January 2025

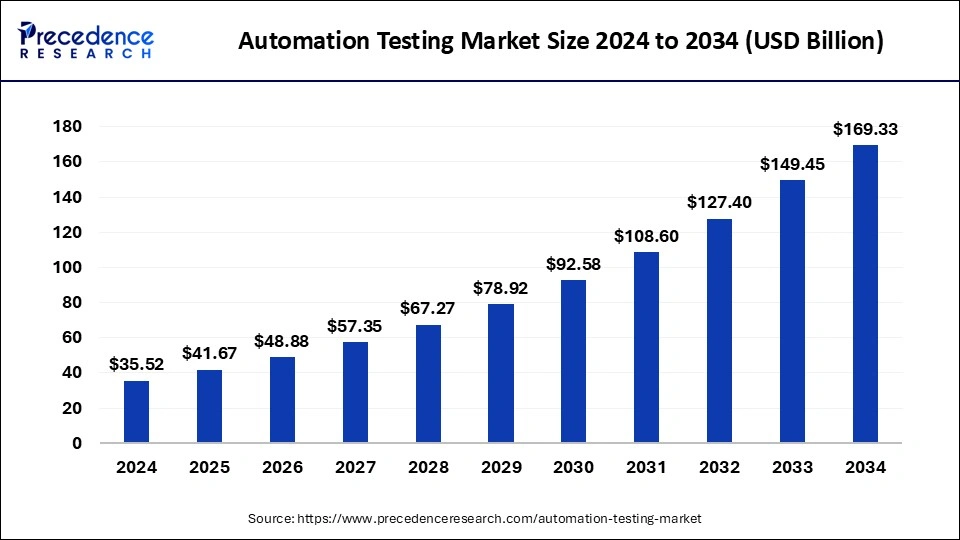

The global automation testing market size is calculated at USD 41.67 billion in 2025 and is forecasted to reach around USD 169.33 billion by 2034, accelerating at a CAGR of 16.90% from 2025 to 2034. The North America automation testing market size surpassed USD 14.21 billion in 2024 and is expanding at a CAGR of 16.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automation testing market size was estimated at USD 35.52 billion in 2024 and is predicted to increase from USD 41.67 billion in 2025 to approximately USD 169.33 billion by 2034, expanding at a CAGR of 16.90% from 2025 to 2034. Businesses' growing readiness to use innovative automation testing techniques like DevOps and Agile methodologies drive the market's growth.

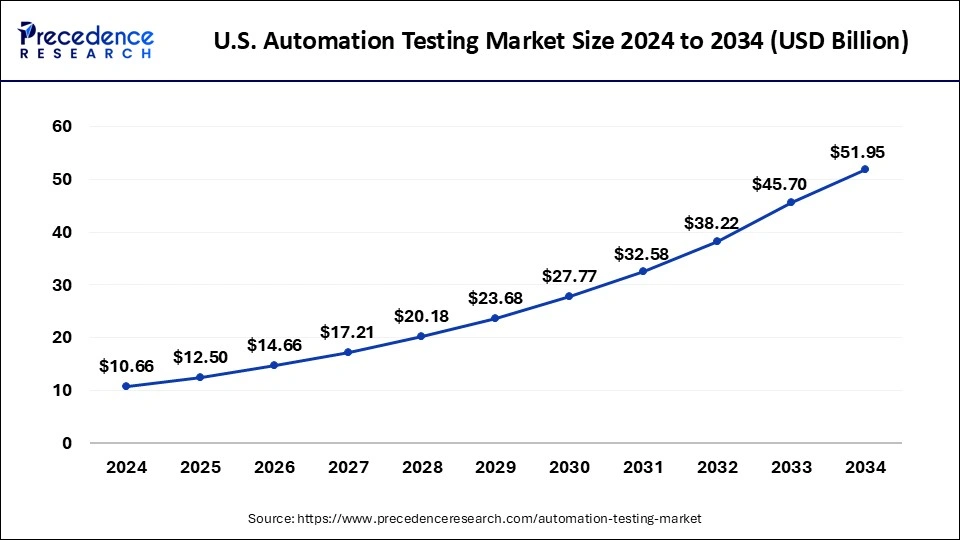

The U.S. automation testing market size was exhibited at USD 10.66 billion in 2024 and is projected to be worth around USD 51.95 billion by 2034, poised to grow at a CAGR of 17.16% from 2025 to 2034.

