January 2025

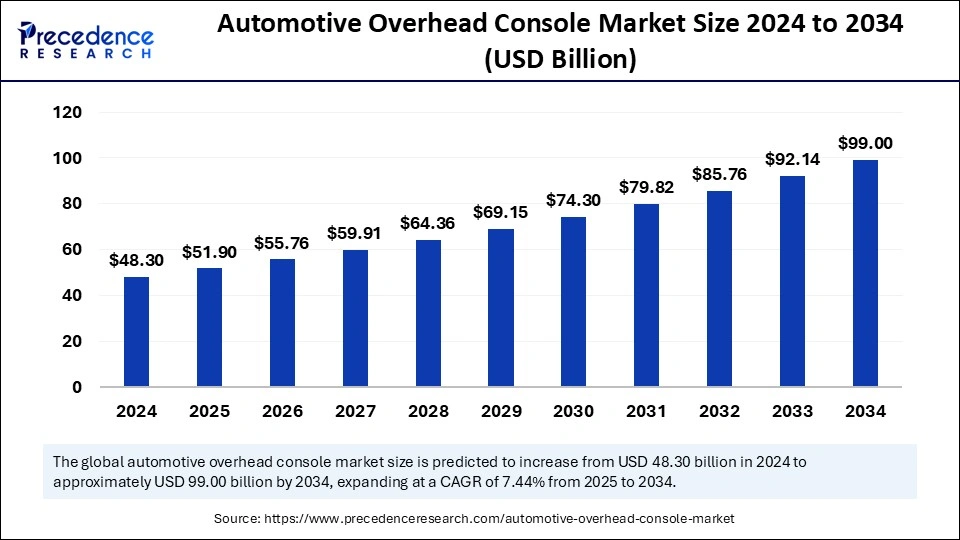

The global automotive overhead console market size is calculated at USD 51.90 billion in 2025 and is forecasted to reach around USD 99.00 billion by 2034, accelerating at a CAGR of 7.44% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive overhead console market size accounted for USD 48.30 billion in 2024 and is predicted to increase from USD 51.90 billion in 2025 to approximately USD 99.00 billion by 2034, expanding at a CAGR of 7.44% from 2025 to 2034. The growth of the automotive overhead console market is driven by the rising development of autonomous and connected vehicles. Moreover, increasing demand for advanced features contributes to market growth.

The integration of artificial intelligence technologies in the automotive sector is driving innovations in the realm of vehicle design, vehicle components, manufacturing methods, and enhancing customer experience. AI-driven systems help in predictive maintenance, fleet management, and autonomous driving by analyzing real-time data. AI can analyze sensor data from overhead consoles in real-time and predict potential failures, ultimately enhancing safety. Automotive manufacturers, stockholders, and insurers leverage AI to modernize operations, enhance consumer engagement, and drive sales. Furthermore, AI drives innovations in the automotive overhead console market by improving vehicle intelligence and seamless human-machine interactions.

An overhead console is positioned on the ceiling between the driver and front passenger seats. It integrates various controls, dome-shaped lights, and courtesy lights. Automotive consoles increase vehicle inner lighting, with dome lights automatically stimulating when a key fob is used or a vehicle door is opened. They can also be manually controlled by mechanical or capacitive touch keys. The automotive overhead console market is witnessing rapid growth due to the rising demand for cutting-edge in-car systems that improve convenience, functionality of vehicles, and consumer experience.

| Report Coverage | Details |

| Market Size by 2034 | USD 99.00 Billion |

| Market Size in 2025 | USD 51.90 Billion |

| Market Size in 2024 | USD 48.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.44% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Technology, Type, Sales Channel, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Production and Adoption of EVs

The production and adoption of electric vehicles (EVs) are increasing across the world, driven by increasing government incentives, environmental concerns, and technological advancements, which are driving the growth of the automotive overhead console market. EVs emit less greenhouse gas than traditional internal combustion engine vehicles, making them ideal for meeting the net-zero carbon goals of various nations. Since EVs often prioritize user-friendly interfaces and advanced features, overhead consoles are essential in EVs. Furthermore, EVs prioritize minimalistic interiors and lightweight. This, in turn, boosts the need for multifunctional overhead consoles that improve vehicle potential, user experience, and interior design. As automotive manufacturers are prioritizing energy efficiency and modernization in-vehicle technologies, the production of energy-efficient automotive overhead consoles is rising.

Need for Advanced Overhead Consoles

There is a high demand for sophisticated overhead consoles, driving the market’s growth. Modern overhead consoles often incorporate advanced technologies like voice control and recognition, touchscreen, and Bluetooth connectivity. The gesture recognition technique has become a standard feature in the next-generation in-vehicle user interface. Gesture recognition technology provides drivers with a more accessible way to interact with vehicle controls, streamlining the user interface. This further enhances the overall driving experience.

High Costs of Advanced Features

Implementing advanced features in vehicles poses significant challenges, ultimately increasing vehicle costs. The utilization of sophisticated electronic systems and technologies in automotive overhead consoles increases manufacturing costs, making them costlier. Moreover, integrating various features and controllers into automotive overhead consoles can increase complexity in design, making it difficult for users to seamlessly manage operations.

Increasing Popularity of AR-Enabled HUDs

The increasing popularity of AR-enable head-up displays (HUDs) is expected to create lucrative growth opportunities in the automotive overhead console market during the projected timeframe. Incorporating augmented reality (AR) in automotive HUDs enhances the driving experience by improving situational awareness and interaction with autonomous technology. AR-enabled HUDs display information about navigation direction, weather warnings, and speed limits directly onto the windshield. Furthermore, AR integration, along with advanced driver assistance systems (ADAS), improves driver comfort and confidence. As the integration of AR-HUDs rises, the need for sophisticated automotive overhead consoles increases to improve user experiences.

