November 2024

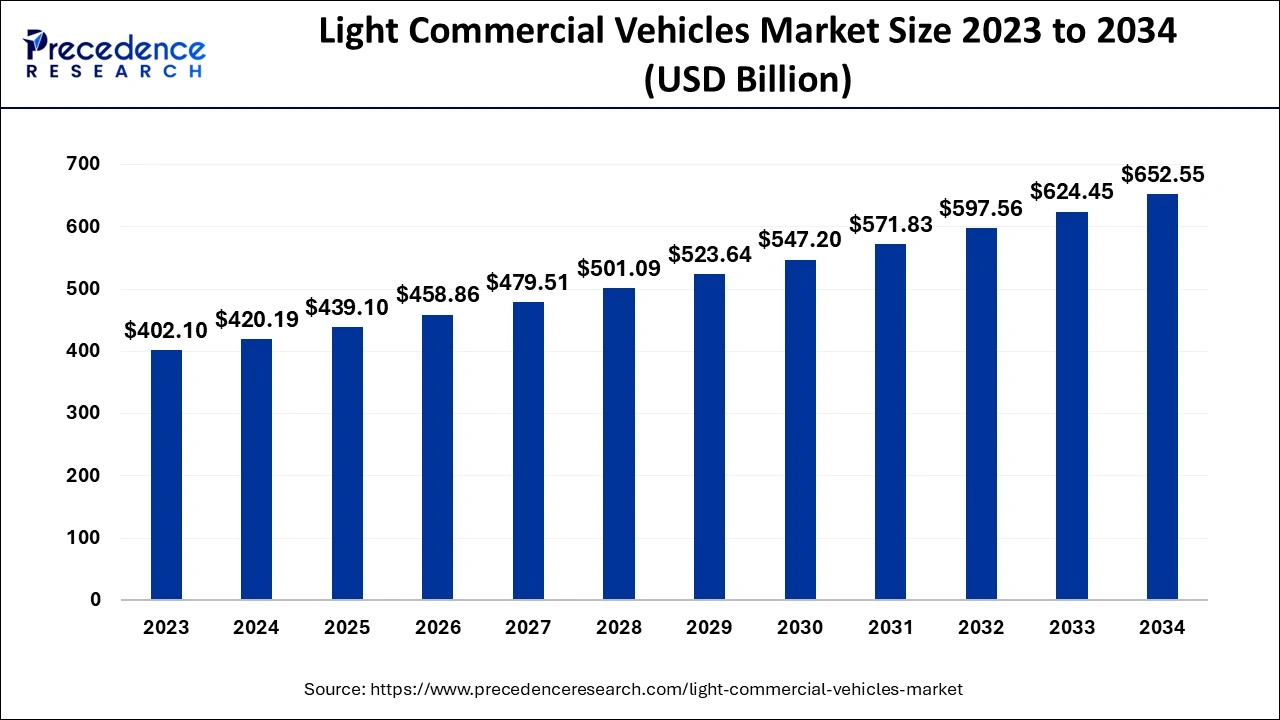

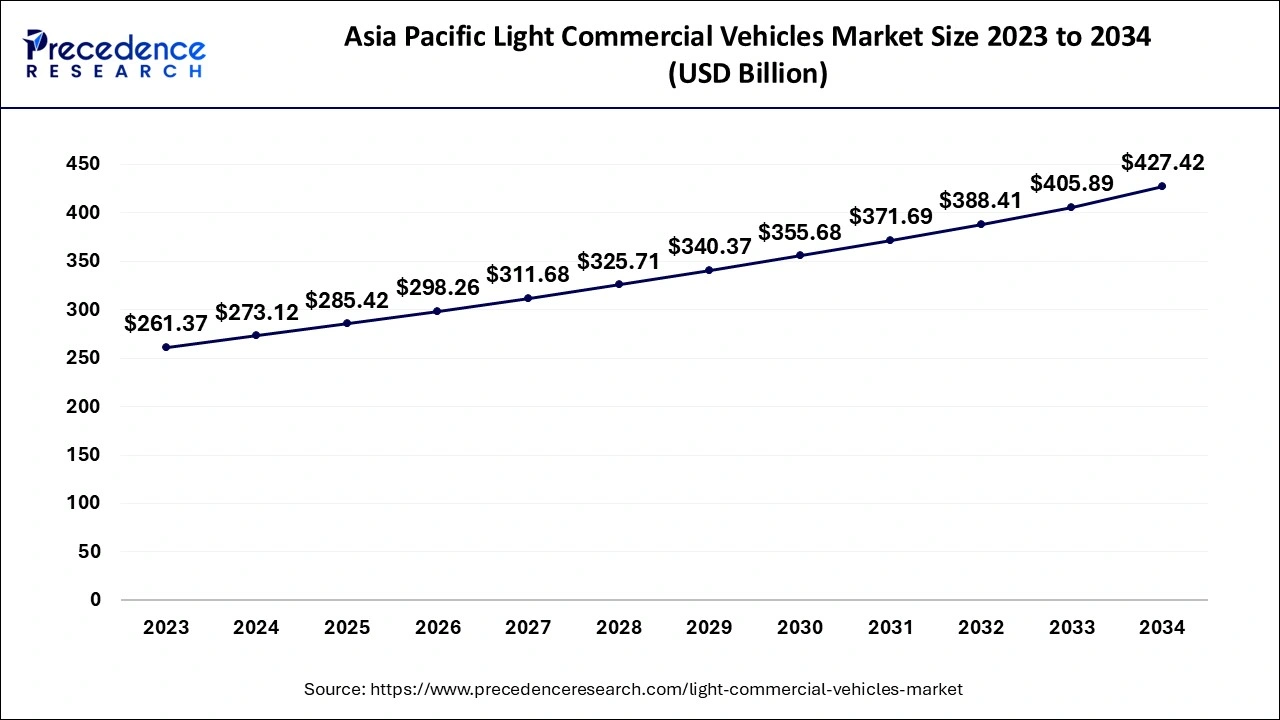

The global light commercial vehicles market size is calculated at USD 439.10 billion in 2025 and is projected to reach around USD 652.55 billion by 2034, the market is expanding at a CAGR of 4.50% between 2025 and 2034. The Asia Pacific light commercial vehicles market size is evaluated at USD 273.12 billion in 2024 and is expected to grow at a CAGR of 4.57% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global light commercial vehicles market size accounted for USD 420.19 billion in 2024, and is projected to reach around USD 439.10 billion by 2025, and is anticipated to hit around USD 652.55 billion by 2034, growing at a CAGR of 4.50% from 2025 to 2034. The light commercial vehicles market growth is attributed to the increasing demand for efficient logistics solutions driven by the rise of e-commerce, urbanization, and advancements in vehicle technology.

In the light commercial vehicles market, artificial intelligence (AI) advances intelligent technologies, such as autonomous driving, predictive maintenance, or fleet management. Self-driving car technologies amplify the existing advanced technology driving aids, including auto-steering, distance control, and collision avoidance, to increase road safety. Utilizing big data and machine learning, predictive maintenance applications foresee when maintenance is required for a vehicle, thus avoiding large chaotic downtimes. Moreover, the AI facilitates the development of immediate real-time constraints on routes and fuel by analyzing traffic and weather patterns and fuel consumption, reducing operation expenses.

The Asia Pacific light commercial vehicles market size is exhibited at USD 285.42 billion in 2025 and is predicted to be worth around USD 427.42 billion by 2034, growing at a CAGR of 4.57% from 2025 to 2034.

