January 2025

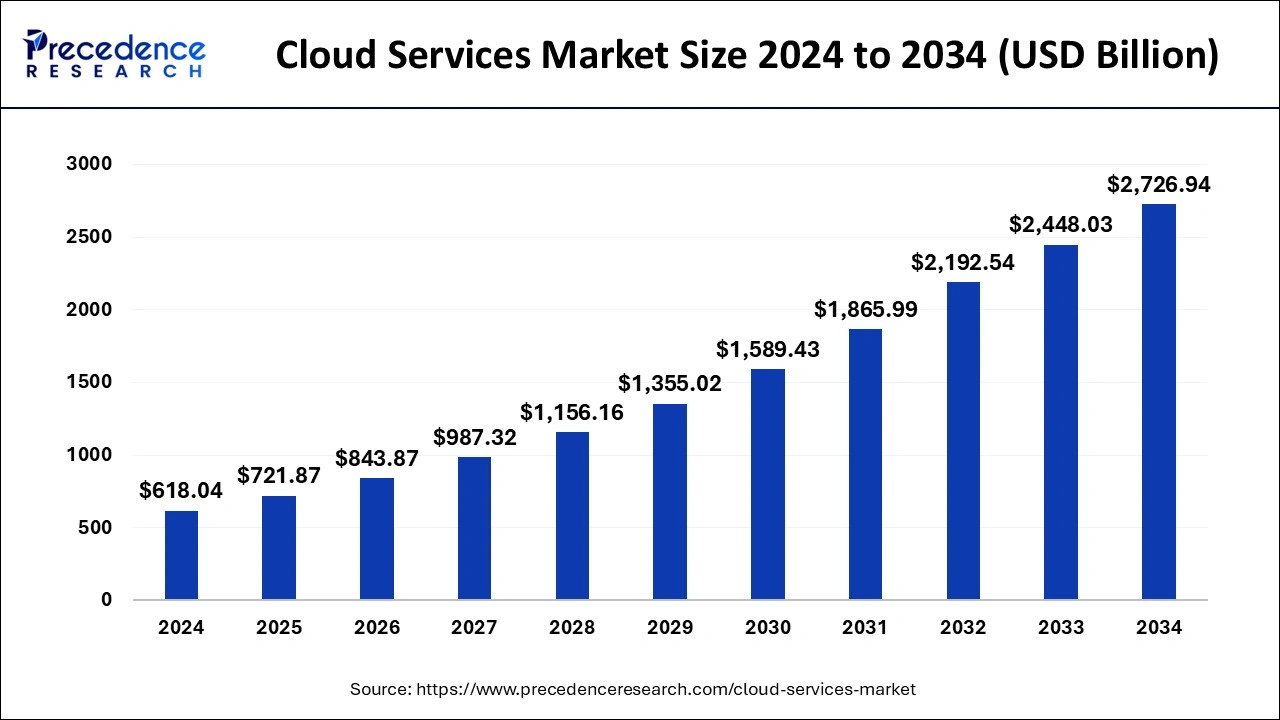

The global cloud services market size accounted for USD 618.04 billion in 2024 and is expected to exceed around USD 2,726.94 billion by 2034, growing at a CAGR of 16.00% from 2025 to 2034. The cloud services market is driven by the increasing demand for scalable and cost-efficient IT infrastructure.

Artificial intelligence helps cloud services run at scale by automating many aspects of IT management. For instance, AI can detect and anticipate failures, repel cyberattacks, and provide and scale services, often with little or no human participation. Tracking service use, billing, and offering customers complex workload monitoring and management systems can all be simpler and more scalable with AI support. It even helps people excel at jobs that they find difficult or tedious. With AI-backed processes, businesses can accomplish tasks such as managing documents, sorting packages, matching invoices, and even summarizing documents like legal briefs quicker and more accurately than humans. The added advantage of this efficiency is that it frees employees to do more complex tasks that need human experience and relationships.

