April 2025

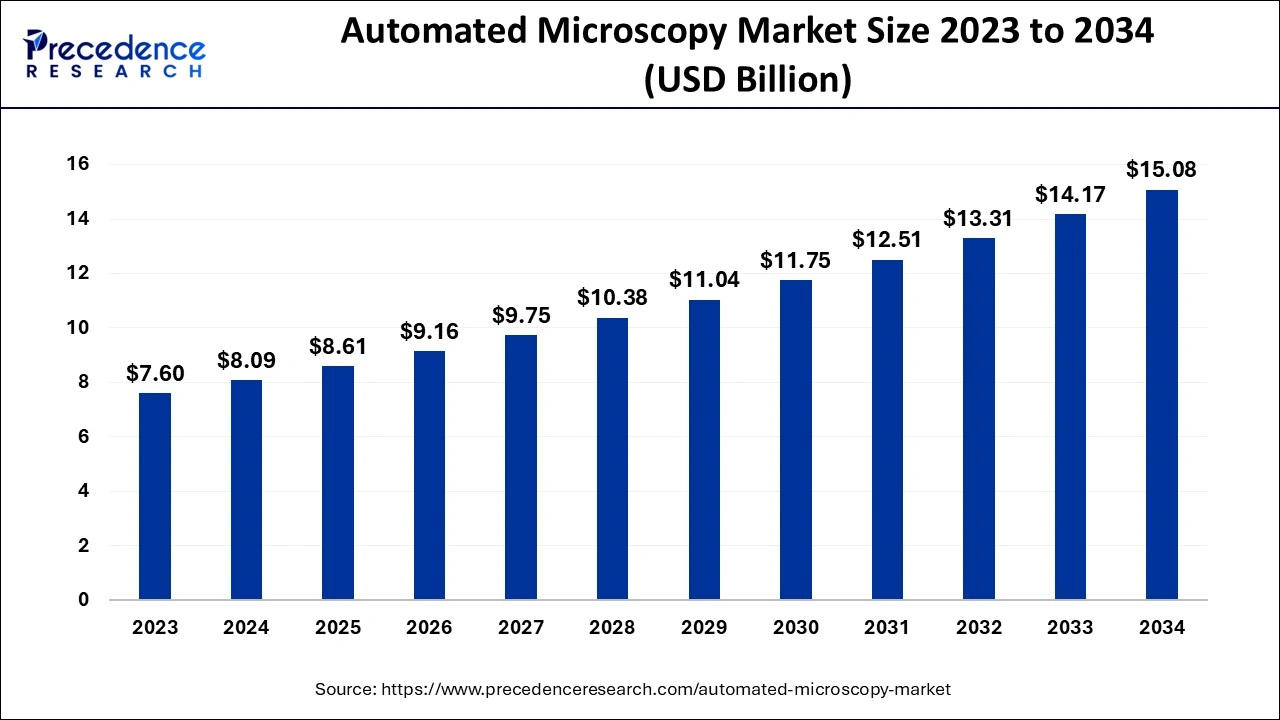

The global automated microscopy market size is evaluated at USD 8.09 billion in 2024, grew to USD 8.61 billion in 2025 and is projected to reach around USD 15.08 billion by 2034. The market is expanding at a CAGR of 6.43% between 2024 and 2034.

The global automated microscopy market size accounted for USD 8.09 billion in 2024 and is expected to exceed around USD 15.08 billion by 2034, growing at a CAGR of 6.43% from 2024 to 2034. The automated microscopy market is driven by the growing need in the healthcare industry for precise and effective diagnostics.

Artificial intelligence (AI) algorithms can detect cellular structures, abnormalities, and specific biological markers more precisely. This is important for identifying minute patterns in intricate samples that are difficult to see with the naked eye. AI makes it possible for workflows to be completely automated, requiring little human involvement in sample analysis, processing, and reporting. This is very helpful for large-scale investigations where speed and consistency are essential. Enabling super-resolution techniques that overcome the diffraction limit of light can produce more accurate photographs that would otherwise require sophisticated, costly equipment.

By enabling high-throughput imaging with little operator intervention, automated microscopy greatly has raised the accuracy and efficiency of research. This is especially crucial in domains where accuracy and timeliness are essential, such as drug discovery. High-resolution photographs are reliably produced by automated imaging equipment, which lowers the possibility of human error in repetitive activities. Unlike classical microscopy, automated systems can incorporate image analysis software that evaluates images quantitatively. This makes it possible to assess cell count, intensity, shape, and other properties objectively, all of which are essential for studying cancer, cell biology, and neurology. The reproducibility and validation of scientific discoveries depend on quantitative data.

| Report Coverage | Details |

| Market Size by 2034 | USD 15.08 Billion |

| Market Size in 2024 | USD 8.09 Billion |

| Market Size in 2025 | USD 8.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.43% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased demand for high-throughput screening

Rapid picture acquisition and processing are made possible by automated microscopy techniques, essential for screening enormous compound libraries. The throughput of drug discovery procedures is increased when thousands of samples can be processed and analyzed quickly. It is utilized in cancer research to evaluate tumor cell responses, and screen for possible therapeutic chemicals.

Growing investments in life sciences research

Governments and private groups are raising funding for life sciences research to address urgent global health challenges such as infectious diseases, cancer, and genetic disorders. This funding infusion makes the acquisition of cutting-edge microscopy equipment that improves research capacity possible. Researchers seek systems that combine different imaging modalities (such as electron microscopy). These multi-modal systems improve research results by enabling thorough examinations of biological samples.

