January 2025

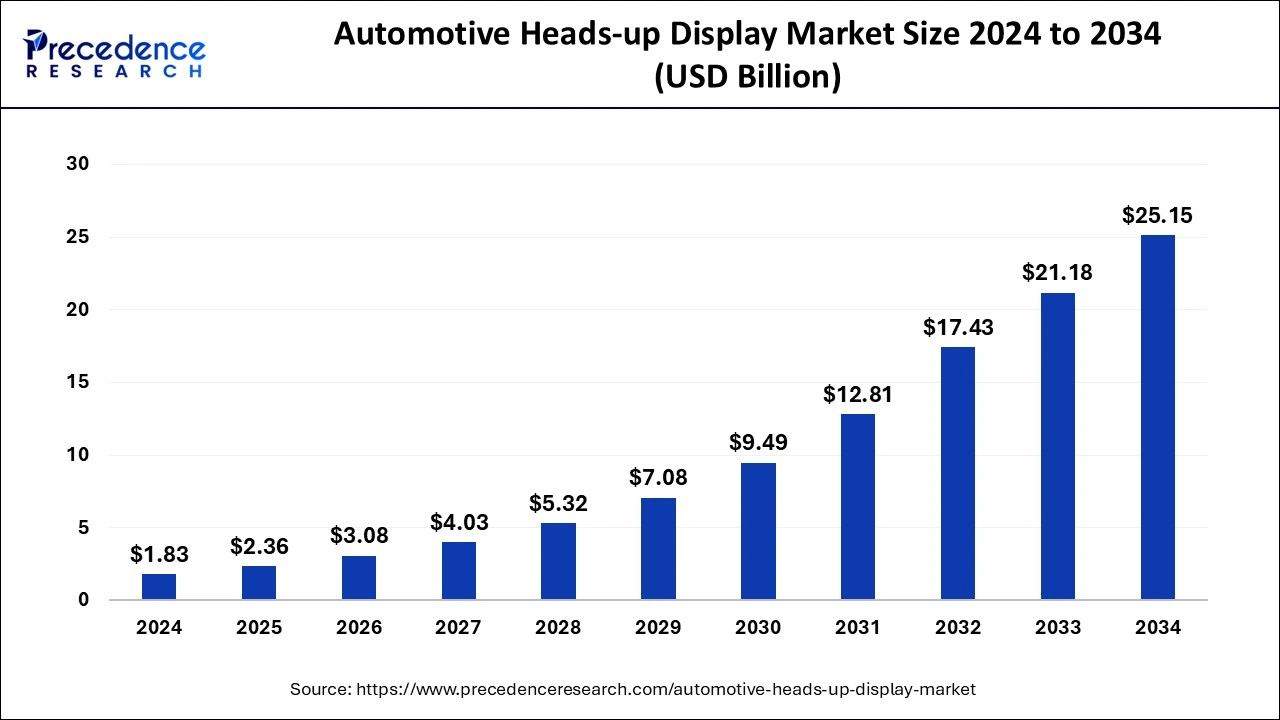

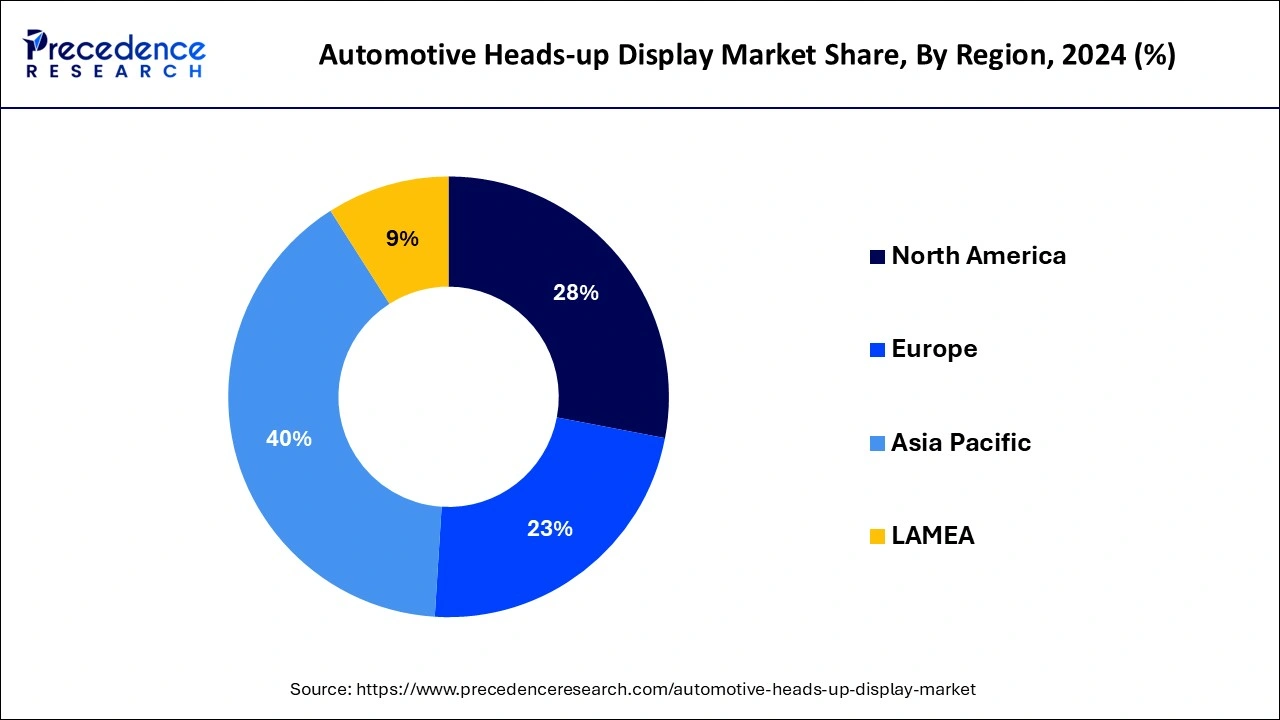

The global automotive heads-up display market size is estimated at USD 2.36 billion in 2025 and is predicted to reach around USD 25.15 billion by 2034, accelerating at a CAGR of 29.95% from 2025 to 2034. The Asia Pacific automotive heads-up display market size surpassed USD 970 million in 2025 and is expanding at a CAGR of 30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive heads-up display market size was estimated at USD 1.83 billion in 2024 and is anticipated to reach around USD 25.15 billion by 2034, expanding at a CAGR of 29.95% from 2025 to 2034. The rising investment by key market players to develop innovative automotive products, rapid technological breakthroughs, stringent government regulations, and rising demand for high-end luxury and mid-size cars are expected to drive the growth of the automotive heads-up display market during the forecast period.

As technology advances rapidly, its integration of Artificial intelligence (AI) is significantly revolutionizing the automotive heads-up display market. Automakers are increasingly integrating AI-powered features in vehicles to enhance comfort, convenience, and safety while traveling. AI integration in heads-up displays offers a more intuitive, immersive, and intelligent driving experience which assists drivers to stay focused while driving and receive vital information. AI-powered HUDs system uses advanced sensors and cameras to identify objects and potential hazards, and then project that information onto the windshield to avoid accidents on the road. By leveraging AI, the system can offer personalized guidance based on real-time traffic, weather conditions, and other relevant information required by the driver. The AI-powered HUD is paving the way for autonomous and connected vehicles.

The Asia Pacific automotive heads-up display market size was evaluated at USD 970 million in 2024 and is predicted to be worth around USD 9520 million by 2034, rising at a CAGR of 30% from 2025 to 2034.

Asia Pacific led the global automotive heads-up display market with the highest market share of 40% in 2024. The Asia-Pacific market players are constantly investing in research and development activities to develop new automotive applications. Due to low cost of labor and favorable government policy, mass production of components can be conducted, resulting low heads-up display pricing. The Asia-Pacific region has enormous growth potential for automotive heads-up display applications due to establishment of more production plants and introduction of new technologies.

North America is projected to expand at the fastest CAGR during the forecast period. The U.S. automotive heads-up display market dominates the North America region. Automotive heads-up displays have aided drivers in reading not only vehicle information but also information about the surrounding environment, because to the rapid technology advancements in the automobile industry in the North America region.

