May 2025

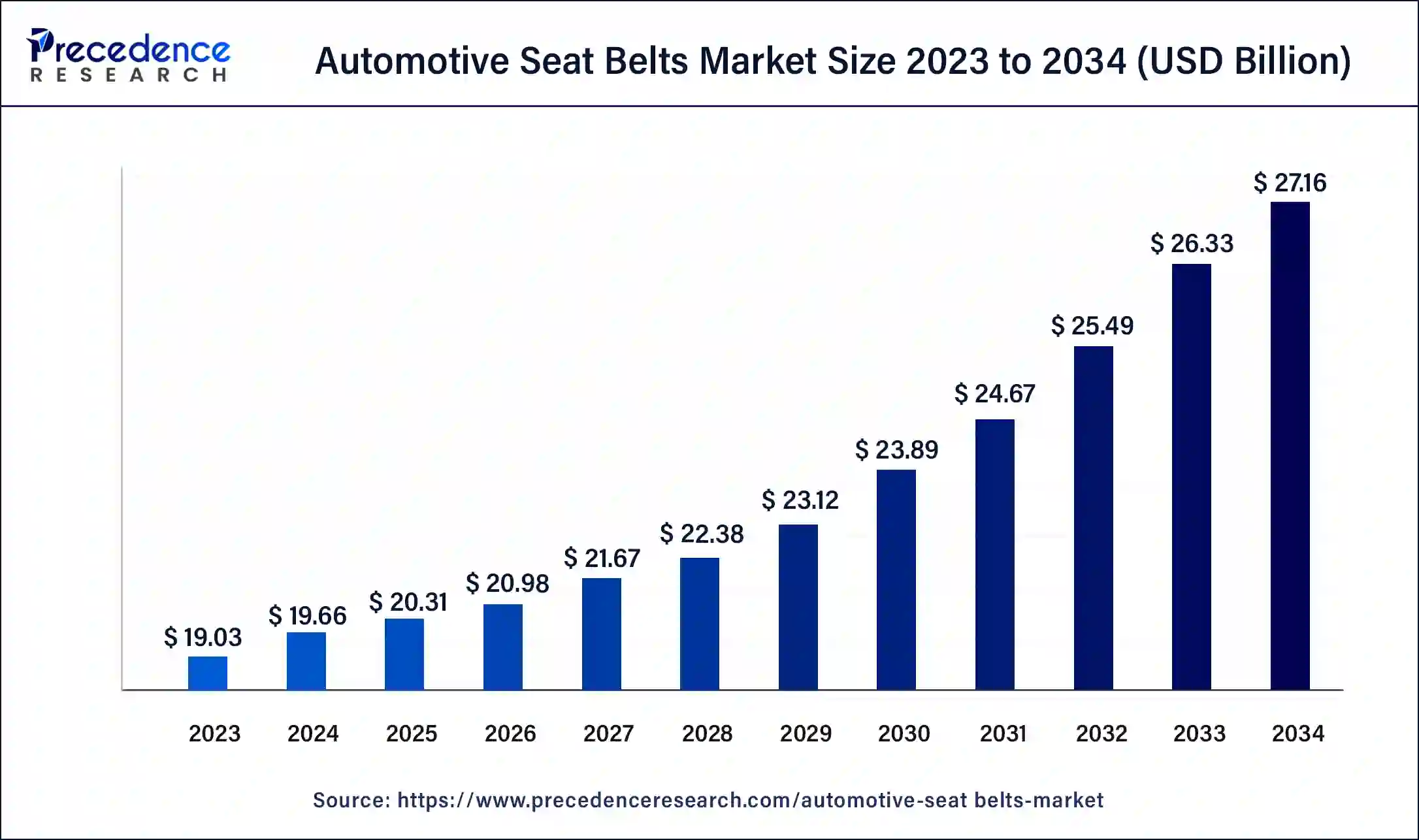

The global automotive seat belts market size was USD 19.03 billion in 2023, estimated at USD 19.66 billion in 2024 and is anticipated to reach around USD 27.16 billion by 2034, expanding at a CAGR of 3.28% from 2024 to 2034.

The global automotive seat belts market size accounted for USD 19.66 billion in 2024 and is predicted to reach around USD 27.16 billion by 2034, growing at a CAGR of 3.28% from 2024 to 2034.