The passenger vehicles segment dominated the automotive overhead console market with the largest share in 2024. This is mainly due to the increased production of passenger vehicles. To enhance passenger comfort, these vehicles often prioritize advanced features, requiring overhead console to provide user-friendly interface. For people with mobility issues, passenger vehicles are essential for reaching places that may not be easily accessible by another transport system. The increase in the popularity of SUVs further bolstered the segment. SUVs are often equipped with safety features, like automatic emergency braking and infotainment systems. These systems rely on automotive overhead consoles.

The light commercial vehicles segment is projected to grow at the fastest rate in the coming years. Light commercial vehicles (LCVs) are designed keeping driver comfort in mind. They are designed to handle light to medium loads over short to medium distances. Generally used in construction, delivery, and service sectors, LCVs are appreciated for their efficiency and adaptability to different environmental conditions. LCVs are often equipped with infotainment systems, communication features, and other safety features that rely on automotive overhead consoles. As the production of LCVs increases, so does the need for automotive overhead consoles.

The electro-mechanical segment held the largest share of the market in 2024. This is mainly due to its cost-effectiveness and enhanced functionality than others. Electro-mechanical systems involve electronic components like buttons and sensors combined with mechanical elements like actuators. They offer greater control, making them suitable for integrating advanced features like automated lighting systems, touchscreens, and voice control systems. They enhance vehicle performance owing to their smooth and precise control.

The display segment is expected to grow at a rapid pace during the forecast period. Modern overhead consoles often incorporate displays or touchscreen for a more user-friendly interface. Displays are ideal to present crucial information like fuel levels, speed, and alerts. This enhances security for drivers on the road and enhances the driving experience.

The front-end console segment dominated the automotive overhead console market in 2024. Front-end consoles offer greater design flexibility. Since front-end consoles are positioned at the front of the driver’s seat, they provide improved access to drivers, enabling instant command over several functions, especially in the case of an emergency. The strong emphasis on vehicle safety further augmented the segment.

The rear-end console segment is anticipated to expand at the fastest rate over the studied period. Rear-end consoles enable passengers to control the temperature levels, lighting, and infotainment systems, which enhances comfort and convenience. Moreover, they provide passengers with additional storage to keep their belongings within easy reach. The increasing focus on passenger comfort and safety is a major factor driving segmental growth.

The OEM segment led the market in 2024. OEM overhead consoles are specifically designed and manufactured, keeping vehicle models in mind. This ensures seamless integration. OEMs often offer warranties on overhead consoles, attracting a large number of users seeking to reduce upfront service or maintenance costs. OEM products are rigorously tested, ensuring that consoles meet stringent quality standards. The rise in demand for inbuilt safety features bolstered the segment’s growth.

The aftermarket segment is likely to expand at the fastest rate during the projection period. This is mainly due to the increasing demand for customized features. The aftermarket offers a range of overhead consoles, enabling car owners to customize their vehicles. The aftermarket improves customer loyalty and satisfaction by offering post-purchase facilities, such as repairs and maintenance.

The driver monitoring segment dominated the automotive overhead console market with the largest share in 2024, as it enhanced the safety of drivers, lowered accident rates, and encouraged proactive maintenance for fleet managers. It is a smart technique that tracks driver behavior to improve performance and safety in fleet operations. This utilizes sensors and cameras to monitor driver actions, such as head position, providing early warning of distractions. With the strong emphasis on driver safety, the integration of driver monitoring systems has increased, which relies on automotive overhead consoles.

The vehicle telematics systems segment is expected to grow at the fastest rate in the coming years. These systems use GPS technology to track automobile activities and provide information about vehicle speed, fuel consumption, braking, and various driving behaviors. Telematics systems use cellular communication to convey data to a remote server. This data is analyzed and used for various purposes, like vehicle location tracking, monitoring driver activities for security, or optimizing vehicle maintenance. Integrating telematics control in the overhead console enhances safety and convenience for the driver.

Asia Pacific’s Sustained Dominance in the Market

Asia Pacific dominated the automotive overhead console market with the largest share in 2024. This is mainly due to the increased vehicle production and sales. The region is leading the world in electric vehicle (EV) sales, with more than 60% of new EVs sold in the next five years. The region is expected to sustain its growth trajectory in the coming years. This is mainly due to the increasing demand for passenger vehicles driven by increasing population growth.

China is a major contributor to the Asia Pacific automotive overhead console market. The country continuously innovates in automotive technologies. Manufacturers of vehicles in China are focusing on improving vehicle safety. Moreover, China is the world’s largest producer of EVs, accounting for about 60% of global vehicle sales in 2023.

North America: The Fastest-Growing Region

North America is expected to witness the fastest growth in the market during the forecast period. This is mainly due to the increasing production and demand for EVs driven by government initiatives to reduce carbon emissions. The region boasts leading automotive manufacturers and a robust automotive industry that supports market growth. The region is an early adopter of advanced features, including vehicle telematics and driver assistance systems. Automakers in the U.S. are investing heavily in novel technologies. Increasing adoption of smart vehicles due to rising consumer preferences for modern features and the growing integration of connectivity and AI solutions contribute to the growth of the automotive overload console market in North America.

Europe to Observe Notable Growth

Europe is likely to observe notable growth in the upcoming period. This is mainly due to the increasing adoption of electric vehicles. Stringent regulations regarding vehicle safety are one of the major factors boosting the growth of the European automotive overhead console market. In addition, European consumers have become aware of the importance of safety features. Thus, they are prioritizing safety while buying vehicles.

By Vehicle Type

By Technology

By Type

By Sales Channel

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025