March 2025

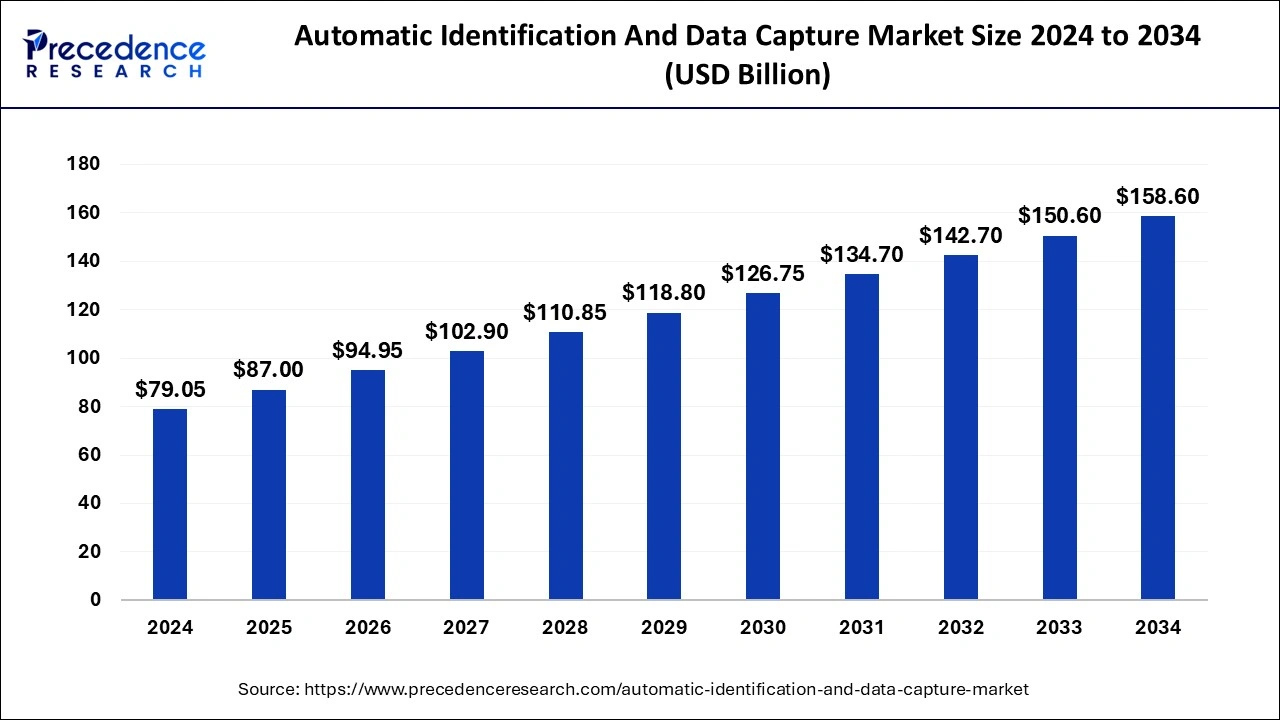

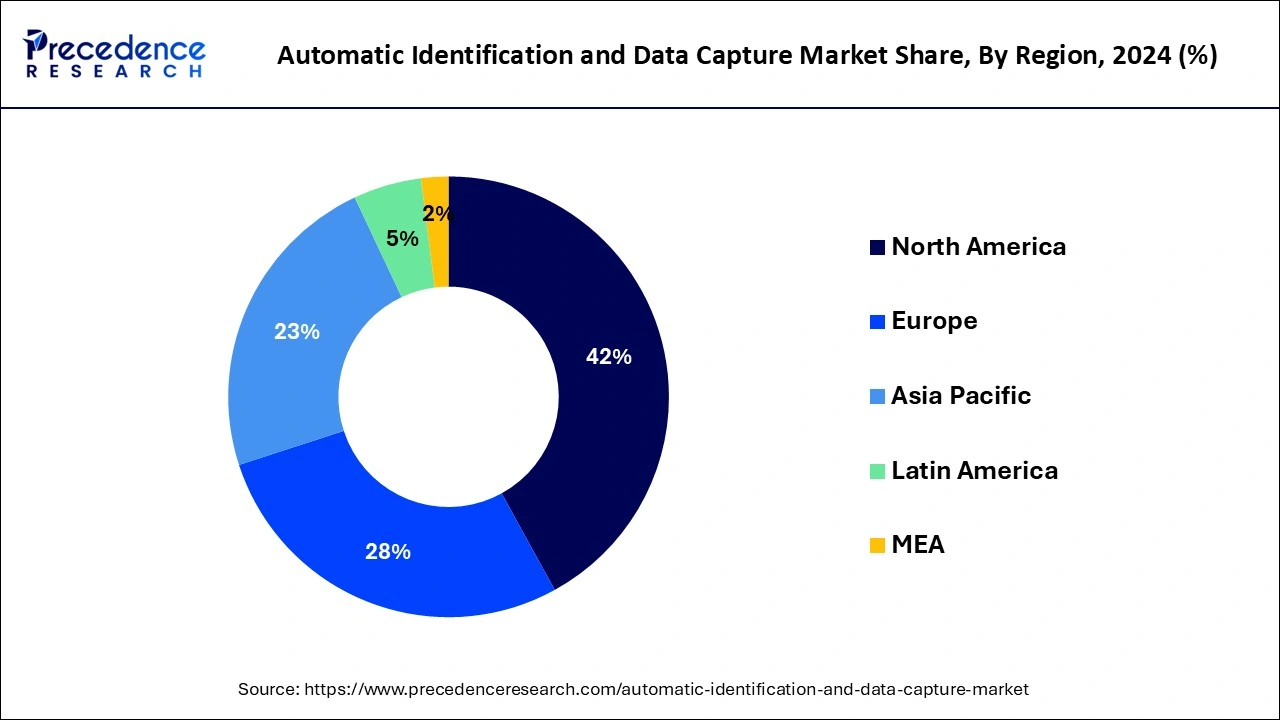

The global automatic identification and data capture market size is calculated at USD 87.00 billion in 2025 and is forecasted to reach around USD 158.60 billion by 2034, accelerating at a CAGR of 7.21% from 2025 to 2034. The North America market size surpassed USD 33.20 billion in 2024 and is expanding at a CAGR of 7.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automatic identification and data capture market size accounted for USD 79.05 billion in 2024 and is expected to exceed around USD 158.60 billion by 2034, growing at a CAGR of 7.21% from 2025 to 2034.

