January 2025

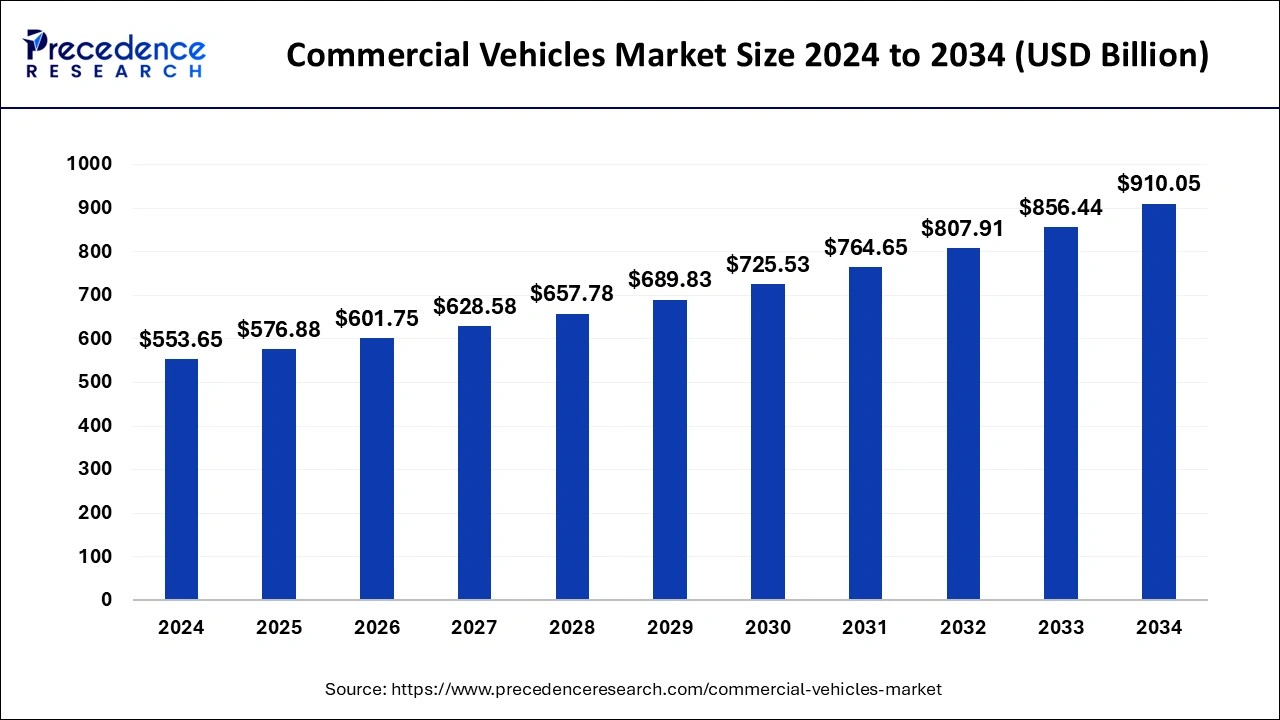

The global commercial vehicles market size is calculated at USD 576.88 billion in 2025 and is forecasted to reach around USD 910.05 billion by 2034, accelerating at a CAGR of 5.20% from 2025 to 2034. The North America market size surpassed USD 246.01 billion in 2024 and is expanding at a CAGR of 5.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global commercial vehicles market size accounted for USD 553.65 billion in 2024 and is predicted to increase from USD 576.88 billion in 2025 to approximately USD 910.05 billion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034.