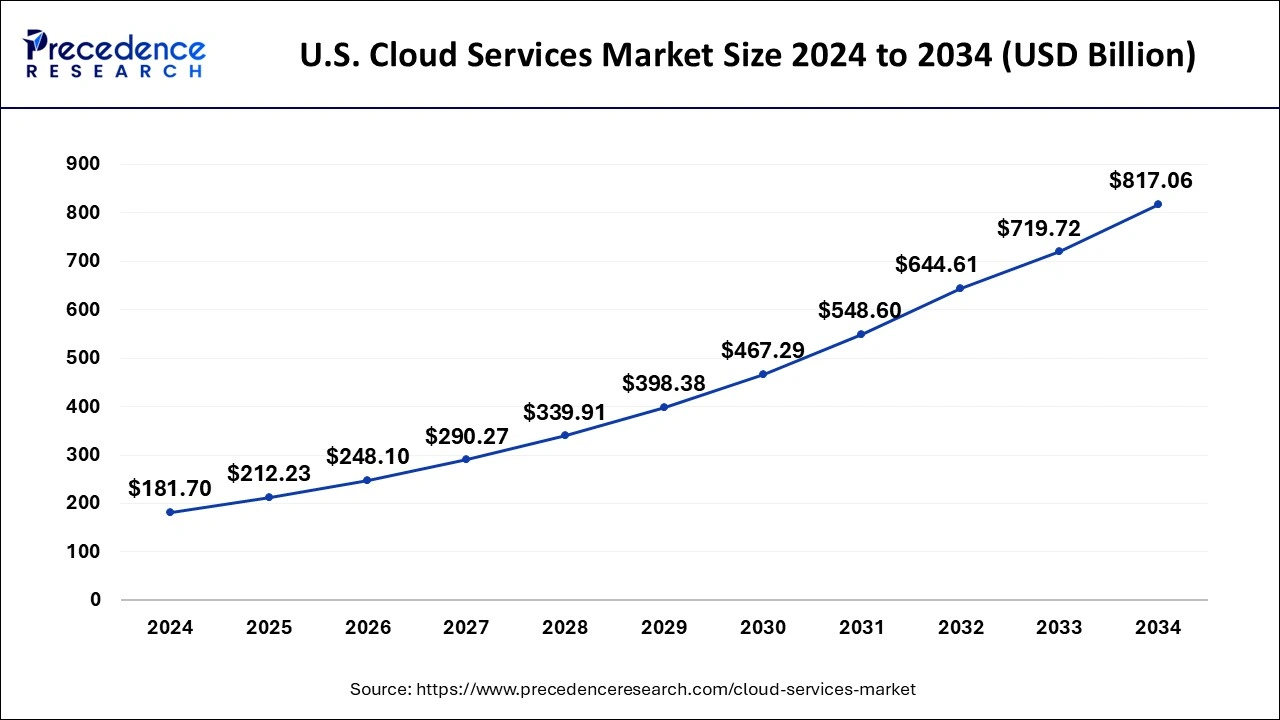

The U.S. cloud services market size was exhibited at USD 181.70 billion in 2024 and is projected to be worth around USD 817.06 billion by 2034, growing at a CAGR of 16.22% from 2025 to 2034.

