January 2025

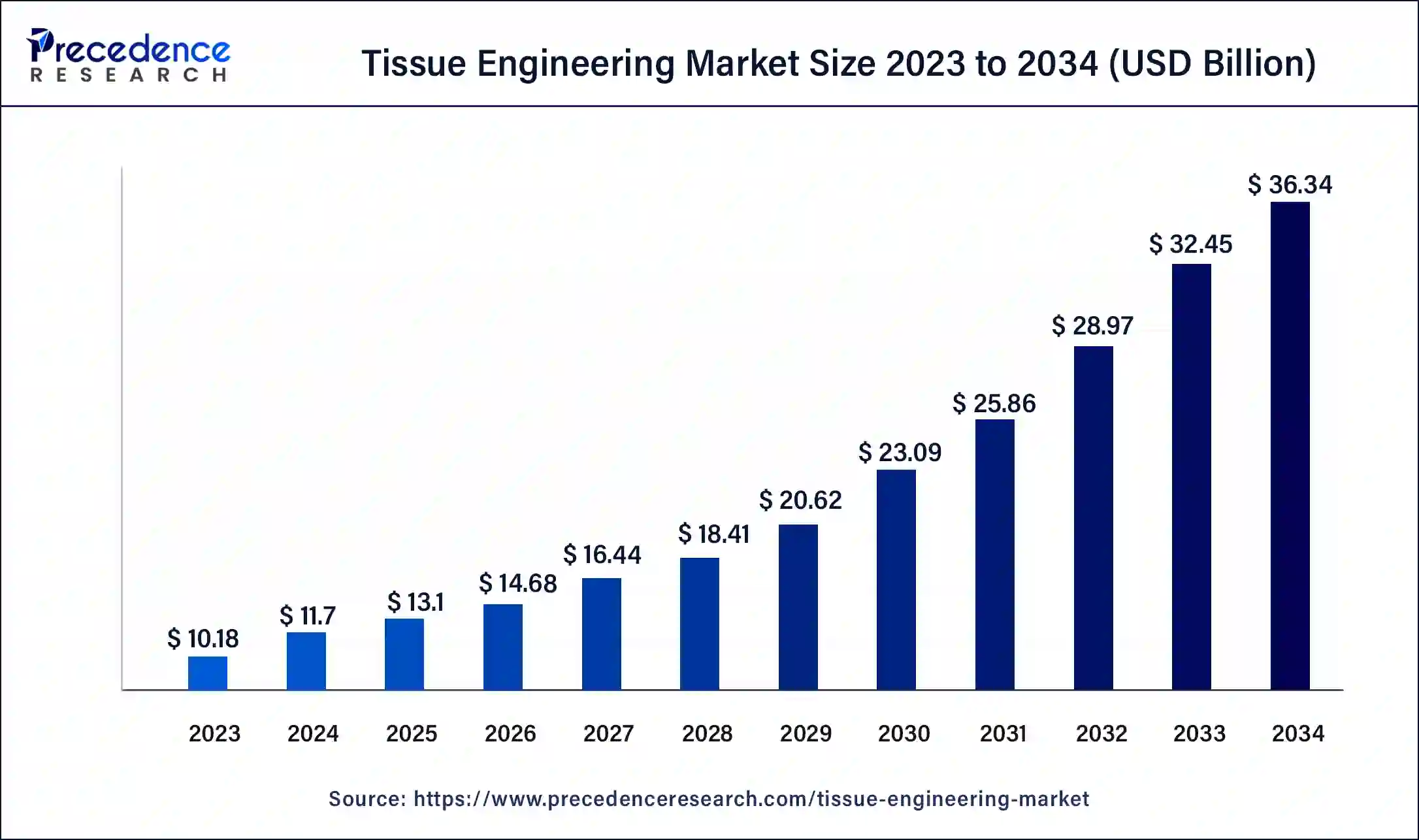

The global tissue engineering market size was USD 10.18 billion in 2023, calculated at USD 11.7 billion in 2024 and is expected to reach around USD 36.34 billion by 2034, expanding at a CAGR of 12% from 2024 to 2034.

