February 2025

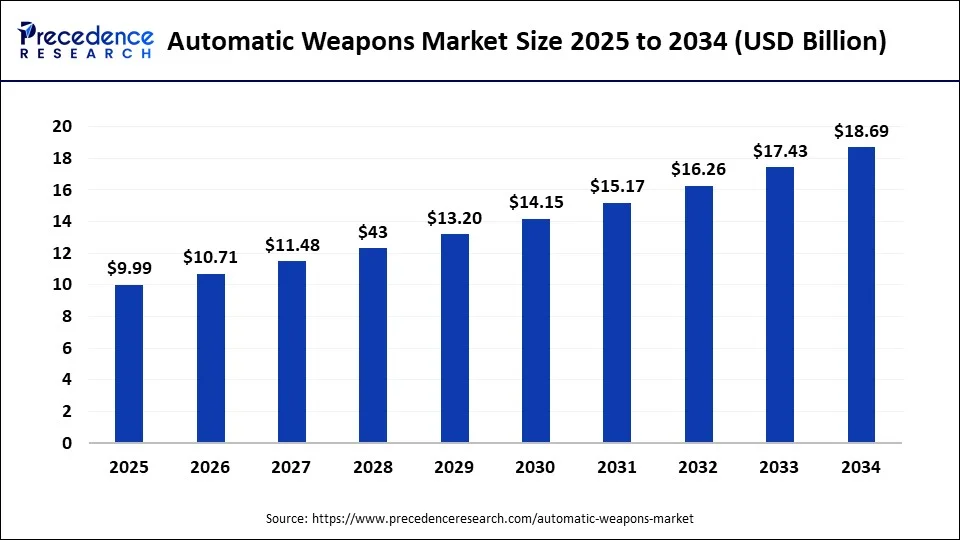

The global automatic weapons market size surpassed USD 8.69 billion in 2023 and is estimated to increase from USD 9.32 billion in 2024 to approximately USD 18.69 billion by 2034. It is projected to grow at a CAGR of 7.21% from 2024 to 2034.