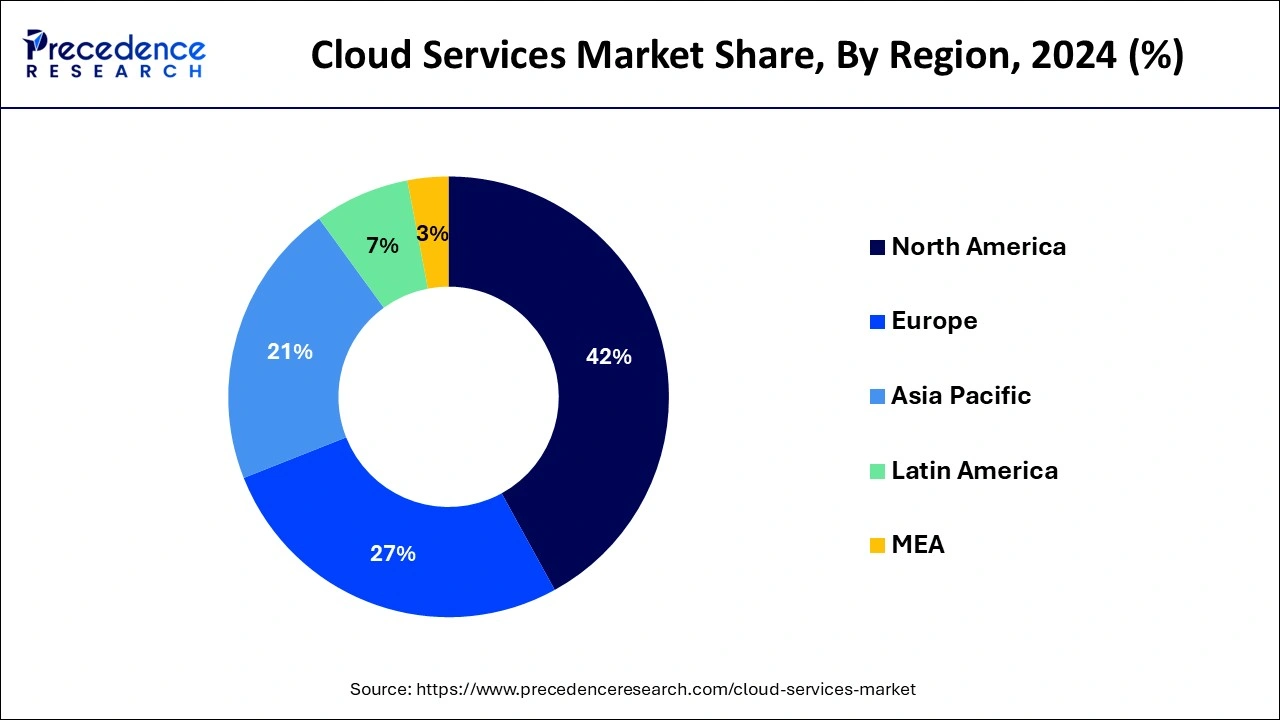

In 2024, North America led the worldwide market with a revenue share of more than 42%. Companies in the United States place a high priority on digitalization and are frequently regarded as pioneers of next-generation technologies such as IoT, big data analytics additive manufacturing, connected industries, ML, AR, AI, and VR, as well as the most recent telecommunications technologies. Apple Inc., for example, launched its cloud computing infrastructure in June 2020 to update and expand its cloud-based solutions and services such as News Plus, Apple Music, and iCloud, and others.

During the projected period, Asia Pacific is projected to grow at an exponential rate. The rising demand for cloud-based solutions in the manufacturing and healthcare sectors is driving the expansion. Furthermore, rising demand for smart electric vehicles, rising penetration of internet, and rising digitalization propelling regional growth.

India has seen a significant and rapid growth in the market due to digital transformation in the country, and widespread adoption of AI by consumers and government support for digital transformation, which fuels the demand for the market. The rising concerns for security and data authentication for data management from various sectors drive the growth. Growing startups and government organizations, and initiatives for in-line work demand the market for security and privacy. Increasing use of digital tools, mobile apps, AI, and online payments drives the growth of authentication. Many sectors, including healthcare, retail, IT, and banking, demand the market. Many key companies are investing in cloud services and cloud-based solutions like TATA. These applications and demand drive the growth in the country.

The USA market is highly advanced and growing due to advancements in digital technology and the digital shift in the country for the storage of data, remote support, and the use of technology like AI and big data demand for use of cloud services, which fuels the growth of the market. The USA is the biggest provider of cloud services and solutions. The providers are Amazon Web Services, Google Cloud, and Microsoft Azure, which play a major role in the growth of the market. All industries in the USA use cloud-based solutions, like healthcare, education, entertainment, and finance, to improve overall performance and cost, which further drives the growth. Ongoing innovation and advances with strong infrastructure in the USA drive the growth and support expansion of the market.

The rapidly accelerating digital transformation happening in emerging economies and markets is creating one of the largest opportunities in the cloud services market. Asian, African and Latin American countries are seeing increased internet penetration, smartphone use, and government digital initiatives, including programs such as India's Digital India efforts or Brazil's Cloud First Policy in the public and private sectors. According to a 2024 IDC report, over 60% of enterprises that are located in Southeast Asia are expected to shift critical workloads to the cloud by 2026.

(Source: https://my.idc.com)

The projected transformation will create an unparalleled demand for scalable, secure, and local cloud solutions. While many cloud service providers are looking to layer cloud services that target a broad range of consumers and enterprises, there are huge opportunities for service providers to focus their investments in data centers, partnerships and pupose-built offerings to this rapidly growing cloud segment. As countries and their populations increase their digital maturity, it is likely that the demand for hybrid and multi-cloud models will also increase substantially.

