March 2025

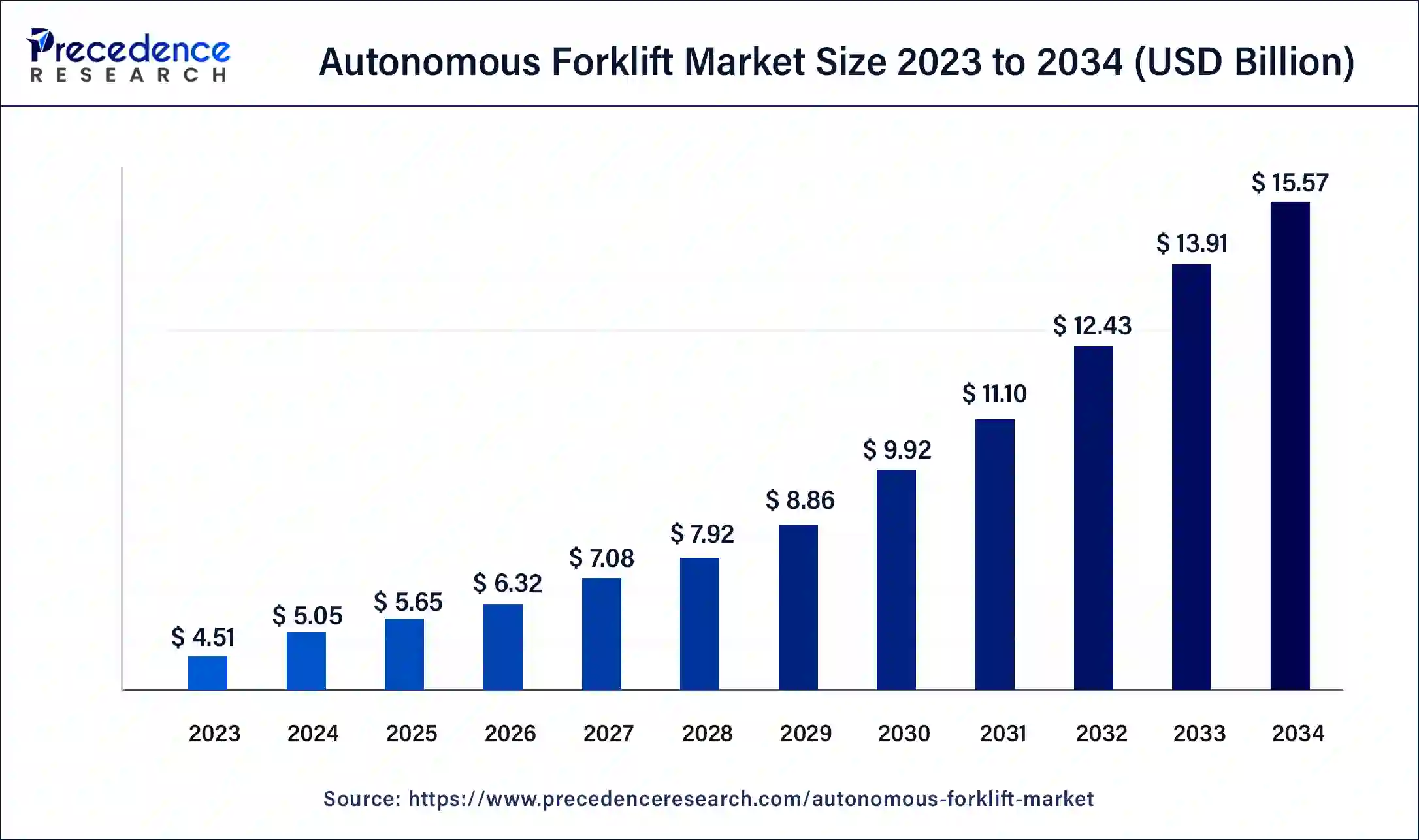

The global autonomous forklift market size was USD 4.51 billion in 2023, calculated at USD 5.05 billion in 2024 and is projected to surpass around USD 15.57 billion by 2034, expanding at a CAGR of 11.9% from 2024 to 2034.

The global autonomous forklift market size accounted for USD 5.05 billion in 2024 and is expected to be worth around USD 15.57 billion by 2034, at a CAGR of 11.9% from 2024 to 2034. Technological advancements, along with the rising application of autonomous forklifts across several industries, including automotive, e-commerce, aviation, metals & heavy machinery, etc., are responsible for driving the growth of the autonomous forklift market.

