July 2024

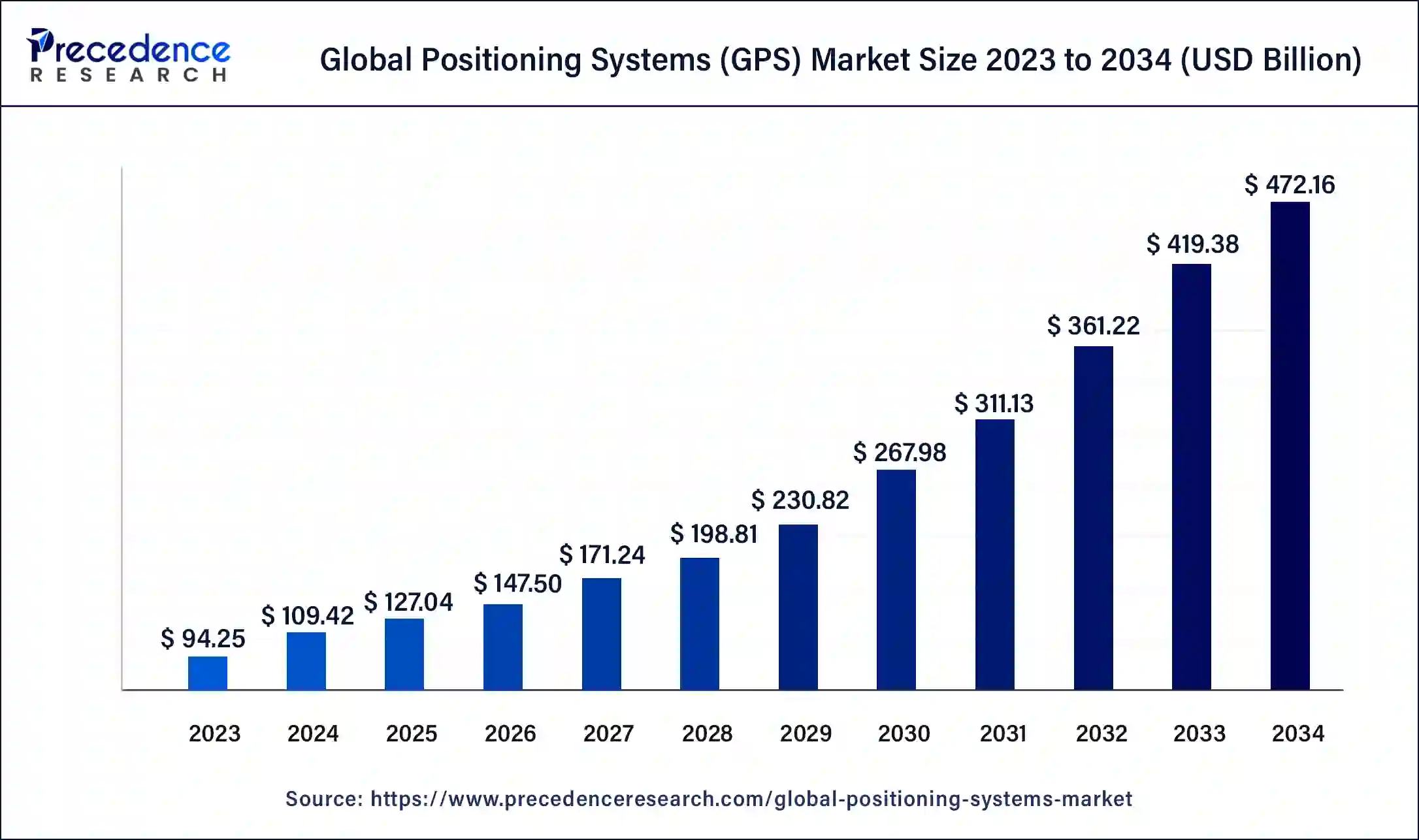

The global positioning systems (GPS) Market size was USD 94.25 billion in 2023, estimated at USD 109.42 billion in 2024 and is anticipated to reach around USD 472.16 billion by 2034, expanding at a CAGR of 15.7% from 2024 to 2034.

