January 2025

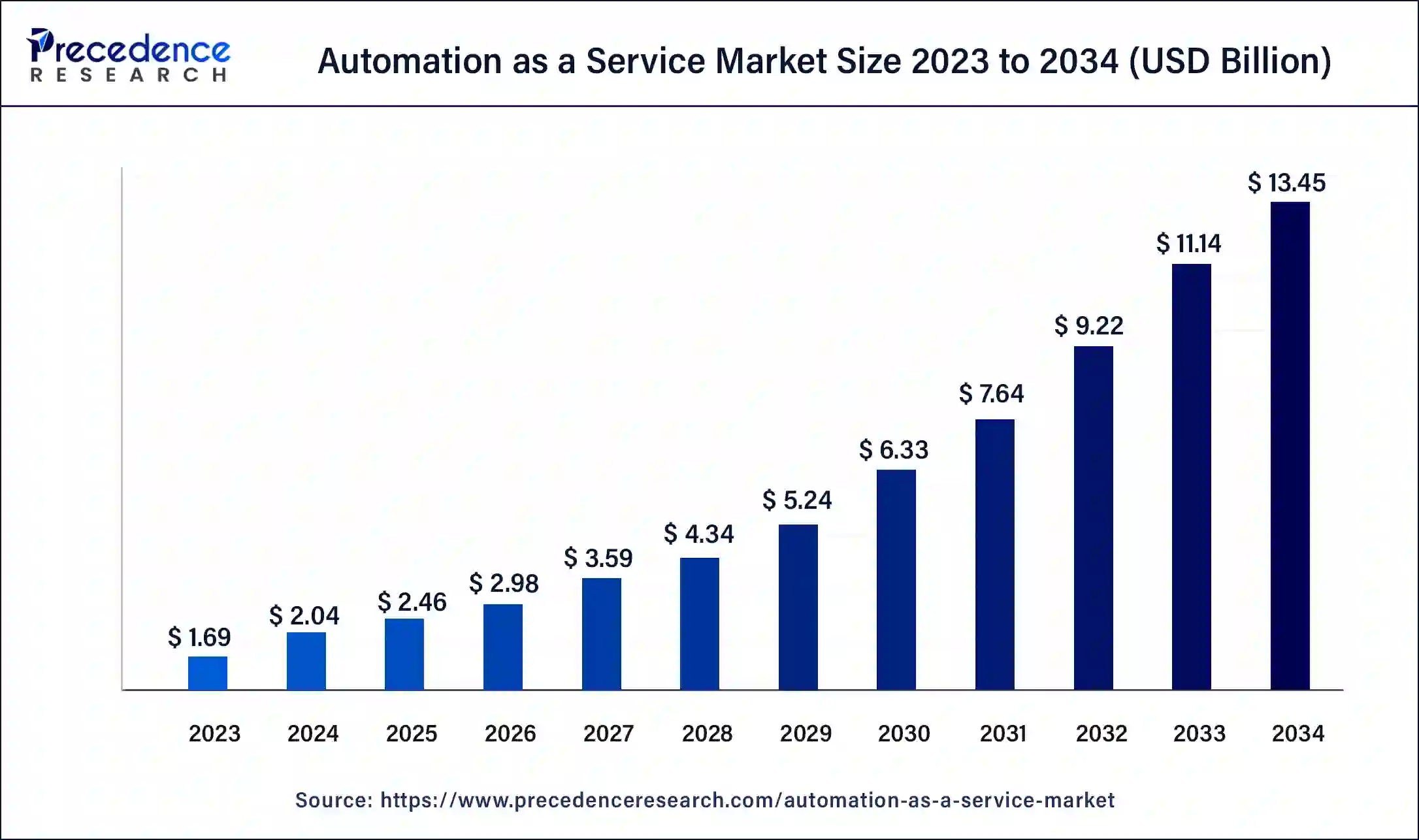

The global automation as a service market size was USD 1.69 billion in 2023, calculated at USD 2.04 billion in 2024 and is expected to be worth around USD 13.45 billion by 2034. The market is slated to expand at 20.75% CAGR from 2024 to 2034.

