January 2025

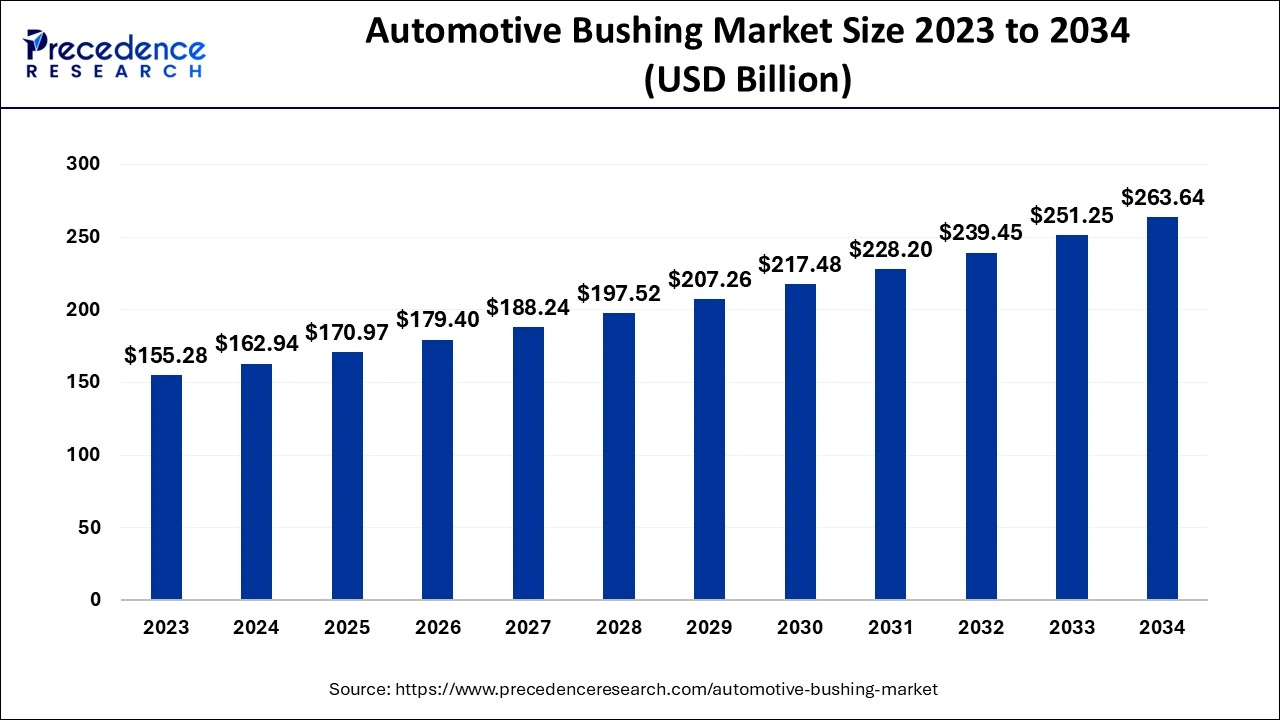

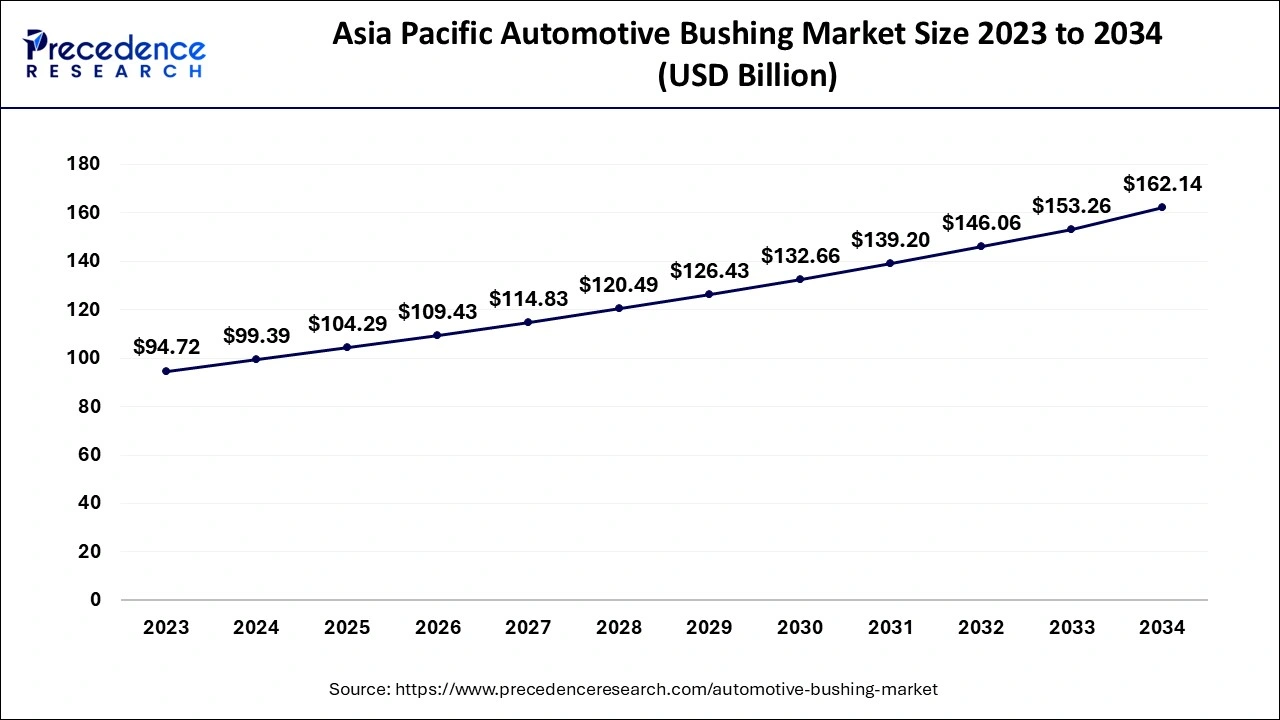

The global automotive bushing market size accounted for USD 162.94 billion in 2024, grew to USD 170.97 billion in 2025 and is projected to surpass around USD 263.64 billion by 2034, representing a CAGR of 4.93% between 2024 and 2034. The Asia Pacific automotive bushing market size is calculated at USD 99.39 billion in 2024 and is expected to grow at a CAGR of 5.01% during the forecast year.

The global automotive bushing market size is calculated at USD 162.94 billion in 2024 and is predicted to reach around USD 263.64 billion by 2034, expanding at a CAGR of 4.93% from 2024 to 2034. The automotive bushing market has grown because bushings can be easily replaced after damage, are affordable, and offer economic value.

The Asia Pacific automotive bushing market size is exhibited at USD 99.39 billion in 2024 and is expected to be worth around USD 162.14 billion by 2034, growing at a CAGR of 5.01% from 2024 to 2034.

