May 2025

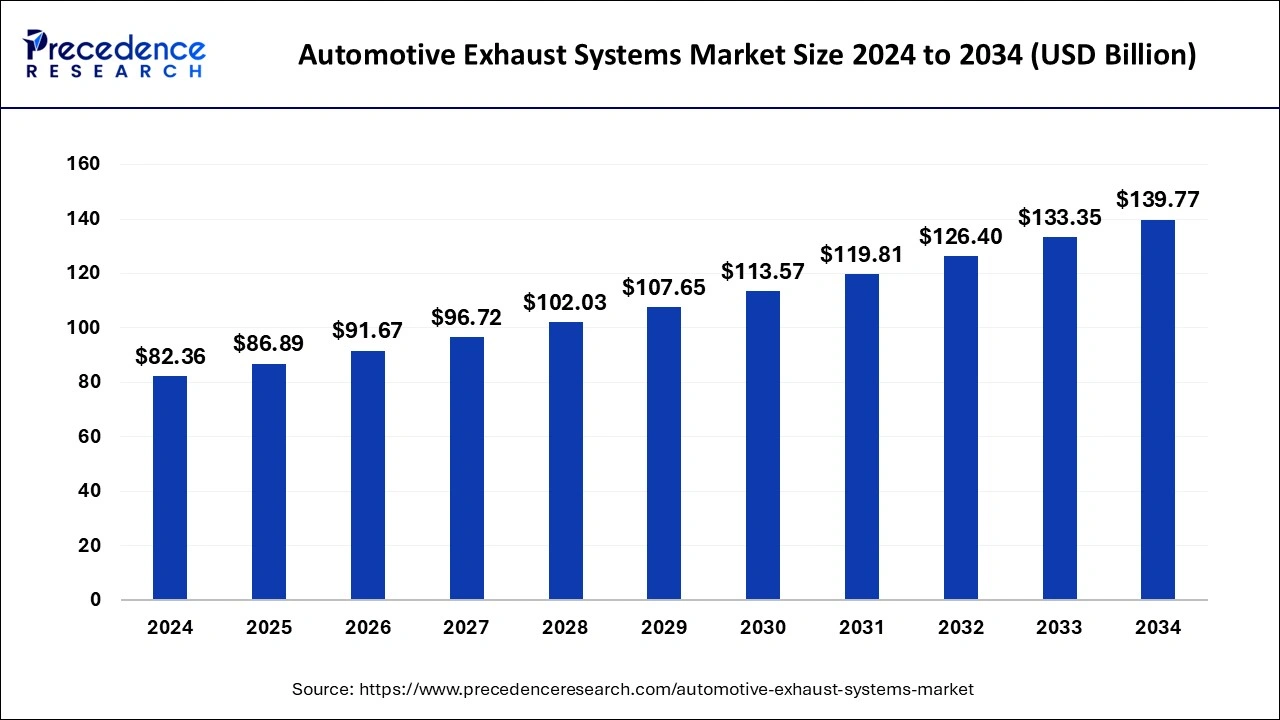

The global automotive exhaust systems market size accounted for USD 82.36 billion in 2024 and is expected to exceed around USD 139.77 billion by 2034, growing at a CAGR of 5.43% from 2025 to 2034. The automotive exhaust system market is expanding due to various factors, such as rising sales of passenger cars and commercial vehicles across emerging countries, along with stringent regulations about carbon emissions and environmental sustainability, which fuel the market’s growth globally.

AI is revolutionizing automotive exhaust systems on a global scale by offering personalized and efficient solutions for production, which increases overall operational efficiency. AI adoption is assisting manufacturers of automotive exhaust systems in enhancing overall operational efficiency and minimizing infrastructure challenges by delivering high-quality products to the global market. Moreover, the European Union's general data protection regulation offers proper guidelines for the use of AI in manufacturing, such as exhaust systems with ethics, to ensure that AI technologies are safe, reliable, and beneficial for both manufacturers and consumers.