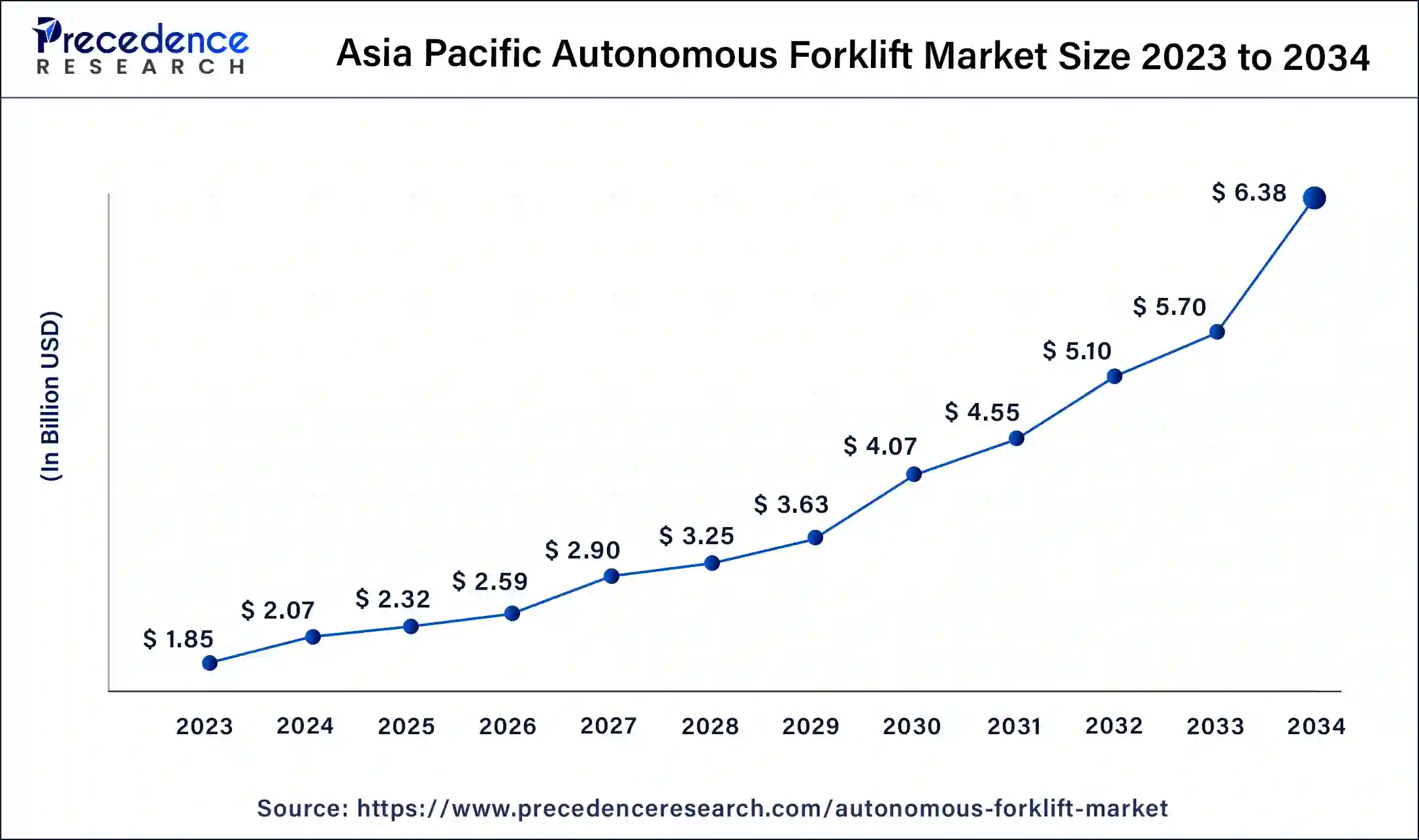

The Asia Pacific autonomous forklift market size was estimated at USD 1.85 billion in 2023 and is predicted to be worth around USD 6.38 billion by 2034, at a CAGR of 12% from 2024 to 2034.

