January 2025

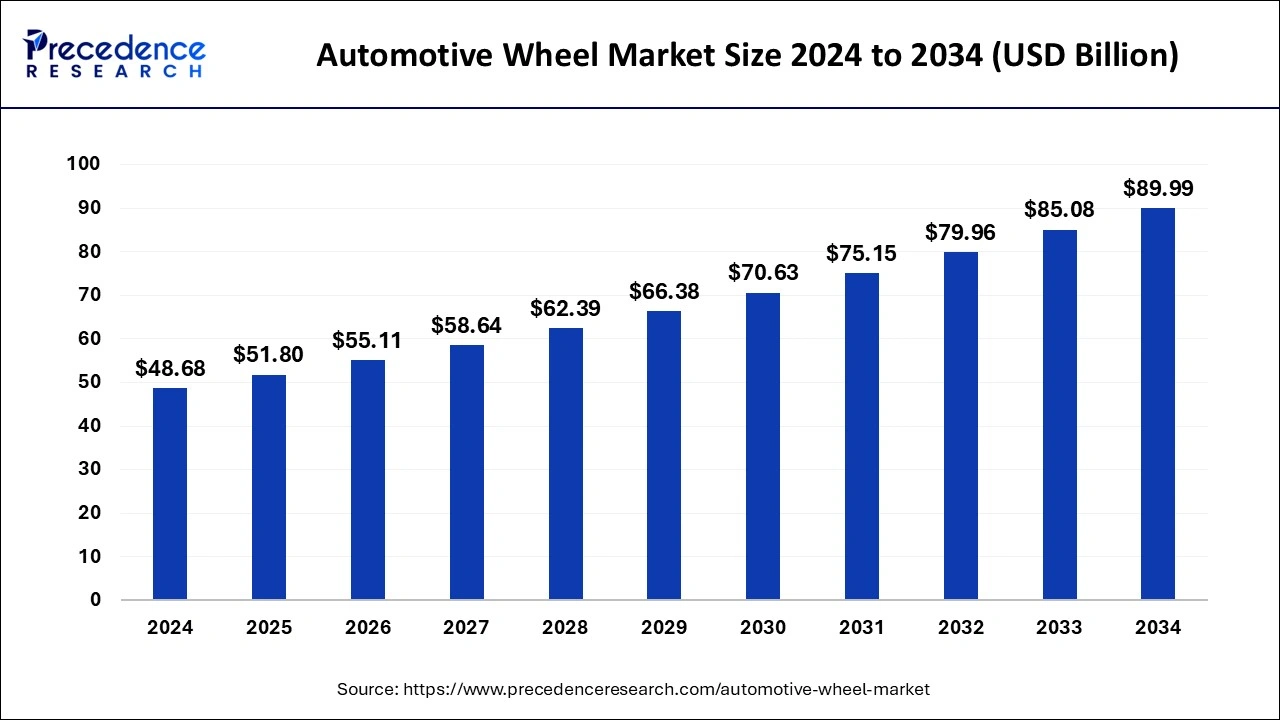

The global automotive wheel market size is calculated at USD 51.8 billion in 2025 and is forecasted to reach around USD 89.99 billion by 2034, accelerating at a CAGR of 6.34% from 2025 to 2034. The Asia Pacific automotive wheel market size surpassed USD 17.31 billion in 2025 and is expanding at a CAGR of 6.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive wheel market accounted for USD 48.68 billion in 2024 and is anticipated to reach around USD 89.99 billion by 2034, expanding at a CAGR of 6.34% from 2025 to 2034. The significant features of wheels including robust construction, lower cost, less maintenance, and high production raise their adoption in the automotive wheel industries and accelerate the growth of the automotive wheel market.

Artificial intelligence and generative AI have great potential to revolutionize the automotive industries and the automotive market by addressing and fulfilling the needs of customers. Generative artificial intelligence can harness a huge amount of data to provide useful insights into customer behavior. It can analyze vast amounts of data including browsing history, purchase patterns, and social media activity to create dynamic customer profiles that help to drive targeted marketing efforts. GenAI can transform a huge amount of data into personalized narratives. It also allows brands to organize personalized marketing campaigns for potential customers.

