July 2024

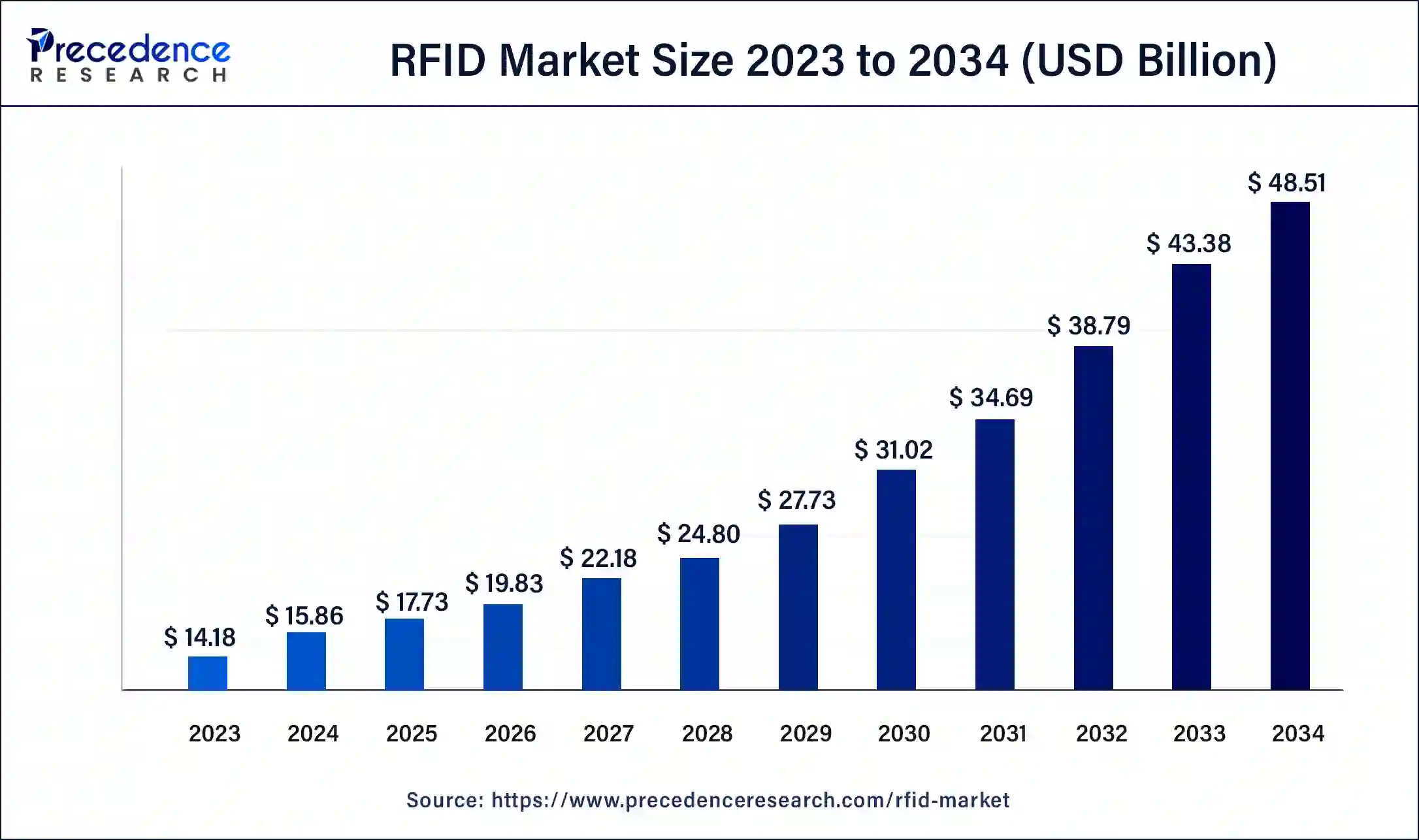

The global RFID market size surpassed USD 14.18 billion in 2023 and is estimated to increase from USD 15.86 billion in 2024 to approximately USD 48.51 billion by 2034. It is projected to grow at a CAGR of 11.83% from 2024 to 2034.