The global positioning systems (GPS) market size accounted for USD 109.42 billion in 2024 and is predicted to reach around USD 472.16 billion by 2034, growing at a CAGR of 15.7% from 2024 to 2034.

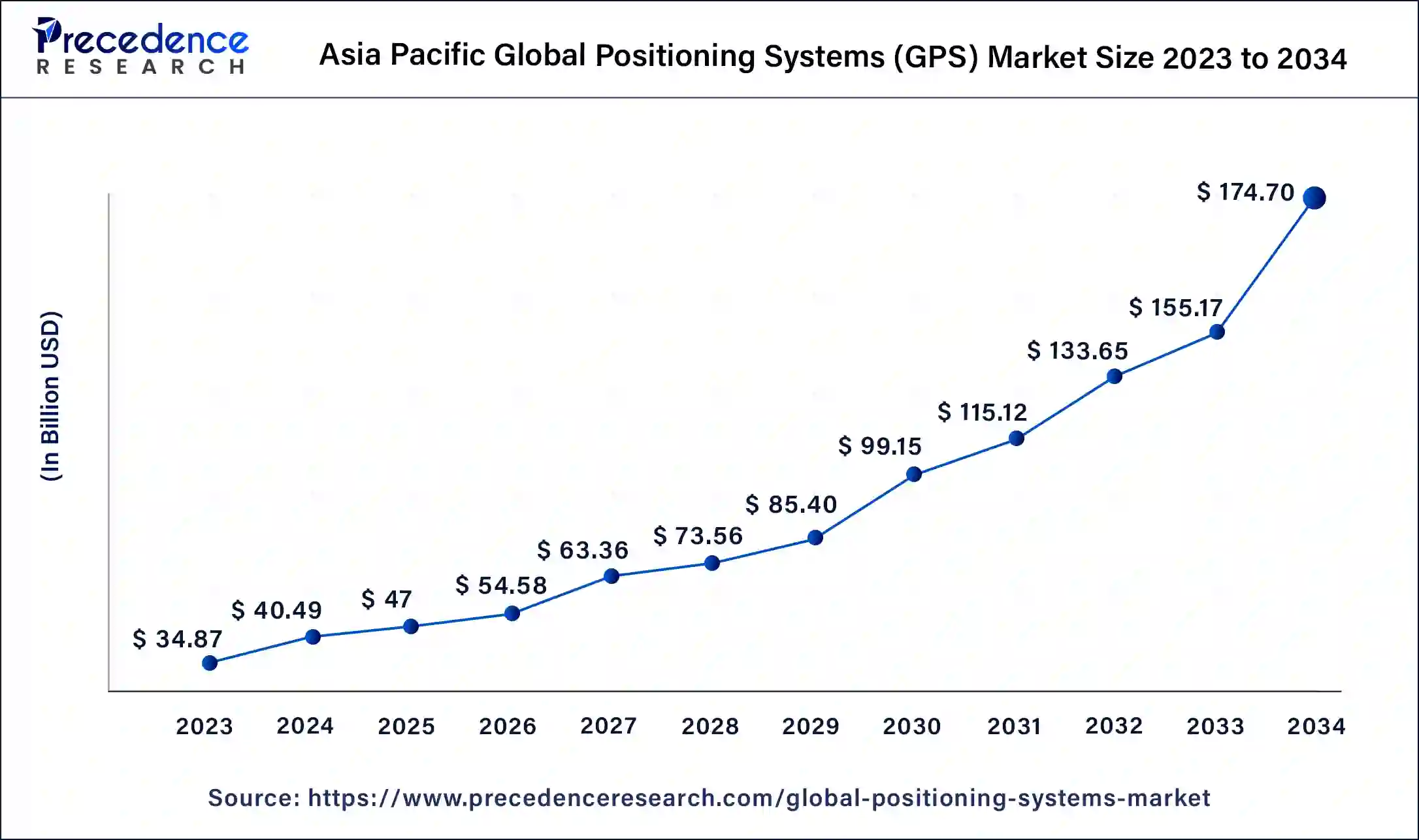

The Asia Pacific global positioning systems (GPS) market size was valued at USD 34.87 billion in 2023 and is expected to be worth around USD 174.70 billion by 2034, growing at a CAGR of 16% from 2024 to 2034.

