May 2025

Automotive Aftermarket (By Replacement Part: Battery, Tire, Filters, Brake Parts, Turbochargers, Body Parts, Wheels, and Others; By Service Channel: DIFM (Do it for Me), DIY (Do it Yourself), and OE (Delegating to OEM’s); By Distribution Channel: Wholesalers & Distributors and Retailers (OEMs and Repair Shops); By Certification: Certified Parts, Genuine Parts, and Uncertified Parts) - Global Market Size, Trends Analysis, Segment Forecasts, Regional Outlook 2024 - 2033

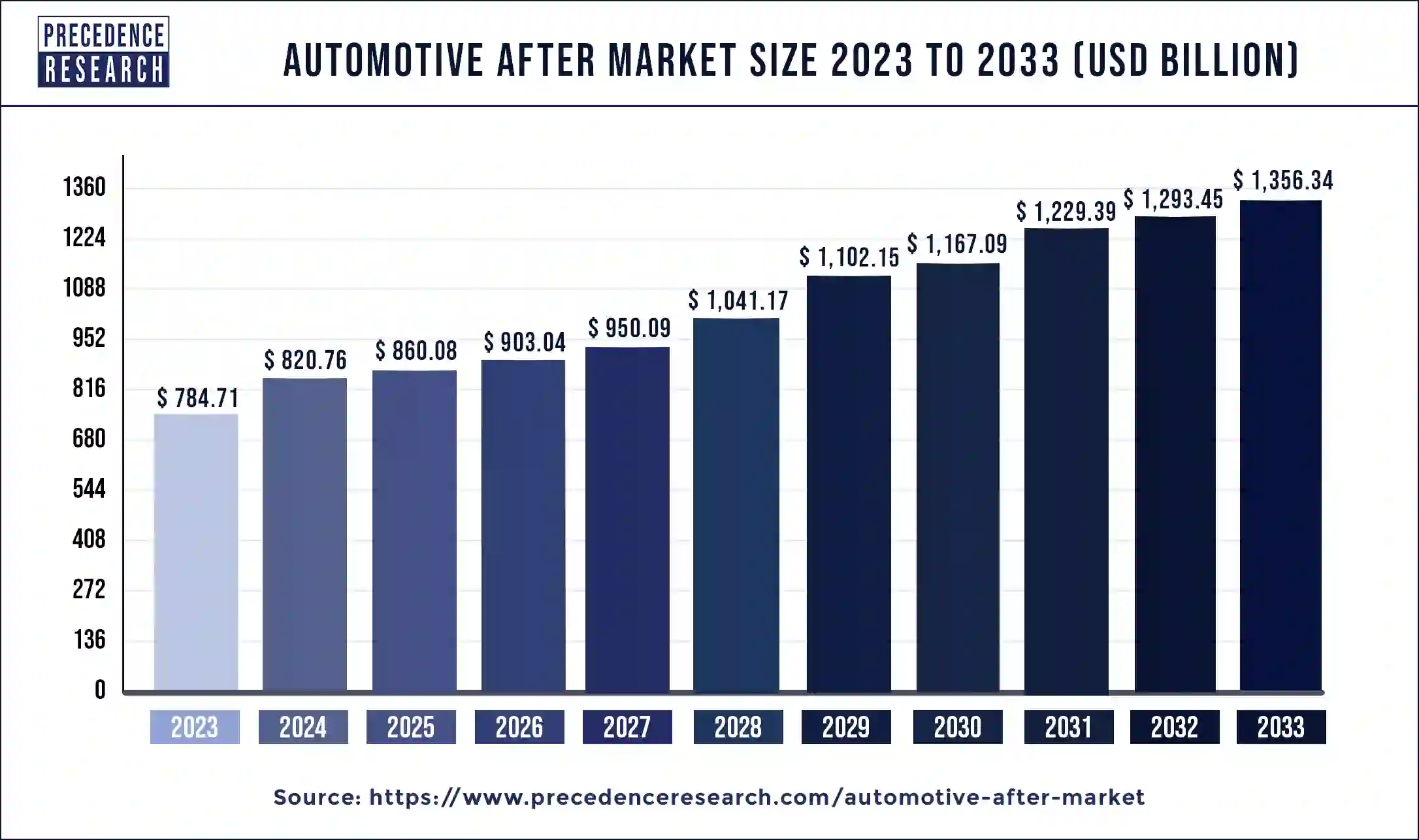

The global automotive aftermarket size was estimated at USD 784.71 billion in 2023 and is predicted to surpass around USD 1,356.34 billion by 2033, poised to grow at a noteworthy CAGR of 5.74% during the forecast period from 2024 to 2033.