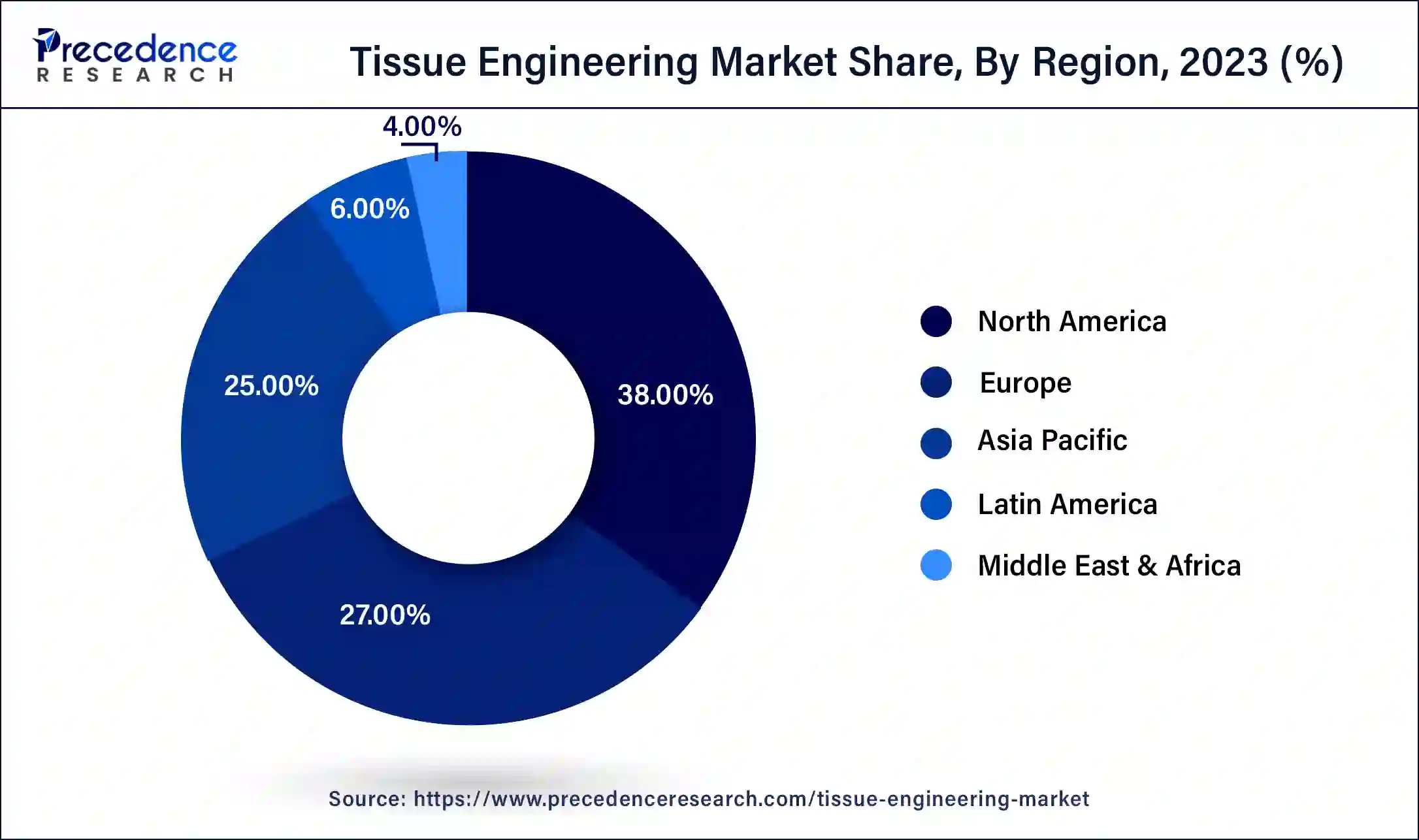

The global tissue engineering market size accounted for USD 11.7 billion in 2024 and is expected to reach around USD 36.34 billion by 2034, expanding at a CAGR of 12% from 2024 to 2034. The North America tissue engineering market size reached USD 3.87 billion in 2023.