The global automation as a service market size is worth around USD 2.04 billion in 2024 and is anticipated to reach around USD 13.45 billion by 2034, growing at a CAGR of 20.75% over the forecast period 2024 to 2034. The North America mobile device management market size reached USD 610 million in 2023. The growing demand for minimizing manual efforts and reducing errors in various industries worldwide is driving the growth of automation as a service market.

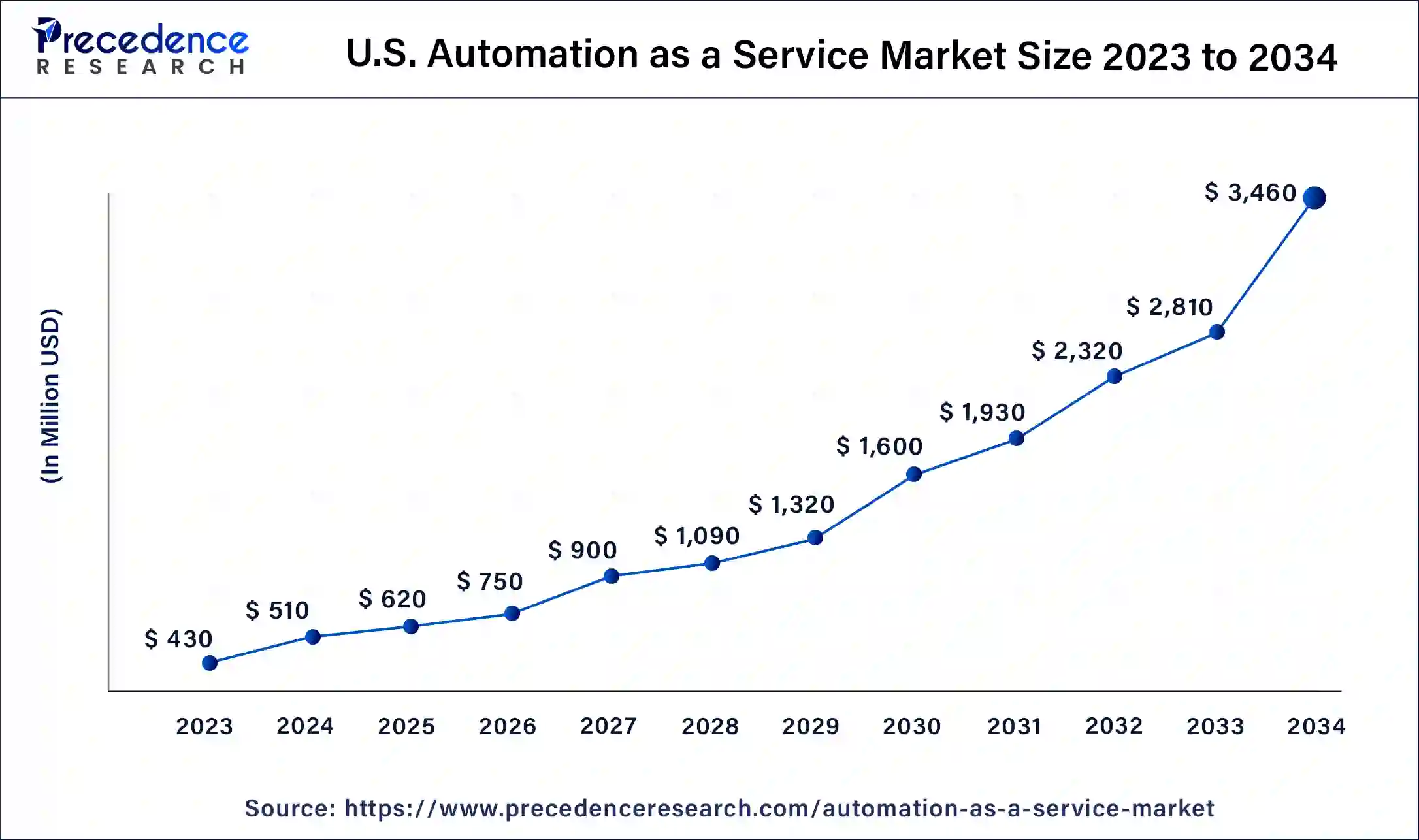

The global U.S. automation as a service market size was exhibited at USD 430 million in 2023 and is predicted to cross around USD 3,460 million by 2034, growing at a CAGR of 20.90% over the forecast period 2024 to 2034.