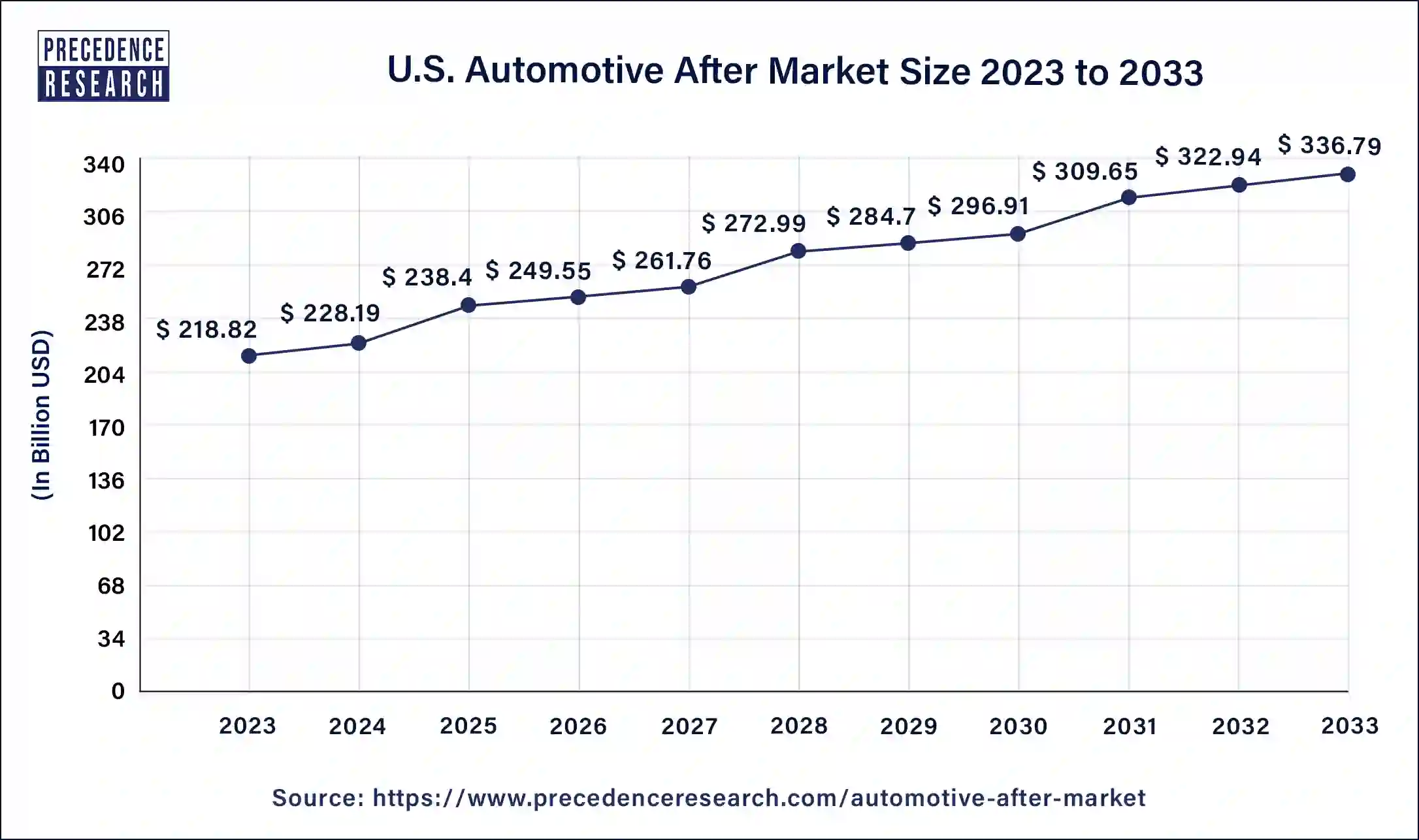

The U.S. automotive aftermarket size was estimated at USD 218.82 billion in 2023 and is predicted to be worth around USD 336.79 billion by 2033, at a CAGR of 4.42% from 2024 to 2033.

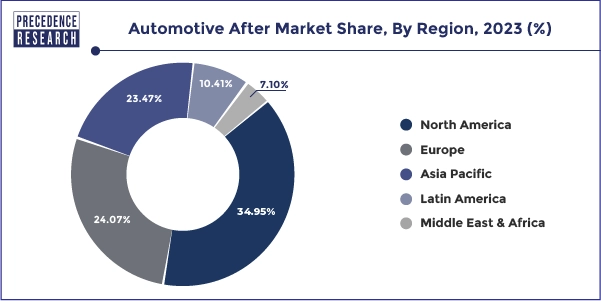

Based on region, North America led the automotive aftermarket in terms of revenue at 34.95% in 2023 and analyzed to witness prominent growth over the forecast period. Surge in demand for passenger cars, use of advanced technology while fabrication of auto parts, and digitalization of component delivery services projected to spur the market growth in the region. Strict emission rules in the region have forced component manufacturers to make necessary upgradation in automotive components to meet the government rules and norms. Rising environment degradation from automotive emission has significantly spurred the need for high efficiency and environment-friendly automotive components for global as well as native markets. The trend of sales of pre-owned vehicles is rising and creating a huge demand for automotive aftermarket in the forecasting period. Also, the vehicles or components of vehicle demand replacement after certain years of usage which serves as the key factors in expanding the market in U.S. Furthermore, increasing consumer expenditure and the presence of well-established industry is also fueling the growth of the overall regional market to a large extent. However, the demand shrank during coronavirus pandemic, but it is estimated to rebound in the coming years.

On the contrary, Europe is a prominent revenue contributor in the global automotive aftermarket owing to a regional home for several automotive OEM manufacturers. In addition, high purchasing power coupled with green revolution to transform the transportation into environment-friendly is some of the major factors that spur the market growth. The Europe region has accounted market share of 24.07% over the period 2024 to 233. Germany