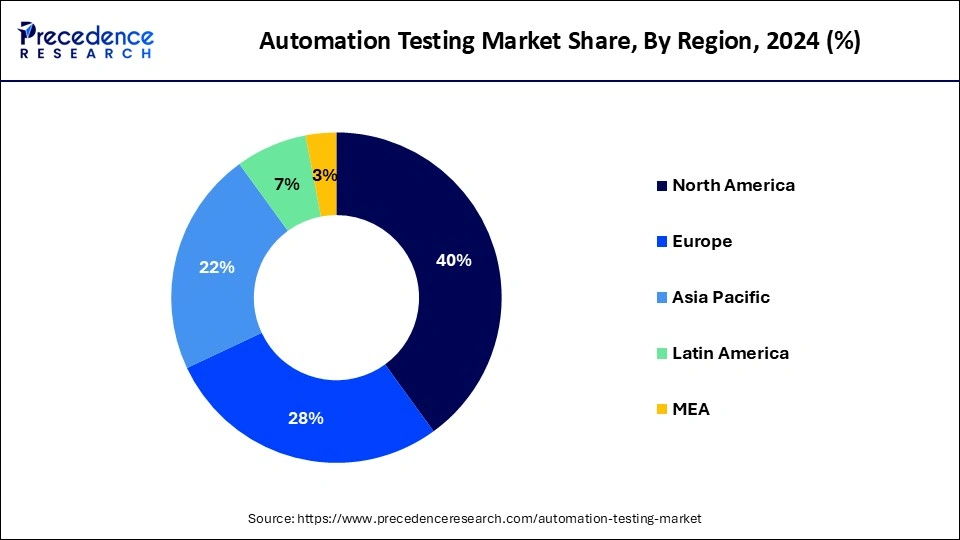

North America dominated the automation testing market and is observed to sustain as a significant contributor during the forecsat period. The market in the region is propelled by a wide array of technology vendors. In the US, increasing demand stems from the growing adoption of smart consumer devices such as smart TVs, home appliances, and laptops. These devices are closely interconnected with web applications, operating systems (OS), and software. As the usage of these smart consumer electronics expands, there will be an increased need for test automation services in the region.

Asia Pacific is anticipated to witness a CAGR of 20.03% over the forecast period in the automation testing market. Several factors are driving this strong growth trend, such as rapid digitalization across various sectors, growing use of automation testing to improve software quality and speed up product launches and expanding investments in IT infrastructure and technological advancements.

The region is expected to grow at the highest rate during the forecast period. This region includes significant economies such as India and China, which boast large customer bases. Additionally, governments are actively promoting the smooth adoption of new technologies such as AI, ML, automation, IoT, mobile and web-based applications, cloud services, and other advancements.

In order to quickly and effectively assess software applications in emergency scenarios, the automation testing market offers automated testing solutions and services. The demand for dependable software functionality and performance under time limitations, such as during crisis response, catastrophe recovery, or urgent deployments, is addressed by this market. Robust capabilities for accelerated testing cycles are provided by emergency automation testing systems, allowing enterprises to rapidly evaluate and address software integrity, resilience, and compliance in high-pressure settings.

| Report Coverage | Details |

| Market Size by 2034 | USD 169.33 Billion |

| Market Size in 2025 | USD 41.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component Size, Organization Size, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Integration of ML and AI in cloud automation

The quick uptake of cutting-edge technology is the main driver anticipated to propel the growth of the automation testing market over the forecast period. Further driving market expansion is expected to be the growing use of AI-enabled technologies in software testing settings, as well as the growing need for automated testing methods and solutions to guarantee a smooth user experience. Moreover, the incorporation of artificial intelligence and machine learning into cloud-based automation testing solutions is making their use easier and may help to grow the industry.

Initial Investment and Implementation Costs

Implementing automation testing requires an initial investment in tools, infrastructure, and skilled personnel. The costs associated with acquiring automation testing tools and licenses, setting up testing environments, and training the workforce can be significantly high. For smaller organizations with limited budgets, these upfront expenses can create a barrier to adopting automation testing.

Rising Demand for Test Automation Consulting and Services

Businesses in a variety of sectors are realizing how crucial automation testing is to maintaining software quality, cutting development costs, and speeding time to automation testing market. But in order to create strategies that work, choose the right technologies, and incorporate automation testing into current processes with ease, deploying automation testing calls for specific knowledge. Test automation assessment, plan creation, tool evaluation, framework implementation, and training are just a few of the useful services offered by test automation consulting companies. These services aid businesses in overcoming obstacles. Thereby, the rising demand for test automation consulting is observed to offer various opportunities for the automation testing market.

