September 2024

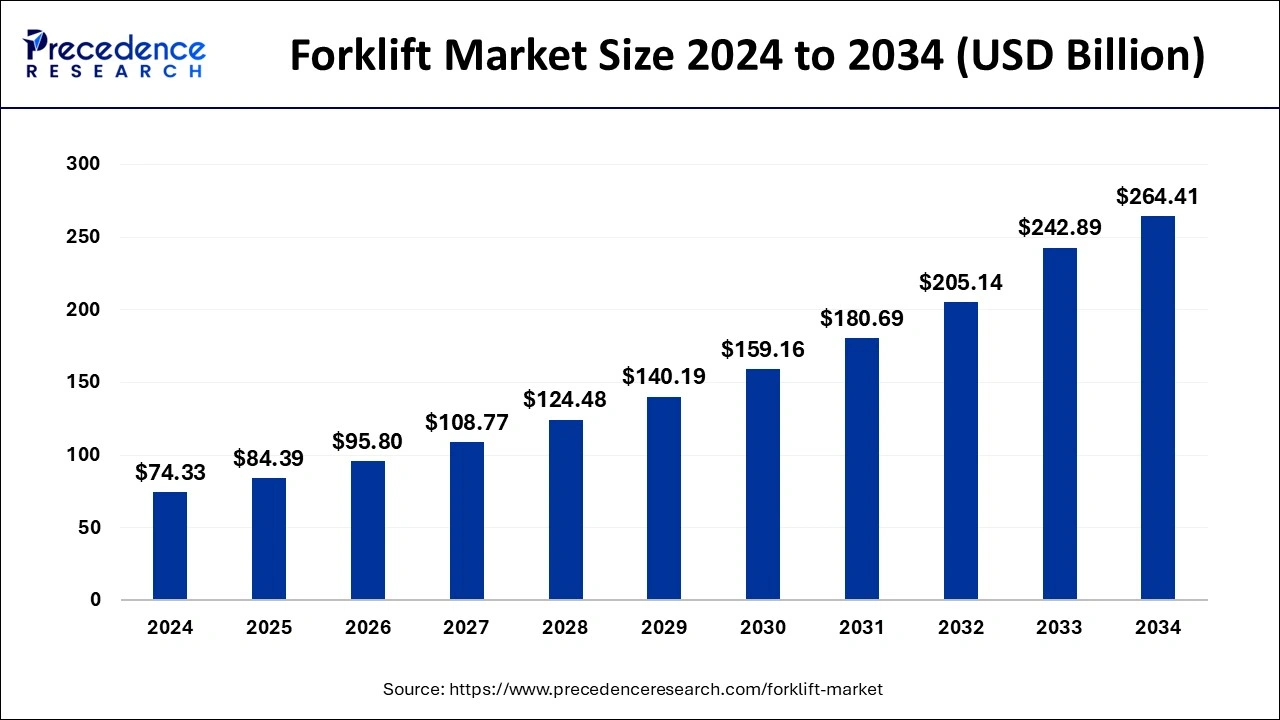

The global forklift market size is calculated at USD 90.97 billion in 2025 and is forecasted to reach around USD 163.48 billion by 2034, accelerating at a CAGR of 6.73% from 2025 to 2034. The Asia Pacific forklift market size was evaluated at USD 50.94 billion in 2025 and is expanding at a CAGR of 6.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global forklift market size accounted for USD 85.23 billion in 2024 and is predicted to increase from USD 90.97 billion in 2025 to approximately USD 163.48 billion by 2034, expanding at a CAGR of 6.73% from 2025 to 2034.

