January 2025

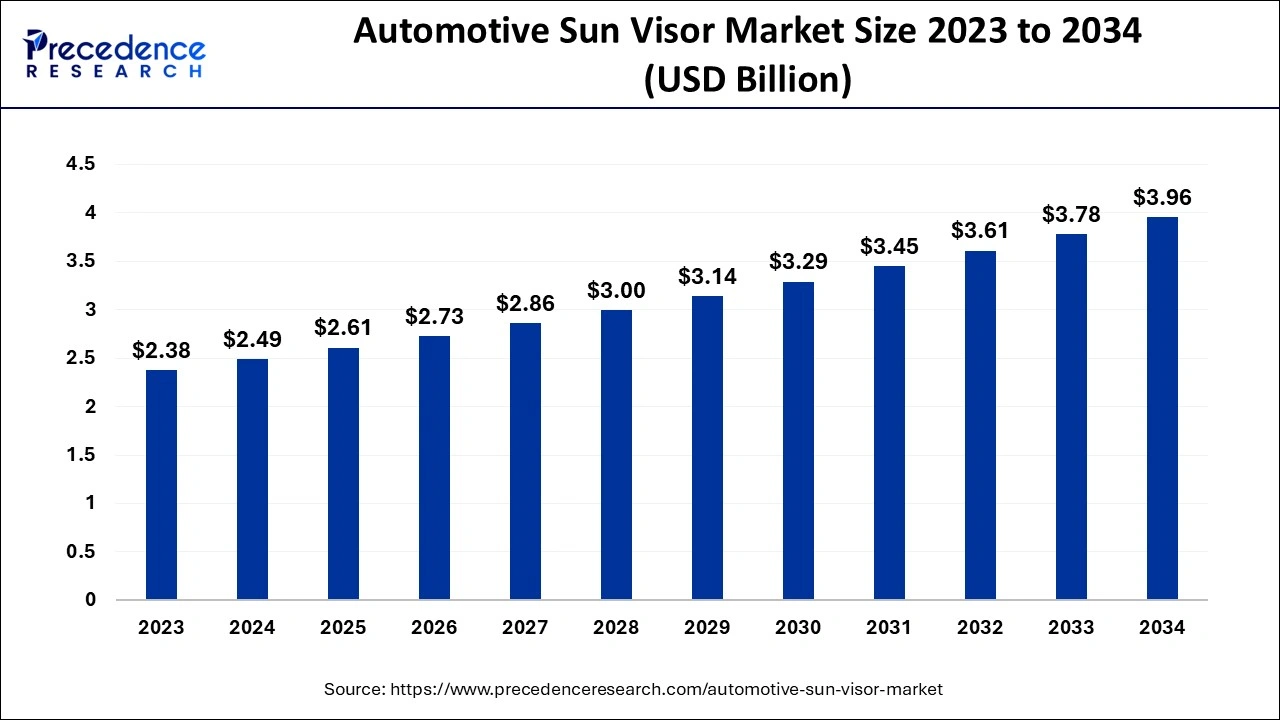

The global automotive sun visor market size is evaluated at USD 2.49 billion in 2024, grew to USD 2.61 billion in 2025 and is projected to surpass around USD 3.96 billion by 2034. The market is expanding at a CAGR of 4.74% between 2024 and 2034. The North America automotive sun visor market size is calculated at USD 1.02 billion in 2024 and is expected to grow at a CAGR of 4.79% during the forecast year.

The global automotive sun visor market size is worth around USD 2.49 billion in 2024 and is anticipated to reach around USD 3.96 billion by 2034, growing at a CAGR of 4.74% from 2024 to 2034. The rapidly growing automotive industry and the stringent regularities for automobile safety are driving the growth of the automotive sun visor market.

The integration of artificial intelligence (AI) into the automotive industry is revolutionizing the overall operations and productivity level of automobile manufacturers. AI integration in the automotive sun visor market, such as the development of the virtual visor, links the LCD panel with the driver-monitoring camera to track the sun’s cast shadow on the driver's face. The panel uses AI to analyze the driver’s face and identify the shadows on the face.