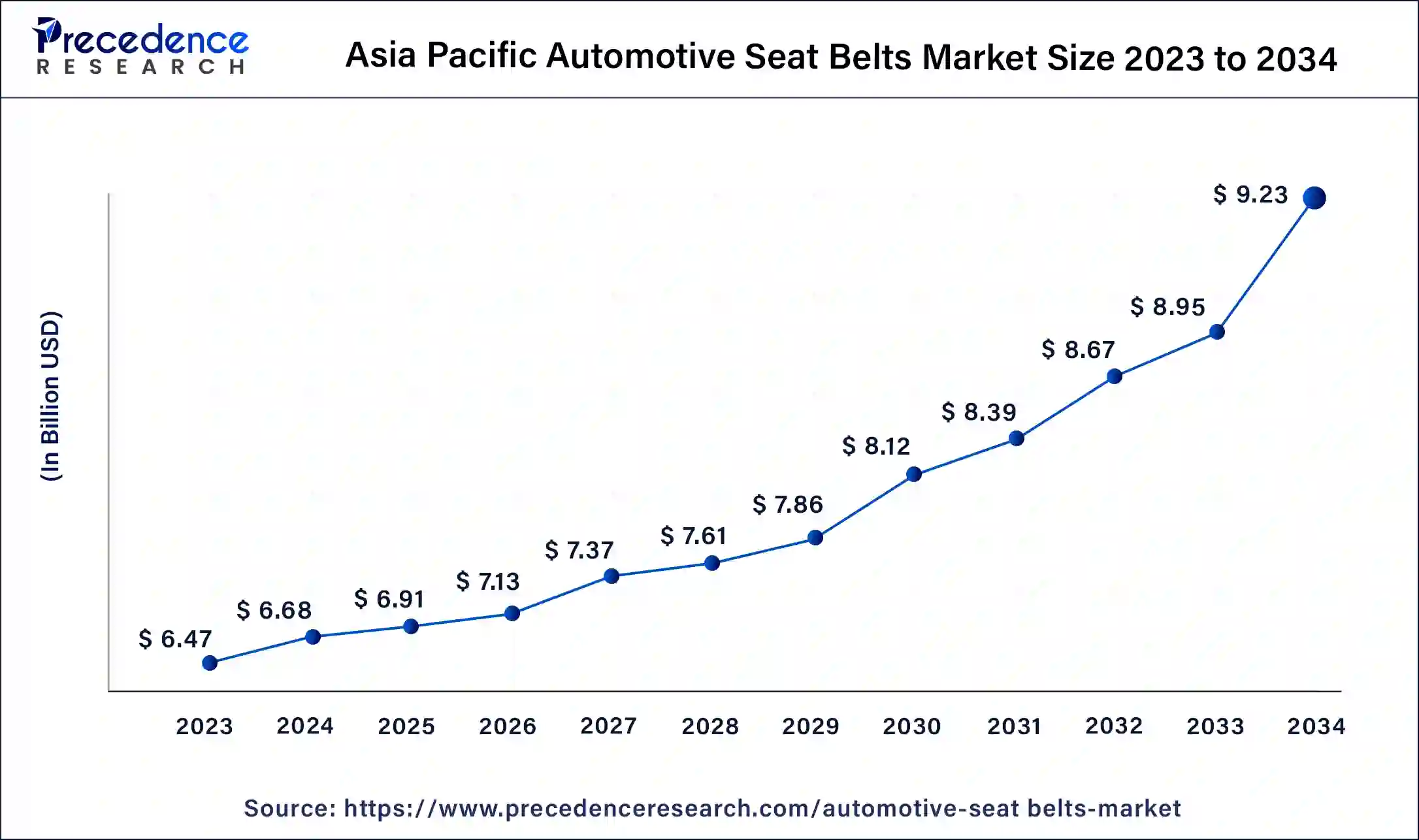

The Asia-Pacific automotive seat belts market size was valued at USD 6.47 billion in 2023 and is expected to be worth around USD 9.23 billion by 2034, rising at a CAGR of 4% from 2024 to 2034.