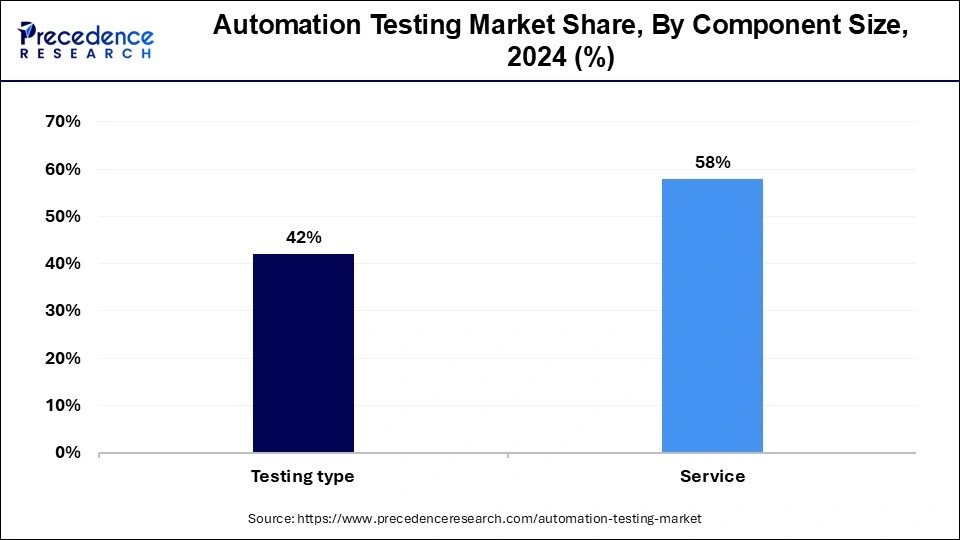

The services segment dominated the automation testing market in 2024. Implementation services facilitate the integration of automation into existing software testing infrastructures. These services seamlessly incorporate automation into current testing setups. To properly integrate automated analysis solutions, various hardware components must be connected, and the system's functionality must be evaluated.

The testing type segment is anticipated to grow at the fastest rate during the forecast period. Automated testing is a technique that automates the validation of software functionality; it should meet requirements before release into production. This approach allows organizations to run specific software tests more quickly without the need for human testers. Documents such as software requirements specifications, designs, and test cases are analyzed during this process.

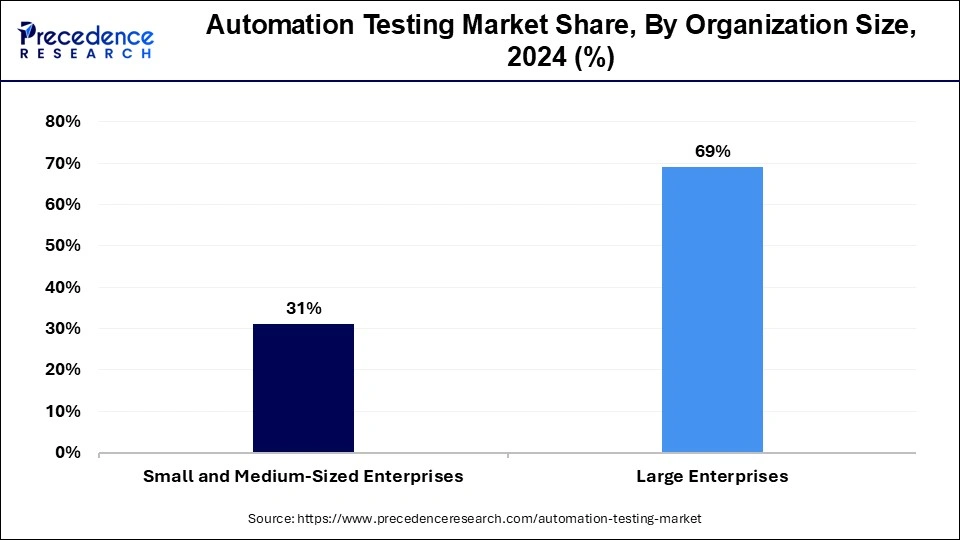

The large enterprises segment dominated the automation testing market in 2024. Automation testing services are essential for enterprises to ensure the smooth functioning of their business operations. These services also help to reduce operational costs and improve customer satisfaction. Test planning should prioritize selecting test cases for automation by considering critical functionalities, high-risk areas, and frequently executed scenarios.

The small and medium-sized enterprises segment is observed to grow at a significant rate during the forecast period in the automation testing market. Small-sized businesses should prioritize automation testing since it improves testing process efficiency, conserves time and money, and guarantees software application quality. Furthermore, it is imperative to give priority to the selection of test cases for automation in contexts with constrained resources and time. Market expansion is fueled by concentrating on high-risk domains, frequently carried out scenarios, and essential features. Additionally, this method increases coverage with the least amount of work and resources.

The BFSI segment led the automation testing market in 2024 by holding the largest market share. This can be attributed to the adoption of digitalization in the BFSI sector, which is driving significant demand for automation testing of application software. Meanwhile, the retail sector is expected to experience the highest growth rate due to the increasing penetration of e-commerce. Automation testing helps in ensuring that all applications comply with these regulations by systematically and consistently testing for compliance, which manual testing might not achieve efficiently.

BFSI organizations are increasingly adopting Agile and DevOps methodologies to enhance their development cycles and reduce time-to-market. Automation testing is integral to these practices as it allows for continuous integration and continuous deployment (CI/CD), ensuring that new code changes do not disrupt existing functionalities.

The healthcare segment is the fastest-growing segment throughout the projected period in the automation testing market. This is because Automation testing is vital in the healthcare industry, where the accuracy, reliability, and security of software applications are paramount. Electronic Health Record (EHR) systems are essential for managing patient information in healthcare organizations. Automation testing ensures these systems integrate smoothly by facilitating data exchange, interoperability, and compliance with industry standards like HL7 or DICOM.

Healthcare applications, including electronic health records (EHR), patient management systems, and diagnostic tools, are critical and directly impact patient care and safety. Ensuring the reliability and accuracy of these systems is paramount. Automated testing provides thorough and repeatable testing processes that can detect errors early, reducing the risk of software failures in a live environment.

By Component Size

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2025

August 2024