March 2025

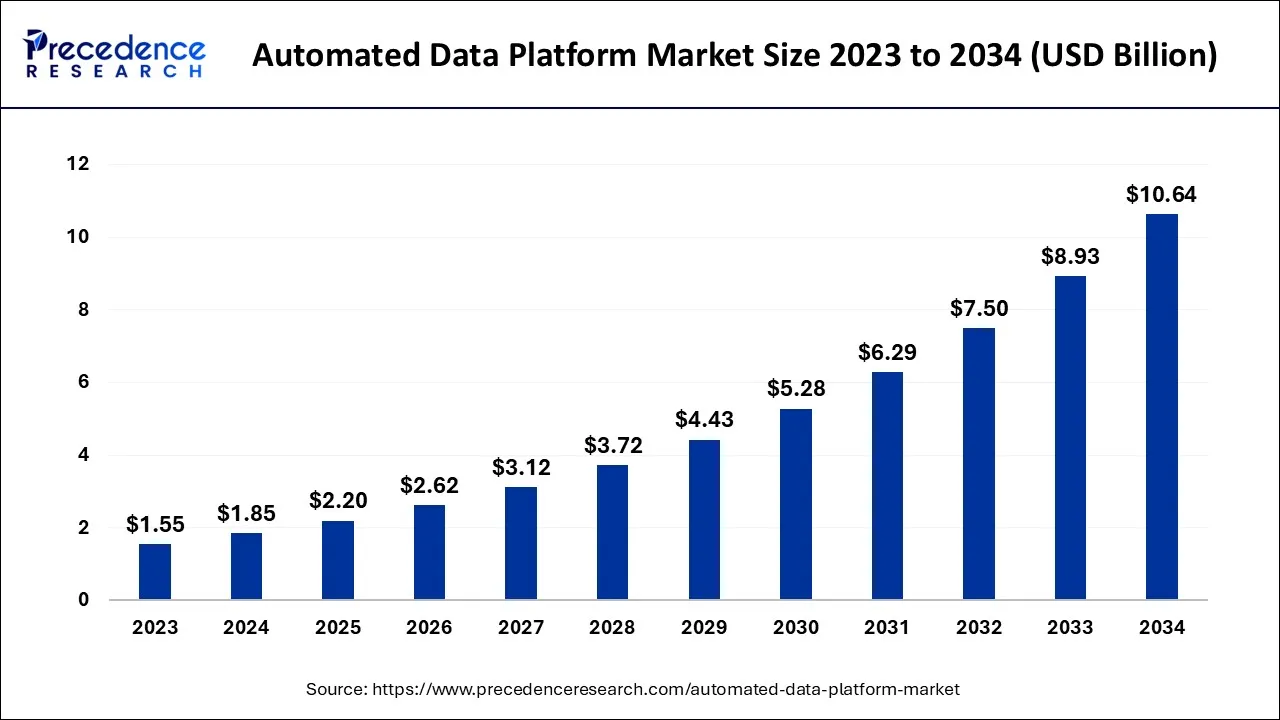

The global automated data platform market size accounted for USD 1.85 billion in 2024, grew to USD 2.20 billion in 2025, and is expected to be worth around USD 10.64 billion by 2034, poised to grow at a CAGR of 19.12% between 2024 and 2034. The North America automated data platform market size is predicted to increase from USD 700 million in 2024 and is estimated to grow at the fastest CAGR of 19.27% during the forecast year.

The global automated data platform market size is expected to be valued at USD 1.85 billion in 2024 and is anticipated to reach around USD 10.64 billion by 2034, expanding at a CAGR of 19.12% over the forecast period from 2024 to 2034. A technology solution known as an autonomous data platform (ADP) handles various parts of data administration and analytics duties. For the storage, processing, analysis, and management of organized, semi-structured, and unstructured data, an ADP offers a unified framework.