The global RFID market size is worth around USD 15.86 billion in 2024 and is anticipated to reach around USD 48.51 billion by 2034, growing at a solid CAGR of 11.83% over the forecast period 2024 to 2034. The North America RFID market size reached USD 5.53 billion in 2023. Increasing adoption of RFID technology in various fields, from manufacturing to healthcare across the globe, while promising enhanced security and high operational efficiency with technological advancements in the RFID field, are the major factors propelling the RFID market globally.

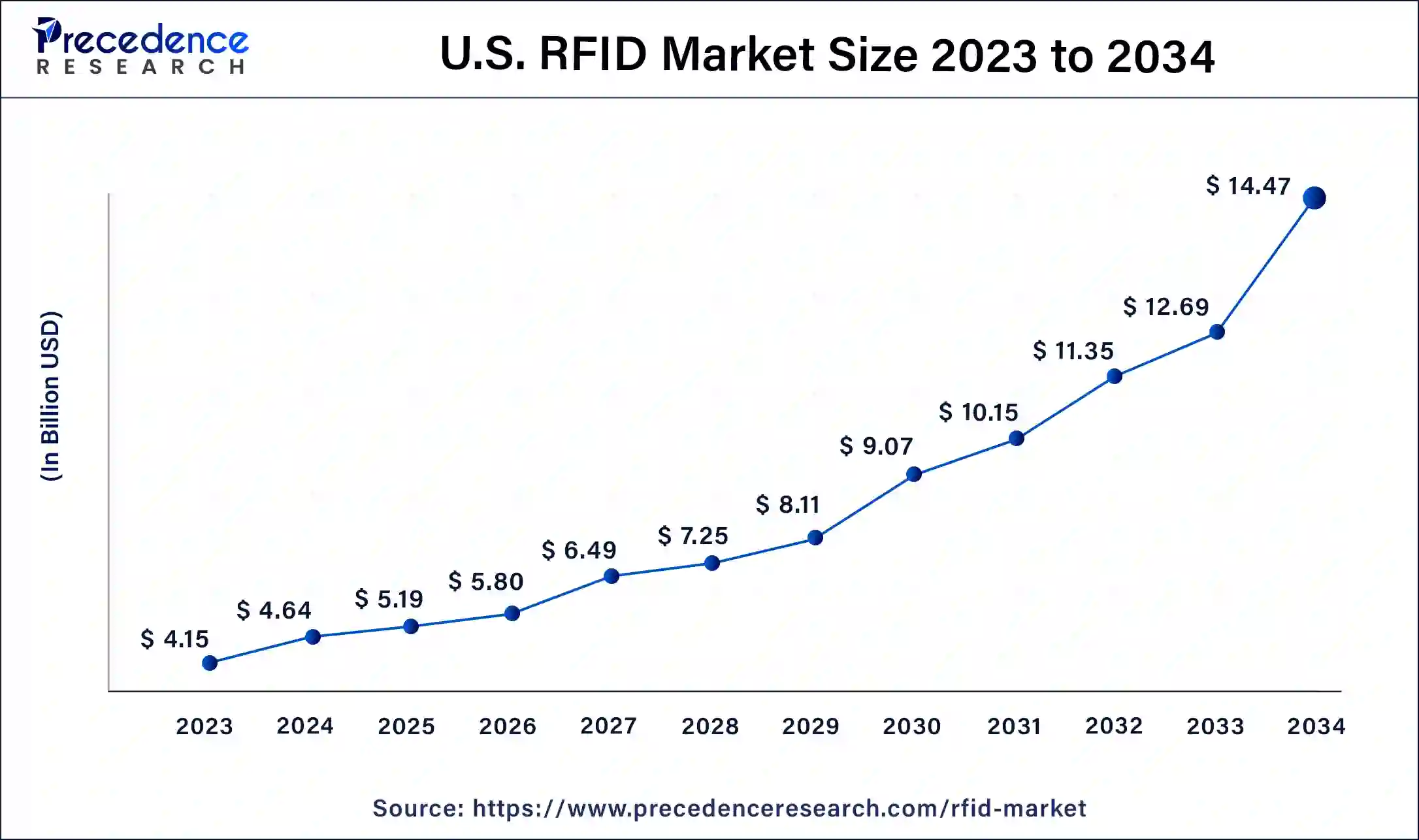

The U.S. RFID market size was exhibited at USD 4.15 billion in 2023 and is projected to be worth around USD 14.47 billion by 2034, poised to grow at a CAGR of 12.02% from 2024 to 2034.

