November 2024

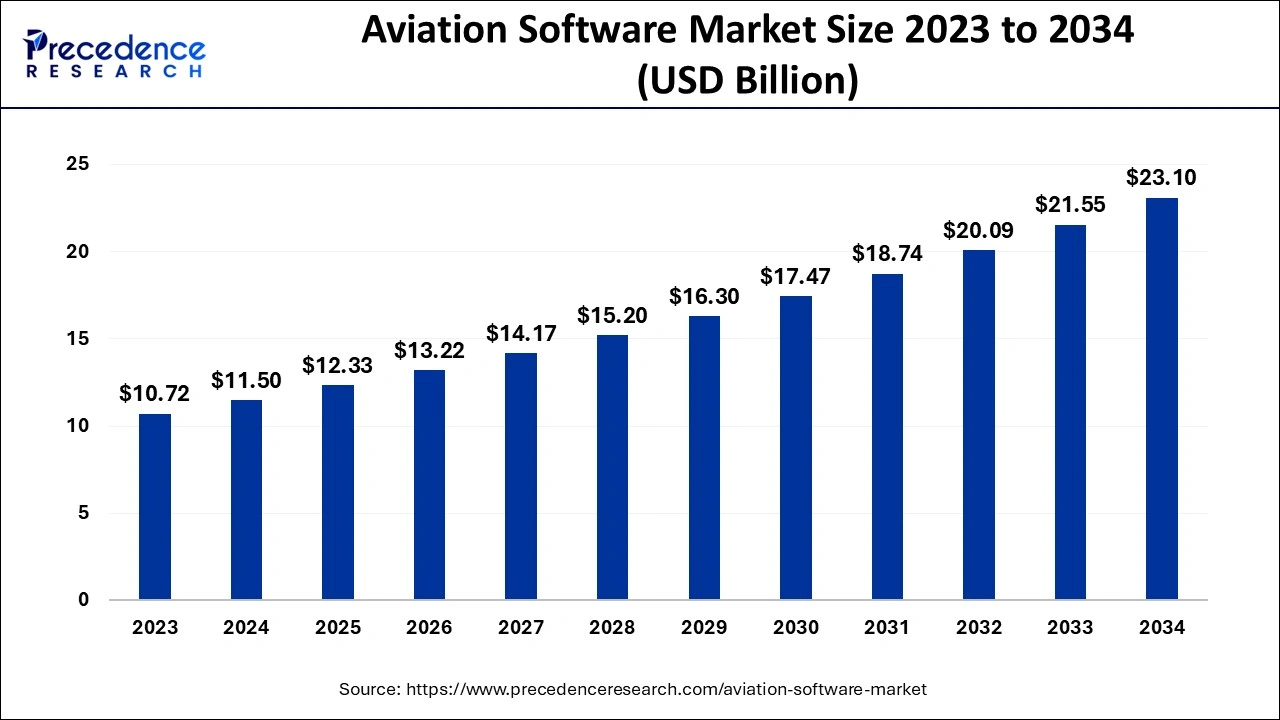

The global aviation software market size accounted for USD 11.50 billion in 2024, grew to USD 12.33 billion in 2025 and is expected to be worth around USD 23.10 billion by 2034, registering a CAGR of 7.23% between 2024 and 2034. The North America aviation software market size is evaluated at USD 4.14 billion in 2024 and is expected to grow at a CAGR of 7.35% during the forecast year.

The global aviation software market size is calculated at USD 11.50 billion in 2024 and is predicted to reach around USD 23.10 billion by 2034, expanding at a CAGR of 7.23% from 2024 to 2034. Rising demand for innovative flight management systems is the key factor driving the growth of the aviation software market. Also, many aviation companies are adopting advanced software solutions coupled with government initiatives in various countries can fuel market growth soon.