Cloud services permit enterprises to do better because of agile deployment, security and data management, utility-based sharing models, low total cost of ownership and high-level computing. In addition, adoption of emerging technologies like artificial intelligence (AI) and machine learning facilitates cloud growth by allowing businesses to tap into AI capabilities. Cloud computing enables the effective and speedier adaptation and operation of corporate activities in changing market settings. It simplifies technology consumerization. It has opened up hitherto unseen opportunities for creating very engaging consumer experiences. Cloud computing has influenced people's and enterprises' behavior, allowing many lines of business to work around technology rules.

Cloud trends are influencing enterprises' investment plans, digital business decision-making processes, and vendor and technology choices. Corporations' key concerns are data security and privacy, since information storage, usage, and transfer must be digitally safeguarded. As per surveys, around 60% of business-sensitive data on hard drives is held unsafely.

According to a recent analysis, worldwide Cloud infrastructure services investment surged 34% to $55.9 billion in the January-March quarter (Q1), as organizations prioritized digitalization efforts to overcome market difficulties. According to market research company Canalys, the top three cloud service providers profited from increasing adoption and size, growing 42 percent year on year and contributing for 62 percent of global consumer expenditure. Google Cloud was the best performing of the top three, rising by 54% in the most recent quarter to represent for 8% of the market.

As a result of the epidemic, foremost workplace shifts is predicted. It is transforming how organizations employ smart technologies like mobile supercomputing, internet of things (IoT), big data, and artificial intelligence to drive Industry 4.0, also known as the fourth industrial revolution. The cloud-computing industry boosted demand in the third quarter of 2020 as organizations continued to transfer workloads from traditional channels to digital formats. Countless firms in a variety of industries have adopted the work-from-home model to preserve employee well-being and operational efficiency, driving up demand for Software-as-a-Service (SaaS)-based solutions.

The rising usage of Video-on-Demand (VoD) has boosted the demand for Infrastructure as a Service (IaaS) to match customer expectations. Furthermore, in healthcare, the demand is constant, and this business generates a large amount of data that must be managed for the benefit of the patients. Data may be easily shared among medical service providers through cloud services, providing patients to receive healthcare solutions. This is assisted by AI and machine learning in cloud services since they shorten the time it takes a healthcare practitioner to examine data and provide the best answer to patients.

| Report Coverage | Details |

| Market Size in 2025 | USD 721.87 Billion |

| Market Size in 2034 | USD 2,726.94 Billion |

| Growth Rate from 2025 to 2034 |

CAGR of 16.00% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Services, Organization Size, Verticals, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In 2022, the private deployment segment topped the cloud services market with a revenue share of more than 47%. Private clouds have computational capabilities as it offers organization with higher self-service, scalability, and flexibility.

The hybrid cloud is anticipated to grow at a rapid rate over the forecast period. The increase is attributed to the increasing adoption of cloud-based solutions among the SMEs in order to boost productivity and reduce operational costs. Furthermore, surging demand for scalable, secure, and cost-effective solutions is fostering the private cloud demand among the large enterprises. During the forecast period, public cloud services segment is projected to dominate the market in terms of market share. The growth can be attributed to digital transformation, increased penetration of connected devices, and increased automation among small & medium-sized businesses. In a private cloud, you host your own data centre or intranet. You own, maintain, update, and upgrade your own server, networking, software, or platform cloud environment using your own firewall and security solutions to protect everything.

Services Insights

In 2022, software as a service (SaaS) had the largest market share. This is due to its ease of deployment, cost effectiveness, and low maintenance costs. During the projected timeframe, infrastructure as a service (IaaS) is anticipated to grow at the fastest rate. The growth can be attributed to the surging demand for hybrid cloud platforms as well as the growing preference for business storage of data and security solutions.

SaaS solution segment s is expected to grow at rapid pace owing to surge in the adoption by BFSI, media and entertainment sectors. For instance, Netflix application is web-based SaaS subscriptions platform that offers flexibility to use. As of 2022, Netflix SaaS application has more than 221.0 million users. Such high users of the SaaS based applications have created massive demand for the market growth.

(Source: https://www.forbes.com)

(Source: https://hackernoon.com)

(Source: https://www.prnewswire.com)

By Deployment

By Service

By Organization Size

By Verticals

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

June 2025

May 2025

January 2025