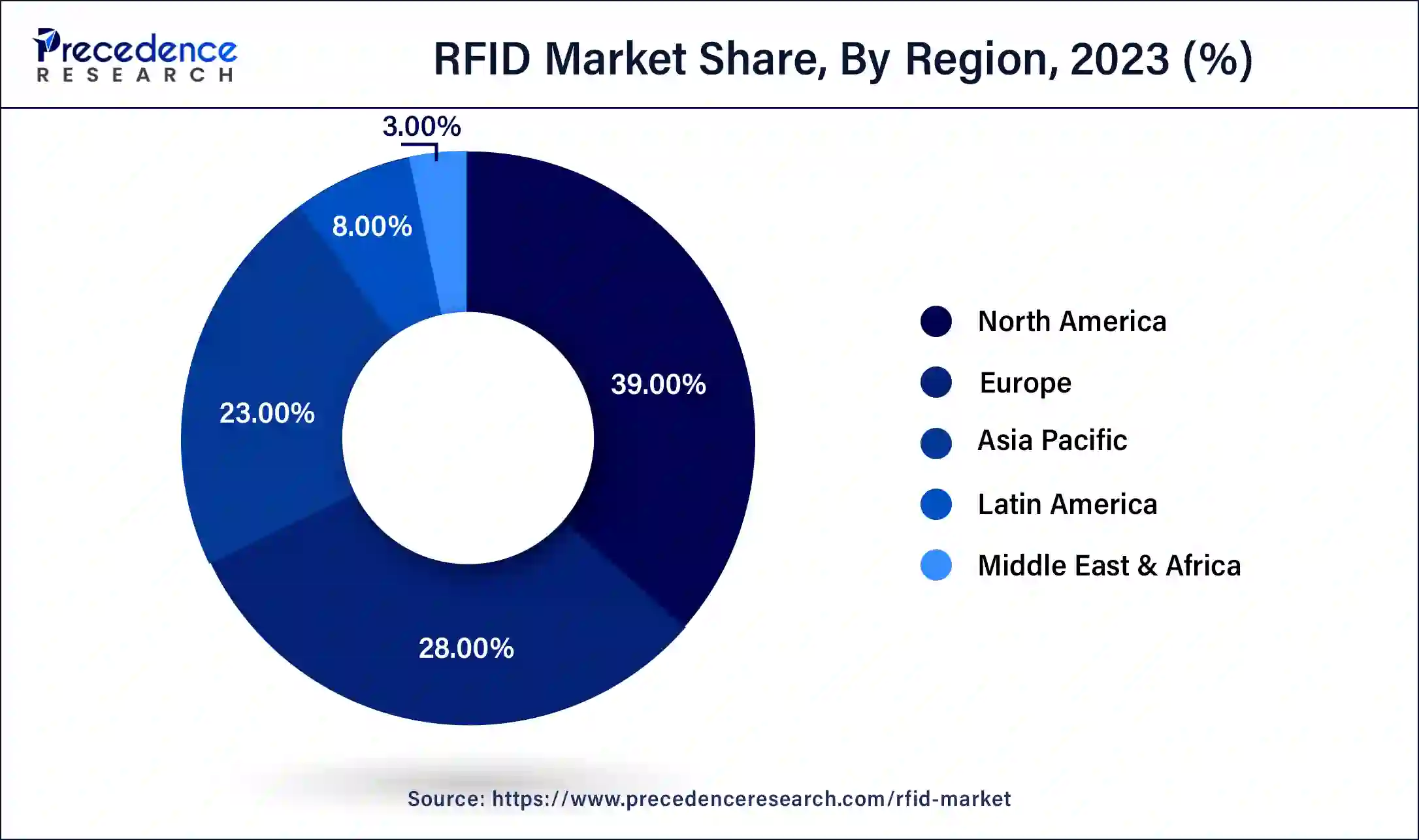

North America registered the largest share of the global RFID market in 2023. North America dominates the RFID market due to early adoption and advanced technological infrastructure. The region's strong presence of key industry players, such as Zebra Technologies and Honeywell International, drives innovation and market growth. Retail giants like Walmart and Amazon leverage RFID for efficient inventory management and supply chain optimization, further boosting adoption. Additionally, sectors like healthcare, logistics, and manufacturing extensively use RFID for asset tracking and process automation.

Asia Pacific is anticipated to proliferate at a significant rate in the RFID market over the forecast period. The Asia Pacific RFID market is rapidly growing due to several factors. The region's increasing industrialization and robust economic growth, especially in countries like China and India, drive demand for efficient supply chain and inventory management solutions. Government initiatives supporting digital transformation and smart city projects further bolster RFID adoption.

Europe is expected to showcase prominent growth in the global RFID market during the studied period. Fashion brands and the retail sector in Europe have already accepted RFID technology and its implementation in inventory management. This helps improve the overall customer experience, including the accuracy of inventories and their management, the identification of stockouts, and the enabling of burdenless checkout processes. The manufacturing and automotive sectors in European countries mostly leverage the benefits of RFID technology. According to the data,94% of European decision-makers, which is 91% globally, expect to use technology to increase supply chain visibility within the next five years.

The global RFID market is experiencing significant growth, driven by increasing adoption across various sectors like retail, healthcare, logistics, and manufacturing. This technology enhances inventory management, reduces operational costs, and improves data accuracy. The market is segmented by product type, application, and region, with UHF RFID tags showing the highest demand due to their long-range reading capabilities.

North America leads in RFID market share, followed by Europe and Asia Pacific, where rising industrialization boosts demand. Key players include Zebra Technologies, Honeywell International, and Avery Dennison. Emerging trends like IoT integration and advancements in RFID technology are expected to further propel market growth in the coming years.

AI Impact on the RFID Sector

