January 2025

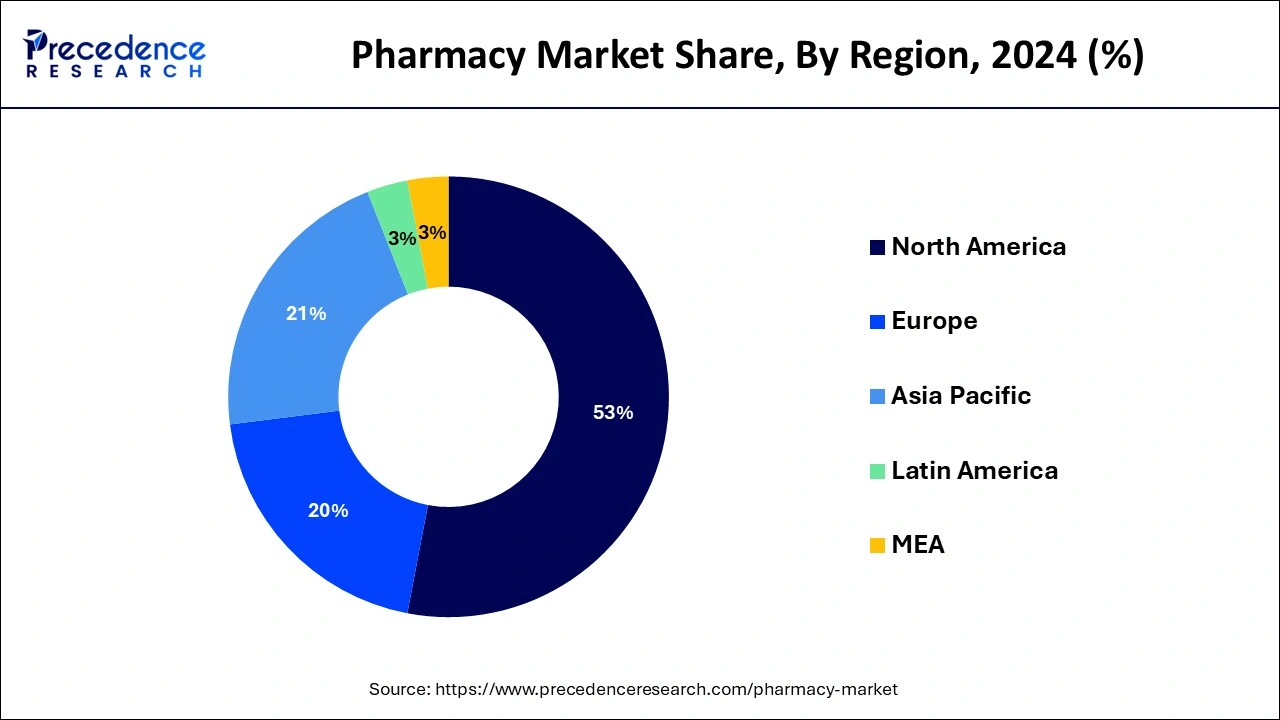

The global pharmacy market size is calculated at USD 1.34 trillion in 2025 and is forecasted to reach around USD 1.92 trillion by 2034, accelerating at a CAGR of 4.05% from 2025 to 2034. The North America market size surpassed USD 680 billion in 2024 and is expanding at a CAGR of 4.23% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmacy market size accounted for USD 1.29 trillion in 2024 and is expected to exceed around USD 1.92 trillion by 2034, growing at a CAGR of 4.05% from 2025 to 2034. Factors such as rising incidence of chronic diseases, rising prescription drug expenditure, and a rise in the aging population fuels are expected to drive the growth of the pharmacy market during the forecast period.

AI integration has significantly transformed the healthcare industry and also has paved the way for the pharmacy sector to be more effective and efficient. AI is shaping a better future for pharmacy. AI emerges as a groundbreaking technology in various aspects. There are several major applications of AI including drug discovery and development, R&D, precision medicine, medication management, and patient outcomes. From effectively analyzing complex datasets to making informed predictions and rapid decisions based on trends and patterns, M algorithms are transforming tasks that wholly rely on human intelligence.