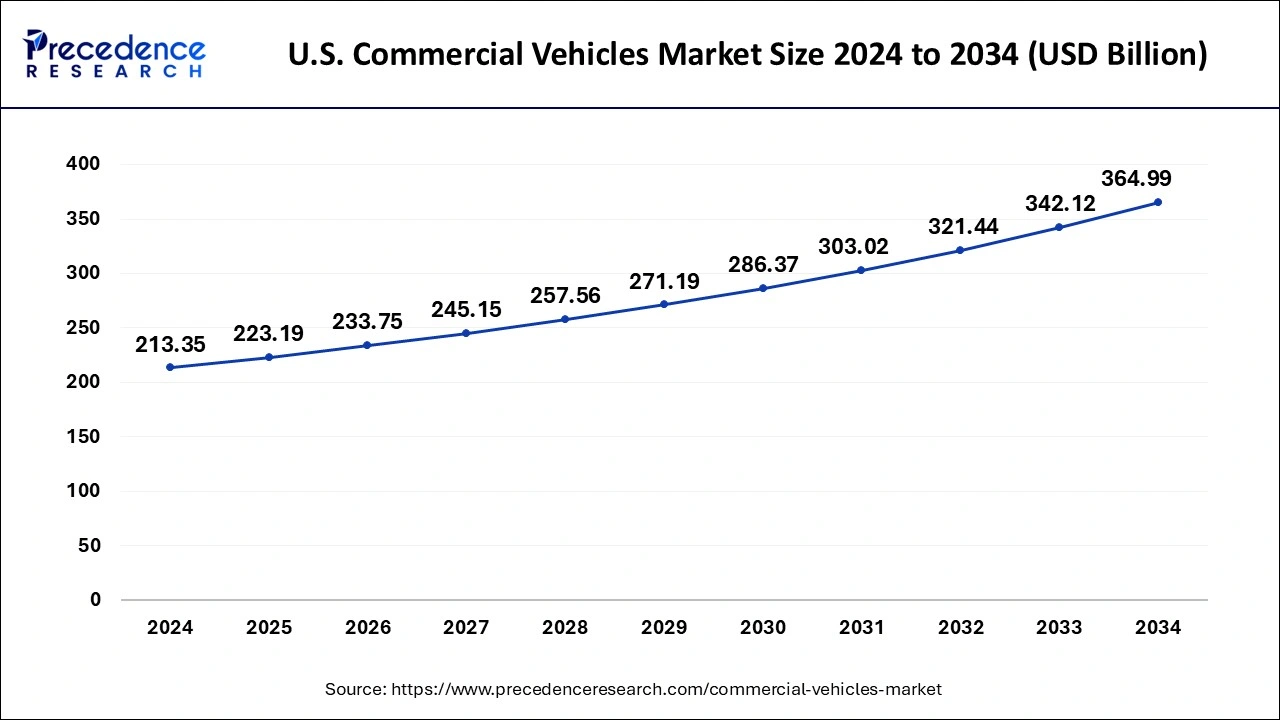

The U.S. commercial vehicles market size was evaluated at USD 213.35 billion in 2024 and is projected to be worth around USD 364.99 billion by 2034, growing at a CAGR of 5.62% from 2025 to 2034.

North America captured the maximum market value share in the global commercial vehicles market and is anticipated to grow at a considerable rate during the forecast period. The U.S. commercial vehicles market size is expected to be worth around USD 408.44 billion by 2034 and is growing at a compound annual growth rate (CAGR) of 5.30% from 2025 to 2034.