High initial costs

The initial expenses of automated microscopy systems are frequently substantial and include the cost of the microscope and any associated technologies (such as cameras). These expenses are further raised by advanced features, including digital analytic capabilities, automated sample processing, and high-resolution photography. The cost of purchasing such equipment can be prohibitive for many labs and institutions, significantly smaller or underfunded ones. Due to the high upfront expenditures, the industry may become segmented, with smaller labs being left behind as only well-funded organizations, such as universities, pharmaceutical corporations, and large research hospitals, invest in automated microscopy. Because the technology is restricted to a few customers, this segmentation may impede innovation and adoption in the larger market.

Advancements in imaging techniques

With resolutions that go beyond conventional optical bounds, new imaging methods like super-resolution microscopy allow scientists to see structures at the molecular level. This skill enables a more thorough examination of biological materials and specimens, leading to advances in diagnoses and research. The sophisticated software that uses artificial intelligence and machine learning algorithms frequently goes hand in hand with advanced imaging techniques. These tools make it simpler for researchers to understand complex data sets by facilitating real-time data analysis, pattern detection, and quantification.

The optical microscope segment dominated the automated microscopy market in 2023. Digital imaging and automation elements formerly reserved for more costly and sophisticated microscopy techniques, including electron microscopy, are now included in modern optical microscopes. These improvements boost workflow consistency and efficiency by enabling researchers to automatically take high-resolution photos. It requires less specialized technical knowledge and is easier to maintain, lowering institutions' long-term expenses. Research and educational institutions find this appealing, particularly smaller labs and emerging markets.

The electron microscope segment is observed to be the fastest growing in the automated microscopy market during the forecast period. For study in materials science, nanotechnology, and the biological sciences, electron microscopes, such as transmission electron microscopes (TEM) and scanning electron microscopes (SEM), are essential because they produce incredibly detailed images at the atomic and molecular levels. High-precision molecular and cellular process observation is made possible by electron microscopy in biotechnology, which supports studies on medication delivery, disease causes, and genetic engineering. This demand is mainly driven by advancements in tissue engineering and nanomedicine.

The drug discovery and pharmaceutical segment dominated the automated microscopy market in 2023. To identify viable therapeutic options, drug discovery procedures must test hundreds of molecules. For high-throughput screening, automated microscopy has become crucial because it enables researchers to quickly examine and see vast quantities of cells, tissues, or substances. This feature reduces the time and resources required for drug discovery by speeding up the identification of active molecules. Automated microscopy streamlines several processes, such as lead identification, hit-to-lead optimization, and validation tests, which helps lower the expenses related to the drawn-out drug development cycle. Faster imaging and analysis aid innovative pharmaceuticals reach the market sooner, which is crucial in a highly regulated and competitive business.

The medical diagnosis segment is observed to be the fastest growing in the automated microscopy market during the forecast period. A key component of precision medicine is early, precise diagnosis, which attempts to customize care to each patient's unique profile. For the development of tailored medicines in oncology, genetics, and infectious disease management, automated microscopy makes it possible to identify biomarkers and molecular alterations. To enable the precise profile of patient conditions and improve results by matching medicines to specific disease pathways, hospitals, research labs, and biotech businesses make significant investments in automated microscopy systems.

The pharmaceutical industry segment dominated the automated microscopy market in 2023. The process of finding new drugs is time-consuming and intricate, including the examination of several biological processes and cellular interactions. Due to automated microscopy, pharmaceutical businesses can perform these analyses with speed and accuracy. These systems may screen large compound libraries, and they can quantitatively analyze cellular responses, speeding up the drug development process and increasing the results' accuracy.

Repetitive imaging activities can be handled by automated microscopy systems with little assistance from humans. By lowering labor requirements and minimizing human mistakes, this automation significantly reduces costs in the pharmaceutical sector. Its high throughput and quick turnaround time boost output and make it an affordable option for drug development pipelines.

The research facilities segment shows a notable growth in the automated microscopy market during the forecast period. Extensive imaging is frequently used in cell and molecular biology research to track cellular responses, interactions, and structure-function correlations. In high-content screening (HCS), which screens enormous libraries of chemicals for possible biological effects, automated microscopy is especially useful. Automated systems are a great option for research centers performing high-content analysis because they lower the possibility of human mistakes in these intricate procedures and increase the precision of cellular experiments.

North America dominated automated microscopy market in 2023. Researchers and physicians may now perform complex studies more quickly because of advancements in high-resolution imaging and automation tools. Microscopy automation has improved throughput, decreased human error, and enabled large-scale data collection, all critical in industries like biotechnology and pharmaceuticals. A competitive atmosphere is produced by the presence of both big and up-and-coming companies, which encourages quick innovation and supports North America's market supremacy. Substantial intellectual property (IP) protections also help these businesses, enabling them to make significant technological investments without worrying about losing their competitive advantage.

Asia-Pacific is observed to be the fastest growing in the automated microscopy market during the forecast period. For diagnostic applications like pathology and cytology, where high-throughput imaging systems can increase precision and efficiency in identifying disease indicators, automated microscopy is essential. South Korea and Japan oversee integrating AI-driven automated microscopy systems into clinical and research applications, two countries renowned for their proficiency in electronics and AI technologies. The requirement for automated microscopy systems is also rising in these areas due to expanding healthcare facilities, particularly in hospitals and diagnostic labs.

By Product Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

November 2024

November 2024