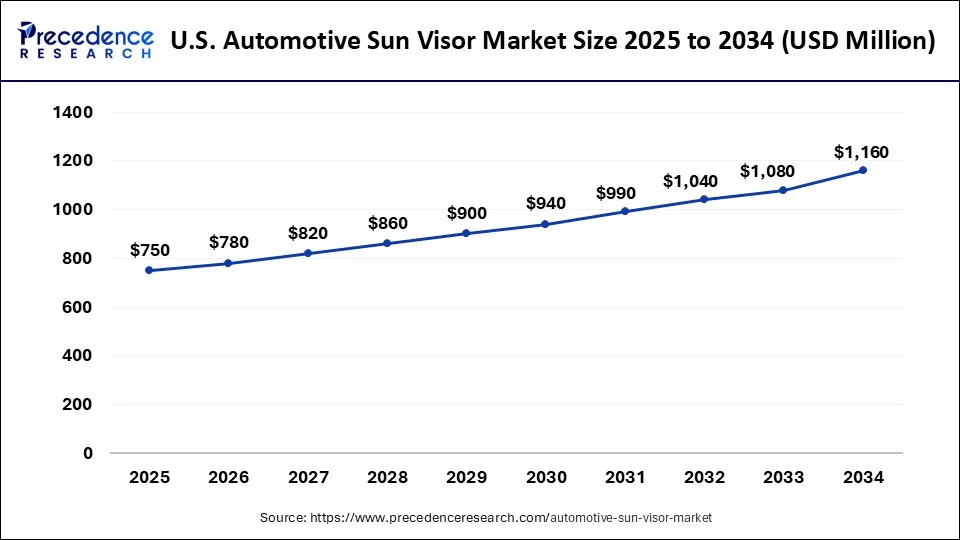

The U.S. automotive sun visor market size is exhibited at USD 710 million in 2024 and is expected to be worth around USD 1,160 million by 2034, growing at a CAGR of 4.98% from 2024 to 2034.