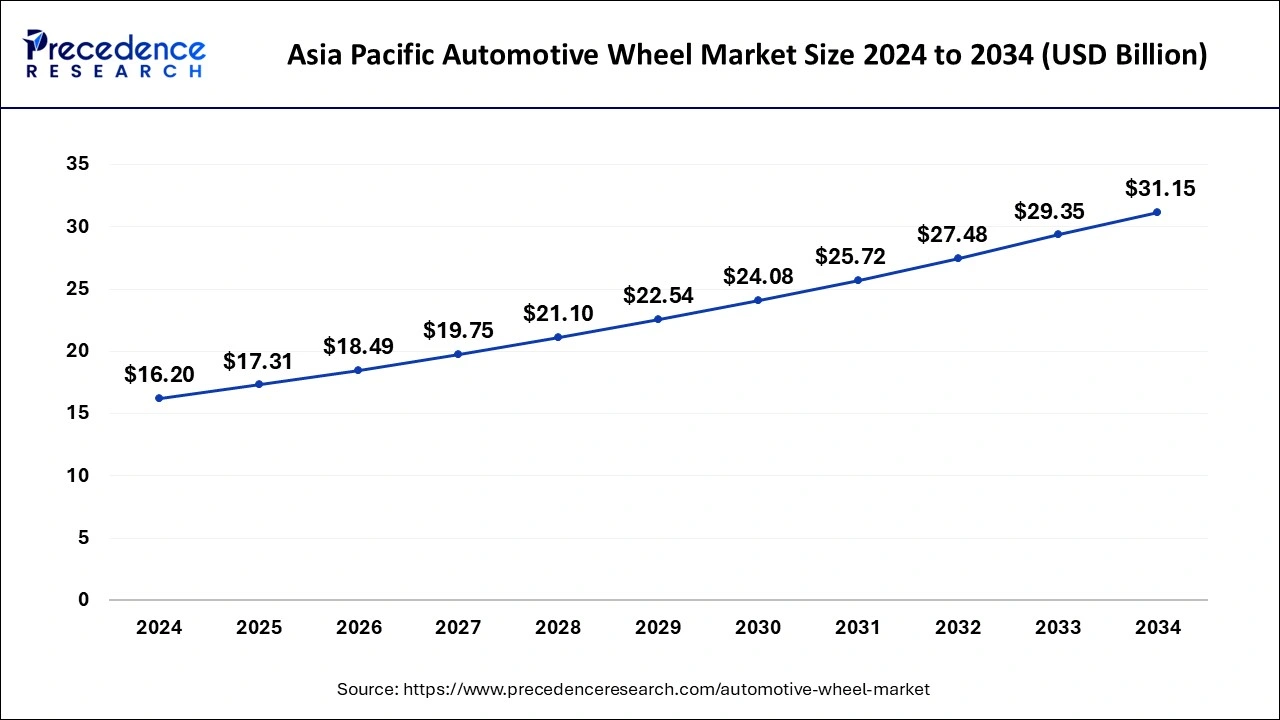

The Asia Pacific automotive wheel market size was estimated at USD 16.20 billion in 2024 and is predicted to be worth around USD 31.15 billion by 2034, at a CAGR of 6.76% from 2025 to 2034.