Artificial intelligence (AI) is revolutionizing the practice of pharmacy is no exception by changing how pharmacists deliver care by optimizing streamlining workflow, enhancing medication management, and improving treatment outcomes. Therefore, the integration of AI is expected to transform the future of pharmacy by delivering faster, cheaper, and safer, drugs. It assists the industry in shifting towards value-centric R&D, building more resilient supply chains, and fuelling digital pharma manufacturing.

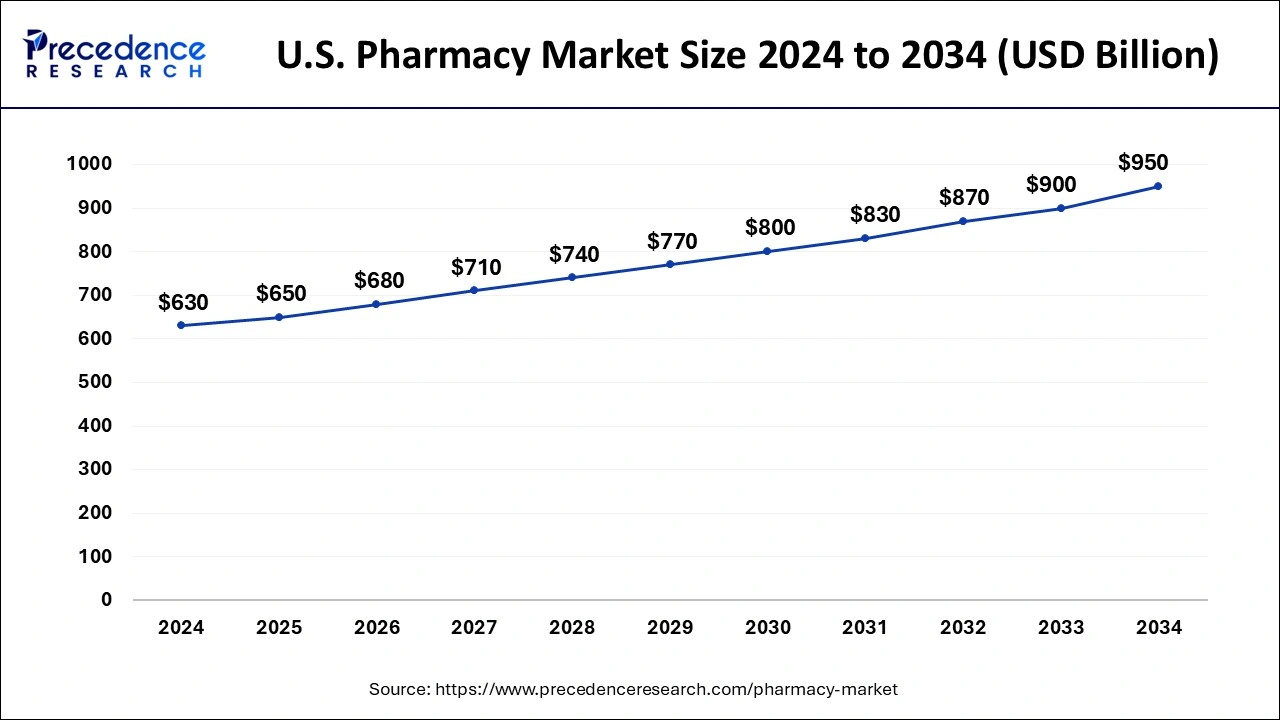

The U.S. pharmacy market size was exhibited at USD 630 billion in 2024 and is projected to be worth around USD 950 billion by 2034, growing at a CAGR of 4.19% from 2025 to 2034.