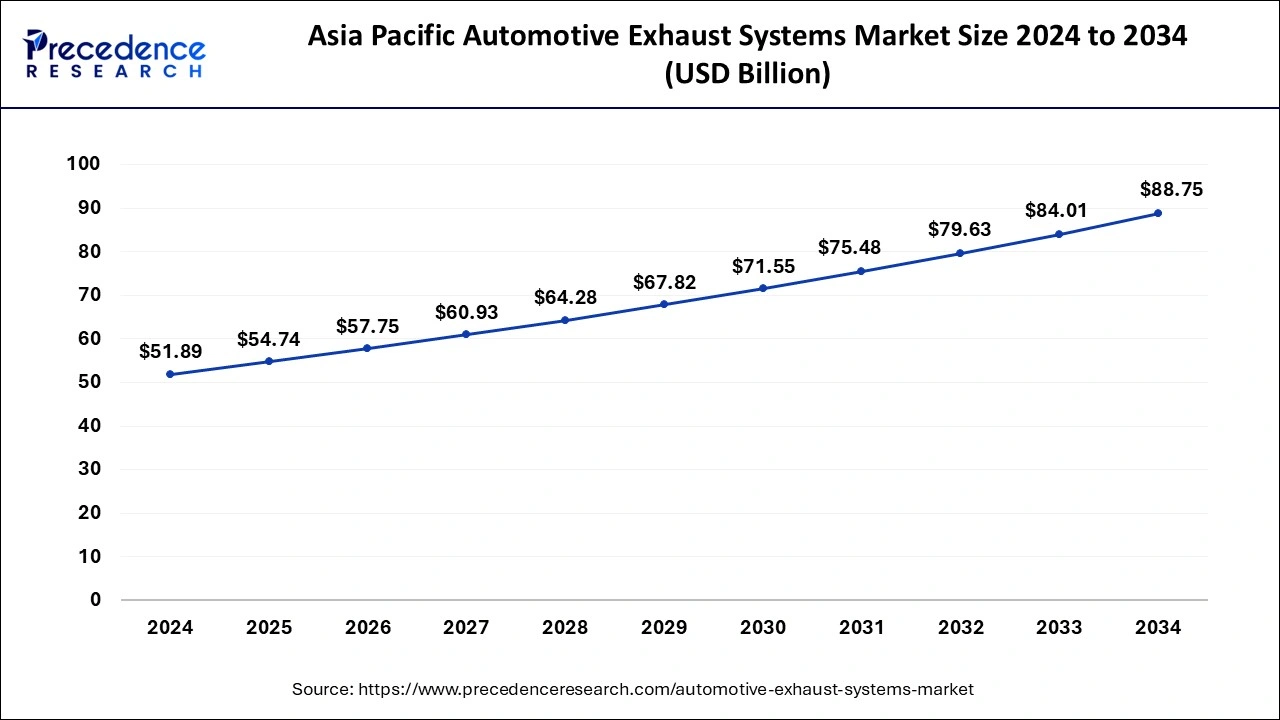

The Asia Pacific automotive exhaust systems market size was exhibited at USD 51.89 billion in 2024 and is projected to be worth around USD 88.75 billion by 2034, growing at a CAGR of 5.51% from 2025 to 2034.

