January 2025

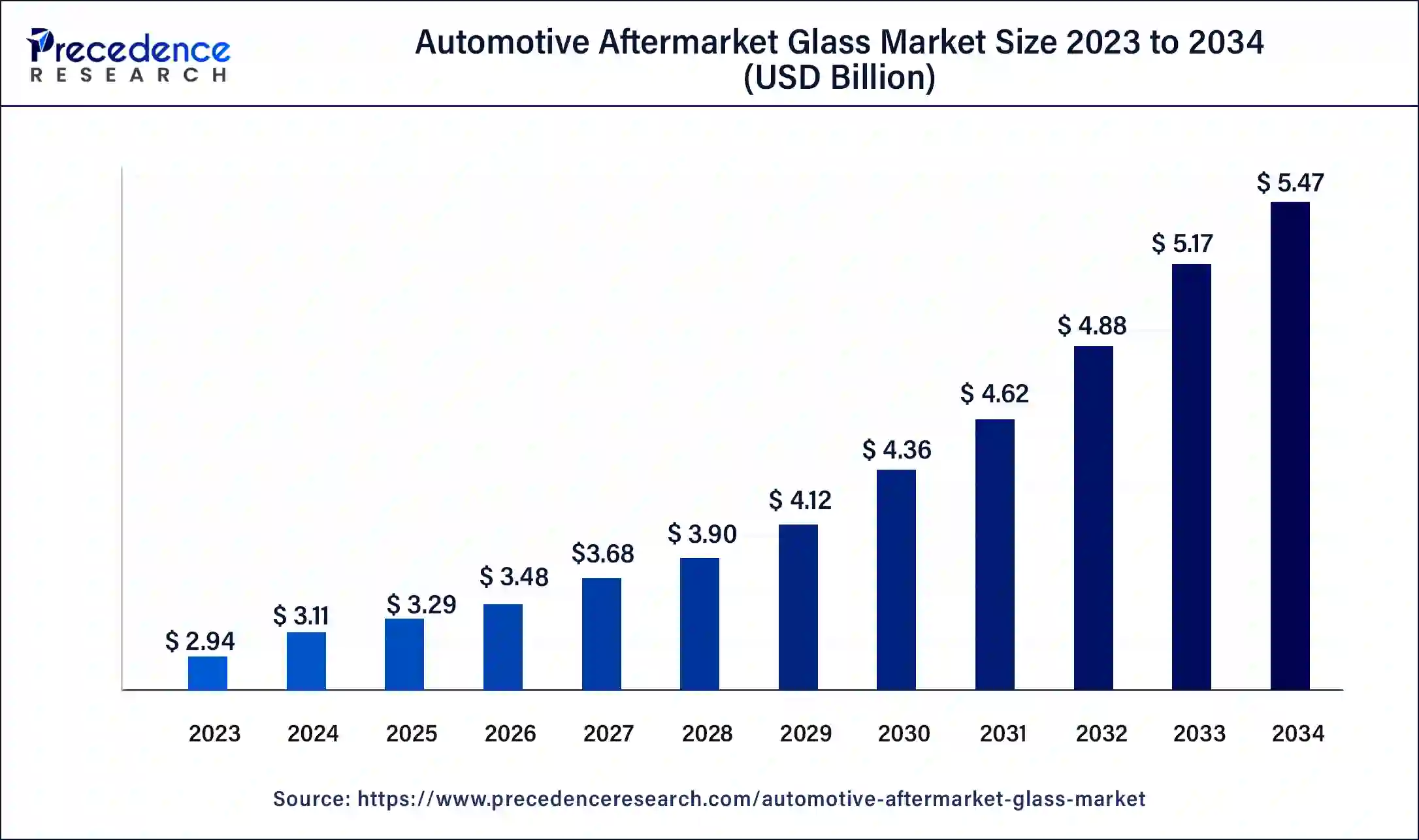

The global automotive aftermarket glass market size was USD 2.94 billion in 2023, calculated at USD 3.11 billion in 2024 and is projected to surpass around USD 5.47 billion by 2034, expanding at a CAGR of 5.8% from 2024 to 2034.

The global automotive aftermarket glass market size accounted for USD 3.11 billion in 2024 and is expected to be worth around USD 5.47 billion by 2034, at a CAGR of 5.8% from 2024 to 2034.

