December 2024

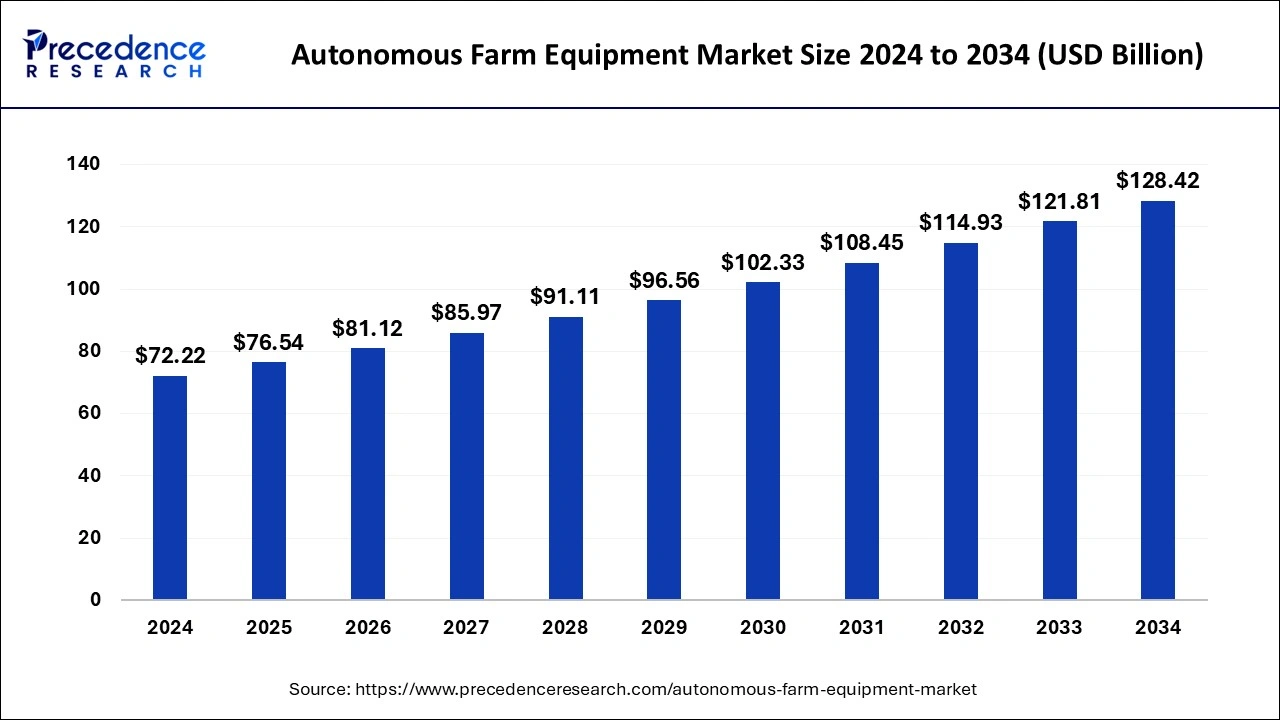

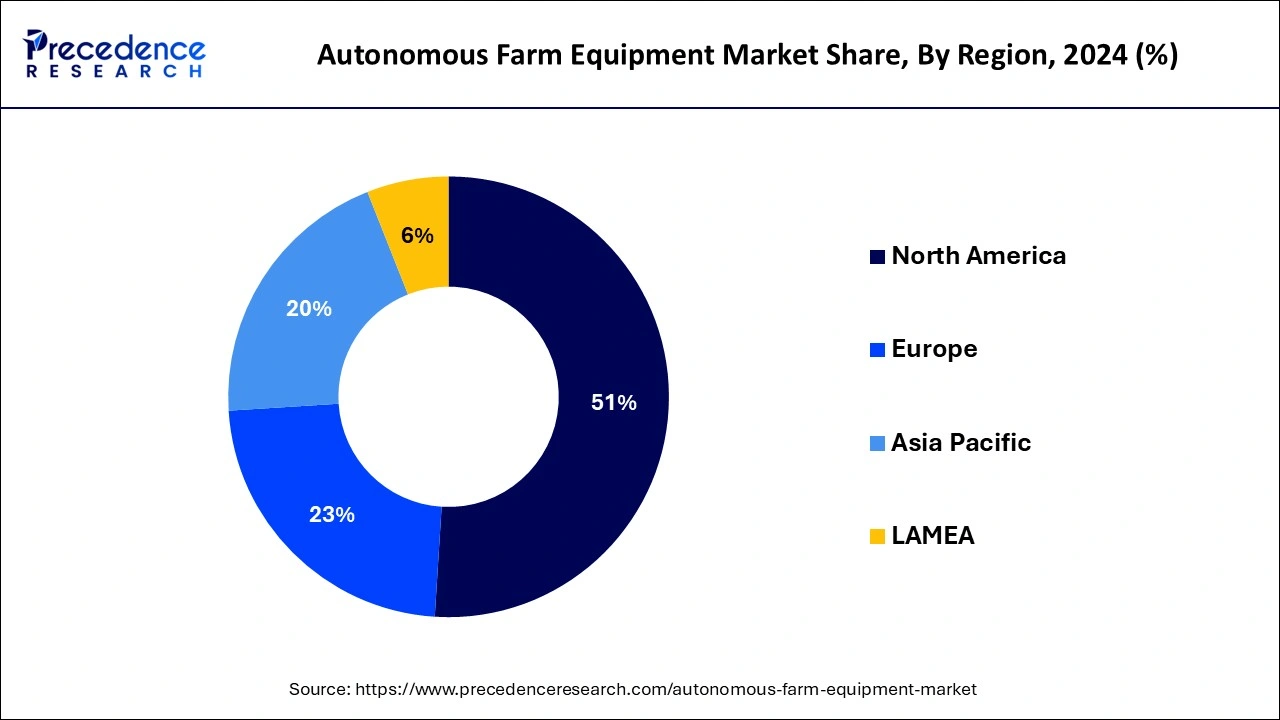

The global autonomous farm equipment market size is calculated at USD 76.54 billion in 2025 and is forecasted to reach around USD 128.42 billion by 2034, accelerating at a CAGR of 5.92% from 2025 to 2034. The North America autonomous farm equipment market size surpassed USD 36.83 billion in 2024 and is expanding at a CAGR of 6.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global autonomous farm equipment market size was estimated at USD 72.22 billion in 2024 and is predicted to increase from USD 76.54 billion in 2025 to approximately USD 128.42 billion by 2034, expanding at a CAGR of 5.92% from 2025 to 2034. Increasing adoption of precision farming techniques and the need to optimize agricultural processes, advancements in technology, such as GPS, IoT, AI, and robotics, are fueling innovation in the market.