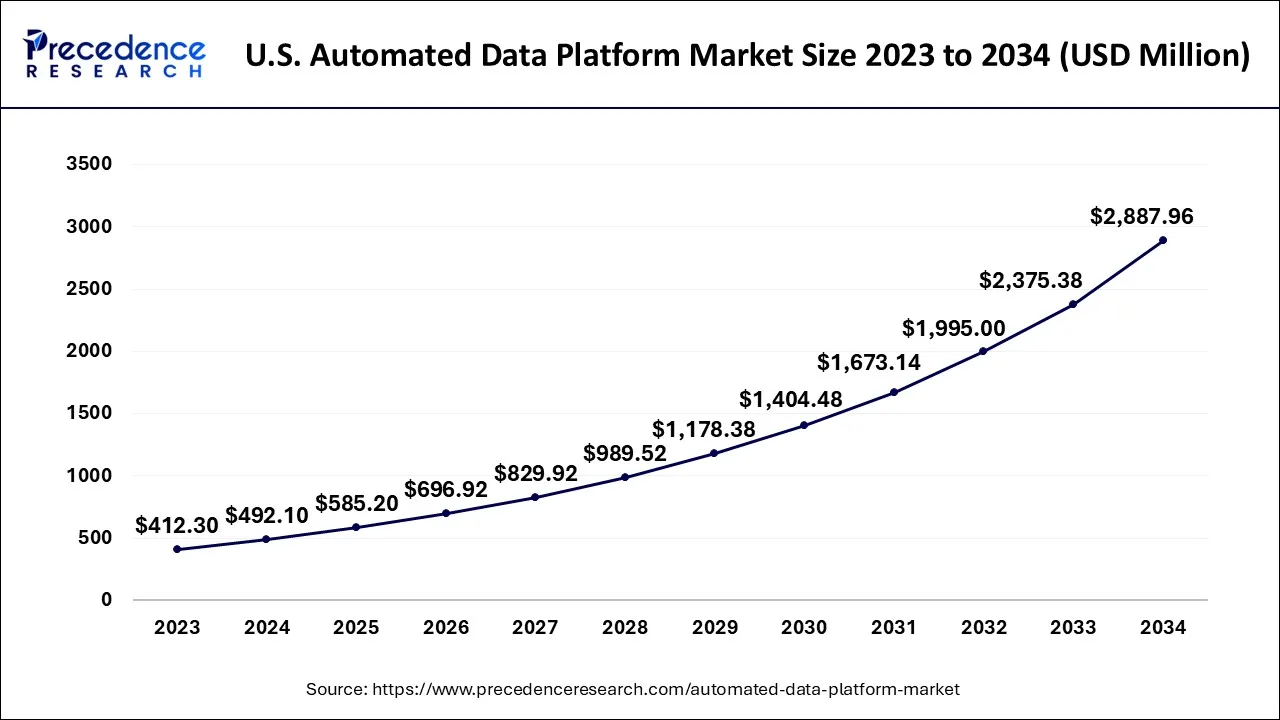

The U.S. automated data platform market size is exhibited at USD 492.10 million in 2024 and is projected to be worth around USD 2,887.96 million by 2034, growing at a CAGR of 19.36% from 2024 to 2034.

