July 2023

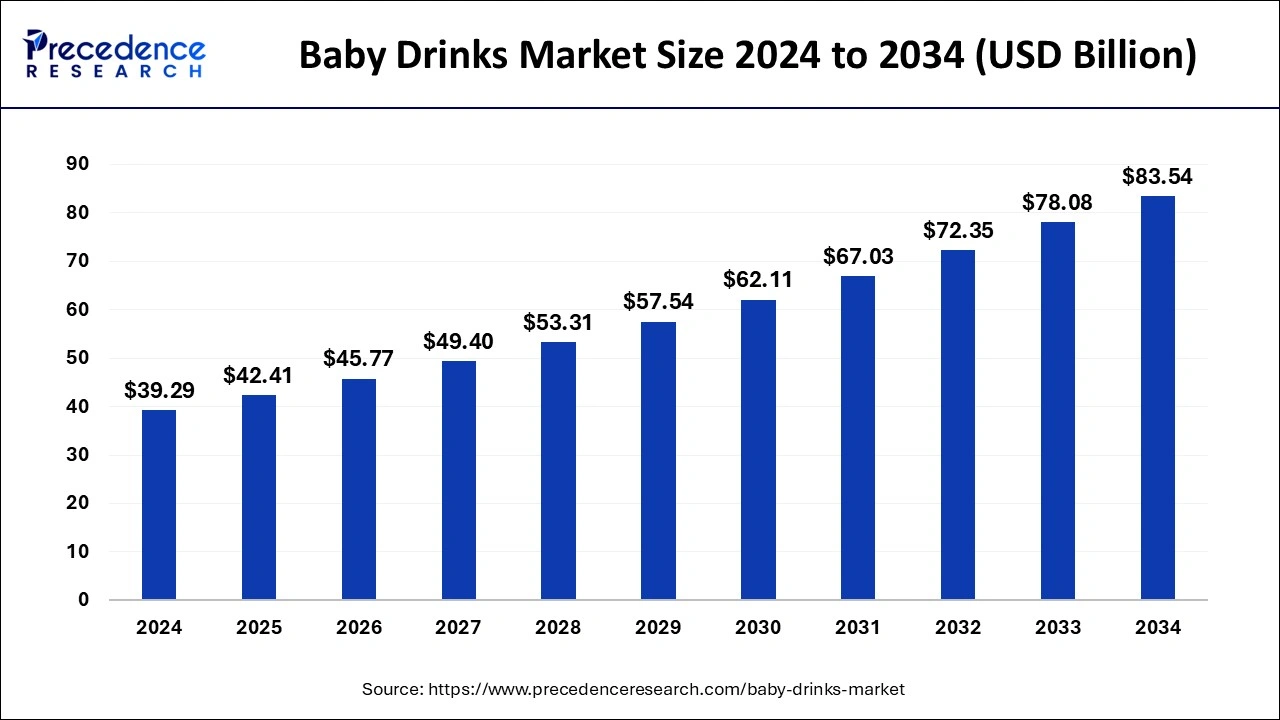

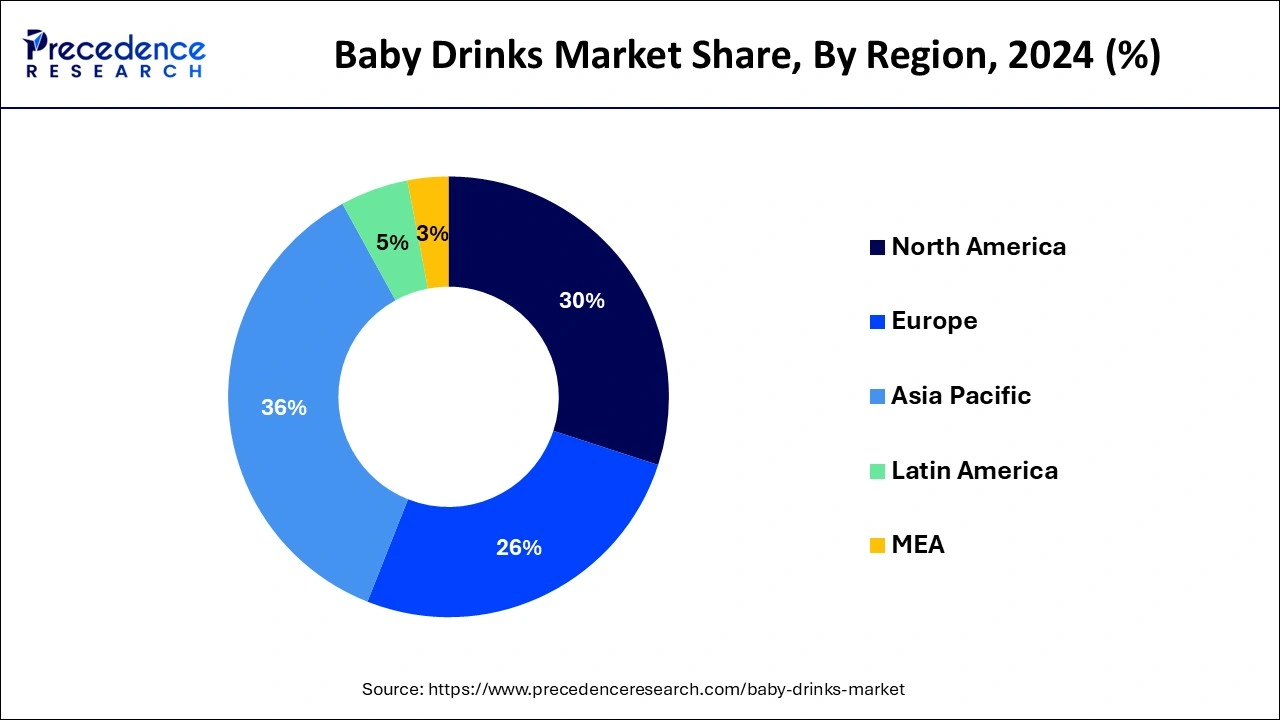

The global baby drinks market size is accounted at USD 42.41 billion in 2025 and is forecasted to hit around USD 83.54 billion by 2034, representing a CAGR of 7.84% from 2025 to 2034. The North America market size was estimated at USD 14.14 billion in 2024 and is expanding at a CAGR of 7.99% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global baby drinks market size accounted for USD 39.29 billion in 2024 and is predicted to increase from USD 42.41 billion in 2025 to approximately USD 83.54 billion by 2034, expanding at a CAGR of 7.84% from 2025 to 2034. The growing demand for chemical-free formula for babies can boost the baby drinks market.