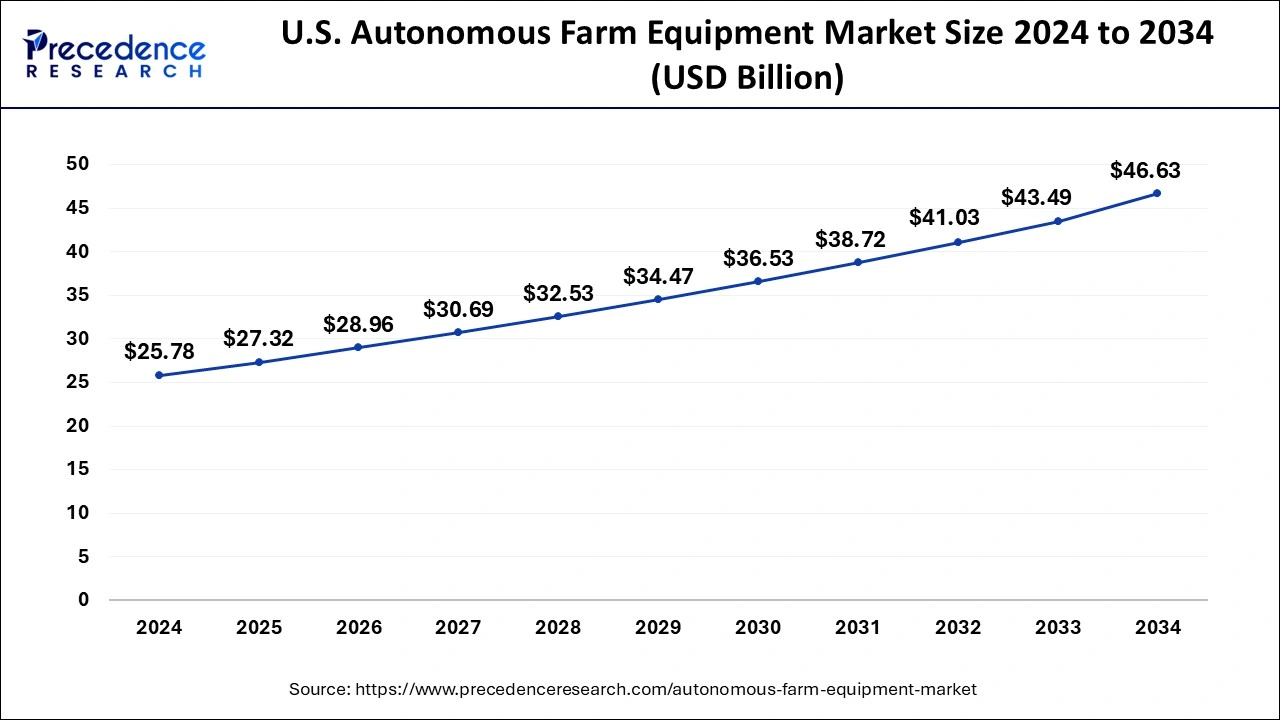

The U.S. autonomous farm equipment market reached USD 25.78 billion in 2024 and is estimated to surpass around USD 46.63 billion by 2034, at a CAGR of 6.11% from 2025 to 2034.

North America accounted for the highest revenue in the autonomous farm equipment market in 2024. The region's agricultural sector is highly developed and technologically advanced, making it fertile ground for automation solutions. In the United States, large-scale farms leverage automation to increase efficiency and reduce labor costs, with key crops, including corn, soybeans, and wheat, benefiting from advanced pieces of machinery such as autonomous tractors and precision planters.

North America stands out as a dominant region in the autonomous farm equipment market, with the United States and Canada leading the way in adoption and innovation. Canada boasts a strong agricultural industry focused on grain production, canola, and specialty crops. Both countries prioritize research and development in agricultural technology, driving the evolution of autonomous farm equipment. Additionally, government initiatives and subsidies support the adoption of automation solutions, further propelling North America's dominance in the market. With a robust infrastructure and a culture of innovation, North America continues to shape the future of autonomous farming on a global scale.

In the autonomous farm equipment market, Asia Pacific is witnessing rapid expansion driven by a combination of factors, including technological advancements, increasing agricultural modernization, and government support. The region is experiencing rapid expansion in autonomous farm equipment adoption, propelled by the modernization of agriculture in countries like China, India, and Japan. China, the world's largest agricultural producer, invests heavily in automation technologies to address labor shortages and improve productivity. India, with its vast agricultural land and growing population, seeks to enhance efficiency and sustainability through automation solutions.

Europe is expected to witness significant growth in the autonomous farm equipment market on a global scale due to opportunities for the market driven by technological innovation, changing agricultural practices, and supportive government policies. In Europe, countries like Germany and France are at the forefront of agricultural innovation. These nations prioritize sustainability and efficiency, driving the adoption of autonomous farm equipment such as robotic harvesters, precision irrigation systems, and drone technology. Furthermore, the European Union's Common Agricultural Policy encourages investment in modernization and automation, fueling market growth across the region.