is one of the most prominent manufacturers of automotive vehicles and has high demand and sales for automobiles which further leads to increase in demand for replacement of several automotive parts thereby expected to drive the market growth in the next few years. Furthermore, innovative business models and online tailored services is expected to boost the market during the forecast period. Combined with the linkages between GDP growth rates, this German sector is anticipated to persist being a home to some of the most technologically enhanced aftermarket companies of the world, which will aid the country to maintain a strong position in the future.

Japan is one of the most technologically advanced country. Thus, Japan is using its advanced technology in automotive aftermarket to produce innovative body parts and other products of cars more efficiently. As Japanese automotive aftermarket is becoming more environmentally aware thus consumers are making more demand. Thus, technological advancements and huge investment in research and development has resulted in development of automotive aftermarket in the region.

Brazil is well urbanized and the population is conscious about the trending automotive accessories which create a huge demand for aftermarket of various vehicles. Also, the up growing digital market has provoked the market to expand as the consumers can visit the various websites and by comparing make the best choice are some of the prominent drivers determining the market growth.

In the region, the demand for vehicle modification is steadily increasing. Moreover, the government policies aimed at reducing greenhouse emissions have resulted in a higher demand for automotive vehicle repairs. With the growing regulatory regulations and the provision of high-quality automotive parts would provide a favorable growth environment. Therefore, countries like Colombia, Ecuador and Chile propelling the growth of automotive aftermarket in Rest of Latin America.