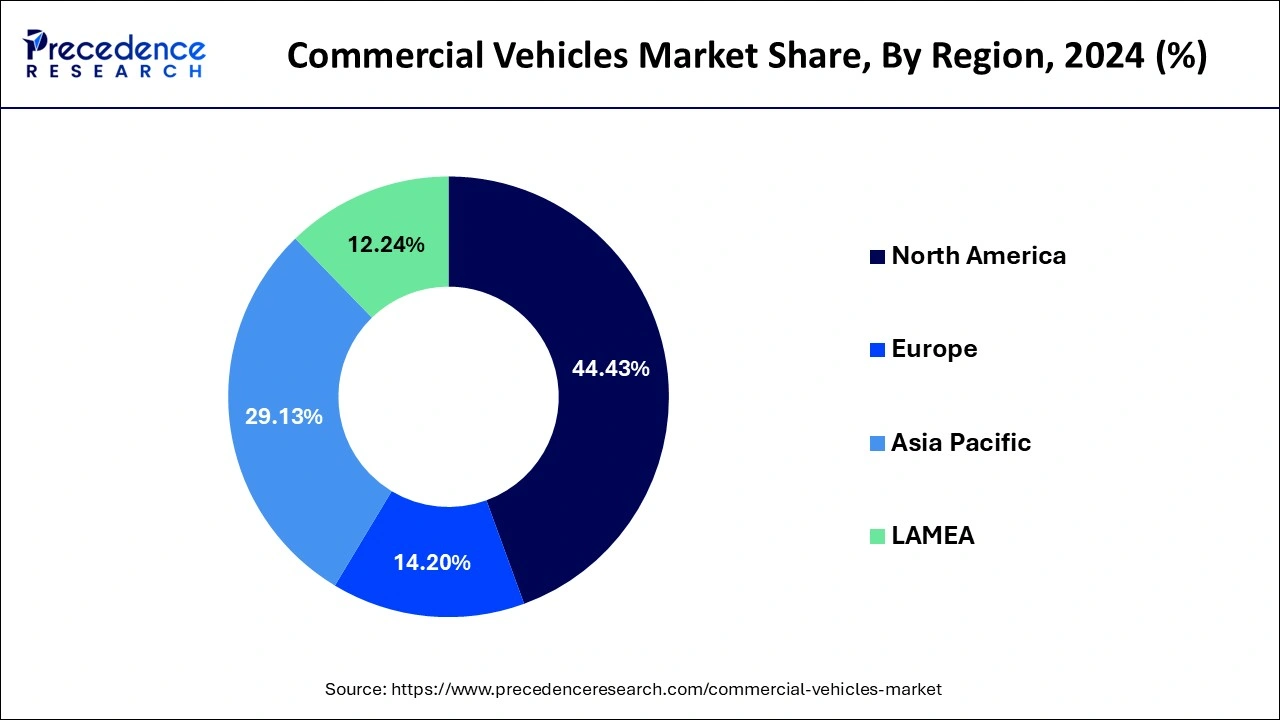

North America emerged as the market leader in the global commercial vehicles market owing to the high adoption rate of commercial vehicles in the U.S. Industrial growth, infrastructure development, and government regulations related to maximum loading capacity for commercial vehicles are some of the major factors that propel the market growth in North America.

Significant development in the industrial sector along with stringent government norms pertaining to load carrying capacity of commercial vehicles is the prime factor that triggers the growth of the region. Further, the rising penetration of electric vehicles and battery-powered vehicles as well as government initiatives to promote the adoption of these vehicles to curb carbon emission expected to propel the demand for commercial vehicles in the coming years.

Maximum Share Captured by North America. The rising demand for the long distance operation from fleet management in North America is significantly boosting the growth of the commercial vehicles market. Furthermore, the growing developments in the industrial sector and the strict regulations of the government pertaining to the load carrying capacity of the commercial vehicles have led to the growth of the market. The presence of unified supply network in North America and establishment of a strong connection between manufacturers and consumers via multiple transportation mediums such as maritime transport, air transport, truck transport, and rail transport are driving the growth of the North America commercial vehicles market. The easy availability of various financing options in North America is further boostingthe market growth. The aggressive investments in the infrastructural development in North America, presence of leading automotive manufacturers in the region, and favorable government support are the most prominent factors that has significantly driven the growth of the North America commercial vehicles market in the past years. Moreover, the demand for the light commercial vehicles is growing rapidly owing to the rising penetration of the online cab services and car rental services in North America.

Besides this, the Asia Pacific registered the highest growth rate over the analysis period. The attractive growth of the region is mainly because of escalating growth in industrial sector, highest adoption rate of electric vehicles in the region, and high yearly investment for infrastructure development.

This is attributed to the increasing road infrastructure along with rising manufacturing facilities due to cost-effective raw materials and labor, particularly in the developing countries such as India and China. In addition, the region is highly promising for the growth of smart mobility solutions owing to favorable policies by governments in the region expected to accelerate the market growth prominently.

Asia Pacific Forecast the Strongest Growth Rate during the Forecast Year (2025-2034). Asia Pacific is expected to witness the fastest growth rate during the forecast period. Asia Pacific is witnessing rapid industrialization, rapid urbanization, presence of huge population, and aggressive investments by the government in the development of sophisticated infrastructure. The presence of huge industries in the region has significantly boosted the demand for the commercial vehicles in this region for transportation of goods to the domestic and international regions. Furthermore, China is one of the largest producer and consumer of electric vehicles across the globe.