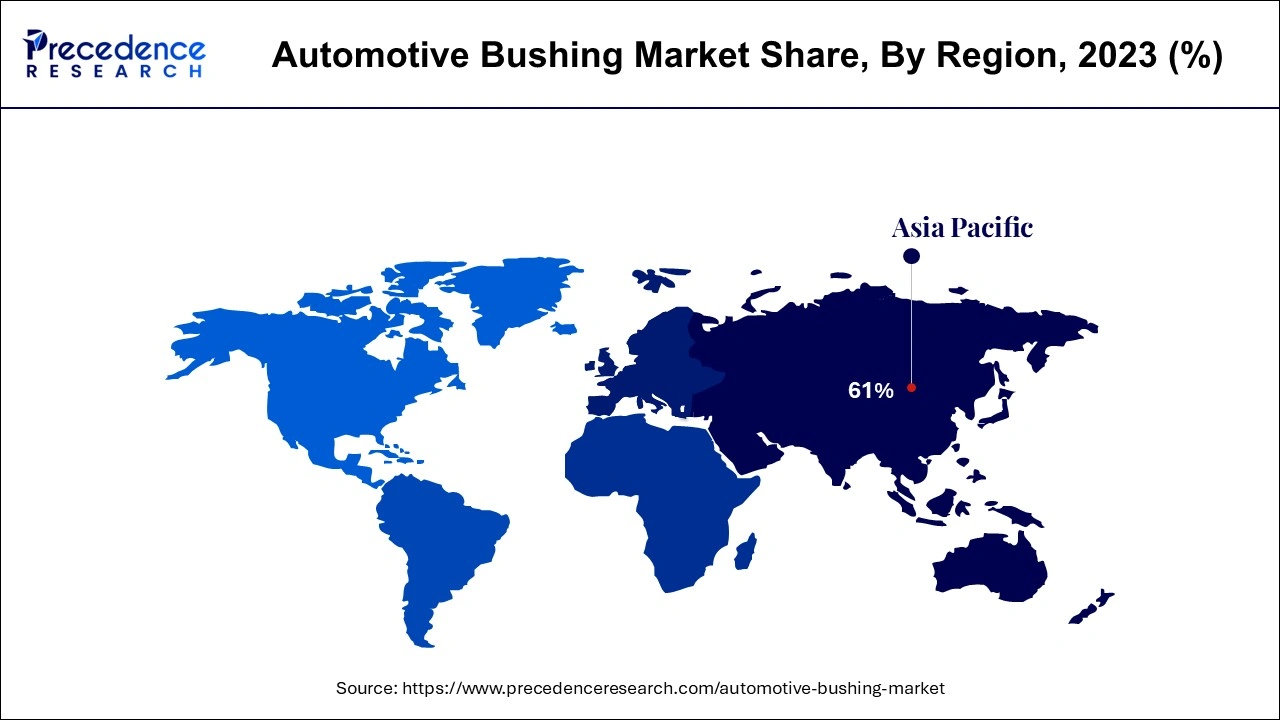

Asia Pacific dominated the automotive bushing market. Asia Pacific, particularly countries like China, Japan, South Korea, and India, is home to some of the largest automotive manufacturing plants in the world. China alone is the largest automotive market, both in terms of vehicle production and sales, accounting for approximately 30% of global vehicle production. India and South Korea are also major contributors, with rapidly expanding automotive industries. The region is also witnessing innovations in automotive technologies, including advanced suspension systems, hybrid vehicles, and electric vehicles (EVs). The growing adoption of EVs, which require more specialized bushings due to the weight distribution and performance characteristics of electric motors and batteries, is further fueling the demand for high-performance bushing solutions in Asia Pacific.

North America is observed to grow at the fastest pace during the forecast period, owing to the factors such as the rise of electric vehicles, changing consumer preferences towards sustainable products, rapid adoption of technology, government policy support, and increasing demand for consumerism in terms of safety and comfort features. Provide high-quality polyurethane bushings and bushing kits for brands such as Subaru, Mazda, Nissan, and many others in North America.

Europe is expected to grow at a notable rate in the automotive bushing market over the forecast period as the competition level increases with organizations becoming the standard and the manufacturing base for most automobile companies is shifting from established international regions. The European Automotive Cluster has developed expertise in vehicles with internal combustion engines (ICE). SuperPro has the widest range of suspension modification parts in Europe, such as poly bushes, suspension bushes, sway bar bushes, sway bars, sway bar links, radius rods, control arms, hard rods, shock absorbers, Shock bushes, greaseable clamps and pin accessories, and more.

The automotive bushing market is proliferating because they are ideal for absorbing vibration and reducing noise, but they tend to wear out more quickly than other bushings. Automotive bushings are small, flexible, cylindrical components designed to provide a cushioning effect on the various metals in a vehicle’s suspension system. Typically made of rubber, polyurethane, or a combination of both, these products help absorb vibrations and reduce noise as the vehicle is in motion. Automotive bushings are available in many different types and sizes depending on the specific application and are often used in areas where metals come into contact with each other, such as suspension systems. Automotive bushings are used to reduce direct metal-to-metal contact in areas such as engines, gearboxes, and suspension systems, thereby reducing noise and vibration.

The automotive bushing market is used in many places throughout the automotive system to provide cushioning and support, reduce noise and vibration, and help maintain proper alignment. The best type of bush for a particular application depends on many factors, including the type of vehicle, driving conditions, and the needs of the vehicle. Some bushes are oil-filled, while others can be molded to be softer or harder in one direction. Bushings are widely used in the automotive industry and play an important role in many areas. They are used in suspension systems, control arms, engine mounts, and other important components. Rubber bushings help reduce noise, increase comfort, and ensure smooth vehicle operation.