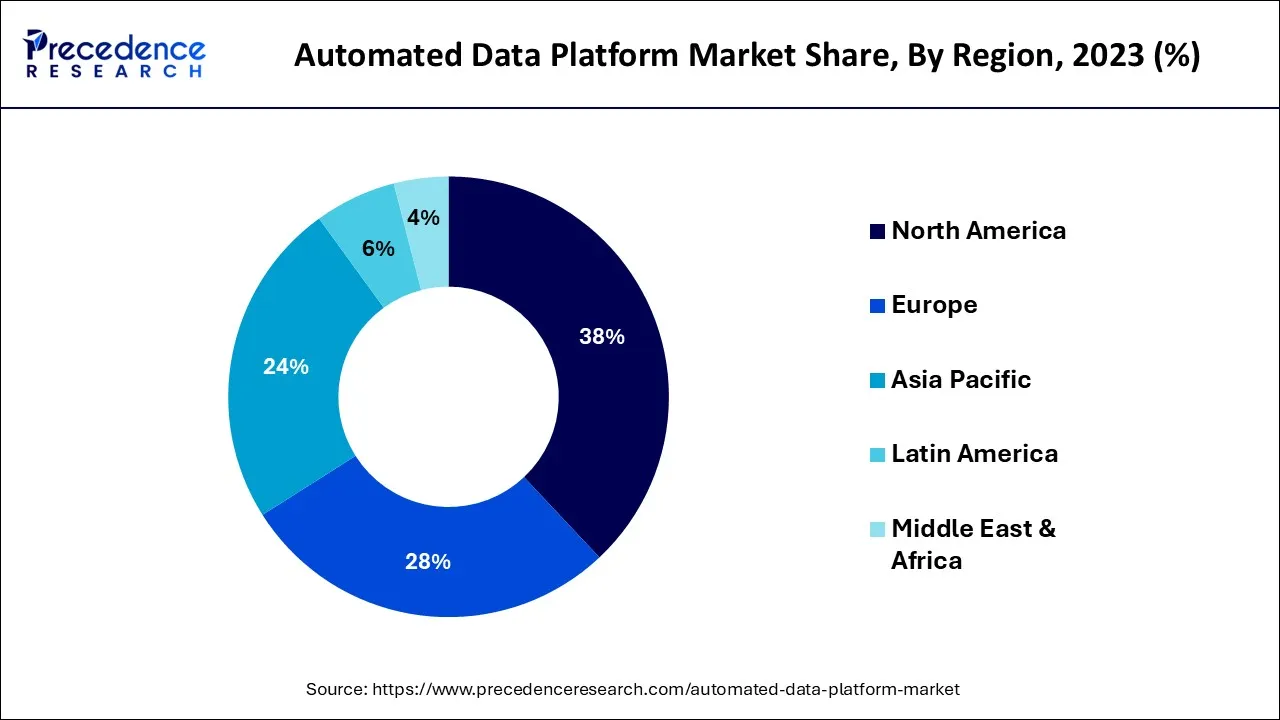

With a 38% revenue share in 2023, North America had the highest revenue share. The region is thought to be the most evolved region in terms of embracing the newest technologies and cloud-based solutions because it is home to most established countries, including the United States and Canada. The pervasive use of mobile phones and the internet in North America is fueling the sizable market growth.

The growing use of cell phones and social networking sites to communicate with customers and business partners is another factor contributing to the market growth in the area. The regional distribution of solutions that offer clients versatile analytics on any cloud while maintaining ongoing control and security is creating strong development prospects for the autonomous data platform business in North America. With a CAGR of 24.3%, the Asia Pacific is predicted to become the area with the greatest growth.

The business is predicted to continue expanding quickly because decision-making is increasingly aided by AI and machine learning. Additionally, the ability of businesses to merge client data from various sources onto a single platform, cutting down on hours of computational work, is facilitating the demand for autonomous data platforms.

Due to substantial investments made in R&D efforts to offer these platforms improved capabilities, the autonomous data platform business is likely to see new growth possibilities. As a result, throughout the projection period, the Asia Pacific region is anticipated to experience favorable growth for automated database systems.

The use of cutting-edge technologies like Machine Learning (ML) and Artificial Intelligence (AI), along with the rise in demand for real-time information and the increasing digitization and automation across industries, are expected to contribute to the growth of the automated data platforms industry. Autonomous data platforms are becoming increasingly applicable in cloud-based businesses, with the trend of cloud platforms in new organizations and the retention of enterprise data primarily in hybrid and public clouds.

An autonomous data platform offers exceptional flexibility, allowing companies to adjust capacity on convenience and needs. With the rapid expansion of social media and associated devices, a significant amount of unstructured information is being generated, which is expected to increase the need for autonomous database platforms from small and medium-sized businesses. Autonomous data platforms ensure that data is encrypted, workloads are tracked, and any entity attempting to access the data.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.85 Billion |

| Market Size by 2034 | USD 10.64 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 19.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Services, By Deployment, By Enterprise Size and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Improvements in cloud processing and artificial intelligence

The fields of artificial intelligence and cloud computing are developing quickly, and as a result, businesses have more choices to increase their productivity and effectiveness. More processes can be automated with the help from stronger artificial intelligence as automation rates can be scaled up to new levels with faster artificial intelligence skills for process and workflow.