The autonomous farm equipment is the term used to elaborate technically advanced machinery specially design to complete the specific task for farming processes that generally done by group of humans. This machinery includes vehicles operated on technically sound sensors, artificial intelligence tools and algorithms, GPS technology to perform a specific task precisely without human intervention.

Autonomous farm equipment is fabricated to assist farmers in working on a wide spectrum of tasks such as harvesting, planting, soil preparation, crop monitoring, etc. The autonomous farm equipment market is witnessing robust growth, driven by the increasing adoption of precision farming techniques and the need to optimize agricultural processes. Advancements in technology, such as global positioning systems (GPS), IoT, AI, and robotics, are fueling innovation in farm machinery. These technologies enable farmers to monitor and manage their operations remotely, improve efficiency, and reduce labor costs.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.92% |

| Market Size in 2025 | USD 76.54 Billion |

| Market Size by 2034 | USD 128.42 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Operation, By Product, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drones use

One of the major driving factors in the autonomous farm equipment market is the frequent use of unmanned drones for agricultural tasks. The use of drones offers multiple benefits to the farmer compared to manual working methods; thus, their usage is rising significantly. Over the years, the agriculture field embraced an innovative way to do precise farming with technically advanced equipment to increase the rate of yield.

Drones can be used to spread the amount of water and pesticides evenly in the specific farm area. Along with this, drones can collect data on soil and the status of crops with the amount of heat generated or dispersed by soil so as to detect the production capacity of expected crops by land. For instance, multispectral imaging methods are offered by drones to capture the light sensors in both visible and invisible in specific ranges.

To achieve this, NDVI maps are popular tools to gather valuable insights about crop status in the farm. NDVI stands for normalized difference vegetarian index. To indicate the malnourished crops, the map shows the amount of infrared light reflected in the specific area. The data can be collected from two weeks of physical signs shown by crops so that it can be fixed earlier to avoid loss in the farming sector. Therefore, it becomes an asset for farmers to raise their yield rate in farming.

High initial investment

One major restraint on the autonomous farm equipment market is the high initial investment required to implement automation solutions. While automation offers long-term benefits such as increased efficiency and reduced operational costs, the upfront costs can be prohibitive for many farmers, especially small-scale and medium-sized operations. These factors collectively contribute to slower adoption rates, particularly in regions with limited access to capital and technology expertise, thereby impeding the growth of the market.

Additionally, the complexity of integrating various technologies into existing farm infrastructure can pose challenges. Farmers may require specialized training to operate and maintain autonomous equipment effectively, adding to the overall cost burden. Moreover, concerns about data security and privacy can also hinder the adoption of automation solutions, particularly as more sensitive information is collected and stored digitally. Furthermore, the lack of standardized protocols between different automation systems can create compatibility issues, limiting the scalability of autonomous farming practices.

Next-generation technology for agriculture

The significant opportunity for the autonomous farm equipment market lies in the application of next-generation technology to farming techniques. The agriculture sector has always been at stake due to the dramatic changes in the environmental conditions that adversely affect the farm yield due to the uncertainty of climate. However, this hurdle can be resolved by incorporating automation in farming solutions such as fully autonomous systems, including weeding robots, semi-autonomous vehicles, tractors, etc.

The next-generation technology aids in smart decision-making for farmers with the help of navigation of farms by sensors, robotics, and analytics. Additionally, the rising use of artificial intelligence holds a promise to offer better and viable solutions for hurdles in autonomous farming with the help of huge sets of data and analytics to predict future outcomes. For instance, according to the prediction by AI tools, farmers could be able to strategically plan for what kind of seed sowing can be fruitful and when to begin it for optimum results.