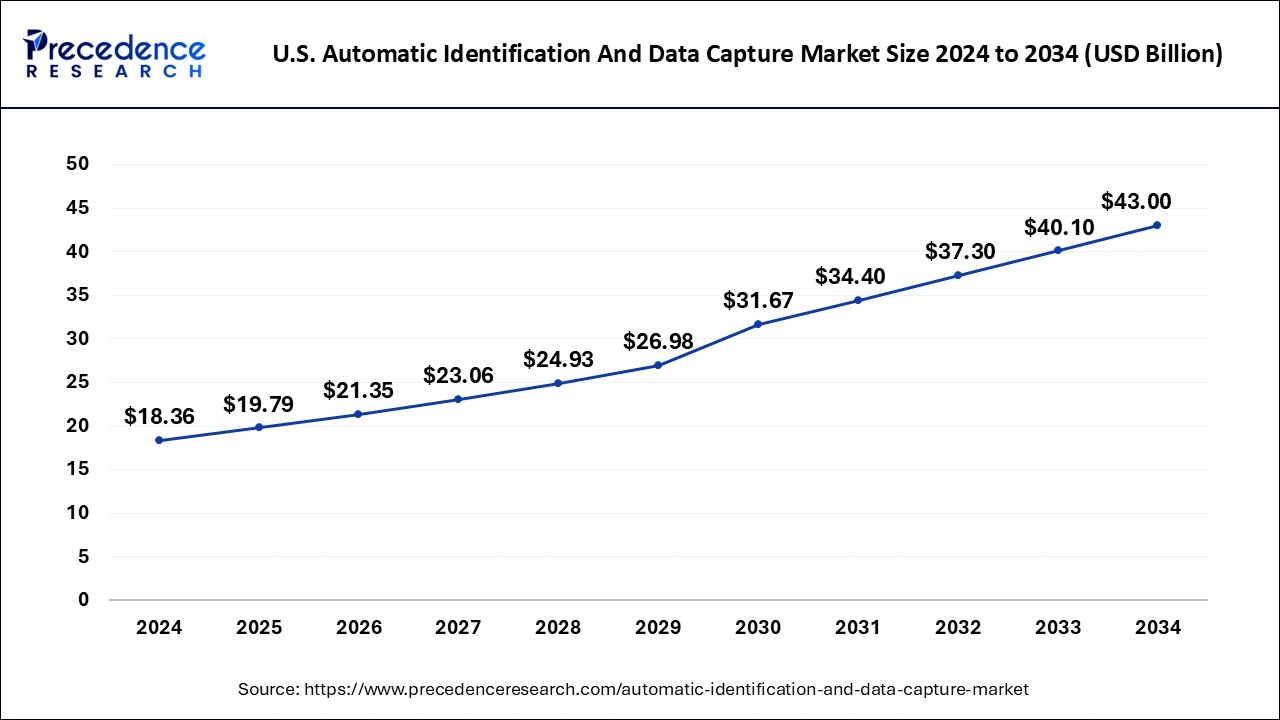

The U.S. automatic identification and data capture market size was exhibited at USD 18.36 billion in 2024 and is projected to be worth around USD 43.00 billion by 2034, growing at a CAGR of 8.88% from 2025 to 2034.

With a roughly 41.20% share of worldwide sales in 2024, North America dominated the industry. This high share can be ascribed to rising government legislation and funding, especially in the manufacturing, healthcare, and retail sectors, as well as rising knowledge of and high adoption of AIDC devices. The expansion of the regional market is also being fueled by the widespread adoption of cutting-edge technology and the technical advancement of numerous sectors.

A project for a supply chain of Fortune 100 stores with more than 2300 sites in North America, for instance, granted OmniQ Inc., an IT company that provides AI-based computer vision solutions, an additional USD 1 in August 2022. The buy order is for complete technological support for the new technology installed in the enormous logistical facilities in the area. By guaranteeing accurate configuration, comprehensive reporting, and a concierge business support staff devoted to the client, will hasten the implementation process.

From 2025 to 2034, Asia Pacific is predicted to have the highest growth, at 14.7%. In order to benefit from the growing middle class's increasing buying power, retail, and logistics companies are expanding their presence in the Asia Pacific area. The automated identification and data capture industry in the area has grown as a consequence. Additionally, the existence of numerous significant companies in the region, including Toshiba, SATO, Panasonic, Godex, and Optoelectronics, is anticipated to fuel the industry's growth.

The process of gathering, capturing, and transforming data into a digital file is known as automatic identity and data capture (AIDC). Images, music, and other digital data are included in this file that can be given to a computer without human interaction. Magnetic strips, optical character recognition (OCR), radio frequency identity (RFID) systems, smart cards, and others are some of the frequently used AIDC instruments.

A person, a video, a photograph, or some audio data can be scanned, identified, captured, examined, recorded, and stored using the automatic identity and data capture (AIDC) technique without the need for human entry. To handle assets, inventory, deliveries, document scanning, and security, AIDC solutions are frequently used. Transportation and logistics, chemical, pharmaceutical, food and beverage, automobile, consumer goods, retail and warehousing, and distribution are just a few of the commercial uses offered by AIDC. For instance, AIM, the industry alliance for automated data capture technologies including RFID, barcode, NFC, IoT, and RTLS, declared its strategy objective to increase its impact among AIDC market participants in February 2022.

Giving a new set of AIDC standards to members and the general public via a recently created "AIM Standards Marketplace" is one of the main objectives of AIM's strategy plan. Examples of AIDC systems include radiofrequency identity (RFID), barcodes, biometrics, labels, smart cards, and speech and vocal recognition. Due to the solutions' improved accuracy, precision, and seamless operation, they have become widely accepted across a variety of sectors. Improvements in AIDC technology, greater usage of sophisticated AIDC systems, and factors like the increasing need to reduce human data input and capture mistakes are all expected to contribute to market development.

For instance, RMS Omega Technologies and Cybra Corporation, providers of barcoding, RFID devices, data collection, wireless, and mobility technologies, declared a partnership in July 2022. The businesses hope to create RFID-based inventory tracking and asset management systems through this partnership. Users will be able to implement powerful tracking solutions thanks to the collaboration, including real-time equipment position tracking, work-in-process operations, inbound and outgoing cargo accounting, inventory benchmark monitoring, and safety procedure enforcement.