GCC - In this region, customers are interested in customizing and improving the appearance of their vehicles in order to enhance their performance. Many vehicle modifications have been demanded in recent years, especially among the region's young people. Also, the per capita income in Saudi Arabia is high which allows the people to indulge in the frequent purchasing of premium products and indulge in luxurious automotive accessories. Hence, this pattern is expected to continue in the coming years lead to increasing demand for automotive parts in the region.

The Asia Pacific automotive aftermarket size was calculated at USD 184.14 billion in 2023 and is projected to expand around USD 342.3 billion by 2033, poised to grow at a CAGR of 6.41% from 2024 to 2033.

| Year | Market Size (USD Billion) |

| 2023 | 184.14 |

| 2024 | 195.67 |

| 2025 | 208.32 |

| 2026 | 222.21 |

| 2027 | 237.52 |

| 2028 | 252.44 |

| 2029 | 268.29 |

| 2030 | 285.14 |

| 2031 | 303.04 |

| 2032 | 322.08 |

| 2033 | 342.3 |

Regulatory bodies including the U.S. Environmental Protection Agency and the JASMA monitor the environmental impact and built standards related to automotive components such as noise emission level from mufflers and resonators in automotive exhaust systems expected to trigger advancement in the automotive parts. In addition, digitization of sales and service of component delivery and online distribution portals for aftermarket components in synchronization with global automotive suppliers, expected to bring prominent investment from the market players. Because of online and digitized delivery gateways, the automotive aftermarket expected to witness significant growth in the developing countries. In addition, rising trend for online sale of automotive aftermarket parts projected to further boost the market growth in the coming years.

Though, the automotive aftermarket is highly influenced by the digitized gateway pattern, high cost of research & development expected to hamper the market growth. Additionally, the consumer shift towards smart and intelligent automobile parts also uplift the overall cost of the components.

| Report Highlights | Details |

| Market Size in 2023 | USD 784.71 Billion |

| Market Size by 2033 | USD 1,356.34 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.74% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Largest Market | North America |

| Segments Covered | By Replacement Part, By Service Channel, By Distribution Channel, and By Certification |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Market Drivers

Rise in technological advancement

Government regulations aid in market growth

Increasing demand for comfort in vehicles

Increase in disposable income

Globalization of Original Equipment Manufacturers (OEM)

Market Restraints

Ratification of vehicles safety techologies

High Operational Cost

Legal Constraints

Market Opportunities

Increasing in older vehicles and their age -

E-commerce changed the automotive aftermarket

Widespread of Aftermarket and unorganized industry

Growing complexity of parts

Market Challenges

The impact of Covid - 19 pandemic

Decreased retails and workshop business

Smooth transition to the electric vehicles industry

Inadequate management of large vehicle data bases and catalogs

The tire segment held the largest share in automotive aftermarket in 2023. There are many different kinds of tires, including performance, off-road, summer, winter, and all-season tires. Specialty tires like low-profile or run-flat tires are also available. Every variety is engineered to provide distinct performance attributes appropriate for varying road conditions and car kinds. Wide-ranging tire sizes are available to fit a variety of vehicles, including big trucks and tiny sedans. Customers usually emphasize that they get the appropriate size and type of tire for their vehicle because proper fitment is crucial for both safety and performance. Tires for the aftermarket are produced by a wide range of companies, from tiny, specialty producers to well-known international brands. A variety of tire models with varying features, performance levels, and pricing points may be available from each brand.

Many contemporary tires have cutting-edge innovations that improve comfort, safety, and performance. Advanced tread designs for increased traction, creative rubber compounds for increased longevity and fuel economy, and technologies like run-flat or self-sealing capabilities are a few examples of these qualities. Tire costs can differ significantly based on a number of variables, including type, size, performance features, and brand. Customers have access to a variety of options, from high-end, high-performance tires to more affordable options. In the automotive aftermarket, tires are distributed via a number of channels, such as independent tire dealers, tire chains, internet merchants, and auto parts stores. Pricing, skill, and service levels may vary depending on the channel.