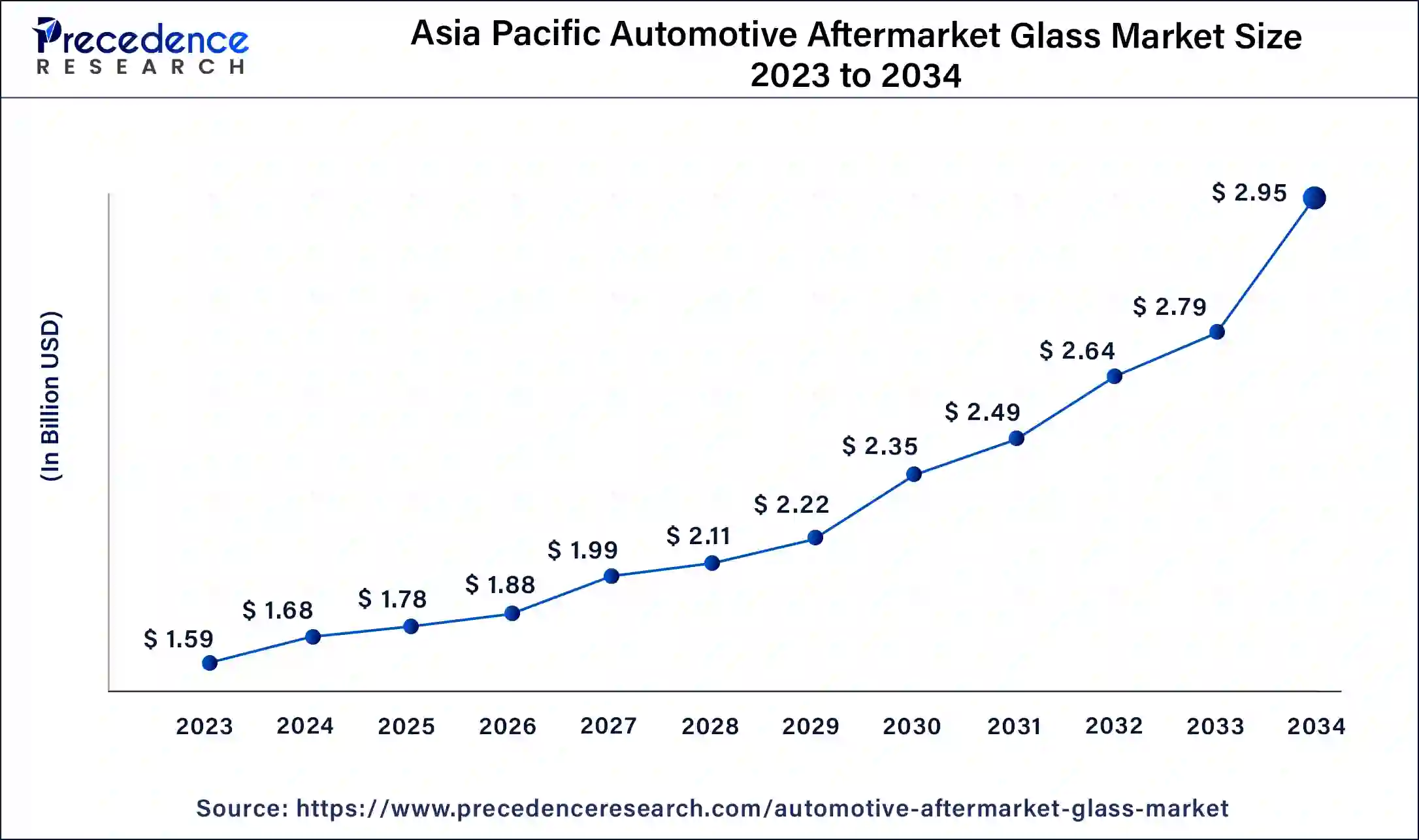

The Asia Pacific automotive aftermarket glass market size was estimated at USD 1.59 billion in 2023 and is predicted to be worth around USD 2.95 billion by 2034, at a CAGR of 6% from 2024 to 2034.