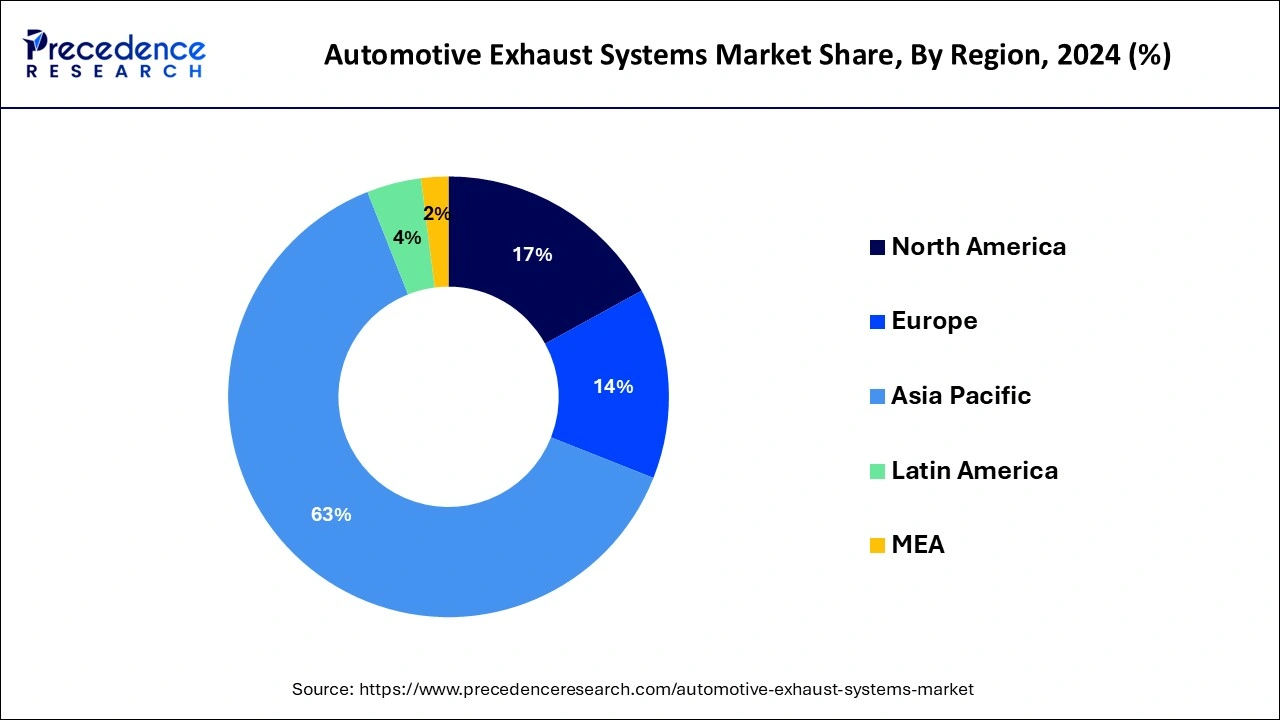

Asia Pacific accounted for about 62.14% of the global supply for automotive ventilation systems during 2024 and is anticipated to grow at a high CAGR. This can be linked to the region's consumers' rising technical savvy and purchasing power. Furthermore, the market is anticipated to increase as a result of the developing automotive sector in developing nations like China & India. Given that India has various advantages, including cheap labor and inexpensive natural resources, the Make in Indian initiative is anticipated to attract significant investments in the automobile industry. India and China were two of the world's fastest-growing countries and have extensive supply chains and distribution networks. In the upcoming years, it is also projected that the country's expanding e-commerce sector would increase the supply of commercial cars. Over the projected timeframe, the Latin American area is anticipated to grow at a furthermore CAGR. It is anticipated that rising vehicle sales and manufacturing in nations like Brazil and Mexico will promote global market expansion. Nearly half of the cars sold in the country are produced in Brazil, which is South America's largest automobile manufacturer. Additionally, the nation is seventh worldwide for vehicle manufacturing. With a contribution of about BRL 266 bn, the country's automobile industry accounts for more than 5.5% of the total GDP. Mexico is also the world's fifth-largest manufacturer of automotive components as well as the sixth-largest maker of passenger cars.

Increased worries about increased carbon emissions standards are a major factor driving the huge increase in automobile particulate filters, which has prompted numerous regional and international levels policies to reduce the same. To increase the effectiveness of particulate filters, companies are implementing strategies like selective catalyst reduction. Sales of automobiles powered by renewable sources are stoking the desire for ecological transportation options as the world's demand for transport picks up speed. This redirects money streams to the creation of this kind of option as electric cars.

