January 2025

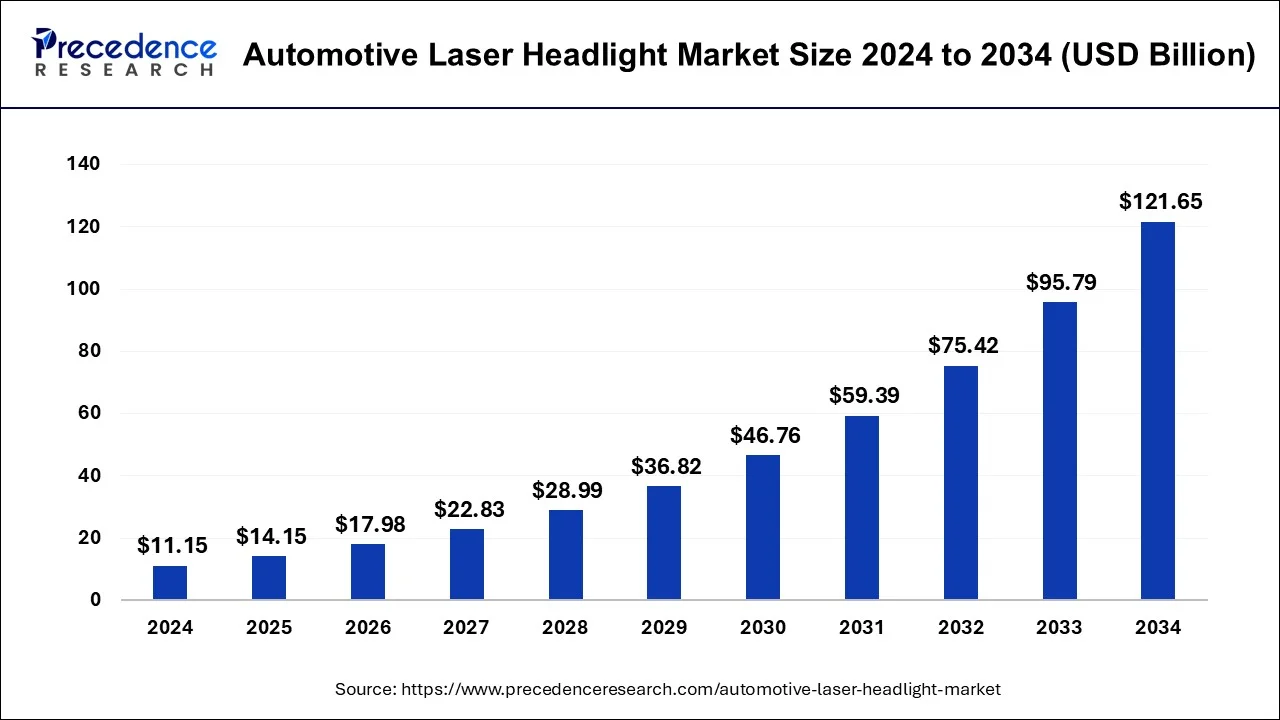

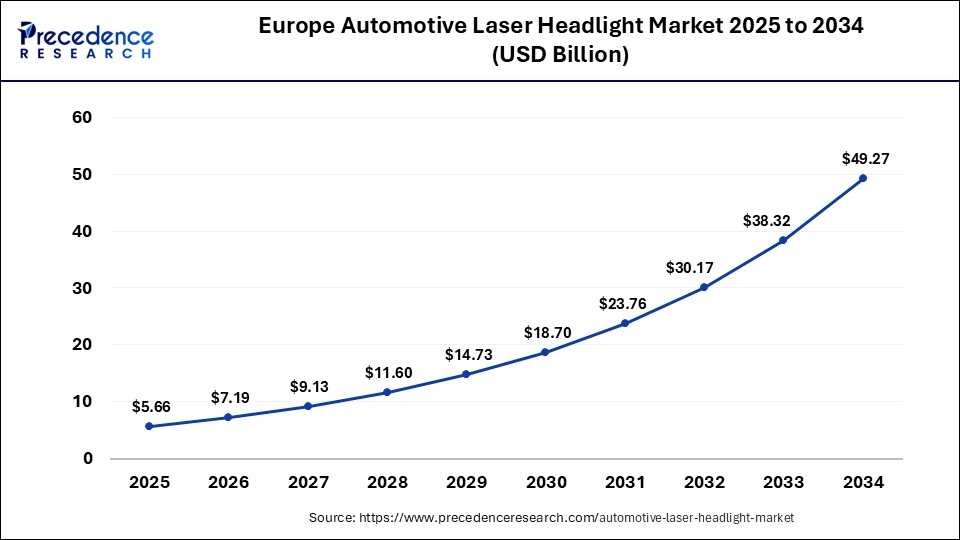

The global automotive laser headlight market size is calculated at USD 14.15 billion in 2025 and is forecasted to reach around USD 121.65 billion by 2034, accelerating at a CAGR of 26.99% from 2025 to 2034. The Europe automotive laser headlight market size accounted for USD 5.66 billion in 2025 and is expanding at a CAGR of 27.15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive laser headlight market size was estimated at USD 11.15 billion in 2024 and is predicted to increase from USD 14.15 billion in 2025 to approximately USD 121.65 billion by 2034, expanding at a CAGR of 26.99% from 2025 to 2034.