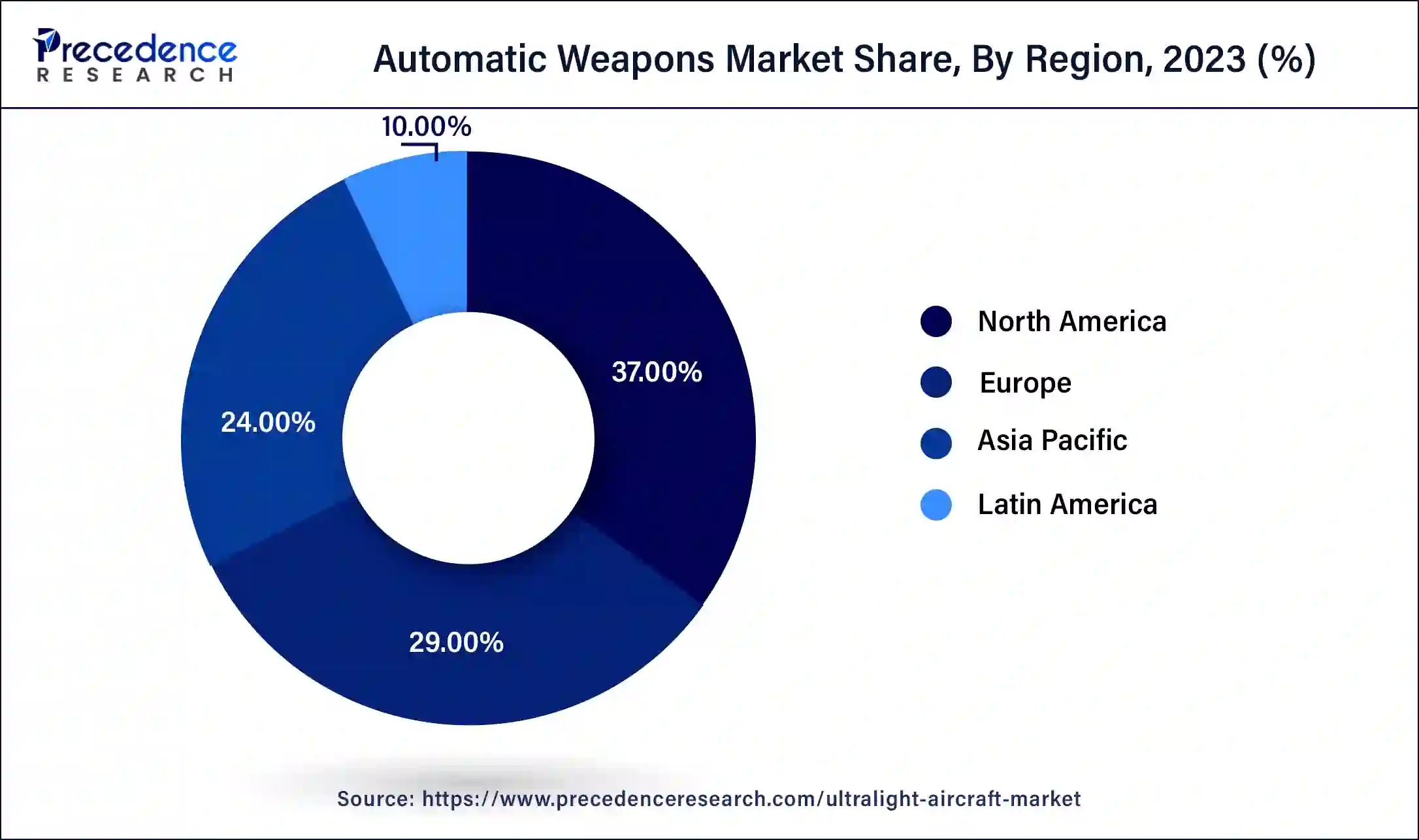

The global automatic weapons market size is expected to be worth around USD 18.69 billion by 2034 from USD 9.32 billion in 2024, at a CAGR of 7.21% from 2024 to 2034. The North America automatic weapons market size reached USD 3.39 billion in 2023. The growing concerns over security threats are the key factor driving the automatic weapons market growth.