Global Automotive Aftermarket, By Product, 2020-2023 (USD Billion)

| By Product | 2020 | 2021 | 2022 | 2023 |

| Battery | 57.52 | 60.49 | 63.72 | 67.24 |

| Tire | 139.19 | 145.96 | 153.33 | 161.37 |

| Filters | 35.60 | 37.16 | 38.86 | 40.70 |

| Brake Parts | 53.79 | 55.67 | 57.72 | 59.95 |

| Turbochargers | 39.84 | 41.53 | 43.37 | 45.36 |

| Lighting & Electric Component | 89.29 | 93.57 | 98.21 | 103.26 |

| Exhaust Component | 95.53 | 99.46 | 103.74 | 108.39 |

| Body Parts | 27.21 | 28.21 | 29.30 | 30.48 |

| Wheel | 34.06 | 35.51 | 37.08 | 38.80 |

| Others | 121.06 | 123.58 | 126.28 | 129.16 |

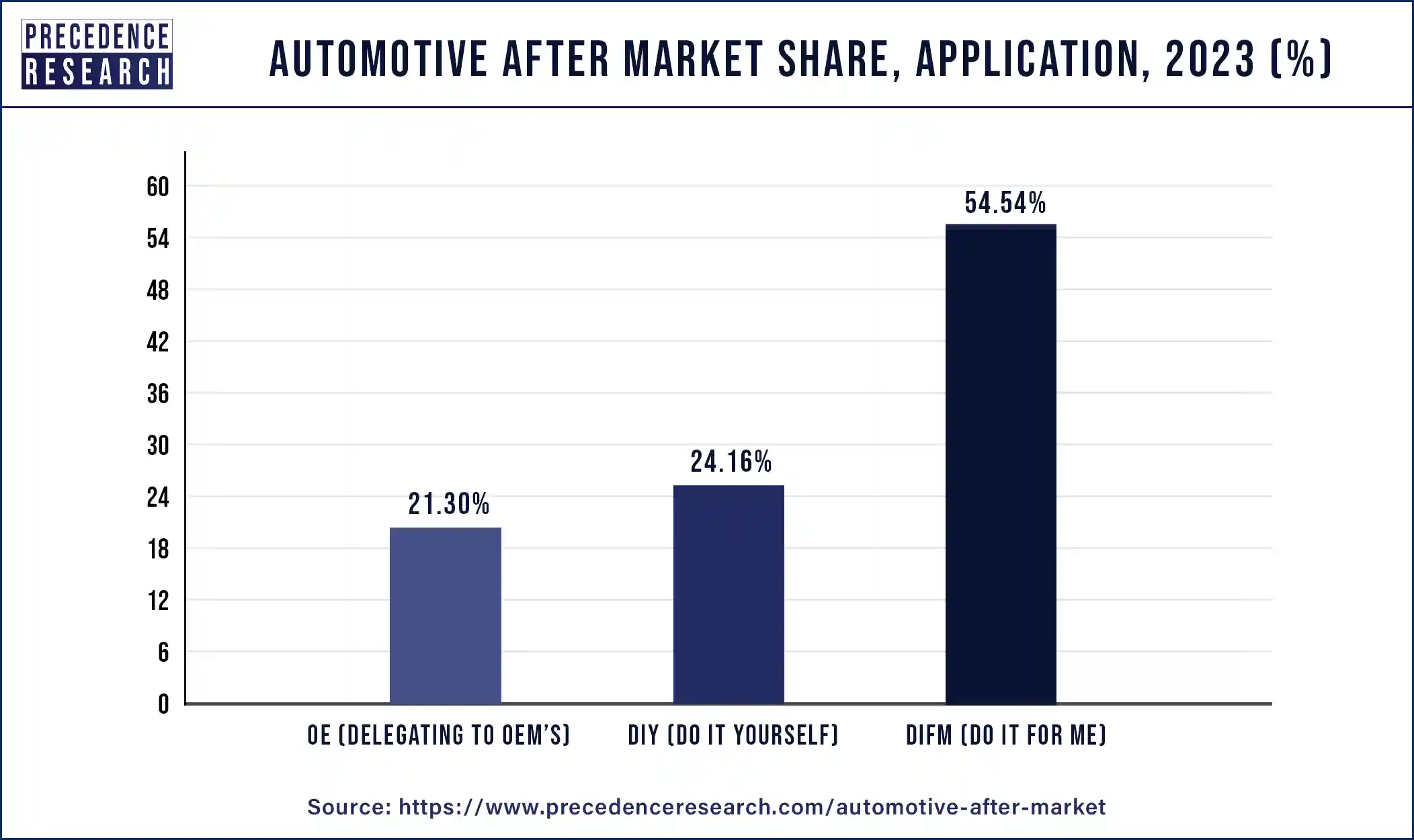

The DIFM (Do it for Me) segment held the largest share in automotive aftermarket. In the automobile aftermarket, a group of customers known as "Do It For Me" (DIFM) prefers to hire specialists to handle chores related to car maintenance, repair, and modification instead of doing them themselves (DIY). Customers in the DIFM market usually look for auto repair shops, service centers, or specialized shops to handle maintenance on their cars, including tire rotations, brake replacements, oil changes, and other mechanical and cosmetic procedures. These customers are prepared to pay for the convenience and knowledge offered by qualified automobile technicians even though they might not have the time, resources, knowledge, or desire to complete these jobs themselves.

Serving the DIFM market requires companies in the automotive aftermarket to provide top-notch products and services, clear pricing, first-rate customer support, and a convenient experience. Services like online appointment booking, car pickup and drop-off, shuttle services, parts and labor warranties, and open communication during the repair or maintenance procedure are a few examples of what this might encompass. Aftermarket companies comprehend and cater to the DIFM segment well because it accounts for a sizeable chunk of the industry and offers chances for expansion and profit. In order to provide value-added services and keep a competitive advantage, it is necessary to be abreast of industry trends, technology developments, and consumer preferences in order to meet the demands and expectations of DIFM clients.