In the year 2024, North America accounted for the largest market share in the global pharmacy market. This is mainly because of the presence of large-scale international chains, such as CVS Health,Kroger, Boots Walgreens, UnitedHealth Group, Cigna, Walmart, and Rite Help Corp. These players are adopting various initiatives and software technologies to increase market share. For example, Rite Aid Corp. introduced its Wellbeing + rewards program, which offers considerable discounts and rewards to its customers. Moreover, the quickly growing aging populace is supporting market growth.

Asia Pacific is expected to be the fastest-growing regional market throughout the forecast period. Rapid growth of the industry in developing countries such as India and China alongside with rising demand for general medications is propelling the demand for pharmacies in the region. Moreover, rapid growth plans undertaken by key pharmacies are supporting market development. For instance, in March 2021, Common Aadhar, a drug-store retail chain in India, launched its software to get generic medications promote them in the outlet.

Moreover, rapid growth plans undertaken by key pharmacies are supporting market development. For instance, in March 2021, Common Aadhar, a drug-store retail chain in India, launched its software to get generic medications promote them in the outlet. Moreover, the increasing geriatric inhabitant in Parts of Asia, such as Japan, is further augmenting the market growth.

In another instance, in November 2020, Amazon.com launched an online pharmacy known as Amazon Pharmacy for selling prescription drugs in the U.S.

The increasing rate of consumers being affected by diseases, increasing elderly people, and growing variety of prescriptions are few among the major parameter driving the global pharmacy market. In respect to the Countrywide Health Services, the price of prescribed medicines in the FY 2020-21 increased by 3.46% as compared to FY 2019-20 in UK. As mentioned by the Centre for Disease Handle and Prevention, 45.7% of the consumers in U.S. used at least prescription drug for the minimum of at least one from the year 2015 to 2018, while more than 20% of the people consumed more than three prescription drugs in the same period.

India is the greatest generic drugs provider worldwide. Also, Indian sector of pharmaceutical supplies 40% of generic demand in the US, more than 50% of demand for various vaccines globally, and more than 20% of all medicine in the UK. Worldwide, India ranks third in terms of the production of pharmaceutical in terms of volume and fourteenth in terms of value. Furthermore, the domestic industry of pharmaceuticalcompriseof a network of 3,000 drug producing companies and 10.5 hundred manufacturing units. In addition, India has an essential position in the pharmaceuticals sector worldwide. This country of Asia-Pacific further has a large pool of engineers and scientists with a potential to steer the market ahead to the greater heights.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.34 Trillion |

| Market Size in 2034 | USD 1.92 Trillion |

| Growth Rate | CAGR of 4.05% from 2025 to 2034 |

| Base Year | 2024 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Pharmacy, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