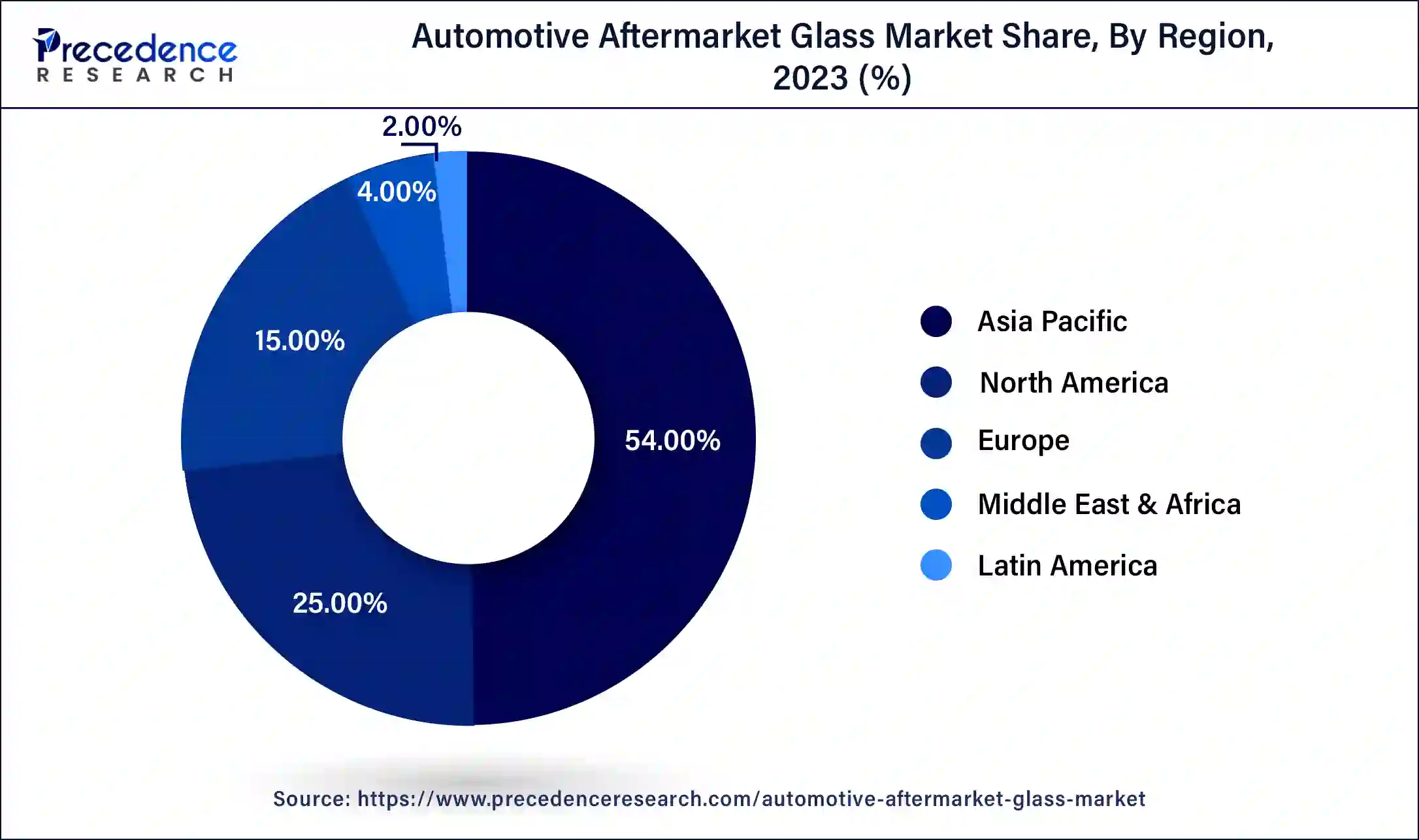

Asia-Pacific holds a share of 54% in the automotive aftermarket glass market due to a combination of factors. The region's robust automotive industry, rising vehicle ownership, and a high frequency of road accidents contribute to the substantial demand for aftermarket glass replacements. Additionally, the presence of key automotive manufacturing hubs and a burgeoning middle-class population seeking affordable automotive solutions further propels the market. Rapid urbanization increased disposable income, and a growing awareness of vehicle maintenance drive the demand for aftermarket glass products in Asia-Pacific, consolidating the region's significant share in the global market.

North America is projected to witness rapid growth in the automotive aftermarket glass market due to several factors. An increasing vehicle fleet, coupled with a high rate of road accidents, drives the demand for glass replacements. The region's focus on advanced automotive technologies and safety standards further fuels the need for aftermarket glass with upgraded features. Additionally, a surge in e-commerce platforms and consumer awareness of customization options contribute to the flourishing market. These factors collectively position North America as a key growth hub in the automotive aftermarket glass industry.