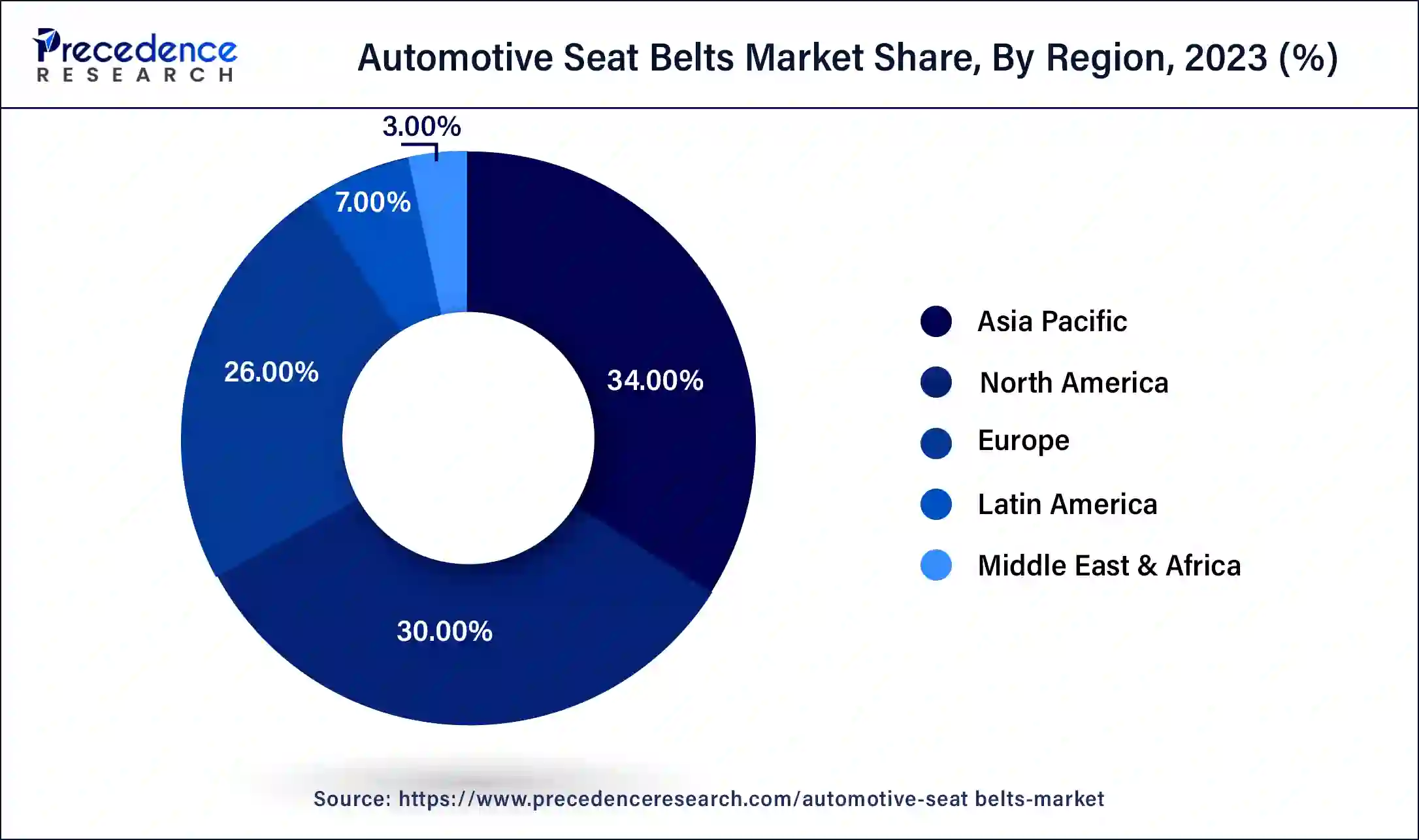

Asia-Pacific has held the largest revenue share of 34% in 2023. Asia-Pacific dominates the automotive seat belts market due to robust vehicle production, increasing awareness of road safety, and stringent government regulations mandating seat belt usage. Rapid urbanization, a rise in disposable incomes, and a growth in middle-class population contribute to higher vehicle ownership in the region. Additionally, collaborations between automotive manufacturers and seat belt suppliers for advanced safety technologies further propel market growth. The burgeoning automotive industry, coupled with a focus on enhancing safety features, positions Asia-Pacific as a major contributor to the global automotive seat belts market.