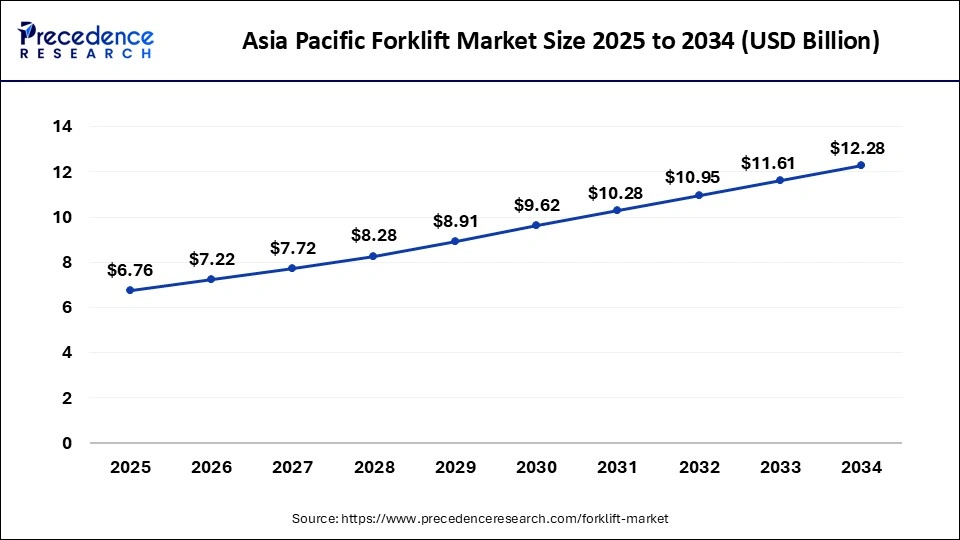

The Asia Pacific forklift market size was exhibited at USD 47.73 billion in 2024 and is projected to be worth around USD 92.37 billion by 2034, growing at a CAGR of 6.83% from 2025 to 2034.

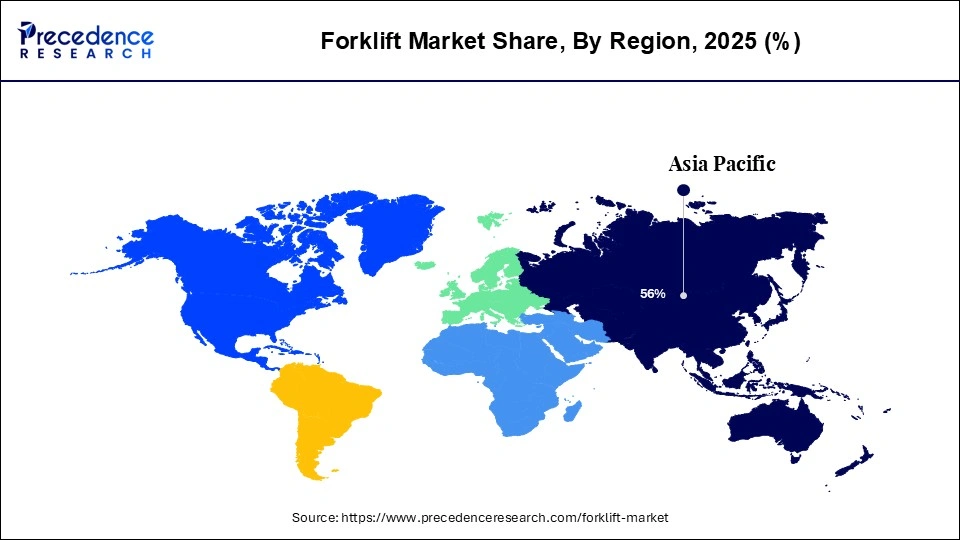

Asia-Pacific held the largest share of 48% in the forklift market in 2024. The segment is observed to sustain the position with an impressive growth rate during the forecast period. Several well-known forklift manufacturers, including Doosan Corporation and Hangcha Forklift, are based in the Asia Pacific area, which promotes technological advancements and increases industry competitiveness. To stay competitive and productive, end-use industries upgrade their fleets in tandem with corporations as they consistently develop cutting-edge electric forklift models with improved performance and features. Governments, manufacturers, and companies working together are anticipated to be crucial in promoting further developments and the extensive use of forklifts in Asia as the market develops.

The industry that produces, markets, and distributes powered industrial trucks (PITs), commonly called forklifts, is known as the forklift market worldwide. These industrial vehicles are primarily used in factories, warehouses, shipping yards, and construction sites for short-distance lifting and transporting items.

In factories, forklifts move components, finished goods, and raw materials between manufacturing lines and storage locations. Trailers are used in mines to carry rocks, minerals, and other resources. They are also utilized in shipping ports and logistical hubs to load and unload containers. Businesses are searching for ways to automate processes as labor costs grow, which has increased the use of automated guided vehicles (AGVs) and other automated forklift solutions.

| Report Coverage | Details |

| Market Size by 2034 | USD 163.48 Billion |

| Market Size in 2025 | USD 90.97 Billion |

| Market Size in 2024 | USD 85.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.73% |

| Bae Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Class, By Power Source, By Load Capacity, By Electric Battery Type, and By End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for forklifts for lean warehouse operations

The primary goals of lean warehouse operations are to reduce waste, increase productivity, and preserve flexibility in response to shifting customer needs. Forklifts are essential to these operations because they make it easier to move and store things in an efficient and well-organized manner. Forklift demand is further fueled by the increased emphasis on optimizing warehouse processes brought about by the growth of e-commerce and just-in-time inventory systems. Furthermore, forklifts are more prevalent in lean warehouse environments due to technological improvements like automation and integration with warehouse management systems, which facilitate smoother operations and greater resource use.

