November 2024

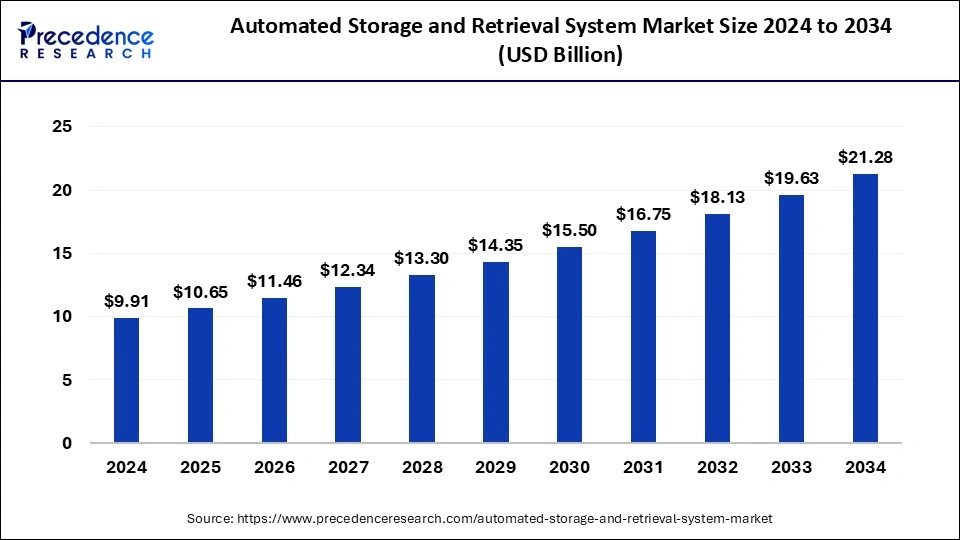

The global automated storage and retrieval system market size accounted for USD 10.65 billion in 2025 and is forecasted to hit around USD 21.28 billion by 2034, representing a CAGR of 7.99% from 2025 to 2034. The Europe market size was estimated at USD 3.59 billion in 2024 and is expanding at a CAGR of 7.45% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automated storage and retrieval system market size was calculated at USD 9.91 billion in 2024 and is predicted to increase from USD 10.65 billion in 2025 to approximately USD 21.28 billion by 2034, expanding at a CAGR of 7.99%.

Inventory management systems with automated storage and retrieval capabilities are often employed in warehouses, distribution centers, and industrial facilities. They are made up of several computer-controlled devices for autonomously transferring cargo from one location to another. These technologies help provide rapid, dependable, precise, and affordable solutions when moving big volumes of goods from one place to another.

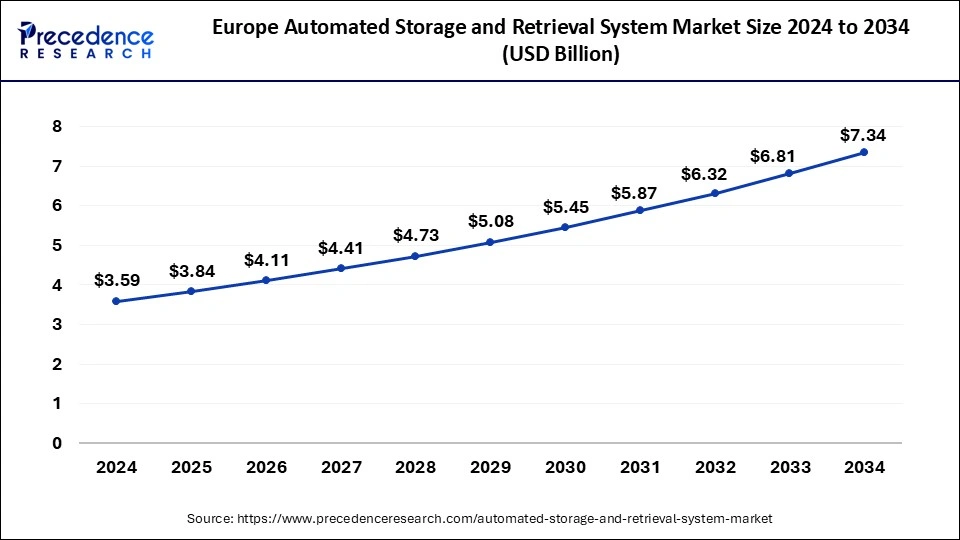

The Europe automated storage and retrieval system market size was exhibited at USD 3.59 billion in 2024 and is projected to be worth around USD 7.34 billion by 2034, growing at a CAGR of 7.45% from 2025 to 2034.