North America is estimated to observe the fastest expansion. North America commands significant growth in the automotive seat belts market due to stringent safety regulations and a high level of consumer awareness regarding road safety. The region's well-established automotive industry emphasizes safety features, propelling the demand for advanced seat belt technologies. Additionally, a robust aftermarket sector contributes to market growth as consumers prioritize retrofitting vehicles with upgraded safety systems. The presence of major automotive manufacturers and a proactive approach toward implementing safety standards position North America as a key player in driving innovations and market dominance for automotive seat belts.

Automotive seat belts are pivotal safety components designed to safeguard vehicle occupants during unforeseen events such as accidents or abrupt stops. Comprising a secure buckle and a webbed strap, these devices are fastened across the lap and chest of passengers. The fundamental role of seat belts is to confine individuals, preventing them from being ejected during a collision and thereby minimizing the likelihood of severe injuries or fatalities.

Modern seat belts incorporate advanced technologies, including pretensioners that automatically tighten the belt upon impact and force limiters that manage slack to reduce occupant impact. Working in tandem with other safety features like airbags, seat belts provide comprehensive protection. Adherence to seat belt usage is mandated in numerous countries due to their established effectiveness in saving lives and reducing injuries, solidifying their status as indispensable components of global vehicle safety systems.

| Report Coverage | Details |

| Market Size in 2023 | USD 19.03 Billion |

| Market Size in 2024 | USD 19.66 Billion |

| Market Size by 2034 | USD 27.16 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.28% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Vehicle, Component, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vehicle production growth and occupant protection focus

Vehicle production growth and a heightened focus on occupant protection are dual catalysts propelling the demand for automotive seat belts. As global vehicle production continues to surge, with an increasing number of automobiles being manufactured, the need for mandatory safety features becomes more pronounced. Governments and regulatory bodies worldwide enforce stringent safety standards, making seat belts a fundamental requirement in new vehicles. This surge in production not only mandates the inclusion of seat belts but also fuels the overall demand for these safety devices.

Simultaneously, the automotive industry's intensified focus on occupant protection amplifies the significance of advanced seat belt systems. Manufacturers are investing in research and development to enhance seat belt designs, incorporating features like pretensioners and force limiters. Consumers, now more than ever, prioritize vehicles equipped with comprehensive safety measures. This dual momentum, driven by both production growth and occupant protection emphasis, synergistically contributes to the rising demand for advanced and technologically superior automotive seat belts in the market.

Global economic Fluctuations and limited retrofitting options

Global economic fluctuations pose significant challenges for the automotive seat belts market as they directly impact vehicle production and consumer purchasing power. During economic downturns, reduced consumer spending on automobiles can lead to a decline in the overall demand for seat belts. Additionally, automotive manufacturers may cut back on production, affecting the incorporation of seat belts in new vehicles. The cyclical nature of the economy thus presents a restraint on the market's growth, making it susceptible to economic uncertainties. Limited retrofitting options also constrain the market demand for automotive seat belts.

Retrofitting advanced seat belt systems into existing vehicles can be technically complex and expensive, dissuading vehicle owners from upgrading their seat belt systems. This limitation is particularly relevant in regions with a significant number of older vehicles on the road. The challenge of retrofitting hinders the market's potential growth, as it restricts the adoption of advanced seat belt technologies in the existing vehicle fleet, which is a considerable portion of the automotive market.

Advanced technologies integration and focus on lightweight materials

Advanced technologies integration and a focus on lightweight materials are pivotal in creating significant opportunities within the automotive seat belts market. The incorporation of cutting-edge technologies, such as sensors and artificial intelligence, enables the development of intelligent seat belt systems that can respond dynamically to driving conditions. This innovation enhances overall safety, providing opportunities for manufacturers to differentiate their products in a competitive market. Simultaneously, a focus on lightweight materials addresses broader industry trends towards fuel efficiency and sustainability. Lightweight seat belt materials not only contribute to vehicle weight reduction but also align with environmental goals.

Opportunities arise for seat belt manufacturers to leverage these advancements, meeting consumer demands for both enhanced safety features and eco-friendly solutions. As automotive manufacturers seek ways to optimize vehicle performance and efficiency, seat belts crafted from lightweight materials with advanced technologies become integral components, opening avenues for growth and market expansion.

