April 2025

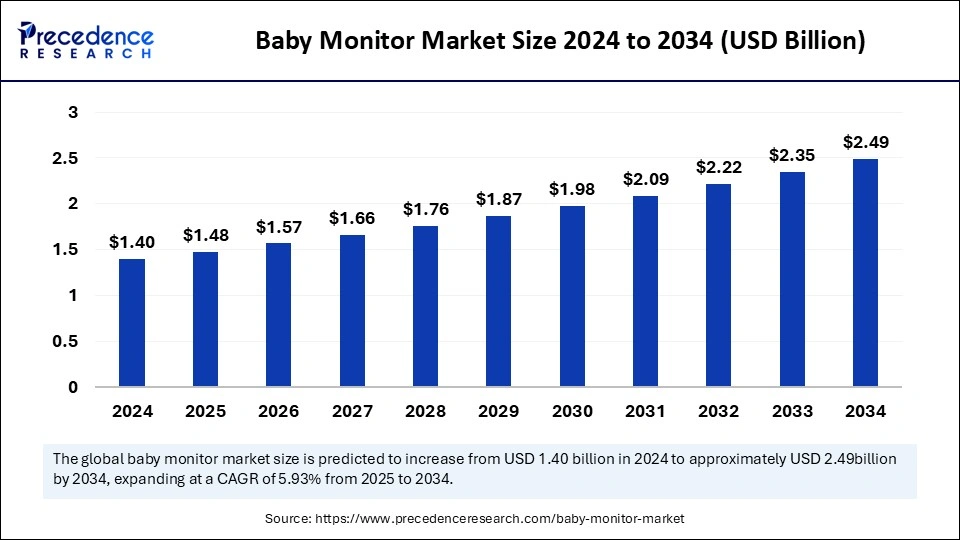

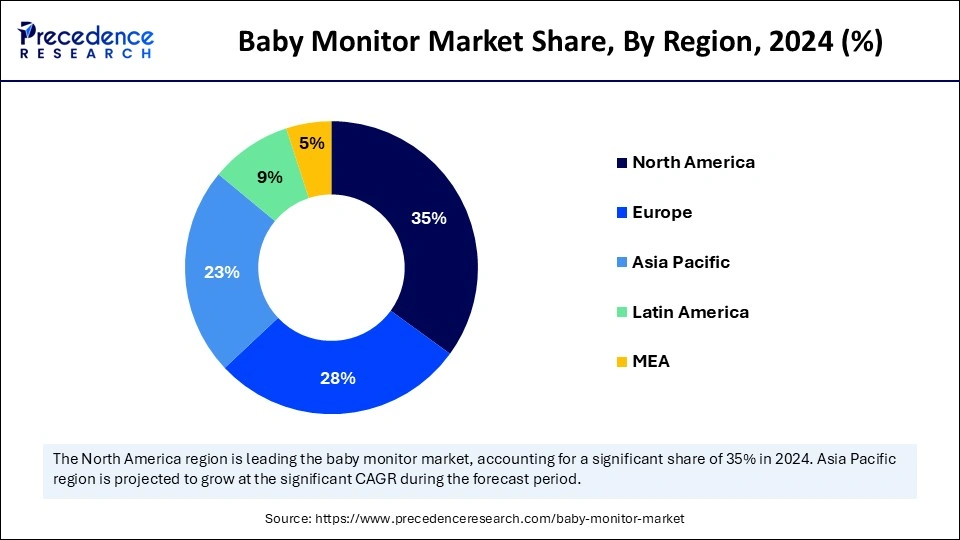

The global baby monitor market size is accounted at USD 1.48 billion in 2025 and is forecasted to hit around USD 2.49 billion by 2034, representing a CAGR of 5.93% from 2025 to 2034. The North America market size was estimated at USD 490 million in 2024 and is expanding at a CAGR of 6.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global baby monitor market size was calculated at USD 1.40 billion in 2024 and is predicted to increase from USD 1.48 billion in 2025 to approximately USD 2.49 billion by 2034, expanding at a CAGR of 5.93% from 2025 to 2034. The increasing number of working parents is the key factor driving the market growth. Also, rising awareness regarding baby safety coupled with technological innovations can fuel market growth further.