The Europe automotive laser headlight market size was estimated at USD 4.46 billion in 2024 and is predicted to be worth around USD 49.27 billion by 2034, at a CAGR of 27.15% from 2025 to 2034.

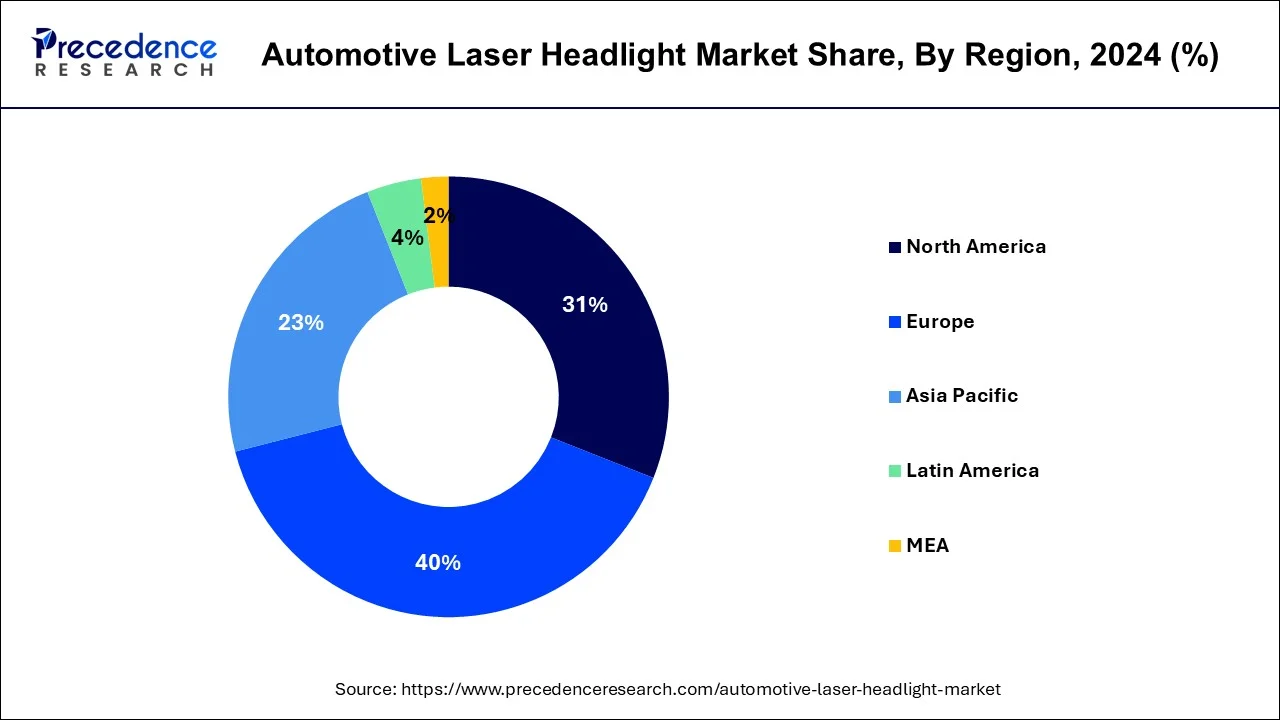

The global automotive laser headlight market is studied for North America, Europe, the Asia Pacific, and Rest of the World. Amongst the aforementioned regions, Europe encountered significant revenue share of approximately 40% in the year 2024 and expected to register lucrative growth over the forecast period. The prominent growth of the region is mainly due to the significant presence of leading laser headlight manufacturers such as Valeo S.A. and OSRAM GmbH in the region. In addition, the region has strong consumer base for luxury and premium cars that escalates the demand for intelligent and smart lighting in the automobile sector.