Next-generation technology holds the potential to resolve a major hurdle faced by the farming market: a shortage of laborers and rising costs of chemically derived pesticides and fertilizers. This technology presents a promising future opportunity for sustainable farming practices and higher yield rates, thus driving an autonomous farm equipment market globally.

The autonomous farm equipment market is bifurcated into partially autonomous and fully autonomous operations. In 2024, the fully autonomous registered the largest market share. Fully autonomous operation, fueling the market growth owing to the rising implementation of précised farming systems without manual efforts.

In the autonomous farm equipment market, the autonomous segment of the farm equipment market is experiencing rapid growth fueled by advancements in artificial intelligence, robotics, and sensor technologies. Autonomous farm machinery, such as self-driving tractors and drones, offer farmers unprecedented levels of efficiency, precision, and scalability. These machines can perform tasks like planting, spraying, and harvesting with minimal human intervention, reducing labor-autonomous farm equipment costs and increasing productivity. Furthermore, autonomous systems can operate around the clock, optimizing resource utilization and maximizing yields. As a result, the autonomous segment is poised to revolutionize modern agriculture, driving further innovation and adoption in the industry.

The tractors segment accounted for the largest autonomous farm equipment market share in 2024 and is anticipated to continue its dominance over the foreseeable period. Autonomous tractors are self-driving vehicles specifically designed to work on the farm without human intervention, making decisions on their own. Autonomous tractors are designed to calculate the required speed and location based on algorithms they have fed into. This fully autonomous equipment is able to detect obstacles within their path, such as humans, larger objects, and animals, to avoid accidents. Farmers can use an autonomous tractor to perform various farming tasks such as fertilizing, planting, and spraying, where consistency, concentration, and precise methods are crucial. Navigating systems like GPS and mapping technologies allow them to work freely on the farm in the desired direction on their own, without a human operator sitting in the tractor cabin. However, for security and controlling purposes, humans can operate autonomous vehicles by using installed apps designed to control autonomous tractors via smartphones or computers.

In the autonomous farm equipment market, the harvesters segment is showcasing significant growth. Harvesters play a pivotal role in the market, revolutionizing the harvesting process. These machines are equipped with advanced technologies such as GPS guidance, yield monitoring systems, and autonomous harvesting mechanisms. They efficiently gather crops like grains, fruits, and vegetables, reducing the dependence on manual labor and increasing productivity. Modern harvesters are designed for versatility and are capable of adjusting to different crop types and field conditions. By optimizing harvesting operations, these machines enhance overall farm efficiency and profitability. Additionally, they enable farmers to harvest crops in a timely manner, minimizing losses and ensuring high-quality yields, thereby driving the growth of the market.

The hardware segment was observed to be the largest shareholder of the autonomous farm equipment market globally. Based on technology type, the market is segmented into hardware and software. Growth of the hardware segment is attributed to the rising technological advancement in the context of farming equipment with higher efficiency achieved by highly precise sensors, making the hardware operations easier to handle and operate. The hardware segment of the market encompasses a wide range of physical devices and machinery used in agricultural operations. This includes autonomous tractors, drones, sensors, actuators, and robotic arms. These hardware components are essential for enabling automation, precision farming, and data collection in modern agriculture. Advancements in hardware technology continue to drive innovation and efficiency in the industry, shaping the future of farming practices.

In the autonomous farm equipment market, the software segment is expected to show notable growth. The software segment of the market is integral to the industry's growth, providing essential tools for farm management, data analysis, and decision-making. Farm management software offers features such as crop planning, inventory tracking, equipment scheduling, streamlining operations, and optimizing resource allocation. Data analysis software enables farmers to analyze vast amounts of data collected from sensors, drones, and other sources, providing insights into crop health, soil conditions, and yield potential. Moreover, decision support systems utilize algorithms and predictive models to help farmers make informed decisions, enhancing productivity and sustainability in modern agriculture.

By Operation

By Product

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

January 2025