Additionally, companies are now able to benefit from quicker, more dependable, and more effective storage and processing options thanks to increasing developments in the field of cloud computing. These developments are laying a solid basis for the global autonomous data platform industry to expand.

High cost of autonomous data platforms

The demands of businesses increase as a result of the expanding technological advancements. In order to meet the demands of gathering, sorting and analyzing their customers' data, these businesses frequently update their cloud-based and customer-centric solutions. Additionally, businesses must make significant expenditures in order to implement cloud-based and autonomous data platforms, which could reduce demand for these platforms during the forecast period.

Private and mixed cloud usage is increasing among modern businesses

Due to the rising patterns of cloud application in new-age companies organizations and storing of corporate data primarily in the hybrid & public clouds, the uses of autonomous data platforms are continuously growing in cloud-based businesses. Moreover, compared to traditional business data storage solutions, autonomous data platforms are offering a variety of ways to examine, exchange, and combine crucial data more securely and quickly.

Due to expanding technological advancements, such as the rise of digital and cloud-based platforms and an increase in the demand for analytics, which is expected to drive the sector's growth, the platform segment accounted for the biggest revenue share of 69% in 2023.

To handle significant business issues and ensure optimum database use, an autonomous data tool assesses a particular customer's big data architecture. It helps companies expand and improve their data handling capabilities. It assesses the security of a number of elements, including setup, confidential information, unusual database processes, and users.

During the projection period, the service sector is anticipated to expand at a CAGR of 21.2%. File corruption can lead to data loss because of different malware and the extremely confidential information the organization handles. The development of the database backup and restore service is being fueled by businesses' focus on having a data backup and restore tool to address this problem.

The need for very large quantities of data to be saved, backed up, and restored by a growing number of large and medium-sized companies is what is causing the services sector to grow over the course of the projected period.

In 2023, the on-premises market made for 51.4% of total income. Since on-premises implementation is thought to be safer than cloud deployment, it is used in companies where identity and secrecy are crucial components of company operations. Additionally, on-premises software is easily adaptable to specific business needs. The on-premises deployment model, which also protects IP addresses and data privacy and eliminates the need for third parties to manage and secure data, may cause businesses to avoid transferring data over the internet. Throughout the projection period, these will support the segment's development.

Over the projection period, the cloud sector is anticipated to expand at a CAGR of 25.3%. Users are more likely to favor and implement cloud-based solutions because of their flexibility and affordability. Platforms for cloud computing offer greater scalability, less expensive implementation, and continuing growth.

The use of cloud-based solutions increases the ease of service delivery because of its virtual setting, which allows businesses to access information across linked devices at any time. Users can send data to connected devices over a network as opposed to storing it directly on their own devices. These advantages of cloud implementation will accelerate the sector's development.