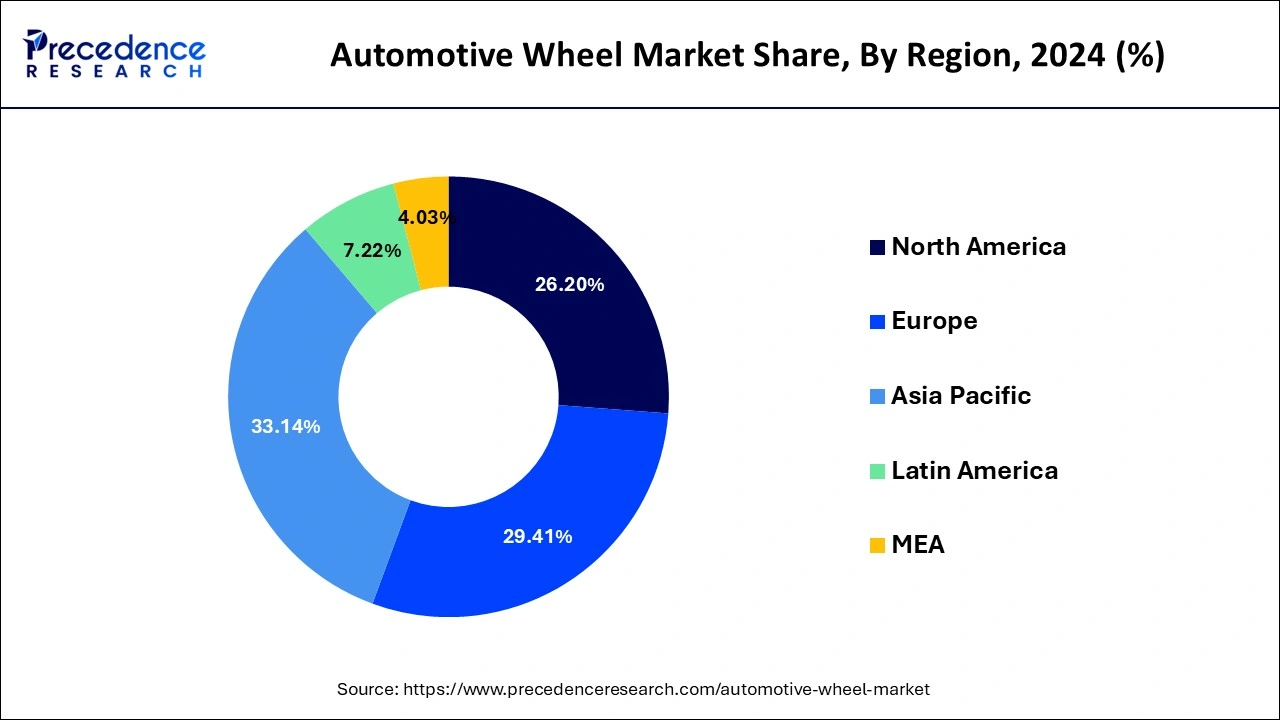

Asia-Pacific segment dominated the global automotive wheel market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The market’s expansion can be attributable to growing passenger vehicle production and demand. Furthermore, the growing need for fuel efficiency and vehicle performance, as well as the increased spending power of customers in developing countries, are propelling this market in Asia-Pacific.

Europe is estimated to be the most opportunistic segment during the forecast period. The automotive wheel market in Europe is expected to grow due to the rising demand for improved fuel economy in automobiles across the region. The automotive wheel market in Europe is expected to be propelled by the presence of original equipment manufacturer (OEM) across Europe with advanced material composition research and development initiatives.

Automotive wheels are used on vehicles, including lorries, passenger automobiles, and motorbikes. They improve the vehicle’s performance, traction, and overall ride quality. Lightweight metals and aerodynamics enhance fuel efficiency, while diverse wheel designs accommodate different driving situations and aesthetics.

| Report Coverage | Details |

| Market Size in 2024 | USD 48.68 Billion |

| Market Size by 2034 | USD 89.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.34% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, and By Vehicle, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing growth in automotive

As global vehicle production grows, the need for automotive wheels rises correspondingly. With emerging markets such as Asia-Pacific and Latin America experiencing a surge in automotive sales, producers are producing more vehicles to meet consumer demand. The growth of both passenger and commercial vehicles has contributed to a steady increase in the automotive wheel market.

Raw material price volatility

The volatility in raw materials poses significant challenges in the industry, and price hikes in vital components of manufacturing wheels such as aluminum, steel, can affect producers' profitability. The price fluctuations are considered by several factors, such as disruptions in timely supply and demand, trade regulations, and inflation, which add up to high production expenses and unstable economic conditions. Thus, it hinders automotive wheel market growth and compels manufacturers to face the challenges of high competition and increased production costs.

Development of advanced materials and technology

Advanced materials such as high-strength steel, forged aluminum, and composite materials provide improved strength and resistance to corrosion, creating the wheels more durable and capable of handling the stresses of road conditions, harsh temperatures, and impacts. More strength improves safety by providing better shock absorption and reducing the risk of wheel failure.

The aluminum segment dominated the market with a revenue share in 2024. With the future commercialization of the wheels, the segment is likely to be driven by the increasing application of diverse material types in dynamic environments.

The alloy segment is estimated to be the most opportunistic segment during the forecast period. The shape and performance of alloy wheels are the main factors for their adoption. The manufacturers are focusing on the lightweight construction of wheels because the automotive industry is primarily focused on energy savings.

The passenger vehicles segment dominated the global automotive wheel market in 2024, in terms of revenue. This is attributed to the increased demand for passenger vehicle wheels, the segment is experiencing significant expansion. The carbon fiber composites are now used in passenger vehicle wheels to provide a combination of high strength and light weight qualities.

The heavy commercial vehicle segment is estimated to be the most opportunistic segment during the forecast period. This is due to the surge in demand for advanced features of heavy commercial vehicles in the automotive wheel market during the forecast period.

Key Companies & Market Share Insights

Many key market players are investing extensively to expand their reach in order to offer their products to original equipment manufacturers (OEMs), as well as to place their manufacturing units near OEM facilities in order to better understand OEM requirements and the regional market. The various developmental strategies such as business expansion, investments, new product launches, acquisition, partnerships, joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players of automotive wheel. The automotive wheel market is also fragmented into many local and regional market players. In March 2020, the Zhejiang Jinfei Kaida invested for project of manufacturing aluminum wheel. To increase their market reach and position, the automotive wheel manufactures are focusing on improving their product portfolio by launching new products in the automotive wheel market during the forecast period.

By Material Type

By Vehicle Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025