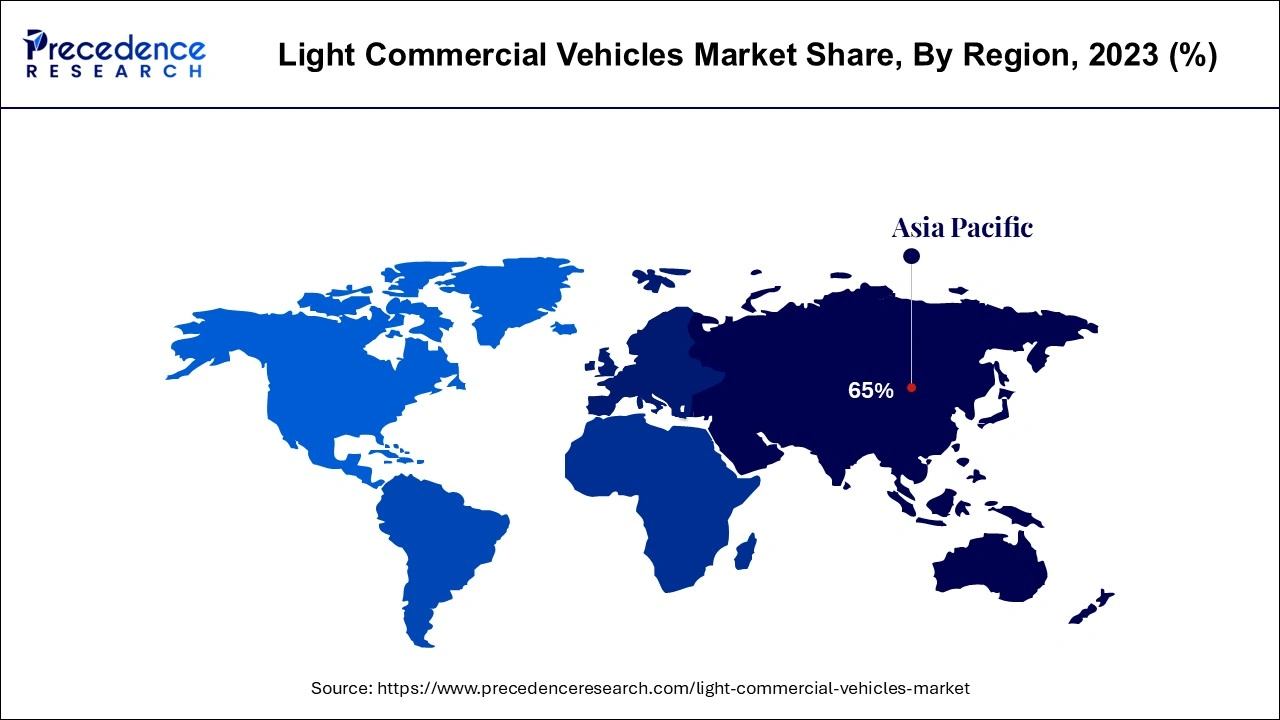

Asia Pacific dominated the light commercial vehicles market in 2024 due to allied factors, such as the fast pace of globalization and the increase in business opportunities in Asian countries, including China and India. The Asia Pacific market is expected to maintain its market leadership as the result of growing infrastructural investments and growing consumer demand for goods and services. This increases the prospects of light commercial vehicles meant for delivery and transportation. Moreover, the rising middle-income population base and the continuing expansion of e-commerce channels are expected to create a high demand for light commercial vehicles suitable for both cities and townships.

North America is projected to host the fastest-growing light commercial vehicles market in the coming years, owing to the revival in the construction and transportation industry. The Bipartisan Infrastructure Law will enhance America's infrastructure by likely providing light commercial vehicles that are used in construction and logistics. Furthermore, the manufacturers’ interest in investing in technology to improve the functionality of these vehicles further facilitates the market in this region.

The greater need for effective solutions for the realization of logistics contributes to boosting the light commercial vehicles market. This demand is mainly driven by the advancement of electronic commerce, which requires the timely delivery of products to customers. The increased use of e-commerce for purchases delivery fleets must be expanded; light commercial vehicles, specifically vans and pickup trucks, are particularly useful owing to their ease of maneuvering in a city. In addition, advancements in typical technologies such as telematics and route optimization software further facilitate operational effectiveness by keeping track of machinery conditions and consumption. Furthermore, companies are sifting towards new and efficient solutions due to the constantly developing economy.

| Report Coverage | Details |

| Market Size by 2034 | USD 652.55 Billion |

| Market Size in 2025 | USD 439.10 Billion |

| Market Size in 2024 | USD 420.19 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.50% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, Gross Weight, Fuel, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Growing demand across various industries

Growing demand for e-commerce and last-mile delivery solutions is anticipated to drive substantial growth in the light commercial vehicles market. The fast growth of online retailing in the B2C segment is exerting pressure on logistics providers and retailers to reinforce fleets with LCVs, especially vans and small truck varieties, as the traffic constraint that big vehicles encounter, there is an increasing tendency toward developing in-house fleets or concentrating on partners with third-party applications and experimenting with technologies, including electric vehicles and autonomous delivery. Companies such as Hello Fresh recently launched an EV fleet across 19 major U.S. metropolitan areas, and such examples signify that the industry is now moving towards environment-friendly or sustainable models supported by consumer policy and policies. These developments are expected to drive additional LCV demand to support growing logistics in e-commerce.