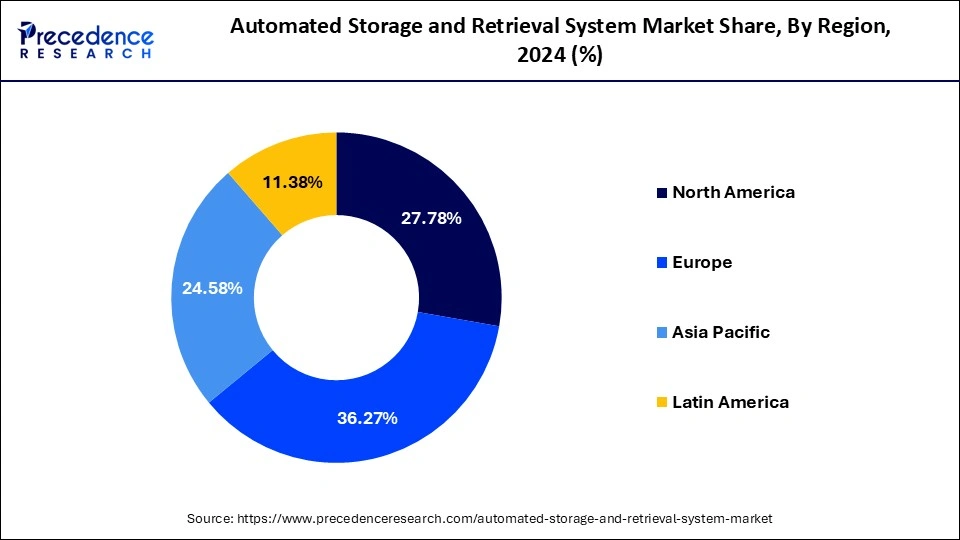

In 2024, the North American region's market for automated storage and retrieval systems maintained a sizeable 27.83% market share. The market for automated storage and retrieval systems is anticipated to increase as a result of a rise in the use of big data technologies by businesses to improve their capacity for risk management and consumer target marketing. Additionally, the manufacturing sectors of nations like the United States and Canada have been at the forefront of automation. The expansion of the automated storage system manufacturers' market share in these nations was made possible by improvements in infrastructure and industrial growth.

The market for these systems will also be greatly boosted by the rising need for safety and control in the industrial and manufacturing sectors in the United States. Automation will become more prevalent in order to decrease worker pay as salaries continue to rise. In addition, Mexico is increasingly serving as a manufacturing base for numerous businesses, mostly due to its affordable labor prices and closeness to the United States. The majority of the top manufacturers are locating their factories in the area.

The NAFTA accords give these businesses an easier way to export their output to the United States and Canada, which encourages the use of more sophisticated manufacturing techniques in this region. The increased use of automated storage systems in Mexico is a result of the increased productivity and efficiency they offer. As a result, these factors are examined to see how they may affect market growth between 2025 and 2034.

In order to guarantee consumer happiness around the globe, there is now a growth in the demand for quick, accurate, and effective fulfillment of in-store commerce. One of the main reasons propelling the market is this, coupled with the expanding industrial automation for enhancing productivity and quality while raising safety, lowering mistakes, and bringing flexibility to the production process. Additionally, ASRS is advancing technologically, helped by cutting-edge sensors. This is accelerating the market's growth, along with the rising need for improved storage systems across a number of industries. Additionally, many governments are making significant investments in creating digital infrastructure, which is helping the sector. In addition, the growing order volume in the e-commerce sector brought on by the ease of selling worldwide, retargeting clients, and customization of the purchasing process is providing industry investors with attractive development potential. In addition, the market is expanding because of the growing use of ASRS by small and midsize businesses (SMEs) to minimize human involvement.

Automated storage and retrieval systems allow robots and other material-handling equipment to automatically store and take items from shelves. These processes may be automated to save money on labor, quicken turnaround times, reduce human error, and increase storage capacity through vertical storage. The desire for higher productivity and efficiency throughout the supply chain, together with the rising need to use people and space as efficiently as possible, are projected to fuel market expansion. Thanks to the incorporation of cutting-edge technology, the market is benefiting from the expanded understanding of automated storage systems and inventory control.

A growing need for automation in the e-commerce sector and the advent of cutting-edge technology like shuttles and mid-load are both positive signs for the category market. Another aspect of the market's predicted strong growth in the future years is the rising usage of robotic systems in warehouses and industrial facilities to speed up procedures. As end-user demand for shelves, pallets, and racks rises, the market is projected to profit from these factors as well as from the systems' ability to reduce labor demands and increase productivity. The vehicle industry utilizes the most automated storage and retrieval systems due to their high level of automation. A lack of qualified labor and a growing focus on quality is driving the industry's demand for automated storage and retrieval solutions.

| Report Coverage | Details |

| Market Size in 2025 | USD 10.65 Billion |

| Market Size by 2034 | USD 21.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.99% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End Use, Type, Load, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Retail supply-chain multichannel approach

Many systems failures

Automated material handling systems now have more options because of the leasing of material handling equipment

In terms of end users, the automotive industry is anticipated to hold the greatest market share for automated storage and retrieval systems in 2024. The growing emphasis on industry 4.0, the shortage of skilled laborers, particularly in developing nations, the rise of local government initiatives to revive the auto industry, and the desire to reduce reliance on third-party logistic providers are all major contributors to the large share of this market.