The rising government initiatives to eliminate carbon emission from vehicles have significantly boosted the demand for the electric commercial vehicles in the region. The growing popularity of the car rental services in this region is expected to fuel the demand for the commercial vehicles during the forecast period. The countries like India, China, and South Korea are heavily investing in the adoption of sustainable public transport solutions in order to move closer towards achieving zero emission economy, which is a prominent factor boosting the growth of the commercial vehicles market in Asia Pacific.

Commercial vehicle is a type of motor vehicle used purposely for the transportation of goods or merchandise. Commercial vehicle growth is mainly influenced by the increase in e-commerce business as well as increasing adoption of commercial vehicles for transportation. Apart from this, increasing industrialization, adoption of e-mobility in commercial sectors, and infrastructure development that supports the advancement & development in automotive industry also triggers the market growth for commercial vehicles.

Commercial vehicle is a type of motor vehicle used for the transportation of goods, materials, and people. It is used across various industries including transportation & logistics, mining & construction, manufacturing industries, agriculture, and many others. Main products covered under the commercial vehicle market are light commercial vehicles, buses & coaches, and heavy trucks. Industrial growth and rising penetration of electric-powered vehicles in commercial vehicles are some of the prime factors that trigger the market pace of commercial vehicles during the forecast period.

Although the market experiences sluggish growth in the recent past, it predicted to recover the overall sales performance in commercial vehicles, especially in the developing countries. Digitization along with the rising infrastructure spending anticipated to boosts the commercial vehicles market growth in the coming years. Initially the market development was closely related to the growth of global economy; however, this interrelation is crumbling rapidly. Demand for specific transport solutions by consumers, integration of telematics services, and rising popularity of shared mobility are some of the major trends that are shaping the commercial vehicle market growth. Further, governments across several nations have implemented various policies and regulations for effectively managing the size of goods that can be carried in a commercial vehicle. For instance, the Federal Motor Carrier Safety Administration (FMCSA) in the United States was established to prevent fatalities and injuries related to commercial vehicles. In wake of same, the body has regulated the maximum size of goods that can be carried in these vehicles. In in turn, is expected to flourish the sale of commercial vehicles in the near future.

| Report Coverage | Details |

| Market Size in 2024 | USD 553.65 Billion |

| Market Size in 2025 | USD 576.88 Billion |

| Market Size by 2034 | USD 910.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Propulsion Type, Power Source, Region |