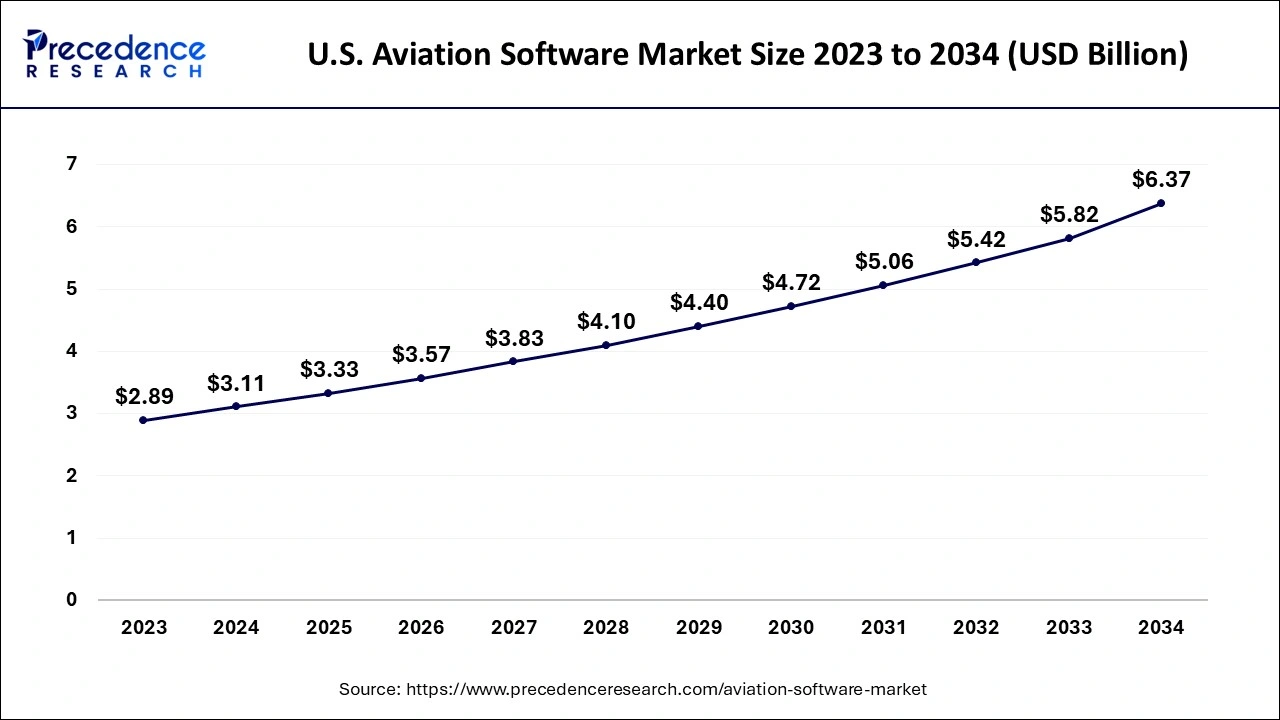

The U.S. aviation software market size is evaluated at USD 3.11 billion in 2024 and is projected to be worth around USD 6.37 billion by 2034, growing at a CAGR of 7.44% from 2024 to 2034.