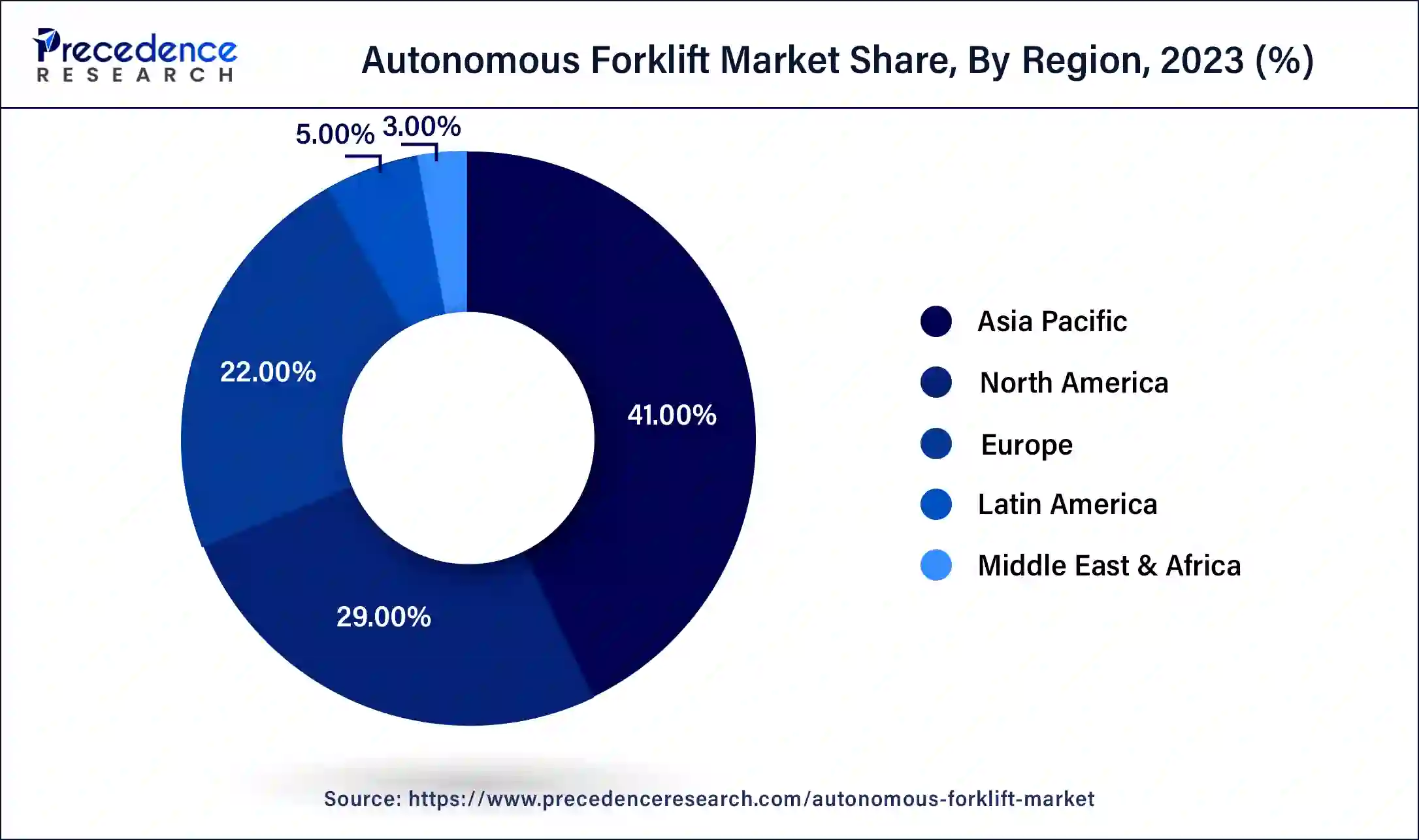

The market in 2023 was dominated by Asia Pacific. Although the deployment of autonomous forklifts across the Asia Pacific is still in its early stages, the decreasing costs and the involvement of various domestic players in the ecosystem present a massive opportunity to adopt driverless forklifts. Also, the e-commerce sector in this region is expected to experience rapid growth in the coming years. Consequently, regional operators are extensively planning to expand their fleets by incorporating advanced forklifts, which will have a positive impact on the demand for autonomous forklifts.

South Korea's autonomous forklift market is expected to grow at a CAGR through 2034. In recent years, the country has seen robust growth in its manufacturing sector, particularly in industries such as automotive, electronics, and shipbuilding. These sectors have a significant demand for autonomous forklifts to enhance productivity, efficiency, and competitiveness; the South Korean government has been actively promoting the adoption of autonomous forklifts as part of its 'Smart Factory' initiative.

North America is expected to show significant growth in the autonomous forklift market over the forecast period. The use of autonomous forklifts is expected to grow significantly in the coming years as companies aim to improve efficiency, productivity, and safety in their material handling and transportation operations. The region's robust manufacturing industry is a key factor driving the demand for autonomous forklifts in North America. Automation and robotics are becoming increasingly prevalent in manufacturing, and autonomous forklifts help streamline material handling and transportation processes, reduce labor costs, and boost productivity. Also, the retail industry in North America represents a significant market for autonomous forklifts, as companies seek to enhance inventory management, product replenishment, and order fulfillment through automation.

The autonomous forklift market focuses on developing, producing, and deploying self-driving forklifts equipped with advanced technologies. Also known as robotic forklifts or automated guided vehicles (AGVs), these forklifts perform material handling tasks without direct human intervention. They use various sensors, cameras, navigation systems, AI algorithms, and other tools to navigate and interact with their environment.