Meanwhile, Europe is witnessing notable growth in the automotive aftermarket glass market due to an increase in vehicle ownership, a rise in road accidents, and a demand for advanced safety features. Stringent regulations emphasizing vehicle safety standards contribute to the adoption of high-quality aftermarket glass. Additionally, a growing preference for vehicle customization and the availability of eco-friendly glass options align with the region's automotive trends. These factors collectively drive the demand for aftermarket glass products, creating a thriving market in the European automotive sector.

Automotive aftermarket glass pertains to the replacement or repair of vehicle glass, including windshield, side windows, and rear windows, when the original manufacturer's glass is damaged. This sector is essential in the automotive industry, providing cost-effective solutions for addressing glass-related issues without replacing the entire vehicle. Aftermarket glass products are often manufactured to meet industry standards and safety regulations, offering compatibility with various makes and models of vehicles. According to the National Highway Traffic Safety Administration (NHTSA), approximately 1.5 million windshields are replaced each year in the U.S. due to damage. Consumers may opt for aftermarket glass due to factors such as affordability, accessibility, or specific customization options. Research by the Automotive Glass Replacement Safety Standard (AGRSS) indicates that properly installed aftermarket glass performs comparably to original equipment manufacturer (OEM) glass in terms of safety and structural integrity. The aftermarket glass market is a dynamic segment within the automotive industry, encompassing a range of products and services that contribute to vehicle safety, aesthetics, and functionality beyond the initial manufacturing stage.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.8% |

| Market Size in 2023 | USD 2.94 Billion |

| Market Size in 2024 | USD 3.11 Billion |

| Market Size by 2034 | USD 5.47 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Vehicle Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Urbanization trends

The escalating global trend of increasing vehicle ownership significantly propels the demand for the automotive aftermarket glass market. As more individuals acquire vehicles, the probability of accidents or incidents leading to glass damage rises, necessitating replacements or repairs. With a growing fleet of vehicles on the road, there is a continuous and expanding market for aftermarket glass products. Moreover, higher vehicle ownership creates a sustained need for replacement glass over a vehicle's lifespan. As cars age, wear and tear on glass components become more pronounced, driving the aftermarket demand. This surge in demand is not only influenced by the sheer volume of vehicles but also by the inherent need for maintenance and replacement services, making the automotive aftermarket glass market an integral and thriving sector within the broader automotive industry.

| Year | Global Vehicle Production (Millions) | Electric Vehicle Production (Millions) | Major Producing Countries | Source |

| 2020 | 77.62 | 3.24 | China, USA, Japan | International Organization of Motor Vehicle Manufacturers (OICA) |

| 2021 | 86.65 | 6.75 | China, USA, Germany | International Organization of Motor Vehicle Manufacturers (OICA) |

| 2022 | 82.89 | 10.5 | China, Japan, South Korea | International Organization of Motor Vehicle Manufacturers (OICA) |

| 2023 | 85.00 (Projected) | 13.0 (Projected) | China, USA, Germany | International Energy Agency (IEA) |

Complex installation process

The complexity of the installation process serves as a significant restraint in the automotive aftermarket glass market, impacting consumer adoption. Many vehicle owners may lack the expertise or tools required for the intricate installation of aftermarket glass components. The technical nature of the process makes self-installation a challenging and often impractical option, leading consumers to opt for professional services. However, the reliance on professional installation increases overall costs, deterring price-sensitive consumers from choosing aftermarket glass solutions.

Moreover, the complexity of the installation process introduces an element of uncertainty and risk for consumers. Concerns about improper installation leading to leaks, poor fit, or compromised safety features may dissuade individuals from pursuing aftermarket glass options. This restraint not only affects individual consumers but also influences the decision-making processes of fleet managers and businesses, further limiting the broader market demand for aftermarket glass solutions.

Collaboration with insurance companies

Collaboration with insurance companies is a strategic avenue creating significant opportunities in the automotive aftermarket glass market. Simplifying and expediting insurance claim processes for glass replacements enhances consumer confidence and encourages the adoption of aftermarket glass solutions. Many insurance policies cover glass damage, and seamless collaboration with insurers ensures a smoother and more cost-effective experience for vehicle owners, driving the market growth. According to a report from the Insurance Information Institute (III), 75% of comprehensive car insurance policies in the U.S. cover windshield replacement, further bolstering the demand for aftermarket glass solutions.