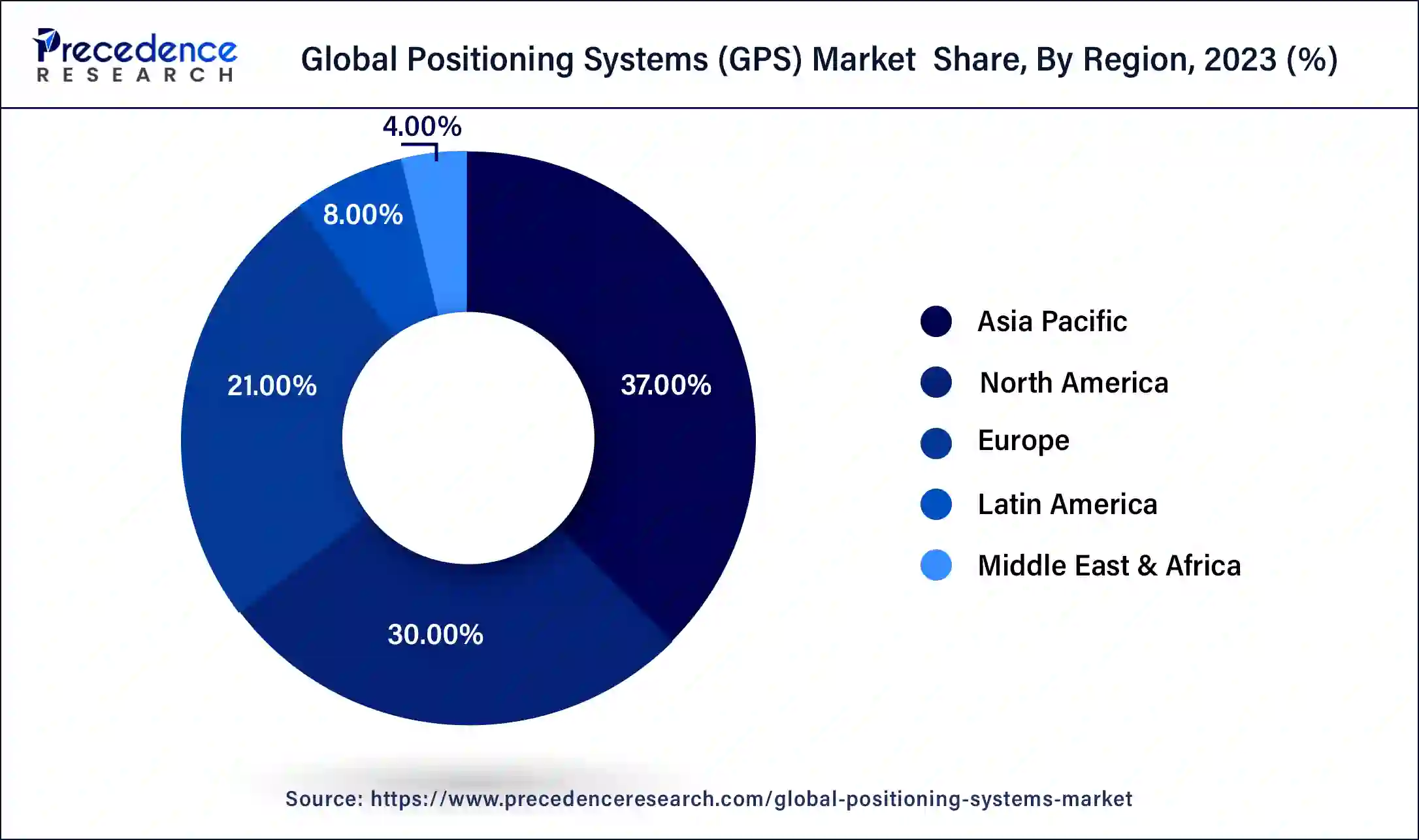

In 2023, Asia Pacific held a share of 37% in the global positioning systems market due to its rapid economic growth, extensive infrastructure development, and increasing adoption of GPS technology across various industries. Growing demand for location-based services, advancements in automotive navigation, and the expansion of precision agriculture contribute to the significant market share. Additionally, the region's thriving automotive sector, along with the rise in smart city initiatives and technological investments, further propels the adoption of GPS solutions, solidifying Asia-Pacific's prominent position in the global GPS market.

North America is projected to witness rapid growth in the global positioning systems (GPS) market due to the increasing adoption of advanced navigation and tracking technologies. The region's automotive, defense, and technology sectors are driving demand for GPS applications, including autonomous vehicles and precision agriculture. The robust infrastructure and investments in research and development contribute to the innovation and deployment of GPS solutions. As industries recognize the critical role of GPS in diverse applications, North America emerges as a key market, positioned for substantial growth in the coming years.

Meanwhile, Europe is experiencing notable growth in the global positioning systems (GPS) market due to increased adoption across various sectors. The European Union's Galileo satellite constellation, offering a homegrown alternative to GPS, has significantly contributed to the region's GPS advancements. Moreover, rising applications in autonomous vehicles, precision agriculture, and smart cities have fueled demand. The European market's growth is further propelled by a robust automotive industry, government initiatives, and the integration of GPS technology in diverse sectors, emphasizing the region's pivotal role in the global GPS market.