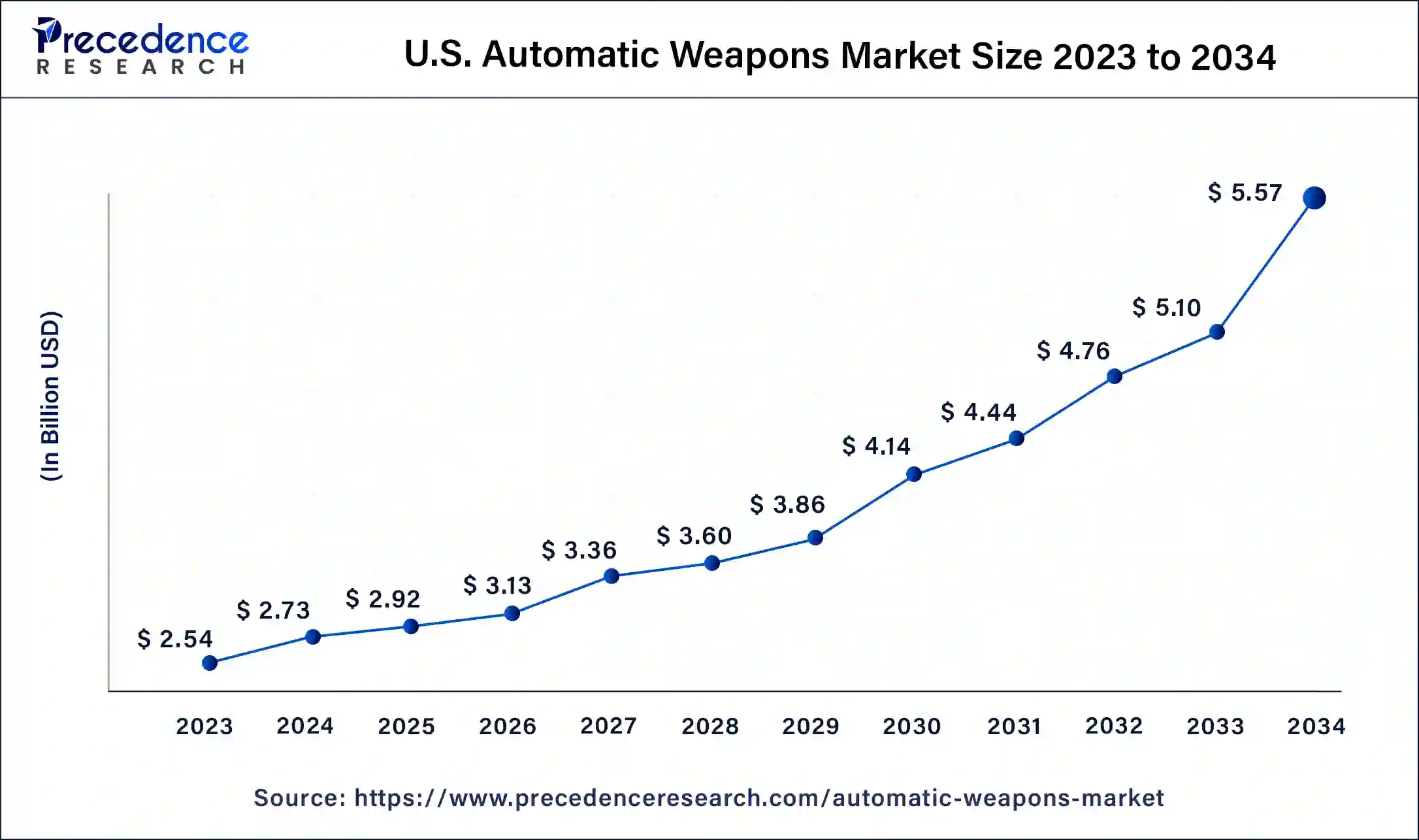

The U.S. automatic weapons market size was exhibited at USD 2.54 billion in 2023 and is projected to be worth around USD 5.57 billion by 2034, poised to grow at a CAGR of 7.39% from 2024 to 2034.

North America dominated the automatic weapons market in 2023. The growth of the market in the region is due to the high defense budget and expenditure to strengthen the special armed forces. The expenditure is mainly for procuring innovative weapons and upgrading the defense sector with advanced weapons. Moreover, the presence of key market players in the region is further driving the market growth.

Asia Pacific is expected to show the fastest growth in the automatic weapons market during the forecast period. This is mainly because of the growing demand for body armor by the military and increasing overall military spending, particularly in India and China. Furthermore, growing defense and individual expenditure in the region can also stimulate market growth in the region in the coming years.

Automatic weapons are meant to discharge continuously if the trigger is pressed. these weapons are different from semi-automatic firearms. Due to their ability to fire continuously these weapons are mainly utilized by law enforcement and the military. Machine guns, submachine guns, and assault rifles are some examples of these weapons to overcome the possibility of abuse and crimes many nations have imposed strict laws controlling the possession and use of automatic weapons.

Top 10 Countries with Highest Gun Ownership

| Country | Rate |

| United States | 120.50 |

| Falkland Islands | 62.10 |

| Yemen | 52.80 |

| New Caledonia | 42.50 |

| Serbia | 39.10 |

| Montenegro | 39.10 |

| Canada | 34.70 |

| Uruguay | 34.70 |

| Cyprus | 34 |

| Finland | 32.40 |

Role of AI in the Automatic Weapons Market

Machine learning algorithms play a vital role in this system and can be leveraged to analyze a large amount of data and make decisions accordingly. Innovative sensor technologies, such as infrared and electro-optical sensors, are the main components of these systems, which help them detect and track targets with great accuracy. Furthermore, many developed countries like the U.S. and China are already investing heavily in the automatic weapons market. However, the system also poses some legal, ethical, and operational challenges that need to be addressed.

| Report Coverage | Details |

| Market Size by 2034 | USD 18.69 Billion |

| Market Size in 2023 | USD 8.69 Billion |

| Market Size in 2024 | USD 9.32 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Type, Caliber, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing cross-border conflicts

Increasing cross-border conflicts around the world are fueling the demand for automatic weapons and thus driving the growth of the automatic weapons market. Border conflicts have increased dramatically in many countries in the past decades. Border disputes between Venezuela and Colombia, China and India, India and Pakistan, and Iraq and Syria are some notable ongoing examples in the world. Additionally, improvements in automatic weapon systems like armed robots and laser weapon systems are anticipated to drive market growth further in the future.