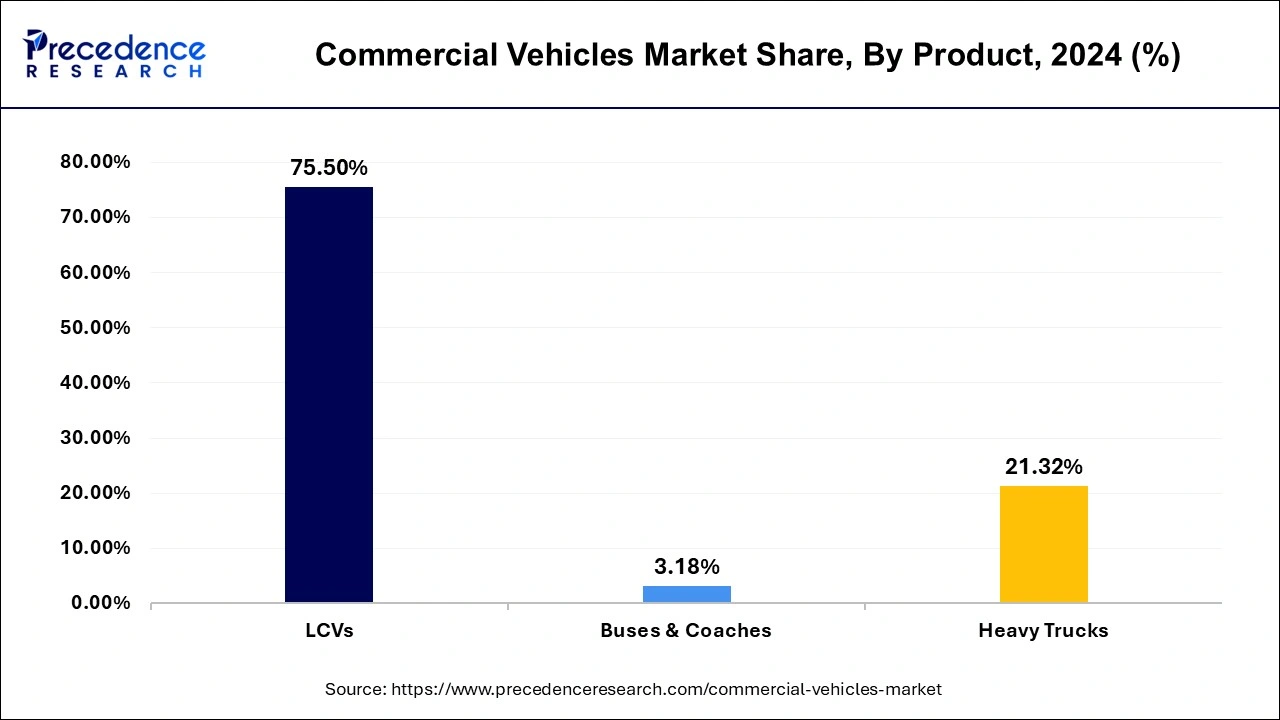

In 2024, Light Commercial Vehicles (LCVs) led the global commercial vehicles market with significant revenue share and predicted to retain its position during the forecast period. Dynamic nature of the vehicle that enables the incorporation of advanced technologies contributes prominently towards the growth of the segment. Further, advent of vehicle electrification and battery-powered engines expected to fuel the demand for light commercial vehicles in the coming years. Growth in the industrial sector also escalates the demand for LCV prominently. Presently, advent of smart industries has upended the fleet management systems. Need for real-time monitoring, tracking, and effectively managing the product delivery systems have triggered the need for smart and effective vehicle. This is attributed to significantly boost the sale of LCV in the near future.

Attractive revenue share of LCVs is majorly because of high adoption of small and medium sized vehicles for transportation of goods across various industrial sectors such as e-commerce business, mining & construction, production sites, and many others.

However, the heavy trucks segment is expected to account for the highest growth over the next decade owing to heavy investments of OEMs in the market, rising demand for powerful automobiles with higher Power Sources of carrying to manage weights and strong suspension systems, increasing need for fuel-efficient trucks, and the strict regulations and laws in relation with carbon footprint and emissions.

Commercial Vehicle Market Revenue, By Product, 2022 to 2024 (USD Billion)

| By Product | 2022 | 2023 | 2024 |

| LCVs | 387.1 | 402.1 | 418.0 |

| Buses & Coaches | 16.2 | 16.9 | 17.6 |

| Heavy Truck | 107.9 | 112.8 | 118.0 |

By propulsion type, IC engine capture the largest revenue share in the global commercial vehicles market; however, electric vehicle projected to grow at the fastest rate during the forecast time period. The accelerating growth of the electric vehicle in commercial vehicles market is mainly due to various government initiatives to propel the adoption of electric vehicles across every sectors. In addition, environment-friendly properties of electric vehicle also help to curb the rate of pollution across various regions.