The integration of artificial intelligence (AI) with RFID technology is poised to significantly impact the market. AI enhances the capabilities of RFID systems by enabling advanced data analytics, predictive maintenance, and real-time decision-making. In retail, AI-driven RFID can optimize inventory management, personalize customer experiences, and improve supply chain efficiency through predictive analytics. In manufacturing, AI can analyze RFID data to streamline production processes and detect anomalies, reducing downtime and enhancing quality control. The RFID market benefits from AI by improving patient tracking and medical asset management.

Additionally, AI algorithms can process vast amounts of RFID data, identifying patterns and insights that drive operational improvements and strategic decision-making. This synergy between AI and RFID is expected to lead to innovative applications, increased efficiency, and a competitive edge for businesses, further propelling the RFID market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 48.51 Billion |

| Market Size in 2023 | USD 14.18 Billion |

| Market Size in 2024 | USD 15.86 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.83% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Frequency Range, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Technological Advancements

Technological advancements are a significant driving factor in the RFID market. Innovations such as improved read range, enhanced data capacity, and better energy efficiency have made RFID systems more reliable and cost-effective. The development of ultra-high frequency (UHF) tags, which offer long-range reading capabilities, has expanded the use cases in logistics, retail, and healthcare. Additionally, advancements in RFID software, such as real-time tracking and data analytics, enable businesses to gain valuable insights and improve operational efficiency. As technology continues to evolve, the integration of RFID with other emerging technologies like the Internet of Things (IoT) is expected to create new opportunities and further drive market growth.

Increasing adoption in retail

The retail sector's increasing adoption of RFID technology is a crucial RFID market driver. Retailers are leveraging RFID to enhance inventory management, reduce shrinkage, and improve customer experience. By using RFID tags, stores can achieve near-perfect inventory accuracy, leading to better stock availability and fewer lost sales. This technology also enables efficient supply chain management, from manufacturing to point-of-sale, ensuring timely restocking and reducing out-of-stock scenarios.