The production levels of automobiles have a direct impact on the market for automobile ventilation systems. Thus, the growing market for engine exhaust projects around the world is being driven by the rising production of passenger automobiles and commercial trucks in emerging and developed countries.

| Report Coverage | Details |

| Market Size in 2025 | USD 54.74 Billion |

| Market Size in 2034 | USD 88.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.51% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Fuel Type, After-treatment Device, Component, and Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing use of combined after-treatment equipment

Technology for exhaust systems is developing quickly

The rising demand for zero-emission automobiles

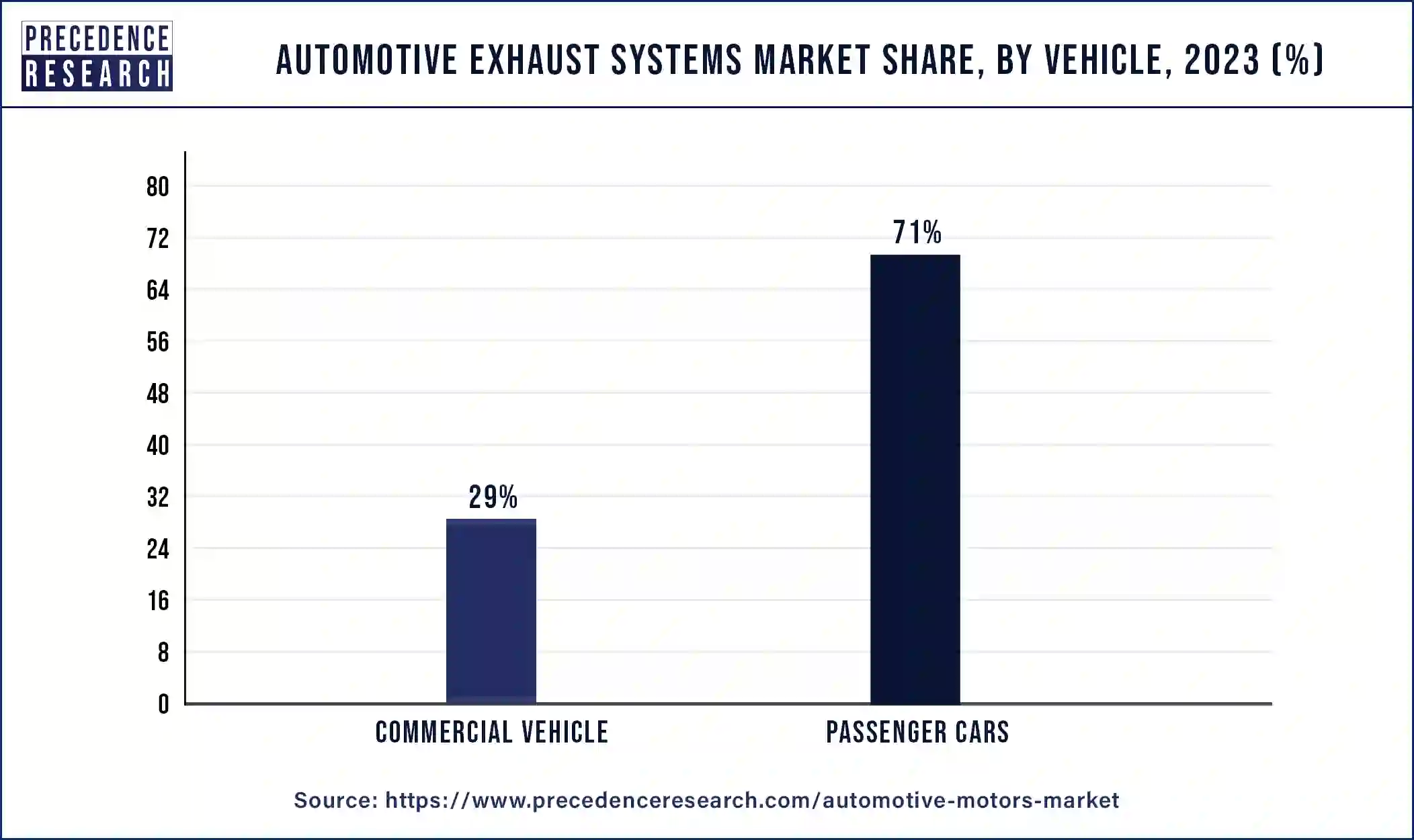

Over 71% of the total income in 2023 came from the commercial vehicle category, and it is predicted that this segment will continue to dominate during the projected period. Over the projection period, the segment is anticipated to grow at a CAGR of more than 8.3%. According to the European Automotive Manufacturer Association, there were 569 automobiles per 1,000 people in Europe in 2019. Additionally, throughout the projected timeframe, emerging markets like India and China are anticipated to further drive market expansion. Only diesel cars with such a DPF are connected by PM detectors. Both petrol and diesel make it possible to make use of temperatures, NOx, and oxygen sensors.

For each particulate filter included in the exhaust pipe for all kinds of vehicles taken into consideration for the research, oxygen molecules devices are installed. In an exhaust pipe, an individual item of heat is utilized for petroleum, 2 unit for petroleum, and 2 units for every other type of fuel. The need for sensing is likely to expand over the projected timeframe as a result of the increased usage of effluent detectors in automotive particulate filters to collect, measure, and analyze the emissions gases and their quantities.