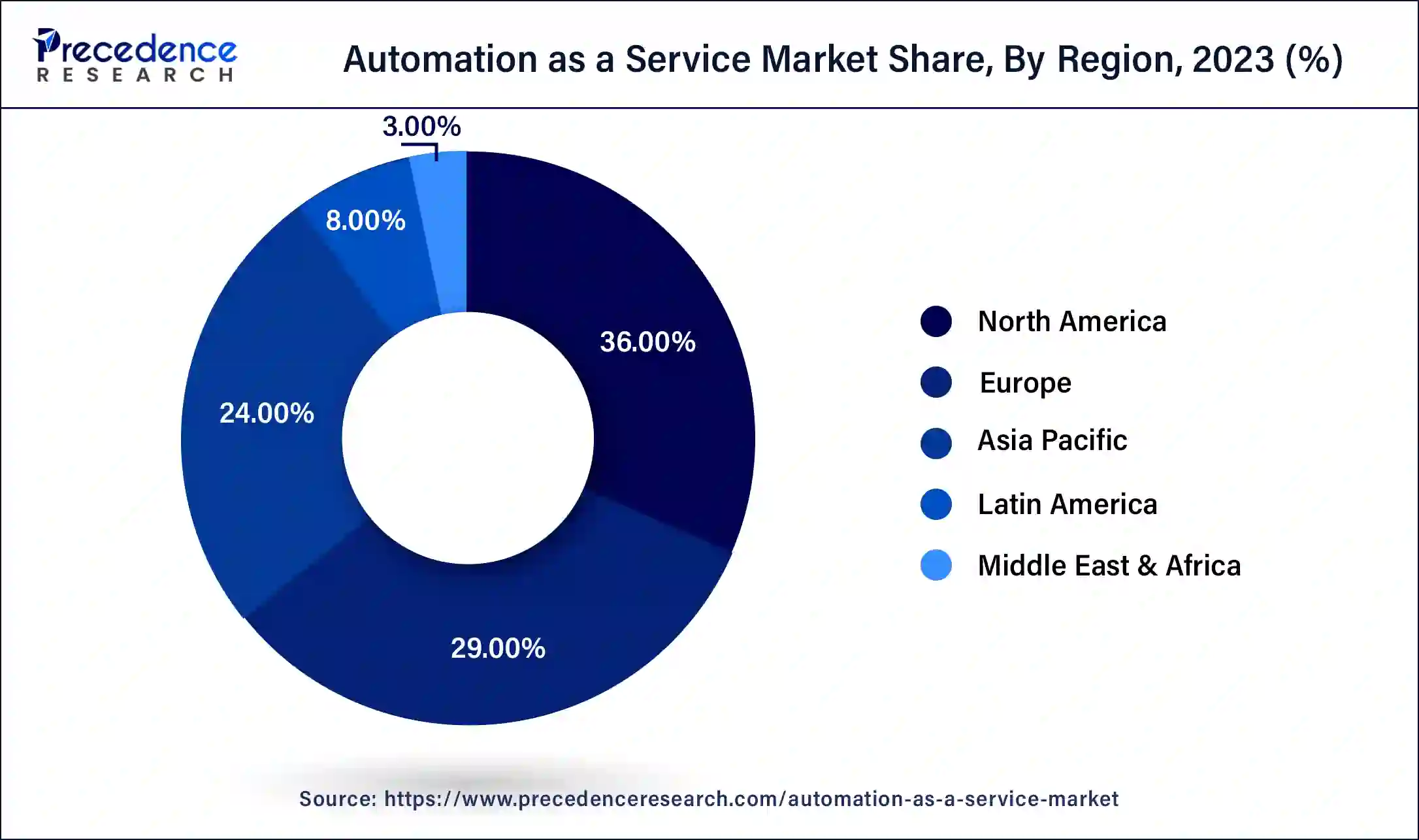

North America held the largest share of the automation as a service market in 2023. The growth of the market in this region is mainly driven by the rising technological advancements in the manufacturing sector along with the growing adoption of automation in several industries in countries such as the U.S. and Canada. The growing developments in the BFSI sector with the presence of several companies such as Morgan Stanley, JP Morgan, Royal Bank of Canada, and some others, along with the rising adoption of automation services in BFSI industries for automating complex tasks and minimizing calculation errors is likely to drive the market growth in this region.

Moreover, several local market players in the automation as a service market, such as Microsoft Corporation, Automation Anywhere Inc., Kofax Inc., and others, are constantly engaged in developing advanced automation services and adopting strategies such as partnerships, launches, and business expansions, which in turn drives the growth of the automation as a service market in this region.

Asia-Pacific is expected to be the fastest-growing region during the forecast period. The rising developments in the technological sector associated with the healthcare and life sciences sector, along with growing investments in countries such as Japan, China, South Korea, and some for developing the IT and telecom industry, have boosted the market growth in this region. Moreover, the growing developments in the manufacturing industry and the rising deployment of Industry 4.0 in the industrial sector have driven the market growth. Additionally, the rising demand for automation solutions in small and medium-sized enterprises is likely to boost the market growth in this region.

Furthermore, various local companies offering automation as a service, such as HCL Technologies, Yokogawa, Fujitsu, and some others, are offering high-quality automation solutions for several applications across the Asia-Pacific region, which is expected to drive the growth of automation as a service market in this region.

Automation as a service market is one of the most important industries in the robotics and automation sector. This industry deals in developing and distributing automation services to numerous enterprises around the world. It comprises two components, mainly solutions and services. There are different types of automation services for different business functions, such as information technology, finance, sales and marketing, operations, human resources, and others. These automation services are designed for large enterprises and small & medium enterprises. There are several verticals of these services, including industrial, BFSI, retail and consumer goods, telecom and IT, healthcare and life sciences, manufacturing, and some others.