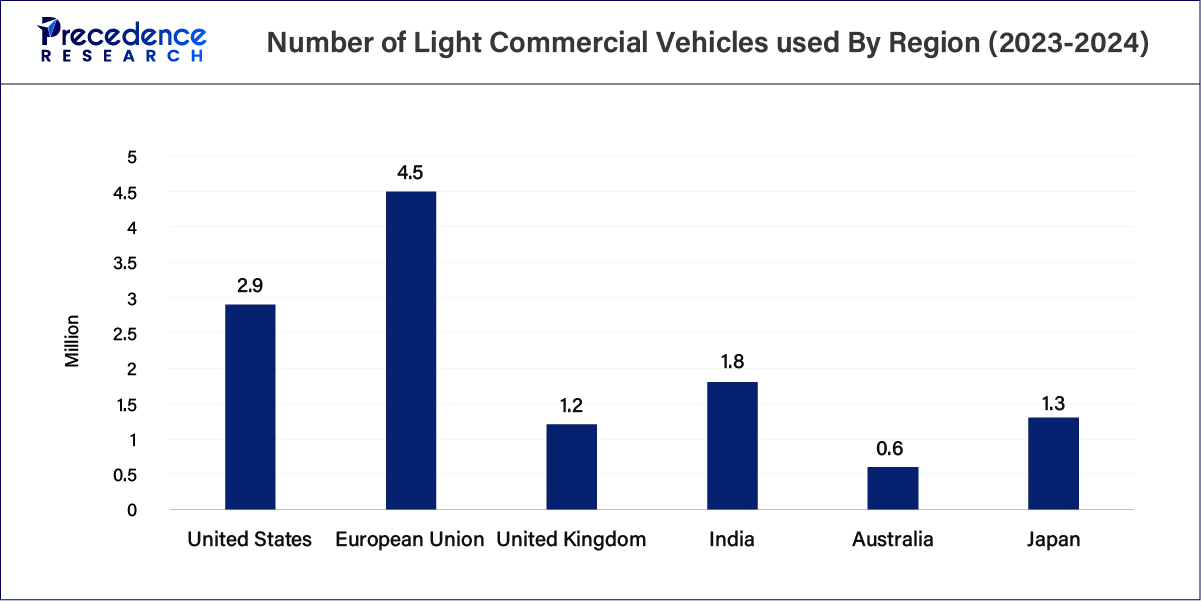

Estimated number of Light Commercial Vehicles used by Region (2023-2024)

High initial costs for electric vehicles

High initial costs associated with electric light commercial vehicles (e-LCVs) are expected to restrain the light commercial vehicles market growth, particularly as companies weigh the expenses of fleet electrification. The initial establishment costs of such equipment may be recuperated by operational cost savings in the future. Many small to mid-sized logistics service providers and fleet owners are often financially constrained to acquire such equipment. This cost barrier affects manufacturers who incorporate sophisticated technologies, such as fully autonomous driving and improved battery power, which increase the cost of production even more. Moreover, the high cost of e-LCVs is expected to dampen companies' adoption of them.

High investments in technological advancements

Rising investments in autonomous driving, telematics, and vehicle-to-everything (V2X) communication are creating immense opportunities for the players competing in the light commercial vehicles market. As investment in autonomous driving, telematics, and V2X communication technologies increases, the opportunities for cars utilizing these advanced technologies emerge. The demand for autonomous LCVs to support last-mile delivery services is believed to be capable of improving logistics functionality and drastically cutting labor costs. Improved telematics help fleet owners manage fleet conditions, track trips in real-time, and address fuel consumption requirements, representing the shift to efficiency and automation in the industry.

The vans segment held a dominant presence in the light commercial vehicles market in 2024 due to its versatility and indispensable use in growing logistics, such as e-commerce. With the growing need for effective last-mile deliveries in recent years, companies have sought to increase the number of vans in their fleets. The integration of advanced telematics and connectivity features in vans is expected to enhance operational efficiency.

The pickup trucks segment is expected to grow at the fastest rate in the light commercial vehicles market during the forecast period of 2024 to 2034. Since they were classified as everyday cars, most pickup trucks are used for both private and business purposes. Furthermore, the increasing consumer preference for outdoor activities and the increasing popularity of off-road vehicles are driving this trend.

The 6000-9000 lbs segment accounted for a considerable share of the light commercial vehicles market in 2024. This weight range comprises different types of vehicles, including commercial vans and light-duty trucks that are used in different operational sectors. This is a result of the increasing need for efficient delivery solutions, especially within cities, which puts fleet operators under pressure to adopt vehicles within this wagon width. Furthermore, the improvements in fuel consumption and emission requirements have contributed to the popularity of these vehicles.

The 9000-12000 segment is anticipated to grow with the highest CAGR in the light commercial vehicles market during the studied years, owing to the growing requirements of industries that cater to construction and logistics, among others, that need greater payload capacity. This segment includes medium-duty trucks mostly used in regional haulage and commercial uses. Additionally, the increased regulations towards using large commercial vehicles for personal freight transport are expected to boost this segment.