Moreover, RFID's ability to provide real-time data helps retailers personalize customer experiences and streamline checkout processes. As e-commerce and omnichannel retailing grow, the need for efficient inventory and supply chain management further accelerates the adoption of RFID in the retail industry.

High initial implementation cost

One major restraint of the RFID market is the high initial implementation cost. Setting up an RFID system involves significant expenses, including purchasing RFID tags, readers, and associated software, as well as integrating these components into existing systems. Additionally, businesses may incur costs related to employee training and ongoing maintenance. Small and medium-sized enterprises (SMEs) often find these upfront costs prohibitive, limiting widespread adoption. Furthermore, the complexity of RFID technology and the need for customized solutions can add to the overall expense. This financial barrier can deter potential users, especially in cost-sensitive industries, thereby restraining the growth of the RFID market.

Internet of things (IoT)

The integration of RFID with the Internet of Things (IoT) presents a significant opportunity for the RFID market expansion. IoT-enabled RFID systems can provide enhanced real-time tracking and data analytics, improving decision-making and operational efficiency across industries. In retail, this integration can revolutionize inventory management and customer engagement. In healthcare, it can enhance patient and asset tracking. Additionally, the growing trend of smart cities and automated supply chains relies heavily on IoT and RFID technologies, creating substantial opportunities for market growth. As these technologies evolve, their combined application is expected to drive significant advancements and adoption.

