May 2025

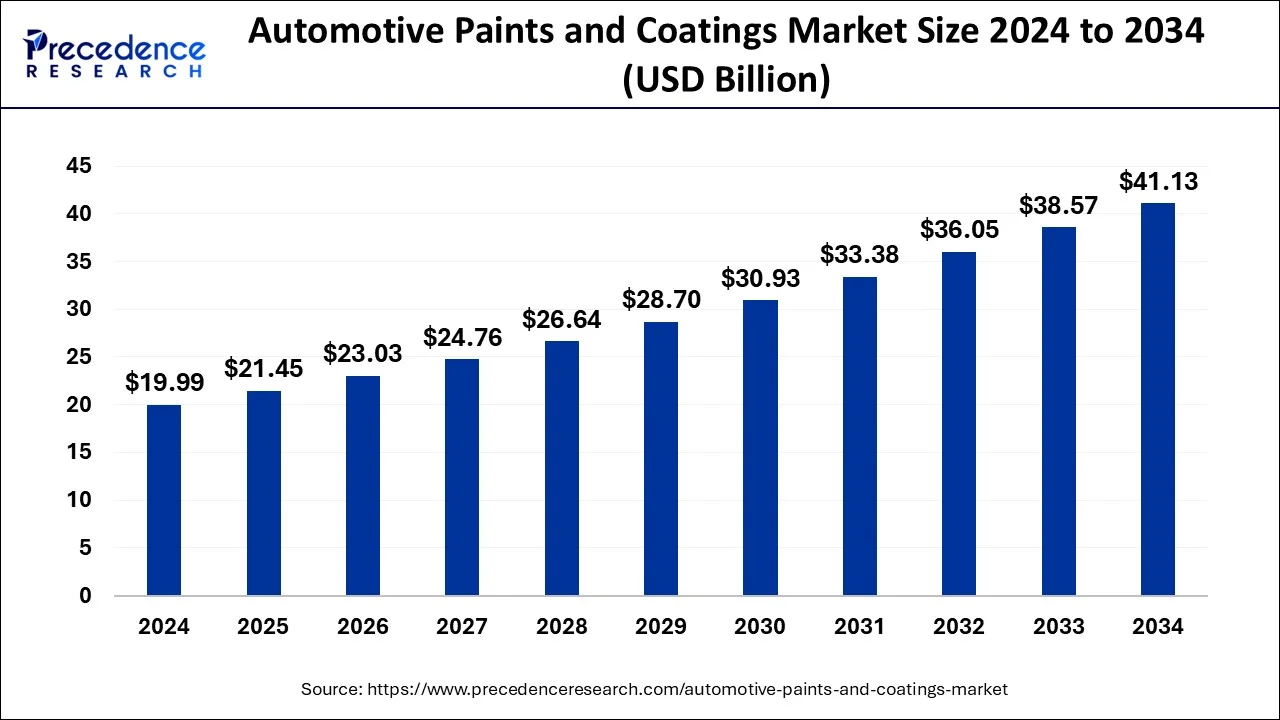

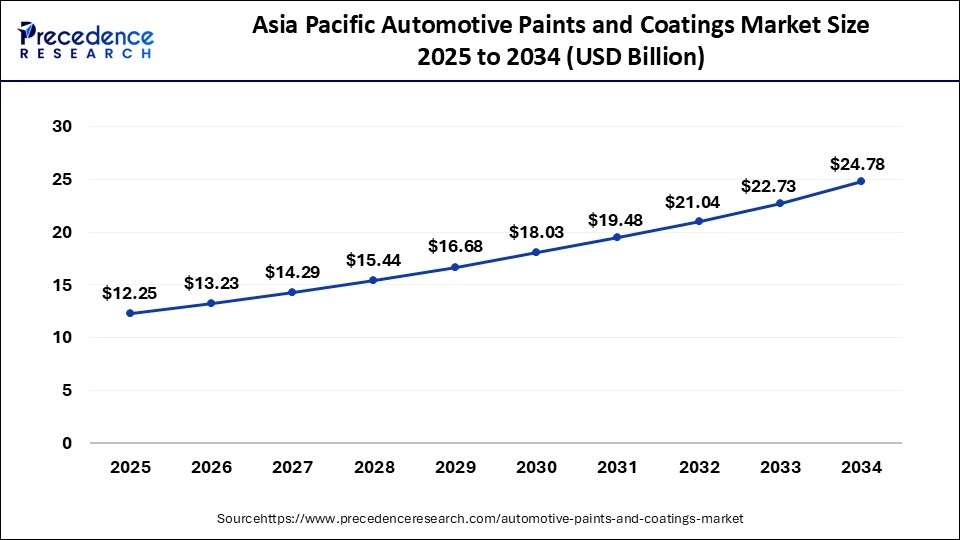

The global automotive paints and coatings market size accounted for USD 21.87 billion in 2025 and is forecasted to hit around USD 43.86 billion by 2034, growing at a CAGR of 8.04% from 2025 to 2034. The Asia Pacific market size was accounted at USD 11.33 billion in 2024 and is expanding at a CAGR of 8.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive paints and coatings market size was worth around USD 20.24 billion in 2024 and is predicted to increase from USD 21.87 billion in 2025 to approximately USD 43.86 billion by 2034, expanding at a CAGR of 8.04% from 2025 to 2034.

AI is creating the bright future for automotive paints and coatings markets. The ability of AI to support eco-friendly and regulatory choices is driving the adoption of AI in the manufacturing industry. Additionally, consumers are preferring AI interaction to make decisions for vehicle purchasing as well as maintenance, including washing and waxing. AI not only helps to maintain protocols or helps with decision-making but also shapes the manufacturing industry by saving costs, production time, and improving performance.

The ability of AI-enabled devices to provide optimization to maintain process applications, energy consumption and reduction of waste, and quality control systems to monitor real-time quality of paints and coatings is making them more popular in the manufacturing industry. With AI integration, the market is projected to be robust in the forecast period.

The aisa pacific automotive paints and coatings market size was evaluated at USD 11.33 billion in 2024 and is predicted to be worth around USD 24.78 billion by 2034, rising at a CAGR of 8.14% from 2025 to 2034.