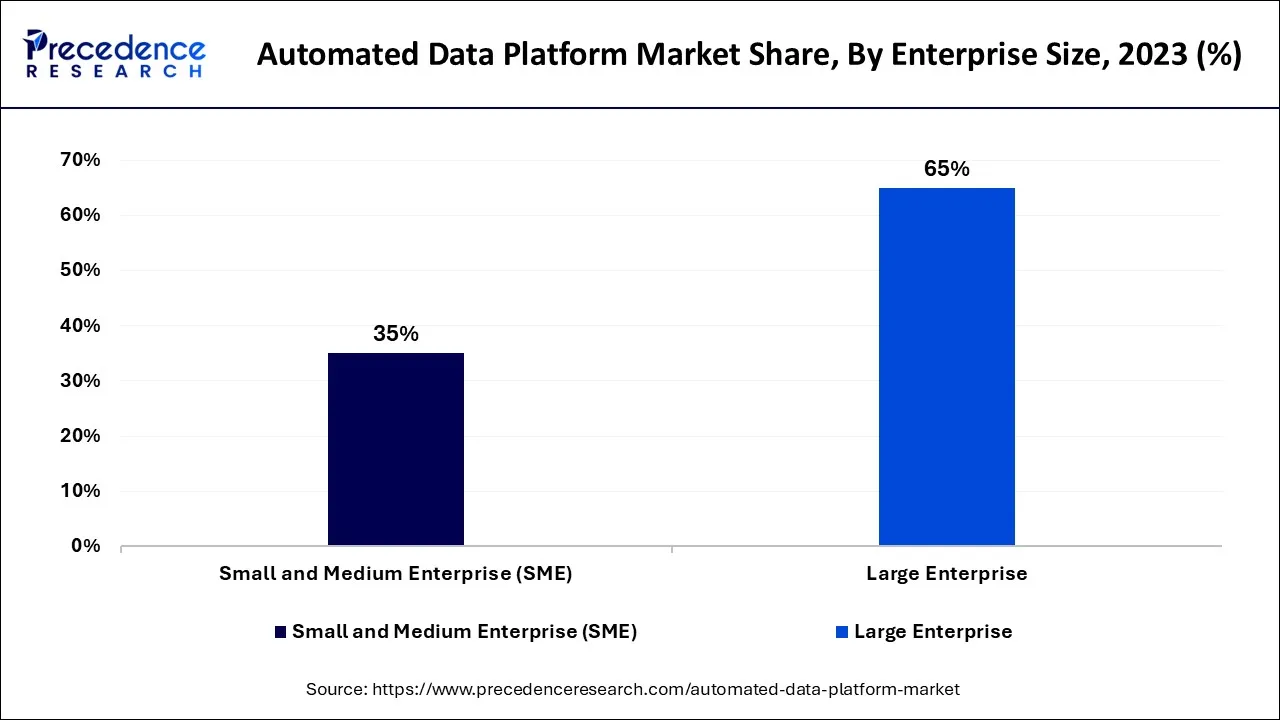

The biggest income portion was accounted by the large enterprise's sector which was 65% in 2023. Due to the advancement toward digitalization and the effective use of technologies to automate and accelerate business processes, it is anticipated that the big firm sector will grow over the course of the projection period.

Large businesses can afford more expensive options, and as a result, these gadgets produce a lot of structured and unstructured data that needs to be handled and kept. Therefore, options for autonomous data platform will be highly esteemed in the years to come. Because of this, the big business market has embraced the autonomous data platform more quickly and will present profitable possibilities for market expansion.

During the projection period, the small and middle business companies sector is anticipated to expand at a CAGR of 24.7%. the growth of expenditures in cutting-edge methods like machine learning, the expansion of AI applications, and the acceptance of digital payment systems.

As a consequence of increased traffic, small and medium-sized companies are expected to increase their demand for self-contained data structures. The automated data platform market is expected to grow as machine learning and AI are used more frequently to enhance decision-making.

The BFSI maintained the top revenue share of 21% in 2023 and is anticipated to hold this position throughout the projection period. The BFSI sector has largely adopted the autonomous data infrastructure.

Companies use analytics tools to extract information, which they then use to build tailored one-on-one client interactions. Data analytics helps banks improve their marketing skills. Risk, compliance, fraud, and determining value at risk are a few functional areas that may significantly profit from analytics to keep optimum performance and make the right choices when speed is crucial. Over the projection period, the retail sector is anticipated to expand at a CAGR of 22.5%.

Autonomous data systems are used by the retail sector for analytics in a number of areas, including CRM, product improvement, and advertising optimization. The retail industry has become more customer-focused as a consequence of the rise in the use of digital networks.

Retailers can monitor customers' purchasing behavior in real-time using the platform, which helps them better understand and meet customers' requirements. These reasons are stimulating the development of the segment over the forecast term.

Oracle and Informatica, a provider of cloud-based corporate data management tools, partnered in May 2022. As part of this collaboration, both businesses will offer industry-leading cloud information management, connectivity, and regulation solutions along with databases, database servers, big data, data lake houses, business analytics, and data science.

Segments Covered in the Report

By Component

By Services

By Deployment

By Enterprise Size

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

March 2025

April 2025

January 2025