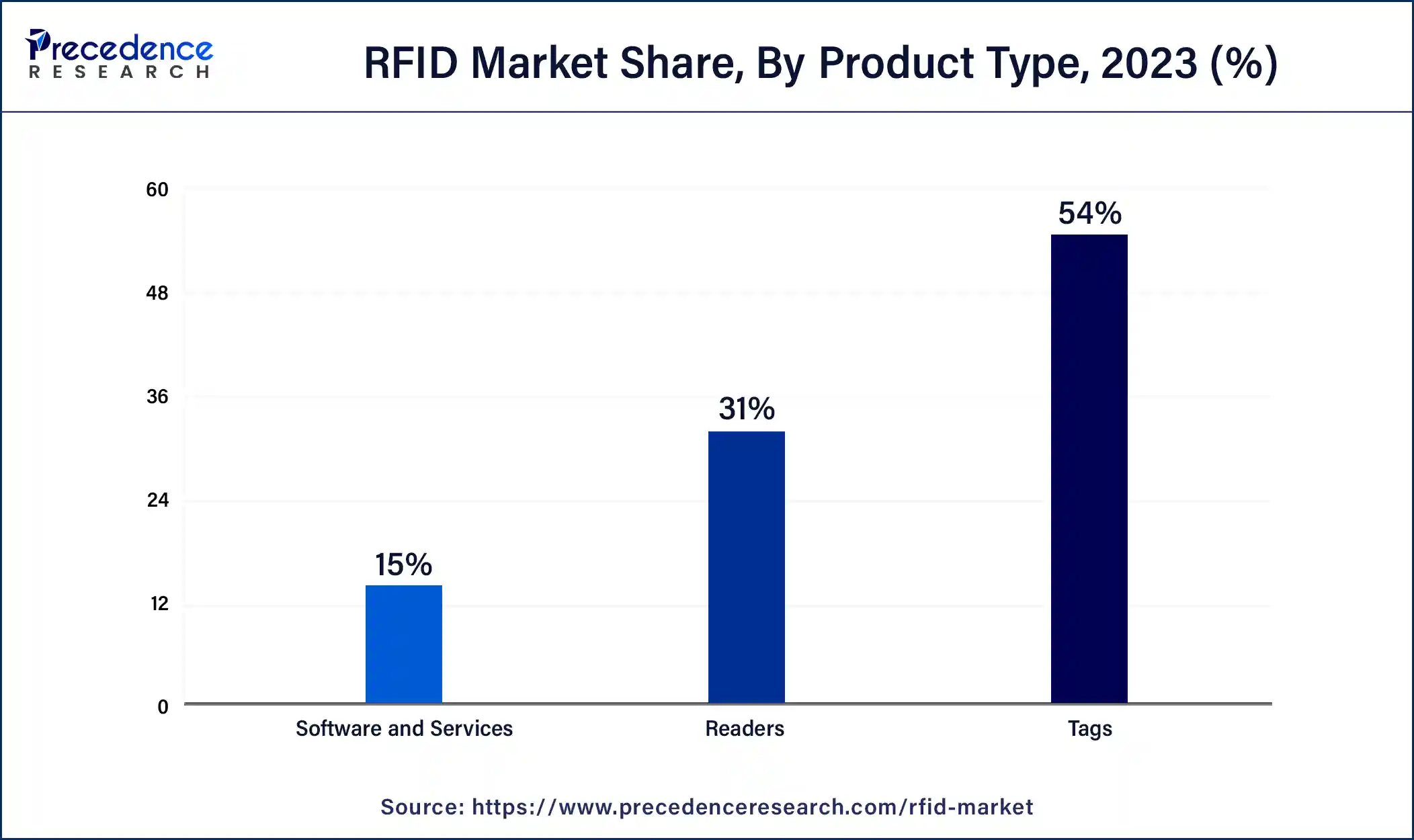

The tags segment dominated the global RFID market in 2023. RFID tags are electronic devices used to label assets to track their physical appearance wirelessly by using other RFID equipment. These tags can be encoded with various data types. Each tag is integrated with an antenna and a circuit. Tags have 96-bit strings of data known as EPC-electronic product code, consisting of tag serial number, asset ID data, and company name that manages this tag. Every country has different frequency band allocations for RFID tags. Some of them are widely accepted and seem legitimate.

The readers segment is expected to grow at the highest CAGR in the RFID market over the forecasted years. The growth of this segment is attributed to their vast applications, ranging from inventory management and military vehicle tracking to patient tracking in the medical sector, which increases security and enhances efficiency. RFID readers are basically equipment that reads the data encoded in the RFID tags by sending out Radiofrequency and collecting the response, which is further sent to computer systems to gather meaningful insights from RFID tags.

The high frequency (3MHz to 30MHz) segment held the largest share of the RFID market in 2023. The growth of this segment is due to its ability to capture large amounts of data in a single scanning as compared to other frequency ranges. Such a high-speed data transfer is crucial in various sectors where time is constrained, like contactless payment transfer by using online platforms like Phonepe and Paytm, as well as asset tracking, in particular, military assets, retail sector, and healthcare settings.

The ultra-high frequency (300MHz - 3GHz) segment is anticipated to showcase the fastest growth in the RFID market in the upcoming years. The growth of this segment is related to the increasing demand for it in various fields, such as pharma applications, inventory management, and wireless transactions. The ultra-high frequency RFID can be more accessible as it has various applications in supply chain management, asset tracking, livestock monitoring, etc., further propelling market growth. However, their high cost per tag is a barrier for many vendors to adopt them widely, which can be troubleshoot as the technology matures with time.

The retail segment accounted for the largest share of the RFID market in 2023. The growth of this segment is due to the enhanced visibility offered by RFID tags in terms of asset tracking from manufacturing to distribution to its destination with safety measures. RFID allows retailers to monitor the delivery schedules of the shipments while tracking their exact location and any potential loopholes that may delay the shipment delivery for specific reasons. Such clarity builds trust between enterprises and customers, which helps proliferate the retail segment widely on a large scale.

The transportation & logistics segment is expected to witness substantial growth in the RFID market during the foreseeable period. RFID technology is immensely helpful as it aids in automating the process of identifying and capturing the data regarding shipments. Such automation reduces human intervention, which further reduces the manpower needed for the transportation and logistics sector, eventually improving overall operational efficiency. These are the factors that help boost this segment's growth.

Segments Covered in the Report

By Product Type

By Frequency Range

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024