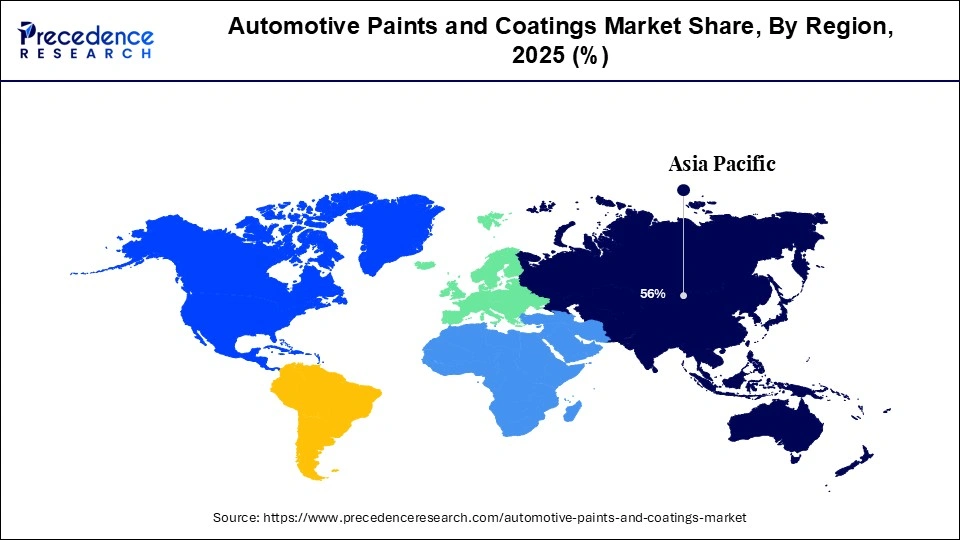

Asia Pacific dominated the automotive paints and coatings market with the largest share in 2024. The region has an expanding automotive sector. Countries like China and India are leading the way in vehicle production, significantly boosting the demand for automotive paints and coatings. There is a heightened adoption of electric vehicles. Governments around the region are also making efforts to boost the development and adoption of electric vehicles. The rise in consumer preferences for vehicle aesthetics and high-quality finishes further bolstered market growth.

Europe expected to offer potential growth prospects for the automotive paints & coatings market due to significant presence of auto manufacturers in the region. In addition, the region seeks prominent merger & acquisitions among the market players that increases the competition among players and makes the market more volatile for development. For example, in December 2016, BASF announced the acquisition of Chemetell that results into the expansion of coating portfolio of the company. Besides this, the company had expanded the vehicle production facility over UK, Germany, and France that supports the product penetration in the region.

The automotive paints & coatings market is significantly rising due to the increased demands for construction and automotive industries. The shift toward sustainability is encouraging manufacturers to develop innovative, eco-friendly painting & caulking solutions. Additionally, the demand for aesthetic appeals to the automotive industry is surging the market expansions. The increased adoption of passenger cars and commercial cars is also driving the market growth. For instance, as per statistics provided by the International Organization of Motor Vehicle Manufacturers (OICA) in 2019, total vehicle production across the world was 91.78 million, out of which 24.64 million were commercial and 67.15 million were passenger vehicles. Several coating types, like basecoat and electrocoat, are emerging in the market.

The increased government environmental regulatory initiatives and investments in automotive industries to improve sustainability, the market is likely to witness novel innovations in the upcoming period in paints and coatings. The increased adoption of automobiles is fueling the demand for specialized and customized paints & coatings, leading the market further to grow. With growing automotive adoption and demand for aesthetic appeals, the market is expected to witness spectacular growth.

Moreover, the market growth has also been driven by the rising advancements in colouring technologies by Multiple American areas. North America is frequently encouraging regional companies to research and developments of novel productions. U.S. Government Regulations and Economic Sustainability are continuously initiating color in the automotive industry.

| Report Highlights | Details |

| Market Size by 2034 | USD 43.86 Billion |

| Market Size in 2025 | USD 21.87 Billion |

| Market Size in 2024 | USD 20.24 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.04% |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Distribution Channel, Texture, Technology Type, Coating Type, Vehicle Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Technology advancements

The adoption of advanced technologies is allowing the development of eco-friendly coatings, affordable and high-performance coatings, which play a favourable role in the market growth. Adoption of advanced technologies like nanotechnology to enhance coating durability, UV protection, and advanced resin systems to improve performance and sustainability are boosting the market.

Additionally, novel technologies like waterborne and powder coatings that provide low VOC emissions and maintain environmental sustainability are significantly contributing to the market growth. The growing surge for digital printing and coating is helping to meet consumer demands. Moreover, cutting-edge technologies like AI and ML are making it easier to improve manufacturing efficiency and automotive performance. With the integration of advanced technologies, the market is rapidly transforming.

Increased adoption of electronic vehicles

The increased environmental regulatory pressures and government initiatives for reducing environmental impacts caused by traditional automobiles are driving the shift toward electric vehicles. Electric vehicles require less paint and coating compared to traditional vehicles. The less complex engine system of electronic vehicles reduces the requirement of coatings. Additionally, the rising adoption of electronic vehicles has raised demands for the eco-friendly coatings along with low VOC emissions, making it difficult to maintain market competition.