Autonomous forklifts operate in warehouses, distribution centers, manufacturing facilities, and other industrial settings, where they lift, transport, and stack pallets and goods. They can function in different modes, such as following predefined paths, navigating using sensors and markers, or dynamically adapting to their surroundings. They are adept at avoiding collisions, detecting obstacles, and optimizing routes to enhance productivity and operational efficiency. The autonomous forklift market is driven by the need for labor optimization, increased operational efficiency, reduced operational costs, and improved workplace safety.

| Report Coverage | Details |

| Market Size in 2023 | USD 4.51 Billion |

| Market Size in 2024 | USD 5.05 Billion |

| Market Size by 2034 | USD 15.57 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.9% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Tonnes, Navigation Technology, End-use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The innovation of new products

New product innovation is a significant trend in the autonomous forklift market as manufacturers strive to meet the evolving needs of businesses. One area of focus is developing more advanced sensor technology. Sensors, critical for providing real-time environmental information, enable safe and efficient operation. Manufacturers are investing in new sensors, such as 3D cameras and advanced radar systems, to enhance accuracy and reliability.

Another innovation area is developing more sophisticated software and algorithms. Autonomous forklifts depend on software to process sensor data and make decisions about navigation and task execution. Manufacturers are working on advanced algorithms that can analyze data more efficiently and make more accurate decisions.

High integration cost

High integration and switching costs due to AI and warehouse management systems (WMS) pose challenges in adopting autonomous forklifts. These forklifts require significant initial investment and skilled labor to operate. Ongoing expenses for maintaining and updating various subsystems are also costly for companies. These factors, coupled with the lack of flexibility of autonomous forklifts, hinder market growth. Conversely, the growth of the e-commerce industry and the adoption of Industry 4.0 technologies are expected to create lucrative opportunities for the autonomous forklift market expansion during the forecast period.

Growth in the e-commerce industry

The e-commerce market is rapidly growing, leading to increased demand for consumer products and the need for warehouse space to store them. Forklifts are used in warehouses to efficiently place and arrange materials or goods, reducing time and space. These products are distributed to retail stores in bulk via pallet loads and cases, using various distribution strategies and warehouse technologies to ensure safe delivery. Depending on the usage, forklifts come in different models, such as sit-down riders, counterbalanced order pickers, and swing-reach turrets, with various power options, including gasoline, electric, diesel, natural gas, and autonomous.

The above 10 tonnes segment dominated the autonomous forklift market in 2023. This indicates that forklifts with a weight capacity of 5-10 tons are the most popular and widely adopted type in the market. These findings reflect the market's preference for mid-range lifting capacities, driven by the versatility and practicality of forklifts in this weight range across various industrial and logistical applications. This contributes to the global dominance of this segment.

The below 5-10 segment is expected to grow at the fastest rate in the autonomous forklift market during the forecast period. Autonomous forklifts with a capacity of 5-10 tons are primarily used indoors. Applications for these forklifts include freight, manufacturing, warehousing, material handling, and logistics. In the confined spaces of warehouses, these compact lifts facilitate the safe and efficient transfer of goods. Furthermore, these autonomous forklifts enhance human resource safety when used to transport hazardous materials in small warehouse spaces.

The laser segment dominated the autonomous forklift market in 2023. LGV navigation system, which uses laser positioning, is the most popular. The forklift is equipped with a navigation laser mounted on top of a pole, which interacts with strategically placed targets in the work area. The laser sends out rotating arrays in a 360-degree pattern.

The vision segment is expected to grow at a notable rate in the autonomous forklift market over the forecast period. This is due to the increased accuracy in route planning and navigation provided by vision-driven autonomous forklifts, which use cameras and sensors to recognize their surroundings. This technology reduces the likelihood of collisions and damage to materials and equipment.

The retail & wholesale segments dominated the autonomous forklift market in 2023. Both private and public players in the ecosystem are investing substantial sums in developing and expanding retail and wholesale facilities worldwide. This investment is driving the surging demand for advanced equipment, such as autonomous forklifts, to be deployed at these sites. The rising demand for warehousing facilities and the expanding e-commerce sector will generate a massive demand for autonomous forklifts.

The logistics segment is expected to grow rapidly in the autonomous forklift market over the forecast period. The launch and growth of e-commerce in logistics and freight operations, along with the increasing need for automated systems, are the primary factors driving the segment's expansion. Additionally, the growing adoption of autonomous forklift technology in the warehouse sector is expected to promote industrial growth. This technology offers several advantages over traditional forklifts, including improved efficiency, accuracy, and precision.

The indoor segment dominated the autonomous forklift market in 2023 by application. Indoor forklifts have a lower turning radius; indoor forklifts can operate effectively even in confined spaces. The reach forklift is a warehouse truck primarily used for indoor work. Its crucial feature is extending its forks beyond the compartment, allowing it to reach into warehouse racks in ways that standard forklifts cannot. Moreover, it has an open compartment that gives the operator greater visibility.

Segments Covered in the Report

By Tonnes

By Navigation Technology

By End-use

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

December 2024

November 2024