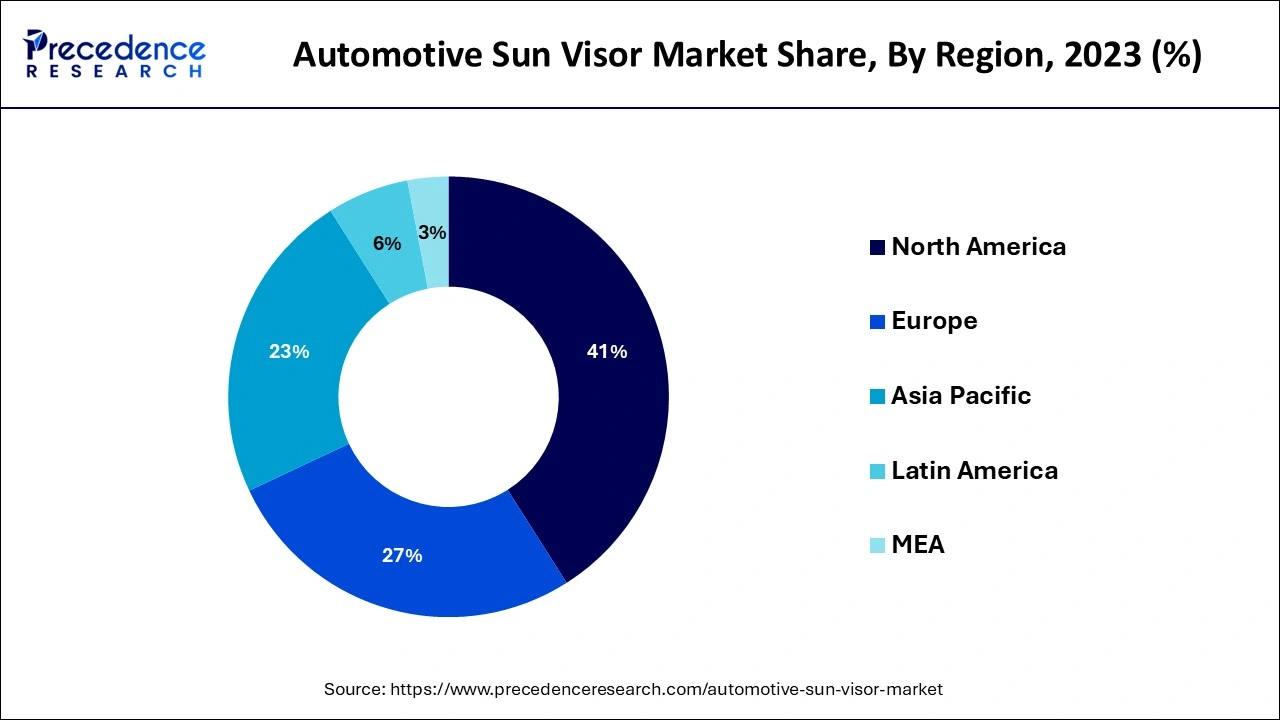

North America dominated the automotive sun visor market in 2023. The growth of the market is attributed to the rising availability of the leading automotive manufacturers and the demand for passenger and commercial vehicles. The development in regional economies like the United States and Canada and the rising disposable income in the population are driving the demand for the automotive sector. The rising awareness among consumers for the enhanced safety features with the technological advancements.

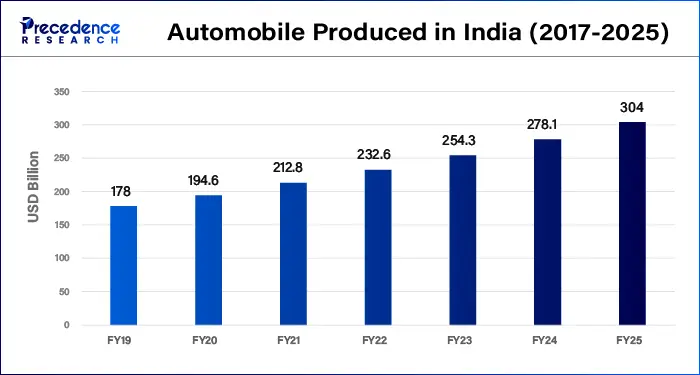

Asia Pacific will witness the fastest growth in the automotive sun visor market during the forecast period. The growth of the market is attributed to the rapidly growing economies like India, China, and Japan, the rise in disposable income, and changing lifestyle preferences. The rising development in industrialization and the growing demand for automobiles by the population for comfort and ease of travel are driving the demand for the automobile sector. The rising investment in the automotive manufacturing sector and technological advancements across the region.

Sun visors are one of the important parts of the automobile that are used as safety features and enable safer driving for the driver of cars. It is mainly used to restrict direct sunlight entering vehicles, which can reflect the eye of the driver and cause the chances of accidents. The rising regularity concern over automobile safety is driving the growth of the automotive sun visor market. In modern vehicles, there are two sun visors installed, one on the driver’s seat and the other one on the passenger seat.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.96 Billion |

| Market Size in 2024 | USD 2.49 Billion |

| Market Size in 2025 | USD 2.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.74% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle, Material, Component, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Awareness about automotive sun visors

The growing automotive industry and the rising concern over the new technologies, interior development, and safety features drive the growth of the automotive sun visor market. Sun visors offer several advantages, such as helping maintain and lower the interior temperature of the car by hindering direct sunlight from entering the vehicle. It protects the electronic parts of the cars, such as music stereos, CDs, and others, from the heat caused by direct sunlight. It also helps protect the interiors of the car, such as the car seat and dashboard color.