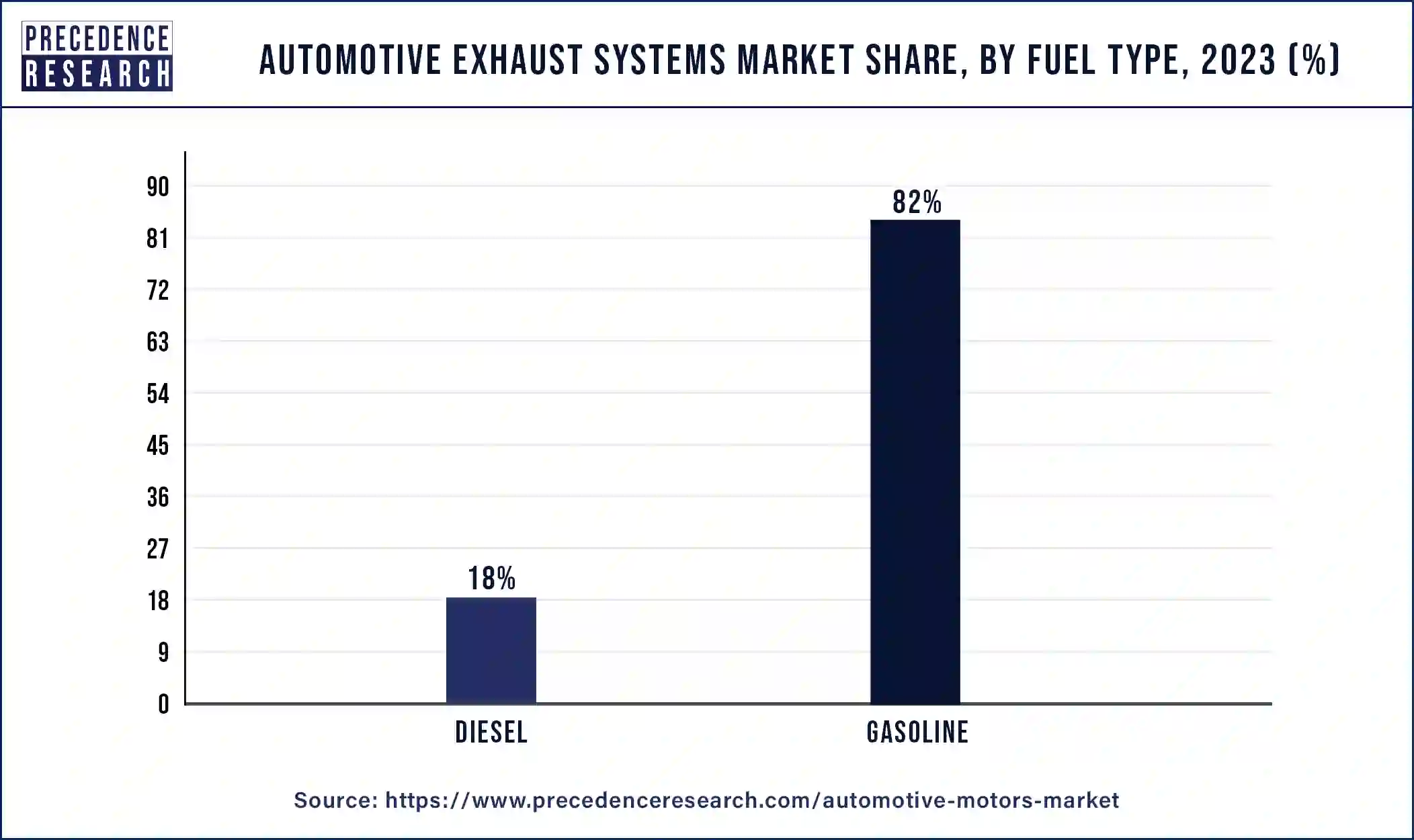

In 2023, the gasoline sector had the biggest revenue portion at about 82%, and it's projected that it will continue to dominate during the projected timeframe. Nine out of ten automobiles in developing nations have combustion engines. While the demand for electric vehicles has reduced ICE vehicles sold in places like the United States and Europe, the lack of an adequate electrical vehicle network in developing nations continues to support the rising sales of gasoline-powered motors. Authorities, though, are proposing to forbid the purchase of ICE cars while promoting the use of EVs.

Imports of gasoline and diesel automobiles and vans will be prohibited in France and the UK from 2040, according to proposals made public in 2017. This restriction was postponed until 2035, though. The sale of new gasoline and diesel vehicles will be prohibited starting in 2035 across the nation. Furthermore, Paris is creating a strategy to phase off diesel vehicles entirely by 2024 and gasoline vehicles entirely by 2033.

To decrease the effect of emissions from vehicle variations in diesel engines, the regulatory organizations are mandating the use of gasoline variations. As a result, improvements in petrol engine varieties have been made, including the development of gasoline fuel infusion engines, which offer better fuel efficiency and reduce pollution than conventional petrol engine varieties. To mitigate the impacts of pollutants and lower emissions rates from GDI vehicles, gasoline particulates filters are utilized. GPFs allow for continuous filtering renewal while preventing soot buildup. With the growing market for straight petrol engines, the GPF sector is expected to experience the fastest rate of growth during the projected timeframe.

The exhaust manifold segment dominated the market globally. The manifold is a structure of tubes that collects the exhaust gases from multiple cylinders into one pipe. It is an essential component of all automotive exhaust systems. Growing disposable income and continued aspirations toward vehicle ownership in emerging markets in the Asia Pacific and the Middle East are leading to significant demand for automobiles, which spurs growth in this segment.

The muffler segment registered the highest CAGR in the forecast period. Global regulations on noise pollution and emissions, spearheaded by organizations such as the United Nations, are leading to the higher installations of mufflers to reduce the noise that is produced by exhaust in an internal combustion engine. Federal mandates in several countries in North America, Europe, and even Asia Pacific are leading to a spike in demand for mufflers, which has led to this segment’s expansion.

By Vehicle Type

By Fuel Type

By After-treatment Device

By Component

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

April 2025

January 2025