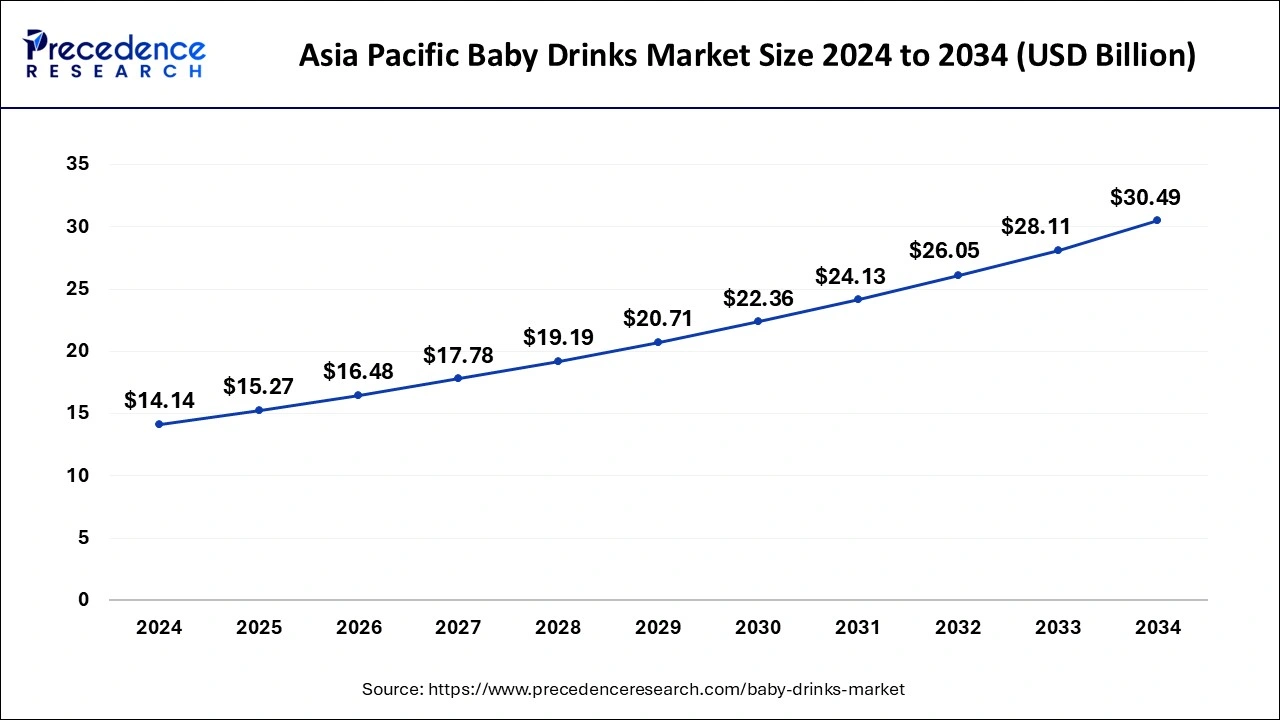

The Asia Pacific baby drinks market size was exhibited at USD 14.14 billion in 2024 and is projected to be worth around USD 30.49 billion by 2034, growing at a CAGR of 7.99% from 2025 to 2034.

Asia Pacific had a significant presence in the baby drinks market by region in 2024. There are many people living in the area, and many of them are small children, which means there is a big market for products and services. In addition, the popularity of particular infant drink varieties in Asia Pacific is influenced by customs, dietary practices, and cultural preferences. In addition, families can now purchase these items because of rising purchasing power in several of the region's developing nations. Lastly, the existence of both regional and international producers that serve a range of tastes and preferences fuels market expansion in this area.

North America is expected to grow rapidly in the baby drinks market by region during the forecast period. Consumers in North America are placing more and more focus on health and well-being, and parents are looking for wholesome alternatives for their kids. Parents with hectic schedules sometimes look for portable and easy-to-transport solutions for their kids' nourishment, which makes infant drinks a desirable option. Parents seeking healthier substitutes for conventional beverages may find infant drink formulations that incorporate organic ingredients, additional nutrients, and appealing tastes. There may naturally be a greater market for baby-related goods, such as infant beverages if birth rates are rising in North America.

The baby drinks market refers to the industry that offers drinks specially prepared liquids for babies and early children, including breast milk, infant formula, or baby juice diluted fruit juice. These are intended to supply vital nutrients required for development and growth in a healthful manner.

The selling of beverages created especially for newborns and early children is included in the market. This comprises goods like baby juice, toddler milk, infant formula, and other specialty drinks made to satisfy the dietary requirements of young children. The industry, which is impacted by things like parenting trends, health issues, and laws governing infant nourishment, frequently consists of both liquid and powered items.