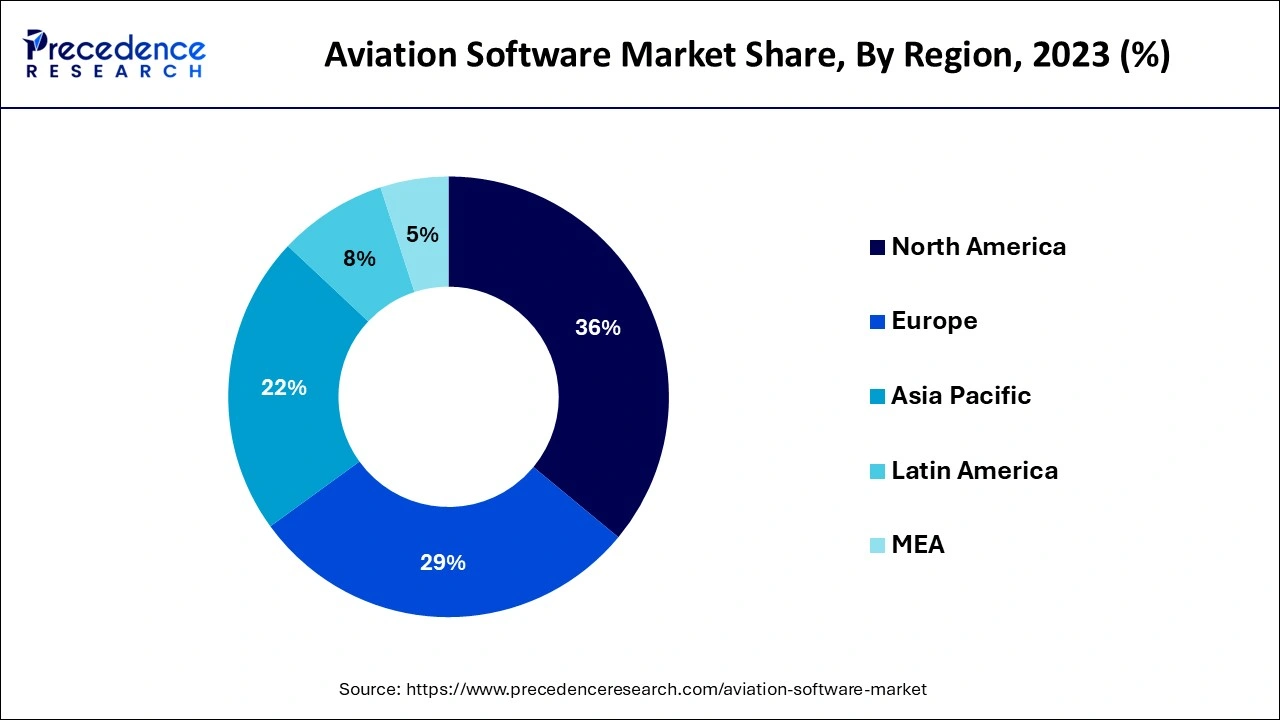

North America dominated the aviation software market in 2023. The dominance of the region can be attributed to the growing adoption of cutting-edge technologies such as AI and IoT. The region's focus on enhancing operational efficiency and passenger safety is boosting demand for advanced software solutions. Furthermore, the presence of top aviation software companies and an established aerospace infrastructure is significant.

Asia Pacific is expected to witness significant growth in the aviation software market over the studied period. The growth of the region can be driven by the region's fast growth in air travel coupled with the surge in the aviation industry. Moreover, the strong presence of major market players is driving the market expansion, particularly in countries like China and India.

The aviation software market has become a crucial element in the aviation industry, optimizing an extensive range of functions from customer service to flight scheduling and planning. This industry contains many software solutions created to enhance efficacy, safety, and regulatory requirements. The need for advanced software applications has grown, leading to substantial expenditure investments in this sector.

World's biggest public airline companies by revenue (as of May 2024)

| Airline | Country | Revenue (USD billions) |

| Delta Air Lines | United States | 59 |

| United Airlines Holdings | United States | 54.8 |

| American Airlines Group | United States | 53.2 |

| Lufthansa Group | Germany | 38.8 |

| Air France–KLM | France/ Netherlands | 32.9 |

Role of Artificial Intelligence in the Aviation Software Market

Artificial intelligence (AI) technologies like natural language processing and computer vision can be used in pilot training, customer service, and threat detection. The increasing adoption of machine learning techniques to resolve various aviation operational problems can strengthen the presence of AI in the aviation software market. Furthermore, the rising application of AI for the baggage screening process and rapid check-in process can drive the adoption of AI in the industry shortly.

| Report Coverage | Details |

| Market Size by 2034 | USD 23.10 Billion |

| Market Size in 2024 | USD 11.50 Billion |

| Market Size in 2025 | USD 12.33 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Software Type, Application, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing air passenger traffic

There is an increasing demand for aviation software solutions because of the continuous surge in air passenger traffic. This growth of the aviation software market is due to the rise in globalization, growth in the middle class, and an increase in the disposable incomes of the majority of people. Therefore, to meet this demand for air travel, airlines need to deploy convenient software solutions to facilitate resources, enhance customer services, and manage operations.

Market fragmentation

An extensive range of suppliers offering tailored solutions for many market segments such as maintenance companies, airlines, and air traffic management is what covers the aviation software market. However, because of this fragmentation, sometimes customers find it challenging to analyze and compare all these packages, which can lead to delays and uncertainties while making decisions.

Digital transformation in the aviation industry

The aviation software market is undergoing an extensive digital transformation, which is mainly led by technological advancements and the rising focus on safety, efficiency, and customer experience. Furthermore, aviation software systems are important for optimizing digitization in numerous business sectors, such as airports, air traffic control, repair, maintenance, etc. Also, by digitizing the industry, airlines may streamline resource management processes and operations, which propel productivity and decrease the overall costs of airline operations.

The management software segment dominated the aviation software market in 2023. The dominance of the segment can be attributed to the services provided by this software including crew management, flight scheduling, and maintenance procedures. Management software is important for airports and other aviation stakeholders to maintain their daily activities efficiently. Additionally, the surge in demand for integrated and comprehensive software solutions can drive segment adoption further.

The simulation software segment is expected to grow at the fastest rate in the aviation software market over the forecast period. The growth of the segment can be linked to the growing demand for innovative operational and training solutions. However, this software creates realistic and sophisticated environments for pilots to perfect their skills. Simulation software also can be used to facilitate maintenance operations.

