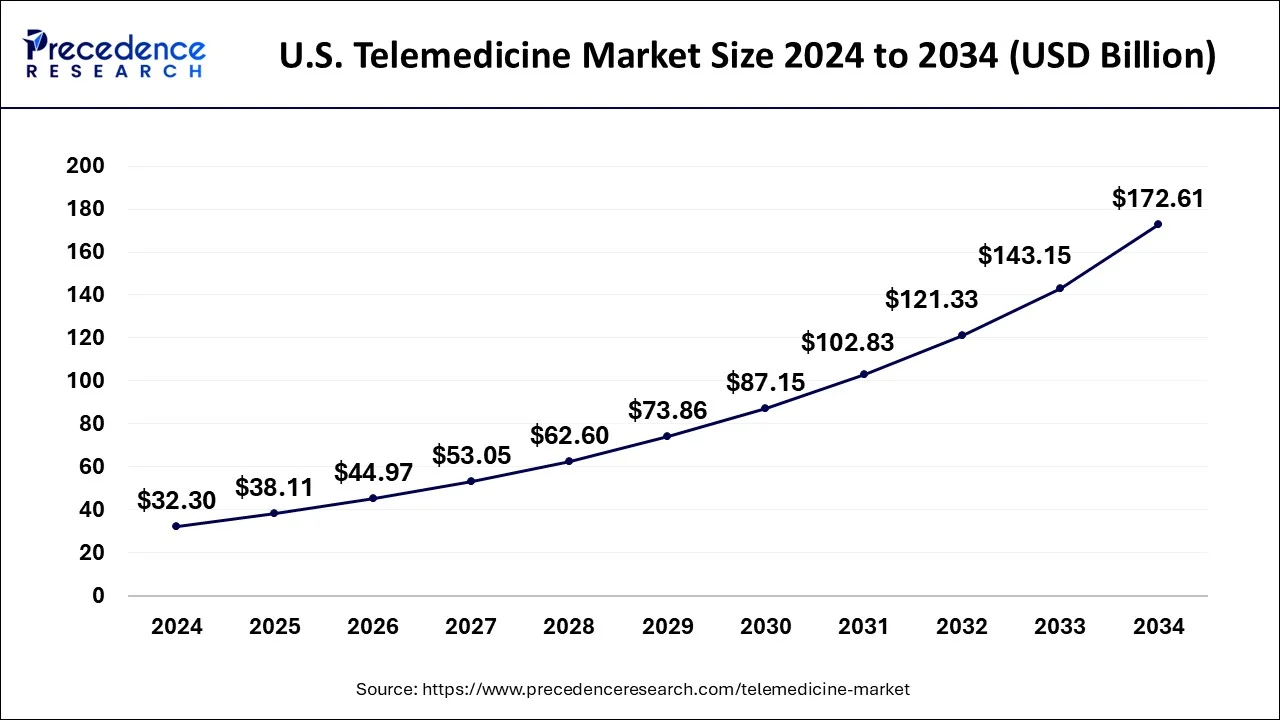

U.S. Telemedicine Market Size and Growth 2025 to 2034

The U.S. telemedicine market size is exhibited at USD 38.11 billion in 2025 and is projected to reach around USD 172.61 billion by 2034, rising at a CAGR of 18.25% from 2025 to 2034.

Based on region, North America accounted 34% revenue share in 2024. The rising burden of chronic diseases and growing geriatric population in US are the major factors behind the growth. Moreover, the region is characterized by increased disposable income, increased demand for the advanced technologies, and developed healthcare and IT infrastructure. According to NCBI, over 40,000 health apps were available for download on Apple iTunes store in 2013 in US. Thus, rapid growth of the telemedicine is boosting the market growth in this region.

The Asia Pacific is expected to witness remarkable CAGR during the forecast period. Asia Pacific is estimated to grow due to various factors such as largest population, rapid urbanization, rising investments on healthcare infrastructure, and increased investments on the IT infrastructure. Further, the use of advanced technologies can significantly reduce the healthcare costs, which drives the adoption of telemedicine in the Asia Pacific region.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like new product launches with latest and innovative features fosters market growth and offers lucrative growth opportunities to the market players.

Telemedicine Market Companies

- Koninklijke Philips N.V.

- Medtronic

- GE Healthcare

- Cerner Corporation

- Siemens Healthineers

- Cisco Systems, Inc.

- Teladoc Health Inc.

- American Well

- AMC Health

- MDLive

Latest Announcement by Industry Leaders

- Andy Flanagan, CEO of Iris Telehealth, commented that telehealth has already proven its value in increasing access to care. However, pairing it with AI holds immense potential to provide more efficient, effective, and personalized mental health services. He added that companies should leverage such technologies to enhance human care, improving patient outcomes and experiences.

Recent Developments

- In May 2025, DLH Holdings Corp, well-known for system engineering and integration, digital transformation and cybersecurity, made an announcement that it will receive a five-year task value of up to USD 37.7 million for delivering scientific research and development, AI/ML, modeling and simulation robotic process automation, cloud-based big data analytics solution and others for TATRC- telemedicine and davanced technology research center.

- In December 2024, DocGo, Inc. announced an extended partnership with SHL Telemedicine to integrate the SmartHeart portable 12-lead ECG device across DocGo mobile health care units. The device will help reduce barriers to cardiovascular care, enabling early intervention and preventing costly emergency room visits.

- In June 2024, Apollo Telehealth and the Government of Manipur launched a telemedicine-driven primary health center in Borobeka, Manipur. The health center was inaugurated to improve healthcare access for communities affected by conflicts.

Segments Covered in the Report

By Type

- Tele-hospital

- Tele-Home

- mHealth

By Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

By Application

- Telepathology

- Teleradiology

- Teledermatology

- Telepsychiatry

- Telecardiology

- Others

By Technology

- Store & Forward

- Real-Time

- Others

By Delivery Mode

- Web/Mobile

- Telephonic

- Visualized

- Call Centers

By End-users

- Providers

- Patients

- Payers

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Meet the Team

Related Reports

November 2024

August 2025

October 2025

October 2025