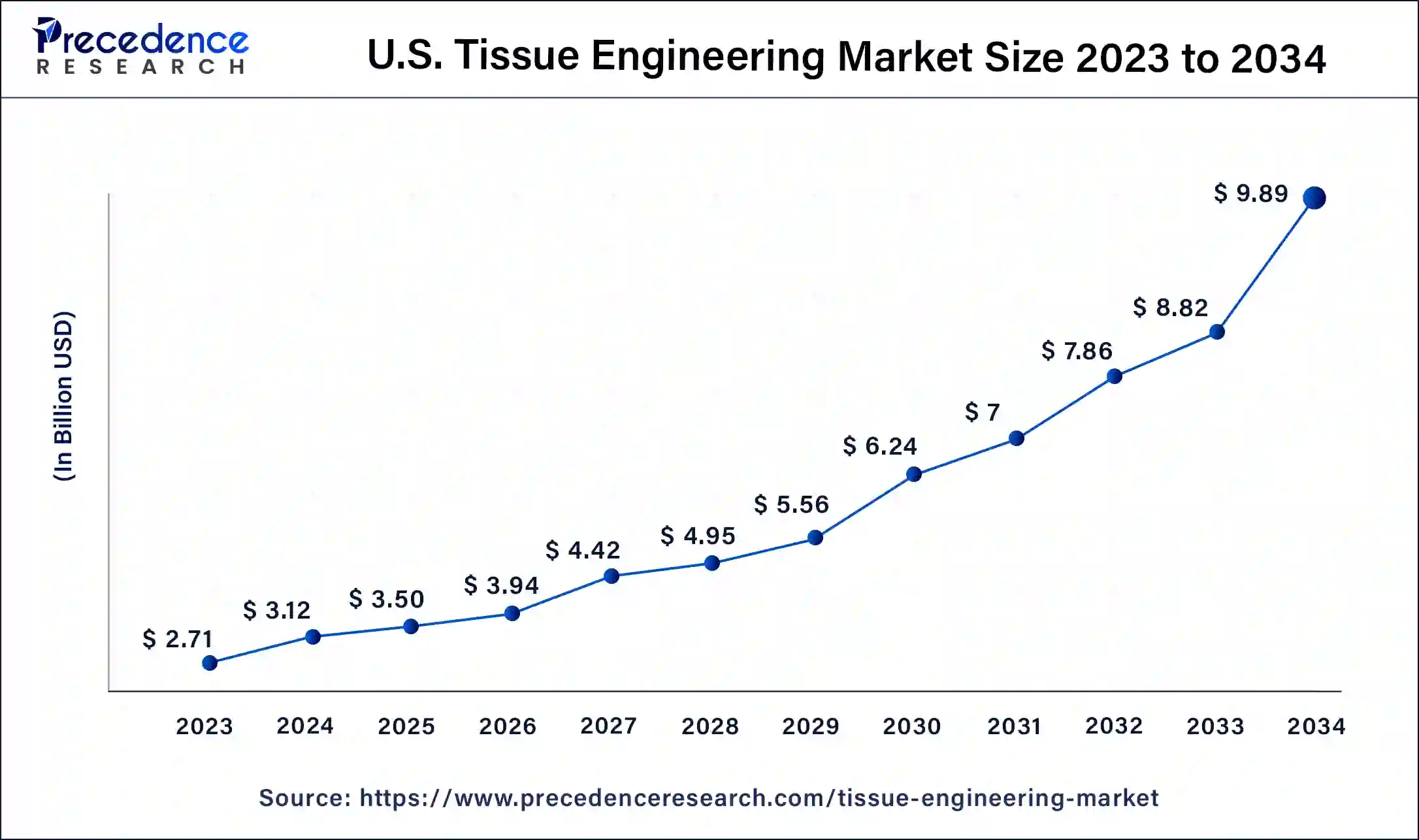

The U.S. tissue engineering market size was estimated at USD 2.71 billion in 2023 and is predicted to be worth around USD 9.89 billion by 2034, at a CAGR of 12.2% from 2024 to 2034.

Due to an increase in interest in stem cell treatment and a rising elderly population, North America had the greatest revenue share in 2023. Additionally, the availability of private and public financing, high healthcare spending, and sophisticated technology for the diagnosis and treatment of chronic conditions encourage a higher proportion of the regional market for tissue engineering. Due to the availability of public funding as well as considerable investments made by private groups, the U.S. is thought to account for a sizeable portion of global revenue. The "2020: A New Vision" effort was started by the U.S. Department of Health to put stem cell treatment and regenerative medicine at the forefront of healthcare. Technology innovation and translational advancement depend critically on the transformational effects of employing regenerative medicine in clinical settings.

Over the course of the projected period, Asia Pacific is anticipated to develop at the quickest CAGR. One of the top nations promoting technical advancements in the field of tissue engineering is Japan. Additionally, it is anticipated that the market for tissue engineering in Asia would develop because of an increase in the frequency of clinical illnesses like cancer. Growth in the industry is also fueled by elements like the development of 3D bioprinting and medical tourism in the area.

Japan is a desirable tissue engineering outsourcing market for wealthy countries like the U.S. Additionally encouraging for quicker clearance of clinical trials is its regulatory framework. The Regenerative Medicine Law, which permits the adoption of practises that might hasten the clinical development of regenerative and cell-based therapies, has been authorised by the Ministry of Health, Labor, and Welfare (MHLW).