The Asia Pacific experience opportunistic growth in the coming years due to high penetration of smart and intelligent automotive electronics. In addition, high consumer base for automotive industry especially in India and China influence auto-makers to implement smart and attractive lighting technologies in their offerings to attract more customers.

Rising urbanization along with increasing purchasing power in developing countries are likely to boost the sale of passenger and light commercial vehicles, thereby augment the market growth market. Furthermore, manufacturers in automobile sector are investing significantly in research & development to design advanced and innovative safety features that can be used for several applications in a vehicle including night vision cameras, sensor controlled automotive lighting, and laser headlights that are expected to propel the demand for automotive laser headlights across the world. Laser headlights ensure passenger’s safety by enhancing the visibility of road especially at night.

However, high cost of laser headlights compared to other headlights anticipated to hamper the market growth of automotive laser headlights. Indeed, the application of laser headlights is banned in some of the countries such as U.S. owing to high intensity of light produced by laser headlights. Besides this, innovative automotive laser headlights are grabbing attention of premium car manufacturers such as Audi and BMW are projected to flourish the sale for automotive laser headlight market in the coming years.

| Report Highlights | Details |

| Market Size in 2024 | USD 11.15 Billion |

| Market Size in 2025 | USD 14.15 Billion |

| Market Size by 2034 | USD 121.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 26.99% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Vehicle Type, Sales Channel, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Passenger vehicle captured significant market value share in the global automotive laser headlight market in 2024 and expected to grow prominently over the analysis period. The prime factor responsible for the growth of the segment is high production and sales of passenger vehicles across the globe. As per OICA, passenger vehicles dominated nearly 75% of the global vehicle production. Increasing demand for premium and luxury cars along with rapid growth in battery-powered vehicles are the prime factors escalating the production of passenger cars globally. Moreover, increase in purchasing power and Gross Domestic Product (GDP) in the developing nations has influenced automobile manufacturers to implement smart and high-end technology in their car series, this in turn accelerates the market for automotive laser headlights in passenger vehicle segment.

However, commercial vehicles experience lucrative growth over the analysis period owing to rising demand for logistics vehicles and recreational vans. Exclusive growth in e-commerce and retail sectors has prominently boosted the product delivery business that in turn flourishes the demand for commercial transports. Beside this, significant growth in the tourism & travel industry has influenced the commercial vehicle manufacturers to implement automation and advanced safety features in the vehicle, this expected to fuel the growth of commercial vehicle segment in the coming years.

By technology, intelligent laser headlight encountered the maximum revenue share in the global automotive laser headlight sector in 2024 and anticipated to grow at a rapid rate during the forecast period. This is attributed to the rising demand for intelligent and smarter technology. Further, escalating demand for autonomous vehicles along with electric and hybrid cars contribute significantly for the market growth. Implementation of Internet of Things (IoT) and sensors to assist driver while driving and enhance the safety features to prevent from accidents are the other major factors accelerating the demand for intelligent laser headlight in automobile sector.

The global automotive laser headlight market is dominated with the presence of leading automotive light manufacturers such as OSRAM GmbH, Valeo S.A., Hella GmbH & Co. KGaA, SLD Laser, and others. These market players are exclusively focused towards expanding their footprint in the global market through merger & acquisition and product development. For instance, in December 2019, SLD Laser launched LiFi Communication and sensing technologies for consumer and automotive applications. Similarly, in 2018, OSRAM GmbH introduced laser-based light sources or application specific LEDs in wide range of designs, mainly for automotive forward lighting and general lighting applications. The company also developed infrared lasers and high-efficiency visible for sensor and projection applications such as Adaptive Cruise Control (ACC) system in vehicles.

By Technology

By Vehicle Type

By Sales Channel

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025