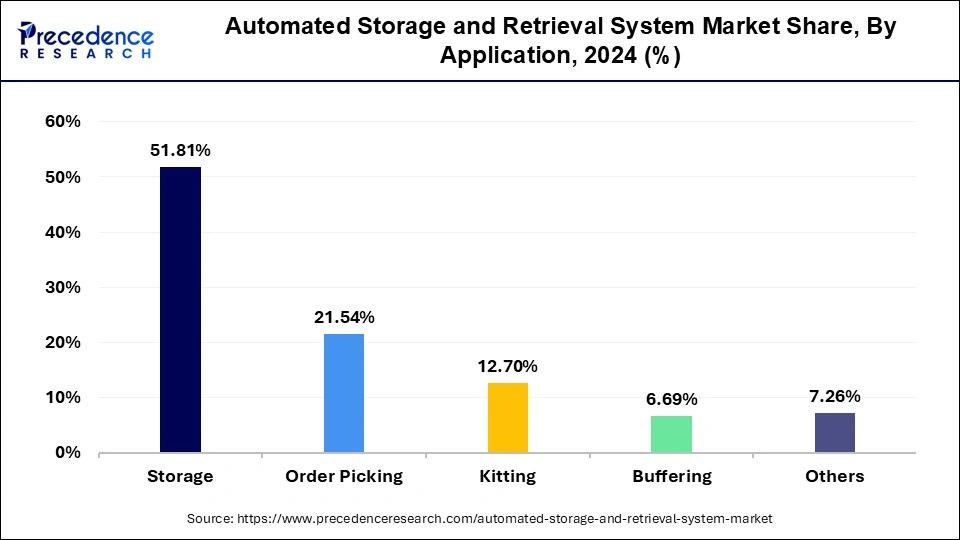

According to the application, the storage sector is anticipated to account for the greatest market share for automated storage and retrieval systems in 2024. The significant market share of this sector is mostly attributable to the explosion of online shopping, the rising desire for creative storage solutions, and the growing urgency to avoid product damage and workplace accidents.

According to type, floor robots are predicted to hold the biggest market share for automated storage and retrieval systems by the year 2024. The greatest share of this market is primarily attributable to the growing use of floor robots in the e-commerce sector, the rising need for floor robots for efficient order fulfillment operations, and the growing necessity to improve supply chain management. But over the projection period, the vertical lift modules sector is anticipated to exhibit the greatest CAGR. The demand for vertical lift modules regarding storage and picking applications in the retail industry, the rising need for larger storage capacities, the rising demand for vertical lift modules for efficient inventory management, and the rising number of deployments of VLM by top automated storage and retrieval systems are all factors that have contributed to the segment's rapid growth.

Automated System & Retreival System Market, by Type, 2022-2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| VLM | 1,723.44 | 1,851.10 | 1,989.98 |

| Carousels | 677.04 | 720.65 | 767.75 |

| Crane-Based | 3,675.85 | 3,932.35 | 4,210.47 |

| Vertical Buffer Modules | 899.77 | 968.35 | 1,043.08 |

| Robotic Shuttles | 522.21 | 563.69 | 609.01 |

| Floor Robots | 1,101.69 | 1,191.65 | 1,289.89 |

According to estimates, the automated storage and retrieval system market will be dominated by the unit load ASRS category. The significant market share of this sector is mostly attributable to the increasing pressure to meet shipping deadlines during busy periods, the growing desire to improve one's business acumen, and the expanding acceptability of unit-load automated storage systems. This market's expansion is anticipated to be aided by the integration of cutting-edge technologies into process handling and shipping operations as well as the growing need for lower incineration costs.

Automated Storage And Retrieval System Market Revenue, By Load, 2022-2024 (USD Million)

| Lead Type | 2022 | 2023 | 2024 |

| Unit Load | 3,109.66 | 3,353.35 | 3,619.34 |

| Mid Load | 1,019.65 | 1,087.52 | 1,160.94 |

| VLM | 1,723.44 | 1,851.10 | 1,989.98 |

| Carousels | 677.04 | 720.65 | 767.75 |

| Mini Load | 2,070.20 | 2,215.17 | 2,372.19 |

By Application

By End Use

By Type

By Load

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

March 2025

November 2024

February 2025