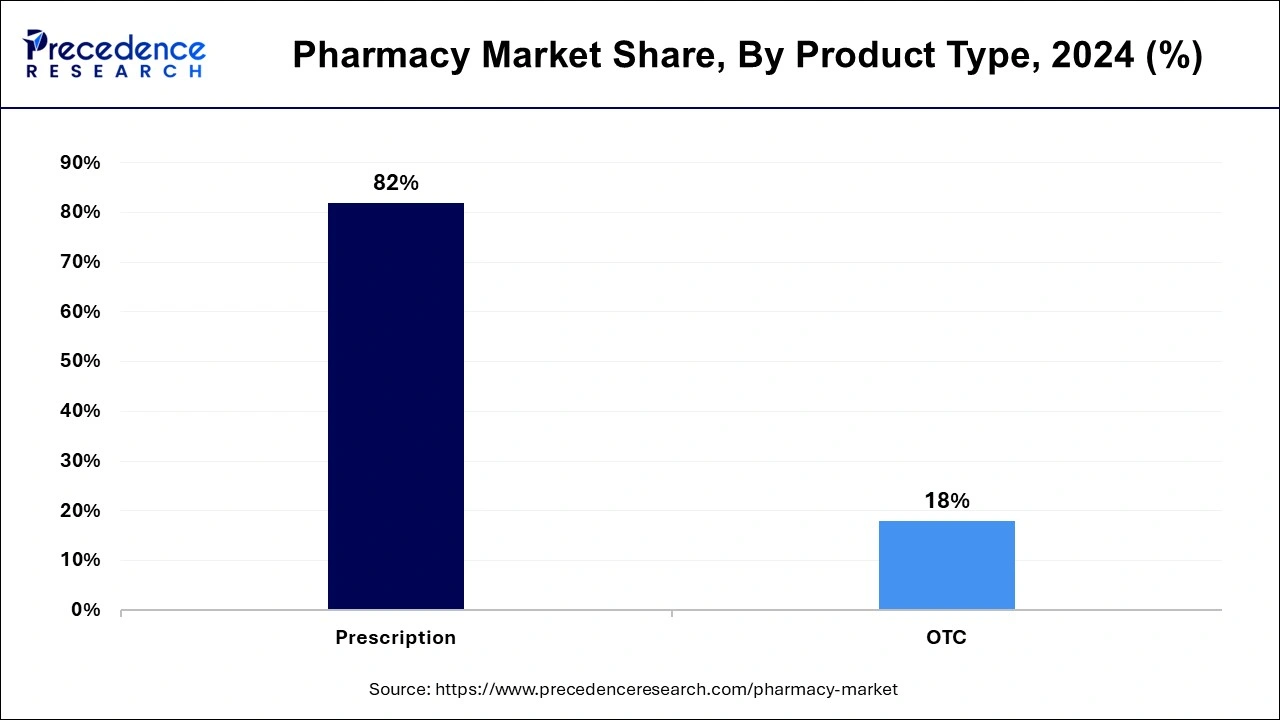

On the basis of product type the pharmacy market is divided into prescription and OTC. The prescription product type segment accounted for the biggest income share of more than 82.9% in 2024. The increasing problem of chronic diseases and the growing aging population is driving the necessity for prescription medications. Based on the International Diabetes Relationship, 463 million grown-ups were suffering from diabetes in 2019. The amount of grown-ups enduring from diabetes is estimated to increase to 700,000,000 by 2045. Based to the United States Heart Association, 126.9 million U.S. citizens were suffering from cardiovascular disease between 2015 and 2018. Moreover, the global aging population is also increasing quickly.

Based on the United Nations, there were more than 703,000,000 grown-ups above 65age globally. This number is believed to increase to 1.5 billion by 2050. Improving demand for prescribed drugs for remedies, such as diabetic, cardiovascular disease, respiratory system diseases, antibiotics, bloodstream disorders, and oncology, is driving the expansion of the prescription segment. The OTC segment is estimated to see the quickest CAGR throughout the forecast period. A rise in demand for OVER-THE-COUNTER medications for diseases, such as top respiratory medications, mouth analgesics, and heartburn symptoms medications, is boosting the segment development.

On the basis of pharmacy type the market is divided into ePharmacy and retail. The retail pharmacy sub-segment held the largest earnings share of more than 56.5% in 2022. The growing volume of independent medical stores and chains, access to medications in supermarkets & size retailers is driving the retail pharmacy segment. The occurrence of large chains, such as CVS Overall health, Boots Walgreens, Customers Drug Mart, Lloyd, and Well chemist, in a few countries, including the U.S., Nova Scotia, Australia, and Italy, is supporting the segment growth. In addition, the rapid use of automation solutions, such as chemist robots, dispensing, and packaging systems, is driving the segment growth.

Numerous E-pharmacies witnessed a rise in income growth in 2022 during the outbreak. For instance, online sales of Boots U.K. grew by 105% during the lockdown. E-pharmacies have benefits, such as personal privacy & confidentiality, free shipping, discounts, decrease in purchase time, and an array of offers. Moreover, the high adoption of digital technologies by the healthcare industry, increasing penetration of mobile phones, and growing quantity of retailers presenting online channels are estimated to push the segment growth.

By Product Type

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2025

January 2025

July 2024