Ranking violent conflict levels across the world (2023 statistics)

| Index Rank | Country/Territory | Index Level |

| 1. | Myanmar | Extreme |

| 2. | Syria | Extreme |

| 3. | Mexico | Extreme |

| 4. | Ukraine | Extreme |

| 5. | Nigeria | Extreme |

| 6. | Brazil | Extreme |

| 7. | Yemen | Extreme |

| 8. | Iraq | Extreme |

| 9. | Democratic Republic of Congo | Extreme |

| 10. | Colombia | Extreme |

Unfavorable government regulations

Sometimes, these regulations can make it difficult and costly for companies to sell automatic weapons, which in turn can restrict the number of potential customers in the automatic weapons market. Many countries have stringent regularity policies regarding the authority and sale of automatic weapons. Additionally, high purchasing costs associated with automatic weapons can also hinder market growth.

Modernization of law enforcement capabilities

In the current automatic weapons market, public safety and the reduction of weapon-related incidents are key concerns for governments globally. The rising incidence of organized crimes, drugs, domestic violence, and arms smuggling demands the modernization of law enforcement capabilities. Furthermore, governments are spending large amounts of money on the development of automatic weapons for law enforcement agencies.

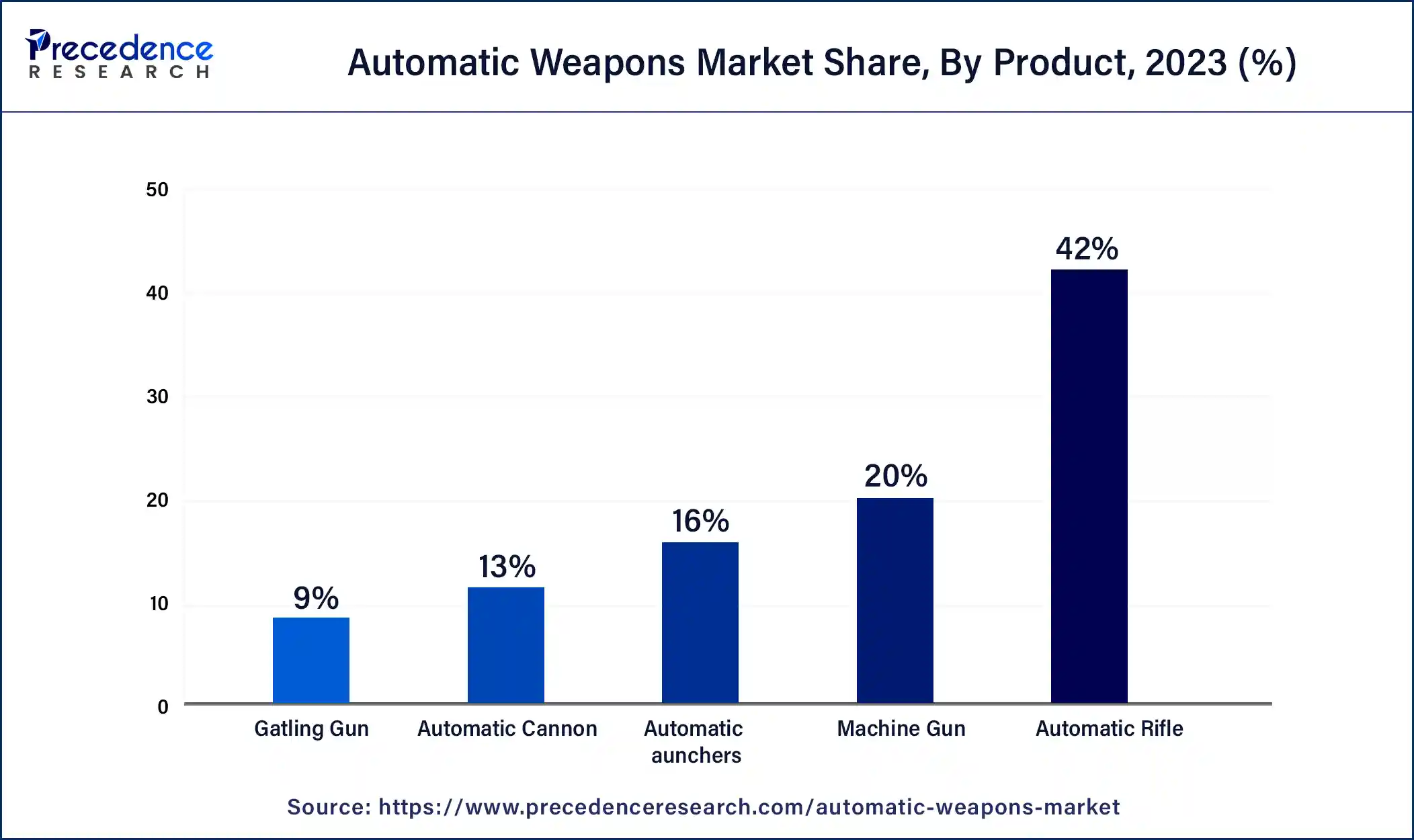

The automatic rifle segment dominated the automatic weapons market in 2023. The growth of the segment is attributed to the rising demand for fully automatic rifles from special forces, particularly from Asian countries. Moreover, automatic rifles have gone through substantial development in recent years. However, future advancements in automatic rifle technology are anticipated to pose a threat to society and cause social ramifications.

The machine gun segment is expected to grow at the fastest rate in the automatic weapons market over the forecast period. Machine guns are made to withstand continuous fire. The replacement of traditional machine guns with light ones can fuel the segment's growth further. Machine guns have many benefits, including the capability to quickly engage multiple targets and suppress enemy positions.