Innovative low-cost solutions and rising smartphone QR reading are anticipated to drive market expansion. Additionally, the quickly expanding retail, consumer goods, and e-commerce industries are likely to fuel demand for AIDC products. Growth is also anticipated to be fueled by increased government efforts to market AIDC goods as a result of a rise in the frequency of human errors and incorrect data input. The need to decrease manual data input and record errors, advances in AIDC technology, and rising usage of sophisticated AIDC systems are all factors that are likely to increase the market growth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.21% |

| Market Size in 2025 | USD 87.00 Billion |

| Market Size by 2034 | USD 158.60 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Product, Technology, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Government regulation of the use of AIDC technology is increasing

Government organizations all over the world have put into place a number of laws in the last ten years to encourage the use of AIDC technologies in a variety of sectors and address the problem of rising data entry mistakes and associated running costs. These guidelines and rules are meant to assist organizations in ensuring improved information visibility, increasing operational effectiveness, lowering running costs through accurate data capture and fewer data input mistakes, and raising customer happiness.

Key Market Challenges:

AIDC systems' high implementation costs

One of the main barriers preventing small and medium businesses from adopting automated identifying and data capturing products is the high cost of implementation. Installing one or two contactless point of sale devices is required when automated authentication and data recording products, such as smart cards, are installed. This is very costly for small and medium-sized businesses with limited money to spend. Similar to this, a lot of tiny retailers still prioritize accepting cash purchases over debit or credit cards. This significantly slows the spread of card-based recognition options for conventional bank acquirers and contactless payment service providers.

Key Market Opportunities:

Increasing the use of fingerprint identification tools

Forensic sciences for criminal identity, automotive keyless entry and ignition, and customer authentication for mobile purchases are just a few industries that have made extensive use of biometric systems. The demand for AIDC devices is also anticipated to rise during the forecast period due to the growing use of biometric authentication devices, particularly for international border crossings to increase national security.

Over 64% of worldwide income in 2024 came from the hardware sector. Increased demand for AIDC hardware devices like scanners, RFID bands, magnetic stripe cards, barcoding solutions, optical character recognition (OCR) systems, smart cards, and fingerprint systems can be credited for the segment's largest market share.

The industry for AIDC technology is also growing as a result of these products' increasing sales. For instance, the Matrix 320 5MP industrial scanner was unveiled in May 2022 by Datalogic S.p.A., a manufacturer of bar code scanners and portable data collecting devices. The new scanner has an excellent field of vision for scanning numerous tags or codes in a single capture with a single reader because it is designed on a multicore framework with HDR capacity and hardware acceleration.

Due to software companies' emphasis on offering distinctive features in data capture software, the software sector is anticipated to expand considerably over the course of the projection period. Vendors of AIDC solutions are increasing their marketing powers to promote their data capture software for handling large volumes of incoming communication from various sectors.

The banking sector is increasingly adopting data capture software to facilitate paperless transactions and improve the efficiency of digitally connected bankers. One recent example of this trend is the partnership between Melissa Inc. and ID-Pal in August 2022. The partnership resulted in the creation of Melissa ID, a flexible software-as-a-service solution that provides a range of automated identity verification tools. These tools utilize advanced technologies, including facial matching, biometrics, address verification, liveness testing, and document checks, to provide a comprehensive and reliable approach to identity verification. By leveraging such innovative solutions, the banking sector can improve operational efficiency, reduce costs, and enhance customer experiences.

In 2024, the BFSI sector had the highest income percentage of over 19%. The largest section share can be ascribed to the financial industry's rising demand for smart cards. It is expected that one possible end-user of the AIDC products will be the transportation and logistics industry. The industry has stretched the envelope and redefined the character of business by implementing AIDC technology for appropriate workflow and supply chain management. The growing demand for smart cards in the finance sector is responsible for the biggest section share. It is anticipated that the shipping and logistics sector will be one potential end-user of the AIDC goods.

Retail distribution centers can work with retail distribution centers to solve these new identification problems and reach the necessary process improvement objectives by utilizing the new, complementary technologies that manufacturers of AIDC systems are developing alongside continuously improving classic laser scanning capabilities.

By Component

By Product

By Technology

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

December 2024

March 2025