Global positioning system (GPS) is a technology that allows accurate determination of a location on Earth using signals from a network of satellites. These satellites orbit the planet and continuously transmit signals that can be picked up by GPS receivers, commonly found in devices like smartphones or dedicated navigation systems. GPS works by calculating the time it takes for signals to travel from multiple satellites to the receiver.

By triangulating these signals, the GPS receiver can pinpoint its exact location, providing latitude, longitude, and often altitude information. This technology is widely used for navigation, mapping, tracking, and various applications in industries such as transportation, agriculture, and outdoor recreation. It has become an integral part of daily life, facilitating precise location-based services and enhancing our ability to navigate and explore the world.

Global Positioning Systems (GPS) Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 15.7% |

| Global Market Size in 2023 | USD 94.25 Billion |

| Global Market Size in 2024 | USD 109.42 Billion |

| Global Market Size by 2033 | USD 472.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Deployment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion in automotive navigation systems

The surge in the global positioning systems (GPS) market is strongly propelled by the widespread integration of GPS technology into automotive navigation systems.

As over 100 million cars worldwide were equipped with embedded navigation systems in 2021, the demand for GPS in vehicles continues to grow.

The success of automotive navigation systems lies in providing drivers with real-time and accurate location information, turn-by-turn directions, and enhanced traffic management. Consumers increasingly seek advanced navigation features and connected car services, driving the automotive industry's adoption of GPS technology.

The expansion in automotive navigation systems not only improves the overall driving experience but also supports the development of autonomous vehicles and advanced driver assistance systems (ADAS). As the automotive sector advances towards autonomous driving, the reliance on GPS for precise positioning and navigation further fuels the demand for GPS solutions, contributing significantly to the market's success and expansion.