A head-up display (HUD) is also known as also known as an auto-HUD. It is a transparent display and is installed in such a way that assists driver from not getting diverted from their viewpoint while driving. This device reflects important driving information on the car's windscreen. Head-up display (HUD) provides crucial information to the driver including the vehicle's speed, directions, temperature, cruise control settings, and various other relevant data that are critical while driving.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.36 Billion |

| Market Size by 2034 | USD 25.15 Billion |

| Growth Rate from 2025 to 2034 | 29.95% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Heads-up Display, Dimensuion, Vehicle Class |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for high-end luxury and mid-size cars

The rising demand for high-end luxury and mid-size cars with cutting-edge safety features like head-up displays around the world is expected to boost the growth of the automotive head-up display market during the forecast period. Head-up displays are mainly found in luxury cars and mid-size cars. HUDs can improve the appearance of cars and make the driving experience safer. Infrared sensors in the latest HUD systems assist in identifying lines on the road and projecting their actual location on the screen. Automotive head-up display devices provide the driver with access to various information including displaying speed, navigation guidance, collision alerts, real-time vehicle diagnostics, warning signals, temperature, and other important vehicle & navigational information throughout the journey on the windscreen in the driver's direct line of sight to assist the driver in making informed decisions. Moreover, the car head-up display system makes the cars rank among the finest safety systems if it is integrated with onboard cameras and adaptive cruise control. Such factors are anticipated to drive the revenue growth of the automotive head-up display market during the forecast period.

High cost

The high cost is anticipated to projected to hamper the market's growth. The deployment of a head-up display requires significant investment which results in increasing the overall cost of the vehicle. Its high costs and availability as an inbuilt feature are only in high-end cars. Several lower and middle-income countries lack awareness among the people in underdeveloped countries which is likely to limit the expansion of the global automotive heads-up display market.

Rapid technological advancement

The rapid technological advancement is projected to lucrative growth opportunities for the growth of the automotive head-up displays market. Automobile manufacturers and HUD market players are continuously focusing on advancing head-up display systems. These systems offer advanced feature geological positioning system (GPS) capabilities that can display warning and error messages on the windshield. The advanced projection technologies, such as micro mirror-based devices based on electromechanical systems with automation and augmented reality-based techniques led to the development of an ultra-thin augmented reality HUD system that displays bright and detailed depictions on the windshield. Such factors drive the expansion of the automotive head-up display market in the coming years.

The augmented reality – heads-up display segment has held the major market share in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. It is attributed to the increasing research and development activities coupled with rising need for the advanced safety systems. It is dangerous for commuter to monitor numerous functions while driving, as this can lead to a road accident and deaths. The augmented reality – heads-up display makes driving safer by decreasing distraction and delivering real-time traffic support. Augmented reality’s easy access to information of driver will help to drive the growth of automotive heads-up display market.

The conventional heads-up display segment is estimated to be the most opportunistic segment during the forecast period. Conventional heads-up displays are widely used in military and commercial automobiles and aircrafts. In airlines, the conventional heads-up display information such as acceleration, radar, flight path, radar, and real-time position allowing pilots to react quickly.

The windshield segment captured the biggest market share in 2024. The windshield heads-up display provides enhanced safety and plenty of other new functions such as blind spot recognition, lane departure navigation, and navigation analytics, all of which contribute to a safe driving experience. To reduce distraction and improve focus, these features are placed in the driver’s field of view.

On the other hand, the combiner segment is estimated to be the most opportunistic segment during the forecast period. The combiner type of automotive heads-up display shows information in the driver’s line of sight using a partially reflective screen similar to glass.

The 3D segment dominated the market in 2024. A 3D automotive heads-up display shows information to drivers effectively and clearly. Augmented reality messages are dynamically projected based on the target’s 3D location. A virtual display is projected into a three-dimensional world in 3D heads-up display, ensuring that there is no mismatch when the driver drives.

On the other hand, the 2D segment is estimated to be the most opportunistic segment during the forecast period. The traditional 2D augmented reality – heads-up display shows information at a specified distance from the driver. It instructs the driver to look at the projection along the optical axis at a specific location.

By vehicle class, the luxury segment led the global market. Luxury cars are usually equipped with a host of state-of-the-art features. Companies are focusing on incorporating innovations and conveniences, such as heads-up displays, to enhance the consumer experience. The luxury car’s higher price point is suitable for the integration of newer, more experimental technology, given that brand-new tech may not be optimally scaled yet.

By vehicle class, the mid-segment showed substantial growth potential. With widespread homogeneity in the automotive market, the mid-segment is looking for new ways to distinguish itself from the competition. This shift toward consumer convenience and futuristic technology is expected to drive notable demand in the automotive heads-up display market.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as new product launch, investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

The various developmental strategies such as business expansion, investments, new product launches, acquisition, partnerships, joint venture, and mergers foster market growth and offer lucrative growth opportunities to the market players.

By Technology

By Heads-up Display Type

By Dimension

By Vehicle Class

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025