Impact of AI on the Automotive Bushing Market

In recent years, the automotive industry has grown rapidly due to the technology evolution. The adoption of artificial intelligence (AI) in the automotive bushing market is one of the biggest advancements. AI offers new ways to improve driving, efficiency, and safety. Real-time sensor data is processed by intelligent algorithms to provide a better understanding of the world around the automotive vehicle. They can see and understand traffic signs, see pedestrians, and predict the behavior of other vehicles.

| Report Coverage | Details |

| Market Size by 2034 | USD 263.64 Billion |

| Market Size in 2024 | USD 162.94 Billion |

| Market Size in 2025 | USD 170.97 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.93% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Rising applications across automotive industries

The increasing demand for the automotive bushing market services from various industries, such as automobiles, recreational vehicles (RVs), trucks, and railways, has accelerated the expansion of the automotive bushings market. In the automobile industry, rubber bushings are an important part of the suspension, engine mount, control arm, and subframe mounts, which can isolate the automotive car from road vibrations, reduce noise, and improve performance. Their ability to allow controlled movement is crucial for smooth steering and handling, improving the overall driving experience.

In addition, the development of sports cars and trucks is increasingly relying on the performance of rubber bushings to provide cushioning, support, and stability, which is important for improving the comfort of long journeys. Rubber bushings, which play a significant role in equipment such as rail pads and rail fasteners in the railway sector, provide flexibility and support between rails and sleepers. This not only reduces vibration and absorbs the impact of passing trains but also extends the life of the rail. These wide applications and the increasing focus on automotive performance infrastructure and durability.

Cost, maintenance, and performance limitations

Several factors are limiting the growth of the automotive bushing market, including misalignment, limited radial load capacity, lubrication requirements, and cost considerations. Depending on the type, shape, and size of the case, the price can range from a few dollars to hundreds of dollars. This price variation can be prohibitive, especially for equipment owners who need to replace multiple bushings or those who need specialized equipment. Additionally, some bushings require lubrication to reduce friction and prevent wear, increasing maintenance and operating costs.

Advanced modeling and customization capabilities

The development of the best model for automotive bushings, such as Daimler’s standard model, has a significant opportunity for the advanced development of the automotive bushing market. The models can be easily modified to meet the requirements of specific problems in various simulation tasks, providing companies with powerful tools to optimize the design and performance of bushing systems. Focusing on an easy-to-use parametric system and providing detailed characterization of key components such as stiffness, delay, and damping.

Daimler’s approach ensures the best in bushing design and integration into the established workflows. The ability to quickly adjust and fine-tune bushing parameters for a specific car should not only drive innovation in automotive suspension but also support the increasing demand for customized high-resolution problems. This presents a major opportunity to expand the automotive bushing market, as manufacturers can better switch between traditional and electric vehicles, where improved ride comfort, performance, durability, and function are important variables.

The passenger segment dominated the automotive bushing market in 2023 as they have many advantages, including improved safety and comfort while driving, reduced noise and damage due to reduced vibration. Bushings support the system and provide comfort for the passengers in the vehicle. They are crucial in positioning and aligning various suspension and steering components.

The light commercial vehicle segment is expected to grow rapidly in the automotive bushing market during the forecast period due to better rides, better road holding, and longer suspension life. It exhibits excellent mechanical properties, providing high strength and load-carrying capacity. This makes the bushing suitable for lightweight applications and is capable of carrying large radial and axial loads.

The suspension bushings segment held the largest share of the automotive bushing market in 2023. The market is segmented into suspension, engine, chassis, interior, exhaust, and transmission. As suspension bushings are an important part of any vehicle suspension, among them suspension holds the largest market share. Their main functions are to reduce vibrations, reduce noise, and provide correct geometry. They ensure that corrosion does not occur due to the metal connection between the suspension framework.

The automotive transmission bushing segment is anticipated to grow significantly in the automotive bushing market during the forecast period of 2024 to 2034 as transmission bushings act as buffers by absorbing the impact of the gear engagement. By doing this, they can reduce weight during the transition. Transmission bushings play an important role in reducing friction in the transmission system. Friction is inevitable when metal objects come into direct contact. Transmission bushings excel at absorbing these vibrations, acting as shock absorbers for the transmission system.

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025