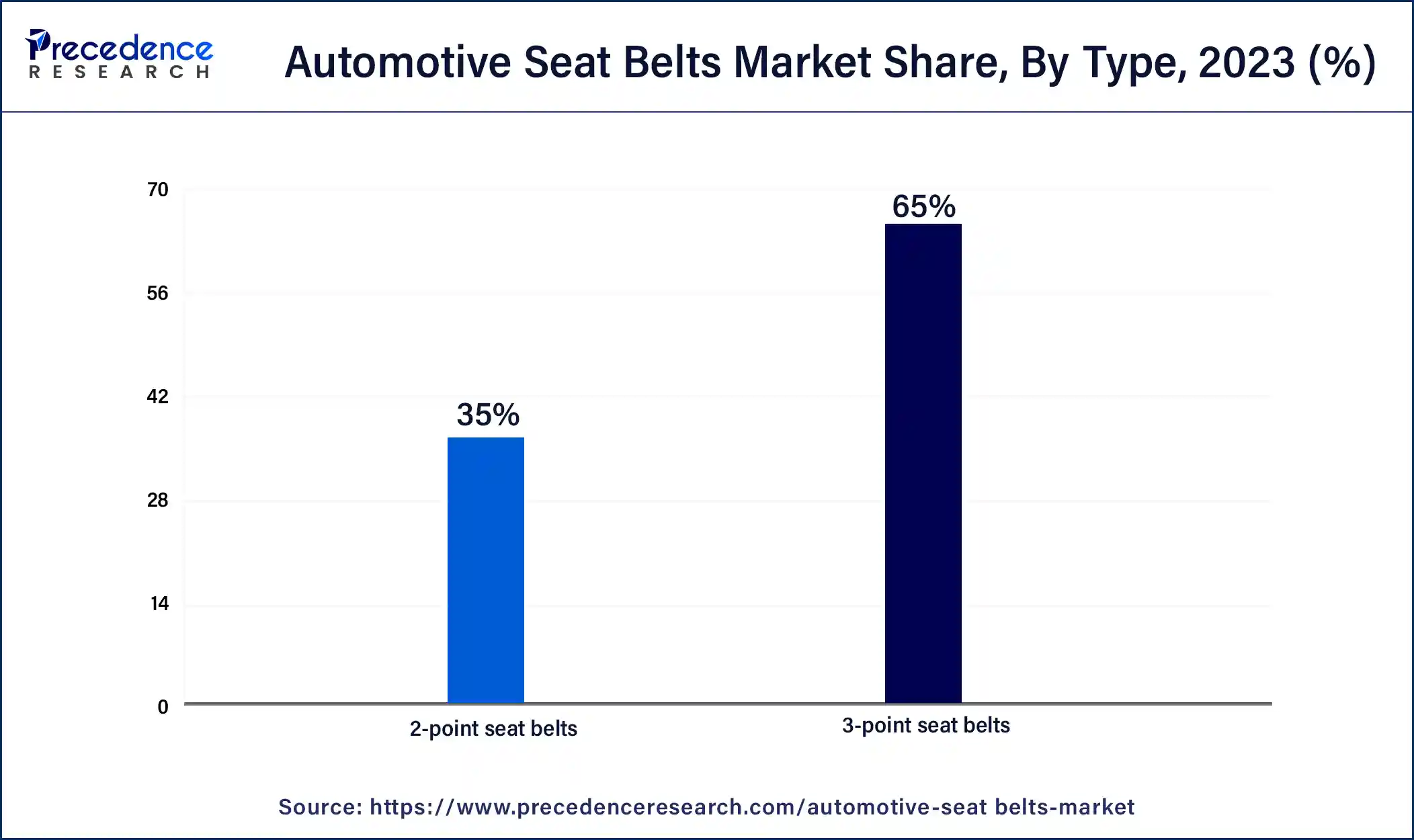

In 2023, the 3-point seat belts segment had the highest market share of 65% based on the type. The 3-point seat belt segment in the automotive seat belt market refers to safety restraints with three attachment points – one over the occupant's lap and two across the chest. This design provides enhanced protection compared to older belt configurations. Trends in the 3-point seat belts segment involve continuous improvements in design and materials, ensuring better comfort and safety. The adoption of pretensioners and load limiters in 3-point seat belts further enhances their effectiveness, reflecting a commitment to advancing occupant protection in vehicles.