Increased demand for efficient material handling

The need for efficient material handling and transportation grows as enterprises strive to increase production and optimize their operations. For lifting, moving, and stacking items in warehouses, distribution centers, manufacturing facilities, and other industrial settings, forklifts offer a flexible and effective option.

Lack of trained professional operators

Companies may find it challenging to operate forklifts effectively and safely without trained operators, increasing the danger of mishaps, product damage, and possible employee injuries. Inadequate training can lead to lower production and increased maintenance costs because of incorrect equipment use. The lack of qualified workers may restrict the use of forklifts across various industries, impeding market expansion and possibly lowering overall operational effectiveness.

Expansion of road networks

Road networks improve regional connectivity as they grow, which boosts economic activity and raises the need for effective logistics solutions. Forklifts play a critical role in material handling in transportation hubs, distribution centers, and warehouses, making them indispensable for fulfilling increasing logistics needs. Due to improved road networks, businesses may move goods easily to and from various areas. The efficient loading and unloading of commodities is made possible by forklifts, which boosts supply chain efficiency. The greater accessibility of more extended road networks also fuels the need for forklifts.

The growth of e-commerce and online retailing

The growth of e-commerce has increased the need for effective distribution and warehousing facilities to manage the movement and storage of goods. For these tasks, forklifts are necessary since they make loading, unloading, and transporting items around warehouses easier. As automation and technology advance, the forklift market changes. E-commerce organizations are increasingly using forklifts with advanced features like automation software, sensors, and telematics systems to increase safety, optimize inventory management, and boost warehouse productivity.

The class 3 segment contributed the highest market share of 44% in 2024. Hand trucks with electric motors are included in this section. These are hand-controlled forklifts, with the operator controlling the machine from the front of the vehicle using a tiller. Hand trucks are often steered while the driver rides or walks to the destination using a handle at the back of the vehicle. These forklifts can easily move goods throughout the warehouse floor without needing the product to be placed on a high shelf or rack, and they are usually used for transporting objects that require minimal elevations.

The class 1 segment witnessed significant growth in the forklift market during the forecast period. It is anticipated that the strong demand for electric rider trucks in end-use sectors like manufacturing, food service, retail, and chemical plants would fuel the segment's expansion. Because these forklifts often have fewer moving components, they require less maintenance and cost less overall. Class 1 forklifts are ideal for various work environments, including manufacturing plants and warehouses, where noise levels and available space are important factors. This is because of their quiet operations and simplicity of maneuverability.

The electric segment captured the biggest market share in 2024. An environmentally beneficial substitute for forklifts driven by gasoline and diesel is electricity. The demand for long-lasting, sustainable forklifts is driven by growing environmental concerns and the depletion of fossil fuel supplies. These forklifts also guarantee a cleaner, healthier work environment for employees. Throughout the forecast period, advancements in battery technology and the growing emphasis on providing a healthy working environment for employees are likely to play a significant role in boosting the segment's growth. Several suppliers are creating new types of electric forklifts to broaden their range of material-handling products.

The 5-15 ton segment generated the major market share in 2024. Forklifts in the 5–15 ton category were made to perform various jobs, such as moving large items in manufacturing facilities and loading and unloading warehouse pallets. Their adaptability makes them invaluable in a variety of industries. Customers were provided Forklift modification options to customize the machines to meet their demands. Due to this flexibility, businesses could adjust to changing operating requirements and optimize their material handling procedures.

The below 5 segments show significant growth in the forklift market during the forecast period. Due to their great versatility, these small forklifts enable enterprises to manage a range of load sizes effectively. These little forklifts make transferring goods across constrained floor areas easier and safer. Applications for these forklifts include manufacturing, warehousing, freight handling, material handling, and logistics. These forklifts help safeguard the workers when they are utilized in small warehouses to move hazardous items.