How Can Artificial Intelligence Improve the Automation Indstry?

Artificial intelligence in automation has enabled companies to use devices and algorithms that are capable of autonomous decision-making. Improved artificial intelligence accessibility helps to enhance business productivity and achieve successful outcomes without the need of plenty of resources. Integration of AI with automation allows for the performance of multiple repetitive tasks such as data extraction and form filling. Machine learning is used for data processing and intelligent document processing that function in data extraction and data validation.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.45 Billion |

| Market Size in 2023 | USD 1.69 Billion |

| Market Size in 2024 | USD 2.04 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 20.75% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Business Function, Enterprise Size, Vertical and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising trend of cloud-based automation platforms

Numerous developments are taking place in the automation industry at the present time. The advancement in technologies such as AI, ML, cloud, NLP, RPA, and others has led the automation industry to grow significantly. Currently, the cloud-based automation platform has gained prominent attraction due to several advantages such as reduced cost, high productivity, enhanced efficiency, improvement in flexibility and scalability, disaster recovery, data backup, and others. Thus, the growing trend of cloud-based automation platforms is likely to drive the growth of the automation as a service market during the forecast period.

Cybersecurity issues along with device compatibility problems

There are various applications of automation as a service in several industries across the world. Although there are several benefits of automation services, there are various issues associated with this industry. Firstly, there are several cybersecurity issues related to automation platforms, such as phishing attacks and malware attacks. Secondly, some automation software is not compatible with several OSs and devices. Thus, cybersecurity issues, along with incompatibility problems, are expected to restrain the growth of the automation as a service market during the forecast period.

Integration of generative AI in automation platform

There are various developments in the automation industry due to advancements in modern technologies. In current times, automation companies have started developing generative AI-based automation platforms that can create images, text, code, or data autonomously and help streamline several business operations for doing repetitive tasks automatically. Thus, the growing integration of generative AI in automation platforms is likely to create ample growth opportunities for market players in the future.