The semi-automatic segment led the global automatic weapons market in 2023. The dominance of the segment can be linked to the growing demand for semi-automatic weapon systems from India, Pakistan, Ukraine, and Syria to tackle regional tensions. The development of material science and manufacturing techniques can propel market growth soon.

The fully automatic segment is anticipated to grow at the fastest rate in the automatic weapons market during the forecast period. The growth is credited to the ease of accessibility of these weapons during war operations. Also, the rising cases of terrorism and demand for precision weapon systems are key factors driving market growth.

The small caliber segment held the largest share of the automatic weapons market in 2023. This is due to the improved performance, the lethality of small-caliber assault rifles, and penetration range during war operations. Additionally, small caliber weapons are easy to handle and convenient to use, which can lead to market growth shortly.

The medium caliber segment is expected to grow at a significant rate in the automatic weapons market throughout the forecast period. Medium caliber refers to projectiles with diameters ranging from 20 mm (about 0.79 in) to 40 mm (about 1.57 in). Medium calibers, such as 20mm (about 0.79 in) and 25mm (about 0.98 in) weapons, dominate the segment. The growth of the automatic weapons industry can boost segment growth further.

The land segment dominated the automatic weapons market in 2023. The growth of the segment can be linked to the growing expansion of military forces worldwide and the increase in the procurement of weapons by land-based forces. The government's increasing focus on close combat systems is also propelling the segment's growth.

The airborne segment is expected to grow at a significant rate in the automatic weapons market over the projected period. The rising replacement of traditional systems with innovative combat systems in combat support aircraft, fighter aircraft, and helicopters is driving the growth of the segment. Furthermore, the growing demand for GPS-guided weapons operating swiftly even in bad weather conditions can contribute to the market expansion.

Segments Covered in the Report

By Product

By Type

By Caliber

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025