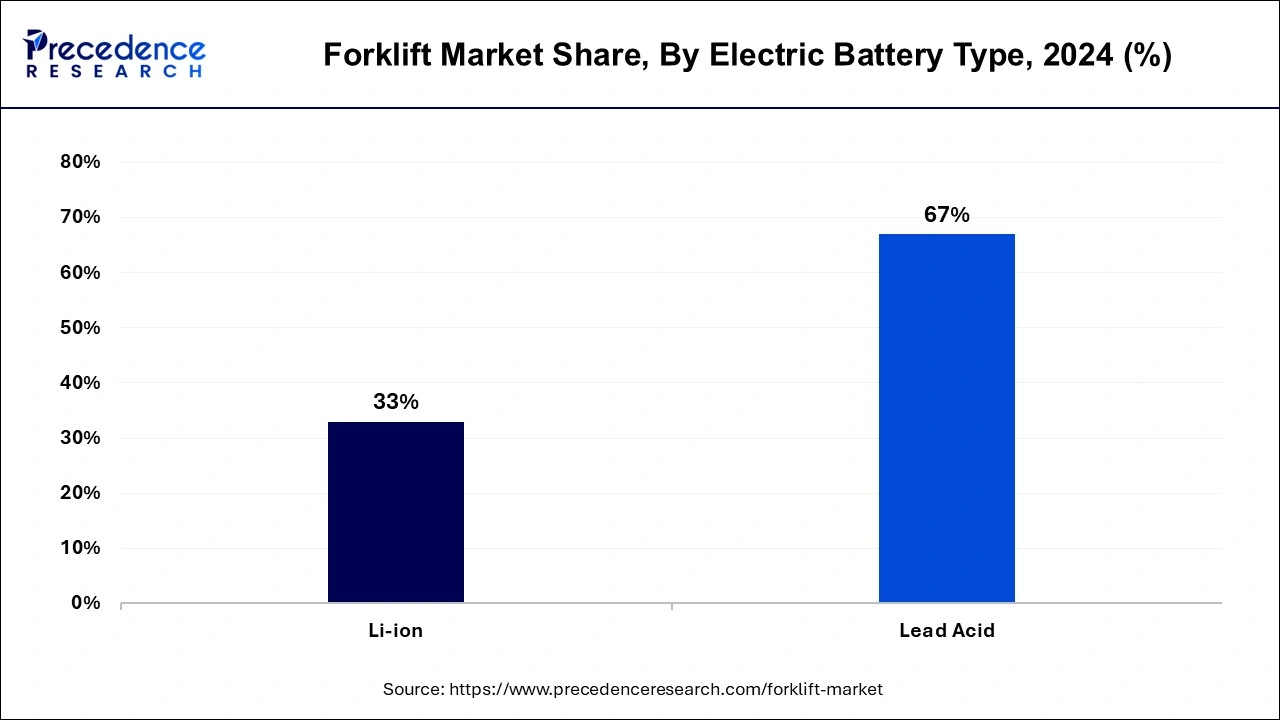

The lead-acid segment has held the largest market share of 67% in 2024. Although lead-acid batteries can deliver a high-power burst, they might be regarded as a dependable energy source. For this reason, they are frequently seen in electric forklifts. Electric forklifts require high current output to carry out heavy lifting and moving duties. Lead-acid batteries are ideal for these applications because they can provide the required power output without experiencing any noticeable voltage decreases or fluctuations.

The li-on segment shows a significant growth in the forklift market during the forecast period. Growing environmental concerns are pushing companies to look for environmentally responsible ways to lower their carbon footprint. Lithium-ion batteries present a more environmentally friendly substitute to traditional lead-acid batteries, which include harmful substances like sulfuric acid and lead. Vendors show their dedication to sustainability by complying with the stricter environmental requirements by using lithium-ion technology in their electric forklifts, encouraging the segment's growth.

The industrial segment has captured more than 25% of market share in 2024. In industrial settings, forklifts are widely utilized for material handling and warehousing duties. Forklifts are essential in manufacturing plants because they move raw materials, intermediate products, and final goods along production lines. Their capacity to move large objects and maneuver in confined spaces contributes to a smooth material flow, which lowers production bottlenecks and boosts operational effectiveness.

The retail & e-commerce segment shows significant growth in the forklift market during the forecast period. Over the past few years, the retail and e-commerce industries have changed tremendously due to shifting consumer tastes and an increasing inclination toward online buying. Forklifts are now an essential part of the industry in an ever-changing landscape since they provide specialized applications that facilitate effective material handling and logistics processes. Forklifts are crucial to efficiently running warehouses because they facilitate the smooth transfer of items from order receipt to storage & order fulfillment. Their precise control and compact form allow for quick and easy mobility in confined locations, which maximizes space usage and speeds up inventory management.

By Class

By Power Source

By Load Capacity

By Electric Battery Type

By End Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024