Moreover, forging partnerships with insurance providers can lead to increased market penetration. By aligning aftermarket glass services with insurance claim procedures, manufacturers and service providers can tap into a broader customer base. A survey by the National Association of Insurance Commissioners (NAIC) found that 65% of vehicle owners prefer working with service providers recommended by their insurance companies, suggesting that partnerships between insurers and aftermarket glass providers could significantly increase customer trust and retention. This collaborative approach not only benefits consumers by facilitating efficient claims but also positions aftermarket glass solutions as reliable and endorsed choices within the automotive repair ecosystem, fostering trust and further market expansion.

Product Insights

The laminated glass segment is anticipated to expand at a significant CAGR of 6.2% during the projected period. Laminated glass is a critical segment in the automotive aftermarket glass market, characterized by the construction of two or more glass layers bonded together with a layer of polyvinyl butyral (PVB) or similar interlayer material. This design enhances safety by preventing shattered glass upon impact, making it a preferred choice for windshields. According to the National Highway Traffic Safety Administration (NHTSA), laminated glass, especially in windshields, reduces the risk of ejection during rollover crashes by 70%, underscoring its safety advantages. A growing trend in the laminated glass segment is the incorporation of advanced technologies, such as acoustic interlayers for noise reduction and solar control interlayers for improved comfort, reflecting the evolving preferences for enhanced safety and driving experience. The demand for acoustic laminated glass is projected to increase by 8% over the next five years, driven by consumers seeking a quieter, more comfortable driving environment, according to a report from the International Transport Forum.

According to the vehicle type, the passenger cars segment held 66% market share in 2023. In the automotive aftermarket glass market, the passenger cars segment refers to personal-use vehicles like sedans, SUVs, and hatchbacks. A report by the International Organization of Motor Vehicle Manufacturers (OICA) states that over 57 million passenger cars were produced globally in 2023, reflecting a substantial base for aftermarket services like glass replacement. A growing trend within this category involves a heightened desire for advanced features in aftermarket glass, such as smart glass and augmented reality. As consumers prioritize safety and modern conveniences, aftermarket glass manufacturers are innovating to meet these demands with cutting-edge products crafted specifically for the preferences and needs of individuals who own and drive passenger cars.

The light commercial vehicles (LCV) segment is anticipated to witness rapid growth over the projected period. The light commercial vehicles (LCV) segment in the automotive aftermarket glass market includes a range of smaller trucks, vans, and utility vehicles. The rise of e-commerce has significantly impacted LCV demand, with the World Economic Forum estimating that e-commerce deliveries will increase by 78% globally by 2030, leading to increased usage and wear of these vehicles. In this segment, the aftermarket glass demand is influenced by trends such as the increasing use of LCVs for e-commerce deliveries and last-mile logistics. As e-commerce continues to grow, the need for efficient LCV fleets rises, subsequently driving demand for aftermarket glass solutions due to the higher likelihood of wear and damage associated with frequent short-distance stops and deliveries.

According to the application, the sidelite segment held 33% market share in 2023. In the automotive aftermarket glass market, the sideline segment refers to the replacement or repair of side windows in vehicles. These windows contribute to both aesthetics and safety, and the aftermarket sideline segment addresses the demand for personalized and functional solutions. According to the U.S. Department of Transportation, side-impact collisions account for 25% of all vehicle accidents, making sidelite glass replacement a crucial part of vehicle safety maintenance. A growing trend in this segment involves the adoption of advanced technologies, such as integrated sensors or privacy-enhancing tints. Additionally, the emphasis on lightweight materials and improved design for enhanced vehicle efficiency contributes to the evolving landscape of aftermarket sidelite applications.

The backlite segment is anticipated to expand fastest over the projected period. In the automotive aftermarket glass market, the backlite segment refers to the rear windshield or back window of a vehicle. This component is crucial for visibility, aerodynamics, and overall structural integrity. A report by the European Automobile Manufacturers Association (ACEA) highlighted that rear-end collisions are one of the most common types of accidents, driving up the demand for backlite replacements. A key trend in the backlite segment involves advancements in materials and technologies, such as the use of lightweight and impact-resistant materials. According to a study by the National Highway Traffic Safety Administration (NHTSA), the implementation of advanced materials in backlites has improved vehicle fuel efficiency by 1.5% due to reduced weight. Additionally, there is a growing demand for backlite customization, including tinting and privacy features, reflecting consumer preferences for both functional and aesthetic enhancements in aftermarket glass solutions.

Segments Covered in the Report

By Product

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025