To regenerate, preserve, augment, or replace different kinds of biological tissues, the biomedical engineering field of tissue engineering combines cells with engineering, material technologies, and the proper biochemical and physicochemical parameters. To repair, replace, or regenerate tissues or organs, tissue engineering (TE), a fast-developing field, transforms basic knowledge in physics, chemistry, and biology into useful materials, technologies, and therapeutic approaches.

Assisting with tissues or organ regeneration, including bone healing (calcified tissue), heart tissue, cartilage tissue, vascular tissue, and pancreatic tissue are some of the main purposes of tissue engineering in medicine and research. The behaviour of stem cells is another topic of study in this area. Stem cells may differentiate into a wide variety of cell types and aid in the body's healing processes. The 3D aspect of tissue engineering enables a more in-depth examination of tumour architecture. Additionally, it offers a setting in which to test possible novel treatments for various disorders. It is anticipated that an increase in R&D efforts would help the market expand as awareness of tissue engineering rises in emerging economies.

The global market for tissue engineering is growing because of developed countries adopting regenerative medicine and tissue engineering technology. To have an advantage over rivals, key actors are forming alliances and working together.

Additionally, to fulfil the demand, prominent companies are upgrading their product portfolios and developing fresh tissue engineering products.

The healthcare sector has been significantly impacted by the COVID-19 epidemic. Since the COVID 19 pandemic, clinical tissue engineering research has been discontinued and non-COVID 19 clinical studies have been scaled back. In the meanwhile, a number of pharmaceutical and biotech companies have moved their attention to the creation of COVID-19 therapy medications and vaccines. Additionally, the global tissue engineering industry has been constrained by a significant decline in cell and tissue donation programmes. As a result, the worldwide tissue engineering industry is being constrained by delays and disruptions in clinical research as well as cancellations or delays in tissue replacement and reconstructive treatments.

Another element raising awareness is the growth in popularity of tissue regeneration technology due to effective products and lower rejection rates. Additionally, there are more procedures performed for regeneration. Pre-clinical research is being done on the use of tissue-engineered vascular grafts in cardiovascular surgery and therapy. Currently, bladders made of tissue engineering are being successfully transplanted outside of the patient's body.

| Report Coverage | Details |

| Market Size in 2023 | USD 10.18 Billion |

| Market Size in 2024 | USD 11.7 Billion |

| Market Size by 2034 | USD 36.34 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Material Type, End-Use, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Multiple problems associated with tissue engineering

Increasing demand for regenerative medicine

Technological advancements in tissue engineering

Due to the growth in musculoskeletal problems, the orthopaedics, musculoskeletal, and spine segments led the tissue engineering market in 2023. The spine, bone replacements, and bone transplants are all part of the orthopaedic regeneration section. Around 900,000 surgical procedures each year include bone replacement or repair, according to the Medicare and Medicaid programme in the United States. Due to an annual occurrence of almost 15 million fracture cases, the cost of healthcare in the US rises by USD 59.9 billion.

Due to a sharp rise in the frequency of cardiovascular illnesses throughout the world, the sector for cardiology and vascular tissue engineering is predicted to develop at the greatest pace during the analysis period. In order to heal, restore, and re-vascularize the injured cardiac tissues, important actors are also participating in the development of stem cell treatments. Additionally, research is being done on gene therapy, sophisticated biologics, and small chemicals to promote the regeneration of injured cardiac cells. In order to examine the impact of cardiovascular illnesses, single and mixed cells from autologous and allogeneic stem cells are being used more often. Additionally, segment growth is anticipated to be boosted by developments in tissue engineering technology. For instance, the creation of 3D heart muscles and Engineered Heart Tissue (EHT) would open up prospective markets for the expansion of tissue engineering in the future.

The market leader in 2023 is anticipated to be the sector of biologically generated materials. The development of tissue engineering and biomedical devices that naturally boost the ability of tissues to regenerate in order to repair deteriorated bodily mechanisms heavily relies on biomaterials.

Neo-tissues that are similar to their basic body components are produced in vitro using biologically derived ingredients. Additionally, these materials promote tissue regeneration by the targeted delivery and on-demand release of certain chemokines at damage sites, as well as by providing transient, tissue-like support matrices that degrade naturally and function. However, throughout the anticipated period, the synthetic material category is expected to see the greatest CAGR in the worldwide tissue engineering market.

Segments Covered in the Report

By Application

By Material Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2025

February 2025

June 2024