The retailers segment held the largest share in automotive aftermarket. Businesses that sell automotive parts, accessories, and services directly to customers make up the retailing component of the automotive aftermarket. These are conventional physical stores with a focus on selling motor accessories and parts. AutoZone, Advance Auto Parts, and O'Reilly Auto Parts are a few examples. Many retailers now operate largely or solely online due to the growth of e-commerce. Online retailers such as Amazon, eBay Motors, and RockAuto provide a large selection of car accessories and parts. These merchants concentrate on particular categories of automotive goods or services. Specialty stores, for instance, offer accessories, restoration parts, and performance parts for particular car models.

A number of major retail chains, including Costco and Walmart, also sell a variety of automotive goods online and in their physical locations. These are stores, like NAPA Auto Parts locations, that run under a franchise arrangement with a bigger parent corporation. Additionally, there are individual car parts retailers serving regional markets. Automotive aftermarket retailers generally carry a large selection of goods, such as tools, maintenance supplies (such engine oil and fluids), performance enhancements, floor mats and car audio systems, and replacement components (including brake pads, filters, and belts). Additionally, they might offer services like installation, maintenance, and repair—either internally or by forming alliances with nearby service facilities or mechanics.

The genuine parts segment held the largest share in automotive aftermarket. Parts made by a vehicle's original equipment manufacturer (OEM) or its approved suppliers are referred to as authentic parts in the automotive aftermarket. The car manufacturer's specifications and quality standards are met by the design of these parts. Since genuine components are manufactured to the same specifications as the original parts fitted during construction, they are frequently thought to be of the finest quality and most compatible with the vehicle. For their cars, consumers frequently go with genuine parts since they provide excellent performance, dependability, and warranty coverage. Using authentic parts can also assist keep the car's resale value high and guarantee that it keeps up with safety and legal requirements.

Segments Covered in the Report

By Product

By Application

By Distribution Channel

By Certification

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

April 2025

January 2025