Dependency on satellite constellations

The dependency on satellite constellations poses a significant restraint on the global positioning systems (GPS) market. GPS relies on a network of satellites working together to provide accurate positioning information. Any disruption, malfunction, or failure within this satellite constellation can directly impact the availability and reliability of GPS services. This vulnerability introduces a risk of service outages, which can have widespread consequences across various industries and applications that heavily rely on precise navigation and location data.

The potential challenges related to satellite constellation dependency underline the importance of addressing reliability issues and developing contingency plans. As the demand for GPS continues to grow, ensuring the resilience of satellite constellations becomes crucial to maintaining the trust and usability of GPS technology across sectors such as transportation, agriculture, and defense. Efforts to enhance satellite network robustness and explore alternative solutions will be pivotal in mitigating the impact of this dependency on the overall GPS market demand.

Integration with emerging technologies

The integration of global positioning systems (GPS) with emerging technologies is creating exciting opportunities for market growth. As GPS technology intersects with artificial intelligence (AI), machine learning, and the Internet of Things (IoT), it opens up new possibilities for enhanced functionality and innovative applications. AI and machine learning algorithms can leverage GPS data to provide predictive insights, improving route optimization, and enabling smart navigation solutions. Additionally, the integration with IoT allows for real-time tracking and monitoring of assets, making GPS an integral part of the interconnected ecosystem in industries such as logistics, transportation, and smart cities.

These advancements not only enhance the accuracy and efficiency of GPS but also pave the way for novel applications in diverse sectors. As businesses and industries continue to explore the potential of these integrated technologies, the GPS market stands to benefit significantly, offering solutions that go beyond traditional navigation to provide intelligent, data-driven insights and services. The ongoing synergy between GPS and emerging technologies positions the market to meet the evolving demands of a digitally connected world.

The location based services segment held the highest market share of 45% in 2023. The integration of location-based features in social media platforms, allowing users to share their location through geotagged posts, has become a common practice. This trend enhances user engagement and contributes to the prominence of location-based services. Location-based services play a crucial role in e-commerce, enabling businesses to offer personalized services, promotions, and advertisements based on the user's location. The Internet of Things leverages GPS technology for location tracking in various applications, including asset tracking, smart city initiatives, and connected devices. IoT devices often rely on location-based services to provide valuable data for analysis and decision-making.

The road segment is anticipated to witness rapid growth at a significant CAGR of 16.8% during the projected period. In the global positioning systems (GPS) market, the road segment refers to the application of GPS technology in navigation and traffic management for roadways. GPS-enabled devices in vehicles provide real-time location data, driving directions, and traffic updates, improving overall road safety and efficiency. A notable trend in this segment involves the integration of GPS with advanced driver assistance systems (ADAS) for features like lane departure warnings and collision avoidance, contributing to the growing emphasis on smart and connected technologies in the road transportation sector.

The consumer devices segment has held a 46% market share in 2023. The consumer devices segment in the global positioning systems (GPS) market refers to the deployment of GPS technology in devices designed for personal use. This includes smartphones, smartwatches, fitness trackers, and other portable gadgets. A notable trend in this segment is the increasing demand for location-based services in consumer electronics. Consumers seek GPS-enabled devices for applications such as navigation, fitness tracking, and social media geotagging. As the integration of GPS technology becomes standard in consumer devices, the market continues to witness a growing emphasis on convenience and real-time location-based functionalities.

The automotive telematics systems segment is anticipated to witness rapid growth over the projected period. Automotive telematics systems in the global positioning systems (GPS) market refer to the deployment of GPS technology in vehicles for real-time tracking, communication, and data transmission. This segment is witnessing a growing trend as more vehicles integrate advanced telematics features. Modern automotive telematics systems offer services like vehicle diagnostics, navigation, and connectivity, enhancing driver safety and providing valuable insights for vehicle maintenance. The increasing demand for connected cars and the rising emphasis on driver-assistance technologies contribute to the upward trend in the automotive telematics systems segment of the GPS market.

Segments Covered in the Report

By Application

By Deployment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

August 2024

April 2025

January 2025