The airlines segment led the global aviation software market in 2023. The dominance of the segment can be credited to the massive operational demand and the crucial role that this software has in the airline industry. Airlines are the backbone of air travel. Hence, airlines necessitate innovative software solutions for several functions, such as crew management, light operations, and customer service. The increasing demand for predictive maintenance and data analytics has further boosted the segment's growth.

The airport segment is estimated to show the fastest growth in the aviation software market over the forecast period. The growth of the segment can be driven by the rising complexity of airport functions and the growing requirement for improved security and efficiency. However, with the rise in travel across the globe and the growth of airport infrastructure, there is an increased need for software solutions that can optimize operations and improve the passenger experience.

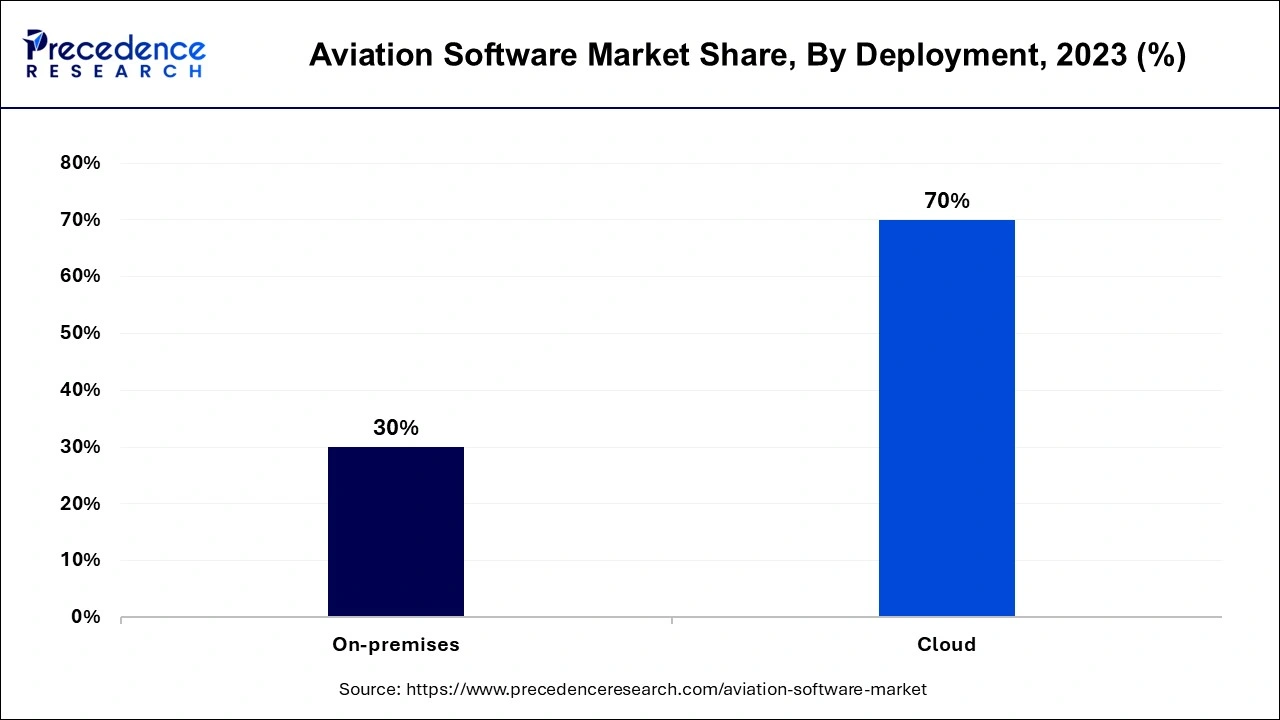

The cloud segment held the largest share of the aviation software market. The growth of the segment is linked to the features provided by cloud-based solutions, such as greater flexibility, scalability, and low cost. Enabling market players to conveniently manage their operations with less infrastructure costs. Also, the cloud enables smooth integration with different technologies like AI and Internet of Things (IoT).

The on-premises segment is expected to grow rapidly in the aviation software market during the projected period. The growth of the segment can be credited to the market's need for control, compliance, and security, which can be easily provided by on-premises systems. Furthermore, aviation companies with confidential data mainly prefer on-premises solutions to secure total control over their IT infrastructure.

By Software Type

By Application

By Deployment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024

February 2025

November 2024