The integration of artificial intelligence into the baby monitor market can improve the performance of these devices and offer parents peace of mind. AI-powered baby monitors can optimize well-being and safety by providing actionable insights that suggest parents make a firm decision regarding their child's care. Furthermore, the most significant benefit of these monitors is their capability to give time-saving solutions for working parents.

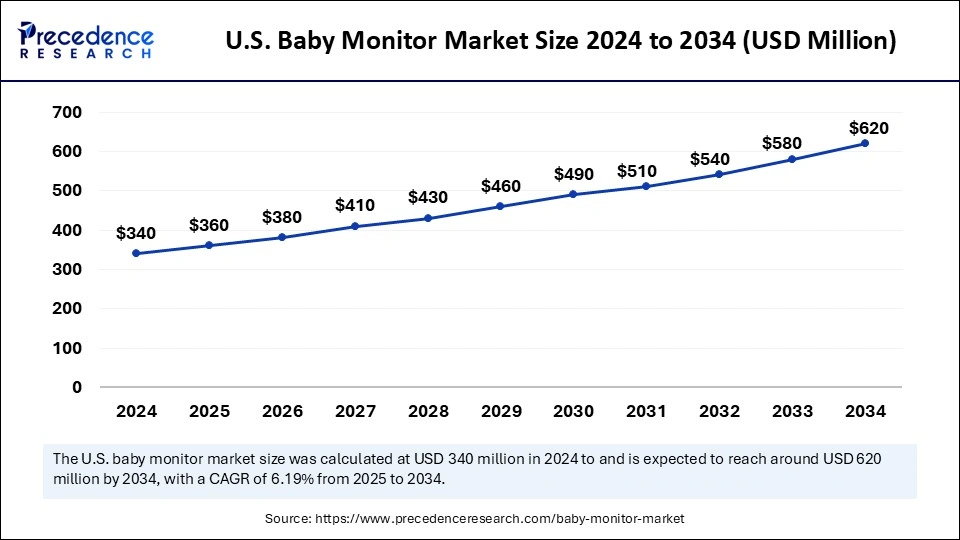

The U.S. baby monitor market size was exhibited at USD 340 million in 2024 and is projected to be worth around USD 620 million by 2034, growing at a CAGR of 6.19% from 2025 to 2034.

North America dominated the global baby monitor market in 2024. The dominance of the region can be attributed to the increasing disposable income and rising awareness regarding child safety coupled with technological innovations. The presence of major market players and an extensive retail infrastructure further facilitate market expansion in the region. In North America, the U.S. led the market owing to the increasing personal equity investments in the country.

Asia Pacific is expected to grow at the fastest rate in the baby monitor market over the studied period. The growth of the region can be credited to the surging middle-class population, rising urbanization, and increasing awareness regarding child safety. In Asia Pacific, India is projected to grow at the fastest rate due to the increasing income levels facilitating the need for premium baby care products such as smart baby monitors.

A baby monitor is a device that allows caregivers or parents to remotely listen and observe an infant's activities. The devices consist of two units: a near-baby transmitter and a receiver with a caregiver. These monitors come in different forms, such as video, audio-only, and smart monitors. In the baby monitor market, innovative models give night vision, high-definition video, temperature sensors, two-way communication, and health measuring features like heart rate and breathing monitoring. Baby monitors offer constant vigilance over infants' health and well-being.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.49 Billion |

| Market Size in 2025 | USD 1.48 Billion |

| Market Size in 2024 | USD 1.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.93% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, Display, Connectivity, Usage, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for innovative safety features

The rising need and demand for advanced safety features in baby monitors play a crucial part in the expansion of the baby monitor market. Parents are increasingly seeking baby monitors that can offer them safety features, including real-time temperature monitoring and motion detection. In addition, smart baby monitors can monitor the baby's sleep pattern, breathing pace, and other aspects to alert parents if a problem occurs.