The baby drinks market is fragmented with multiple small-scale and large-scale players, such as Nestlé, Campbell Soup Company., Abbott, The Kraft Heinz Company, Holle baby food AG, Hain Celestial, Dana Dairy, Nature's One, Nannycare Ltd, Mead Johnson & Company, LLC., Beingmate Group Co., Ltd., Arla Foods amba, D. Sign Softech Private Limited, FrieslandCampina, Organix Brands Limited, HIPP, ORHEI-VIT, Danone S.A., Freed Foods, Inc.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.84% |

| Market Size in 2025 | USD 42.41 Billion |

| Market Size in 2024 | USD 39.29 Billion |

| Market Size by 2034 | USD 83.54 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for natural infant formula

The growing demand for plant-based and organic infant formula can boost the growth of the baby drinks market. The increasing need for natural and organic baby formula can be due to parents' rising realization of how crucial it is to give their babies a clean and healthy diet with no artificial additives. The goods provide a reassuring option that supports the desire for a more natural and holistic start in a child’s life. The focus on the purifying component is Indicative of a frontier consumer accustomed to eating more healthily and transparently, even when it comes to baby feeding, which results in driving the market.

Rising demand for premium infant formula

The rising demand for premium infant formula can boost the baby drinks market. A growing number of parents are ready to spend money on products that provide more than just basic nourishment, which is fueling the market for premium infant formula. This formula is designed to meet the special needs of their babies and frequently includes extra characteristics like improved nutrition, simpler digestion, and assistance for consecutive development of the child. The premium formula highlights the change in baby care towards a more knowledgeable and health-conscious approach, reflecting a desire to give their children the greatest start in life possible.

Risk of infection

The risk of infection may slow down the baby drinks market. The water must be added to formulated juice or milk. So, there is a chance of infection if the water is contaminated with bacteria or other germs, which might cause the babies to have major problems in the first 12 months of their life, which can lead to slowing down the market’s growth.

Opportunity

Growing popularity of lactose-free and hypoallergenic infant formula

The growing popularity of lactose-free and hypoallergenic infant formula can be an opportunity to grow the baby drinks market. The rising awareness of newborns' dietary sensitivities and allergies is responsible for the growing popularity of wave formulas that are lactose-free and hypoallergenic. For infants who are allergic to common constituents in ordinary formulas or have a lactose intolerance, these specialty formulas offer a good substitute.

The baby formula segment dominated the baby drinks market by product in 2024. The nutritional makeup of baby formula is intended to resemble that of breast milk, including the necessary nutrients for healthy growth and development of infants. For parents who are unable or do not desire to breastfeed, this makes it the preferred option. Parents who may find it difficult to breastfeed or who need to supplement breast milk with formula might benefit from the convenience that baby formula offers.

It’s simple to make and store, so feeding schedules may be adjusted accordingly. Parents from a wide range of geographic and socioeconomic backgrounds can easily obtain baby formulas because it is readily available in multiple forms, such as powder, liquid concentrate, and ready-to-feed. Safety Standard: to guarantee the safety and quality of baby formula products and provide parents peace of mind about their suitability for infants, manufacturers follow stringent regulations and quality control systems.

The juice segment is expected to grow to the highest CAGR in the baby drinks market by product during the forecast period. The concern regarding the potential health implications of artificial food coloring has led to an increase in parents looking for natural and healthier substitutes.

As juices are made from fruits and vegetables, they provide a more natural and safer alternative. Parents who favor clean-label products for their children may find juice pigments intriguing as they also deliver brilliant colors without the use of synthetic ingredients. The juice segments are in line with customer aspirations for simpler, more healthful ingredients, which are in line with the growing emphasis on transparency and product purity.

The pharmacy segment dominated the baby drinks market by product in 2023. Parents looking for trusted and safe products for their babies can rely on pharmacies as a trusted provider. The pharmacies are handy, one-stop stores for parents, trustworthy, and the products are easily available in pharmacy stores.

The supermarket & hypermarket segment is expected to grow at the highest CAGR in the baby drinks market by product during the forecast period. The supermarket & hypermarket segment is expected to grow because of their convenience and accessibility of baby drink products. These supermarkets & hypermarkets are great places to buy baby drinks because parents often visit them for their usual shopping requirements. Additionally, a large range of brands and goods are often available in supermarkets and hypermarkets, enabling parents to evaluate and select the best solution for babies. Additionally, a large range of brands and goods are often available in supermarkets & hypermarkets, enabling parents to evaluate and select the best solutions for their babies.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2023

February 2025

October 2024

August 2024