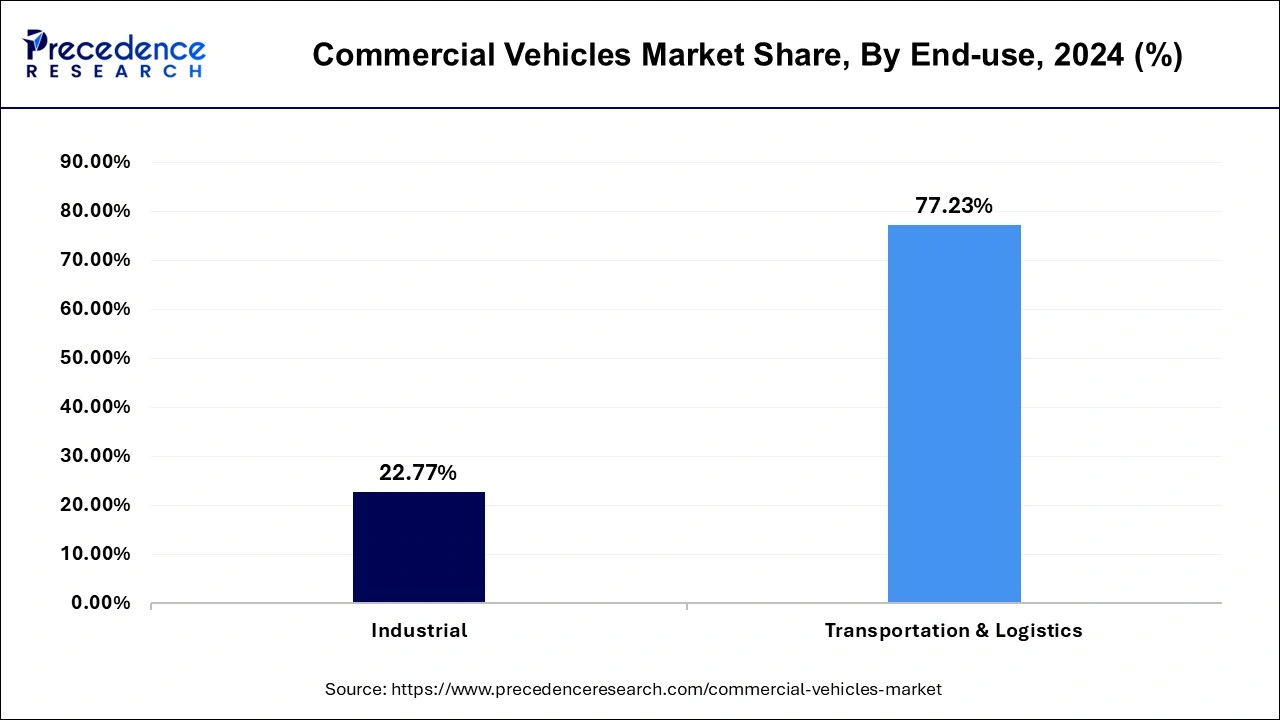

In 2024, the transportation segment accounted for significant market value share and predicted to exhibit lucrative growth rate of nearly 5.60% over the forecast period. Rising expenditure on commutation to improve accessibility and affordability is one of the prime factors that escalate the growth of the segment. Further, emerging trend of shared mobility along with norms related to traffic of fleet on road are the other prominent reasons that trigger the growth of passenger transportation in the coming years.

On the other hand, logistics segment witnessed prominent demand in the past few years owing to the growth in trade activities worldwide. Moreover, the segment captured remarkable revenue share in 2021 due to increasing penetration of e-commerce and retail business. Shifting consumer trend for online purchasing have flourished the growth of e-commerce sector, thereby boosting the market growth for logistics segment.

The diesel segment accounts for the highest revenue share in 2024. The robust growth of this segment is owing to factors which include a rise in demand for passenger vehicles and increasing concerns about fuel efficacy. The rapid economic development along with the urbanization trends watching individuals migrating from rural areas to urban areas is also one of the major factors driving the growth of this segment in the years to come.

The fuel cell vehicle segment is projected to grow at the fastest rate over the next decade, with a CAGR of 9.58%. Hydrogen fuel cell vehicles possess a high potential to alleviate emissions in relation to the transportation sector. This vehicle does not produce any CHG emissions during the operation, unlike diesel or gasoline vehicles. These benefits are expected to have a positive impact on overall fuel cell vehicle share. In addition, research and development activities in hydrogen and fuel cells are further expected to propel the fuel cell vehicle market.

Commercial Vehicle Market Revenue, By Power Source, 2022 to 2024 (USD Billion)

| By Power Source | 2022 | 2023 | 2024 |

| Gasoline | 87.5 | 90.0 | 92.7 |

| Diesel | 275.7 | 282.9 | 290.5 |

| HEV / PHEV | 36.2 | 39.1 | 42.2 |

| Battery Electric Vehicle (BEV) | 68.4 | 73.5 | 79.1 |

| Fuel Cell Vehicle | 11.6 | 12.6 | 13.6 |

| LPG & Natural Gas | 31.8 | 33.7 | 35.6 |

By Product

By End-use

By Propulsion Type

By Power Source

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

May 2025

May 2025