Preference for non-technological solutions

Some parents might seek or prefer conventional or non-technological solutions for keeping an eye on their babies, like audio-only monitors, physical checks, and co-sleeping arrangements. Moreover, a recession, economic downturn, or constant fluctuations in disposable income can significantly impact consumer spending habits. These two major factors can constrain the demand for innovative baby monitor market products.

Increasing prevalence of nuclear families

The surge in dual-income and nuclear families, shift in family dynamics, and rise in disposable income are creating lucrative opportunities for the baby monitor market in the near future. Parenting today is way more difficult as technology is lengthening the distance between the child and the parent. Furthermore, for working parents, a baby monitor can give peace of mind as this device offers a key solution that allows parents to monitor their baby anywhere, anytime.

The audio baby monitor segment held the largest baby monitor market share in 2024. The dominance of the segment is owing to the increasing use of these baby monitors by parents as they lessen the stress and anxiety of parents who are far from their children. Baby auditors are small and much easier to carry with them. The price of these monitors ranges from cheapest to highest, allowing couples to buy them with all economic classes.

The video baby monitors segment is estimated to grow at the fastest rate over the studied period. This is due to the use of video cameras allowing parents to securely access the live condition of their child when they are far from home, allowing them to monitor the baby's nap times, baby's activities, and feeding schedules. Many video smart baby monitors feature two-way audio communication, automatic mobile notifications, and temperature sensors.

The analog baby monitors segment dominated the baby monitor market in 2024. The dominance of the segment can be attributed to the simple light and sound system provided by these monitors. The sound activation feature in this baby monitor can keep you aware of the baby's sounds. Additionally, the light gets activated when the baby makes a little sound, so even with a low volume, parents will know whether the baby needs it or not.

The digital baby monitor segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the innovative capabilities and features of these monitors. This monitor has features that are both digital and analog. In addition, digital technology offers a clear transmission, cutting any annoying white noise individuals hear from analog monitors. These monitors often come with an extended transmission range.

The one-way display segment held the largest baby monitor market share in 2024. The dominance of the segment can be linked to its widespread adoption among parents due to its real-time monitoring features, which allow parents to watch their baby remotely. Moreover, one display is more convenient and sophisticated due to its ability to give one-way monitoring for parents who can't afford the advanced display system.

The two-way display segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the innovative capabilities of these displays, such as temperature monitoring, two-way communication, and night vision, which in turn results in further segment expansion in the market. Also, this display is very soothing for the baby to reassure their parents regarding the baby's condition.

The wireless baby monitors segment led the baby monitor market in 2024. The dominance of the segment can be driven by rising demand for portable and convenient baby monitoring solutions. The main benefit of this baby monitor is that it can allow parents to check their baby from any place in the world, mostly from your phone app. Furthermore, this facility can capture the precious or funny moments of a baby that can be watched by the parents from remote places.

The smartphone-enabled baby monitors segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment is due to the increasing utilization of smartphones and the rising availability of innovative features in smartphone-enabled baby monitors. This connectivity feature can offer two-way communication, improved safety and security, and night vision capabilities.

In 2024, the residential segment led the baby monitor market by holding the largest share. The dominance of the segment is because of the rising number of working parents and nuclear families across developed and developing countries. The prime advantage of using baby monitors on a residential scale is the improved security and safety they provide. These devices also facilitate efficient multi-tasking for working parents.

The commercial segment is expected to grow at the fastest rate during the projected period. The growth of the segment can be linked to the increasing adoption of baby monitors in hospitals, daycare centers, and other commercial establishments. The use of baby monitoring devices in daycare facilities allows parents to check in on the baby throughout the whole day, enabling them to watch how their day is going.

By Type

By Technology

By Display

By Connectivity

By Usage

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

December 2024

April 2025

April 2025