The solutions segment dominated the market in 2023. The rising demand for automation solutions in the manufacturing and retail industries has driven market growth. Also, the growing application of automation solutions in small and medium enterprises to streamline business operations, along with increasing organizational efficiency, is expected to boost market growth to some extent. Moreover, the ongoing development of advanced automation solutions to solve complex problems easily is expected to propel the growth of the automation as a service market during the forecast period.

The services segment is expected to grow at the fastest CAGR during the forecast period. The rise in the number of business enterprises worldwide has increased the demand for automation services, thereby driving market growth. Also, the integration of modern technologies such as AI and ML in automation service platforms is likely to boost the market growth. Moreover, the growing adoption of BPA tools in several companies to reduce manual errors and increase efficiency in repetitive tasks is expected to drive the growth of automation as a service market during the forecast period.

The finance segment dominated the market in 2023. The growing demand for automation services for performing financial operations such as EMI registration, debit card issuance, brokerage processing, and others has driven market growth. Also, the rising development of automation solutions and services to solve the issues of the fintech companies is likely to boost the market growth to some extent. Moreover, the increase in the use of intelligent automation in the finance industry for performing financial transactions and helping with data analysis is expected to propel the growth of automation as a service market during the forecast period.

The information technology (IT) segment is expected to grow with the highest CAGR during the forecast period. The rise in a number of IT companies across the world has increased the demand for automation as a service in their organizations for simplifying complex tasks, which drives market growth. Also, the rising application of automation services in the IT industry to perform repetitive tasks without the intervention of administrators is likely to boost market growth to some extent. Moreover, the growing advancements in IT industries supported by government policies, along with increasing usage of automation services in application deployment and incident management in IT companies, are expected to boost the growth of the automation as a service market during the forecast period.

The large enterprise segment dominated the market in 2023. The growing number of big companies that have 250 or more employees across the world has driven market growth. For instance, in June 2023, Microsoft announced that the company had employed 221,000 people globally, with most employees being recruited to the operations domain. Also, the demand for automation solutions in large enterprises has increased due to several benefits, such as cost savings, reduced errors, and a rise in efficiency, among others, thereby boosting market growth. Moreover, the rising trend of business process automation (BPA) among large enterprises, along with increasing demand for software as a service (SaaS) and analytics as a service (AaaS) for simplifying complex tasks, is expected to drive the growth of automation as a service market during the forecast period.

The small and medium enterprise segment is expected to grow with the highest CAGR during the forecast period. The rise in a number of startup companies around the world has increased the demand for automation services, thereby driving market growth. For instance, the Ministry of Commerce and Industry in India announced that there are 1 17,254 government-recognized startups in the country on December 31, 2023. Also, the growing demand for automation solutions among SMEs to reduce dependency on human resources has driven the market growth. Moreover, the integration of modern technologies such as AI and ML in automation services for performing numerical tasks, communication processes, documentation, and some others in SMEs is expected to boost the growth of the automation as a service market during the forecast period.

The BFSI segment dominated the market in 2023. The growing demand for personalized customer experience and rising emphasis on increasing efficiency in the BFSI sector have driven market growth. Also, the increasing application of automation solutions in the BFSI industry to enhance scalability and accessibility is likely to propel market growth. Moreover, the upsurge in demand for AI chatbots to handle numerous operations simultaneously in the BFSI sector is expected to drive the growth of automation as a service market during the forecast period.

The manufacturing segment is expected to grow with the highest CAGR during the forecast period. The rising demand for automation as a service in the manufacturing sector is due to several advantages, such as optimizing operations, cost savings, enhanced productivity, and some others, which have driven the market growth. Also, the ongoing integration of RPA solutions and predictive maintenance systems in the manufacturing industry to streamline business operations is likely to boost market growth to some extent. Moreover, the growing demand for automation solutions in the manufacturing industry to ensure timely deliveries, along with enhancing customer satisfaction and loyalty, is expected to drive the growth of automation as a service market during the forecast period.

Segments Covered in the Report

By Component

By Business Function

By Enterprise Size

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2025

August 2024