Fluctuating supply of raw material

The fluctuating availability and prices of raw material for the making of sun visors such as fibers, vinyl, and different types of plastics due to the supply chain and distribution and other factors which are limiting the expansion of the automotive sun visor market.

Technological integration

The evaluation of technologies for sun visors and other components of vehicles is driving growth opportunities in the automotive sun visor market. Technological advancements such as transparent LCD, virtual visors, and intuitive cameras replace the traditional sun visors in the automobile. The rising intervention of the leading manufacturers in the technological evaluation of the automobile parts in the market.

The passenger vehicle segment dominated the automotive sun visor market in 2023. The rising population and the increasing demand for passenger vehicles in the market owing to the economic development in the countries and the rising disposable income in the population driving the shift in the lifestyle and acceptance of luxury is driving the demand for the automotive industry and increase the demand for the passenger vehicles that results in the increased demand for the sun visors in the passenger vehicles. Sun visors are one of the essential parts of passenger vehicles, also known as the windscreen, and are used as a safety concern. The growing concern towards the increasing safety in passenger vehicles and the rapidly growing automobile industry, as well as the development of passenger cars with new interiors, enhanced safety features, and aesthetics, are contributing to the expansion of the passenger vehicle segment.

The commercial vehicle segment is expected to witness significant growth in the automotive sun visor market during the forecast period. The growth of the segment is attributed to the rising transportation and supply chain industry, which causes the increased demand for commercial vehicles such as trucks, trailers, and other heavy-load vehicles. Sun visors help hinder the entrance of sunlight into the eyes of the passengers or drivers, which causes distraction and leads to accidents. The sun visor in commercial vehicles plays an important role in minimizing the chances of accidents, which hamper the productivity and efficiency of commercial operations. The increasing interventions of the leading automotive players in the development and addition of new safety features in commercial vehicles are contributing to the demand for sun visors in the commercial vehicle segment.

The vinyl segment led the global automotive sun visor market in 2023. The increased use of vinyl for the manufacturing of sun visors for the automotive industry is due to its enhanced properties, such as excellent UV (ultraviolet) resistance properties that increase the lifespan of automotive sun visors. Vinyl is the most cost-efficient and durable material used in the manufacturing of different parts and components of the automobile. This material is highly used for the making of sun visors, seat covers, interior trims, and others. It has a high resistance to wear and tear, which makes it an ideal material for the interiors of the vehicle. The vinyl materials are lower in terms of development and installation costs due to the low cost of raw materials and convenience in use. The increasing adoption of vinyl material by automotive manufacturers due to the ease of use, easy availability, and low development and installation costs is driving the demand for the vinyl material segment.

The fabric segment will witness substantial growth in the automotive sun visor market during the predicted period. There are different types of fabrics that are used in sun visor manufacturing as nylon is considered the best material for automotive sun visors It provides enhanced aesthetics and UV resistance properties, which boosts the demand for fabric material adoption for the making of automotive sun visors.

The conventional segment accounted for the largest share of the automotive sun visor market in 2023. The increasing demand for conventional sun visors by the commercial and passenger vehicle segments is due to their affordability in terms of manufacturing and low cost of development. The increasing preference for choosing the right and affordable materials for the making of conventional sun visors, increasing adoption of conventional sun visors by the leading automobile players, and the enhancement of safety features associated with the conventional sun visors and further research and development activities in propelling the advancements of the conventional sun visors collectively driving the growth of the segment.

The LCD segment is expected to grow notably in the automotive sun visor market during the forecast period. The rising adaptation of technologies into the automobile sector and the advancement in the sun visor material and features which technologies are enhancing the growth of the segment. The LCD sun visors utilize liquid crystal technology, which enables adaptability in changing light conditions and adjusting lighting as per the tint levels. The ongoing research on the development of safety features of automobiles and interior features like sun visors, which play an important role in minimizing accidents, and the rising consumer expectations towards technological advancements are driving the growth of the LCD sun visors segment.

By Vehicle

By Material

By Component

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025