The 2-point seat belts segment is anticipated to expand at a significant CAGR of 4.3% during the projected period. The 2-point seat belts segment in the automotive seat belts market refers to the traditional seat belt design with two anchorage points, typically securing the lap area. This segment, while historically prevalent, is experiencing a shift in trends as automotive safety standards evolve. Modern safety regulations and consumer preferences are driving a transition towards more advanced seat belt systems with additional anchorage points, such as 3-point or multi-point seat belts. Despite this shift, 2-point seat belts remain relevant, especially in certain vehicle types, contributing to a diverse seat belt market.

According to the vehicle, the passenger cars segment has held 47% revenue share in 2023. The passenger cars segment in the automotive seat belts market refers to seat belt systems designed specifically for vehicles intended for personal transportation. Trends in this segment include a heightened focus on smart seat belt technologies, integrating sensors for improved occupant safety. Additionally, customization options and aesthetic considerations are gaining prominence as consumers seek personalized features. The passenger cars segment is witnessing innovations that align with the broader market trends of advanced safety features and a seamless integration of technology for a more secure and comfortable driving experience.

The HCV segment is anticipated to expand fastest over the projected period. In the automotive seat belts market, the heavy commercial vehicle (HCV) segment refers to large trucks and buses designed for transporting goods or passengers. In recent trends, the HCV sector has witnessed a growing emphasis on safety, with increasing regulations mandating robust seat belt systems. Manufacturers are responding by integrating advanced technologies like pretensioners and adaptive restraint systems to enhance occupant protection. The demand for durable and effective seat belts in HCVs aligns with the broader industry focus on improving safety standards for both drivers and passengers in heavy-duty vehicles.

According to the component, the retractor segment has held a 25% revenue share in 2023. The retractor segment in the automotive seat belts market refers to the component responsible for controlling the length of the seat belt strap, ensuring proper restraint during vehicle movement or sudden stops. A key trend in retractors involves the integration of advanced technologies such as pretensioners and load limiters. Pretensioners automatically tighten the seat belt upon impact, while load limiters release controlled slack, optimizing occupant safety. This trend reflects an industry-wide commitment to enhancing seat belt effectiveness through technological innovations for improved crash protection and overall vehicle safety.

The pillar loops segment is anticipated to expand fastest over the projected period. The pillar loop is a crucial component of automotive seat belts, serving as the attachment point for the upper portion of the belt. This segment encompasses the anchor point on the vehicle's structure, typically located on the vehicle's B-pillar. Trends in pillar loop design focus on enhancing durability, ease of use, and compatibility with advanced restraint systems. Manufacturers are incorporating materials and engineering innovations to make pillar loops more robust and adaptable, aligning with the broader trend of integrating sophisticated technologies for improved safety and user experience in the automotive seat belts market.

According to the distribution channel, the OEM segment has held a 62% revenue share in 2023 The Original Equipment Manufacturer (OEM) segment in the automotive seat belts market refers to the direct supply of seat belts to vehicle manufacturers for installation in newly manufactured vehicles.

A key trend in this segment involves collaborative partnerships between seat belt manufacturers and OEMs to develop and integrate advanced safety features seamlessly. As safety regulations evolve, OEMs are increasingly prioritizing innovative seat belt technologies, creating opportunities for manufacturers to align their offerings with the evolving demands of vehicle producers and regulatory standards.

The aftermarket segment is anticipated to expand fastest over the projected period. In the automotive seat belts market, the aftermarket segment refers to the distribution channel involved in the sale of seat belts after the initial vehicle purchase. This includes replacement and upgrade options for existing seat belt systems. A current trend in the aftermarket segment involves a rising demand for advanced safety features, prompting consumers to retrofit vehicles with technologically enhanced seat belts. As safety-conscious consumers seek to improve their existing vehicles, the aftermarket presents an evolving landscape with a focus on innovative seat belt solutions and customization options.

Segments Covered in the Report

By Type

By Vehicle

By Component

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

April 2025

January 2025