Growing demands of water-based coatings

The growing concern of environmental sustainability is the key factor driving the growth of the water-based coating for automobiles. The straight environmental regulation has been empowering manufacturing companies for developments of coating production, which will reduce VOC emissions and environmental impacts. Additionally, water-based coating technologies are able to improve performance. The rising concerns for safety, high performance, and durability are aging the popularity of the water-based coatings. The rising popularity and demands for the water-based coatings are driving opportunities for further innovations and developments of improved coating technologies. The rising environmental regulatory initiatives for the adoption of water-based coating technologies are holding market potentials.

The passenger cars segment accounted for the largest market share due to its highest production volume in the globe, which led to the largest demand for the paints and coatings. The rising need for personal vehicles has driven this production volume of the passenger cars. Rising middle-class population and disposable income are the major factors driving the growth of the segment. This factor is also attributed to demands of the aesthetic appeal of paints and coatings on the cars. Additionally, stringent environmental regulations encourage the adoption of eco-friendly coatings and paints, making the segment dominate the market.

The metallic paints segment dominated the global automotive paints & coatings market due to its properties like durability and flexibility. Metallic paints offer a high-gloss finish, which makes them more in demand among aesthetically conscious people. Additionally, the rising demands for luxury vehicles have increased the adoption of the metallic paints. The ability to hide minor damages is making them further popular. With rising luxury vehicle manufacturing, the segment is anticipated to continuously lead the market.

The OEM segment accounted for the largest market share due to rising demands for customized paints and coating appearances. OEM provides a long-term supply of paints and coatings, which has made them popular. Moreover, with growing consumer demands for luxury vehicles, aesthetic appearances, and comfort, the segment is significantly fueling. The rising automobile sales are projected to enhance the segment growth in the upcoming period.

The polyurethane segment held the biggest share of the automotive paints & coatings market. The segment growth is attributed to high durability, chemical resistance properties, high strength, flexibility, adhesion, and high-gloss finishing ability of the polyurethane. Additionally, the ability of low VOC (volatile organic compound) emissions makes them the first preference for the sustainability-conscious manufacturers. The rising demand for high-quality coatings and focus on environmental sustainability, the segment is witnessing spectacular growth.

The electrocoats segment captured a significant market share in 2024. Rising demand for superior gloss finish and appealing exterior appearance on advanced and luxurious vehicles is positively inducing the demand for automotive clearcoats. In addition, temperature fluctuation, long term protection from micro scratches projected to propel the demand for clearcoats in the automotive segment.

Electrocoats offer large number of benefits such as superior throw power, higher corrosion resistance, and lower curing temperature owing to which the segment is gaining high popularity. The market for electrocoats capture significant revenue share and expected to propel prominently during the forecast period. HAP’s free properties coupled with lower VOC formulation contribute significantly towards environmental protection. Furthermore, market players adopt various types of electrocoats such as cathodic epoxy, anodic acrylic, anodic epoxy, and cathodic acrylic because of their attractive properties and benefits that make vehicle surface more durable and weather resistant.

The waterborne coating segment accounted the highest market share in 2024. Owing to its capability to protect vehicle from severe weather condition along with substantial cost reduction. In addition, waterborne technology provides lower temperature processing, high chemical resistance, and solvent free preparation of coatings.

On the other hand, powder coating offers precise thickness of film that enables them to rectify inappropriate coated area, this makes powder coating a preferred choice for large end-use applications. Additionally, attractive features of paints & coatings that include cost effectiveness, environment-friendly, high quality, easy usability, and swift paint applicability are some of the key trends followed by the industry participants.

The global automotive paints & coatings market offers high competition due to presence of large number of players. The market players are adopting new strategies to behold their strong market footprint such as partnerships, long term contracts, and new product development. For instance, in February 2018, BASF announced the launches of R-M refinish and Glasurit paint brands in Europe. The paints are certified to reduce the CO2 emission as per biomass balance approach.

By Vehicle Type

By Coating Type

By Technology Type

By Texture

By Distribution Channel

By Raw Material

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

January 2025

June 2025