The gasoline segment led the global light commercial vehicles market, owing to the higher availability and low initial cost as compared to the diesel and electric segments. New gasoline vehicles are generally cheaper to buy and lighter than diesel options, making them efficient for short-haul transport. This segment has been able to harness the latest technologies in emissions regulations to further improve fuel efficiencies and performance levels that were needed despite the enhanced emissions regulations. Furthermore, more refueling stations make gasoline vehicles more desirable for fleet holders.

The electric segment is projected to expand rapidly in the light commercial vehicles market in the coming years, owing to their growing range and fuel efficiency. Electric engines offer superior torque and fuel efficiency and are employed in tasks related to carrier and construction industries. These engines are now being used extensively in different commercial and other applications, as their ability to handle heavily laden tasks well. The available technologies to reduce emission levels are also helping to reduce the environmental impact of diesel automobiles.

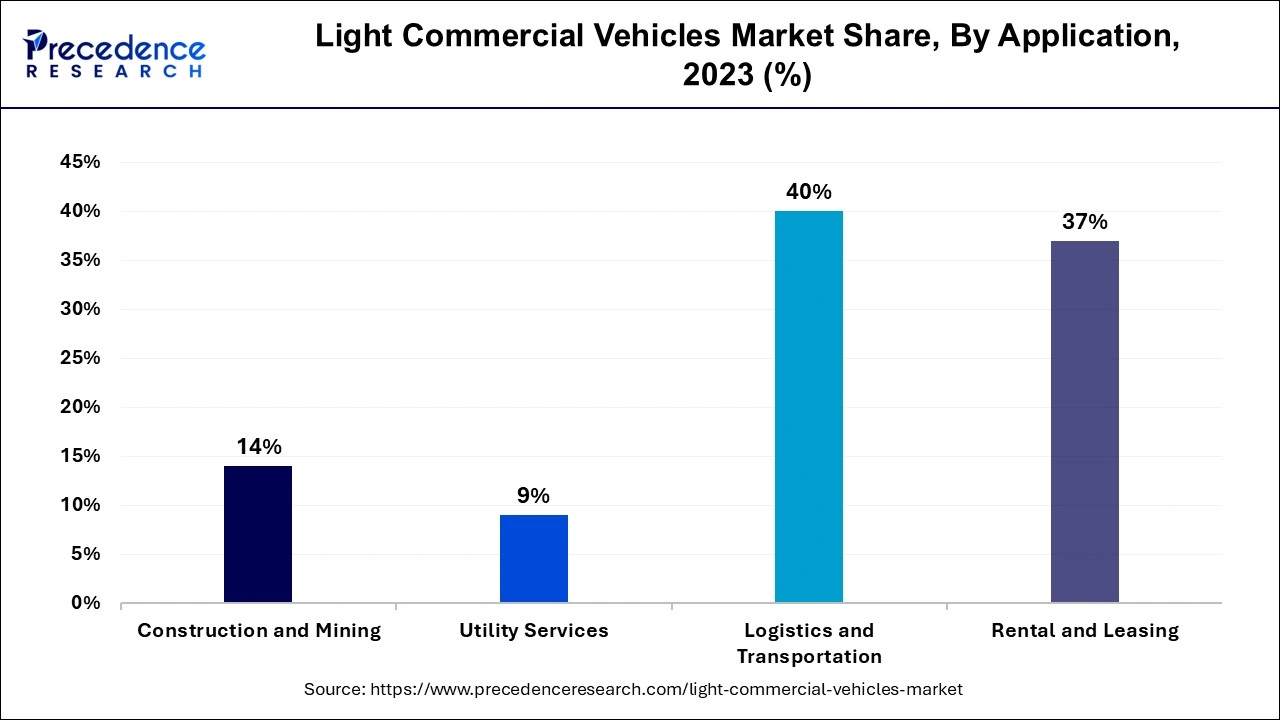

The logistics & transportation segment dominated the global light commercial vehicles market in 2024 due to the growth in e-commerce and the need for improving delivery performance. Logistics firms are now assuming tremendous risks for a purposeful scaling of light commercial vehicle fleets to meet Consumers’ speed expectations. Additionally, the increased adoption of last-mile delivery services is also helping drive the uptake of application-enabled, flexible vehicles that move through complex and congested cityscape landscapes, improving operations.

The construction & mining segment is projected to grow at the fastest rate in the light commercial vehicles market in the future years, owing to the rise in infrastructure projects and mining activities. Furthermore, the inclination towards green construction methodologies is prompting the use of electric light commercial vehicles.

Electrification leads the next wavy of LCV innovation

Connected tech and autonomous features reshape fleet management

By Vehicle

By Gross Weight

By Fuel

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

May 2025

April 2025