February 2025

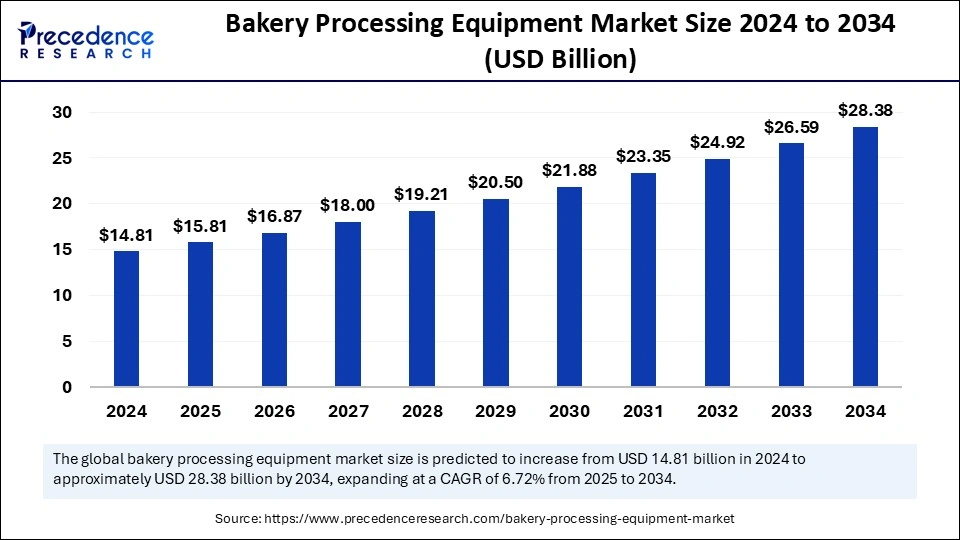

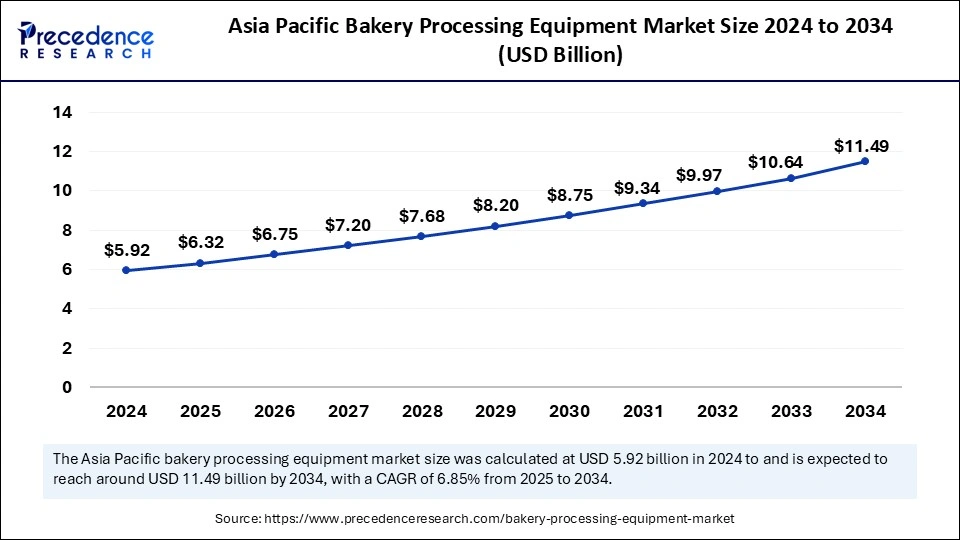

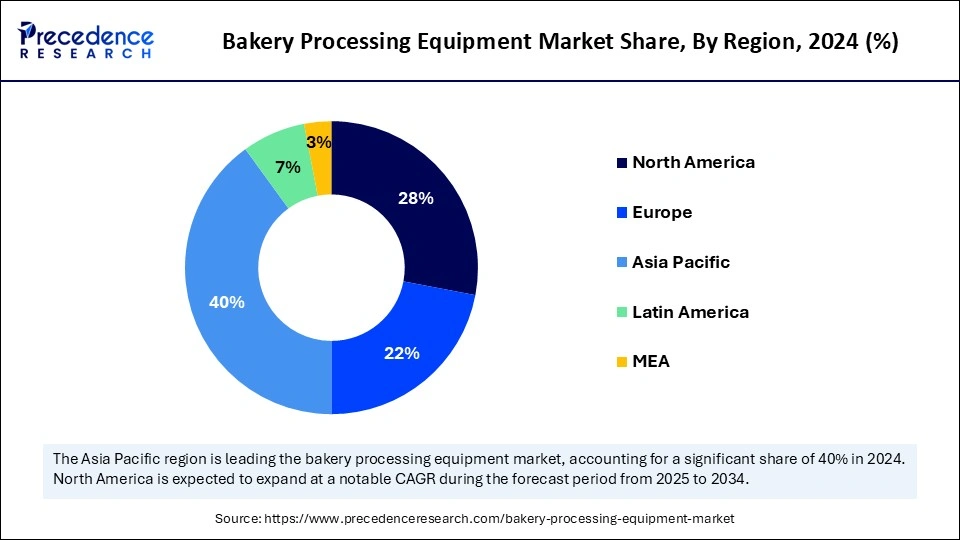

The global bakery processing equipment market size is evaluated at USD 15.81 billion in 2025 and is forecasted to hit around USD 28.38 billion by 2034, growing at a CAGR of 6.72% from 2025 to 2034. Asia Pacific market size was accounted at USD 5.92 billion in 2024 and is expanding at a CAGR of 6.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bakery processing equipment market size was estimated at USD 14.81 billion in 2024 and is predicted to increase from USD 15.81 billion in 2025 to approximately USD 28.38 billion by 2034, expanding at a CAGR of 6.72% from 2025 to 2034.The market is witnessing rapid growth due to the rising demand for packaged food products, such as ready-to-eat meals and snacks. The rapid expansion of the food processing industry further contributes to the market growth.

The integration of Artificial Intelligence algorithms in bakery processing equipment enhances the efficiency and reliability of these equipment. AI systems will make baking processes smoother by reducing ingredient waste. AI algorithms optimize the baking process by analyzing real-time data about ingredient usage, energy consumption, and baking times. AI prolongs equipment lifespan by predicting potential failures and reducing downtime. In addition, integrating AI algorithms in bakery processing equipment can automate several processes, such as blending, baking, and cooking.

Asia Pacific bakery processing equipment market size was exhibited at USD 5.92 billion in 2024 and is projected to be worth around USD 11.49 billion by 2034, growing at a CAGR of 6.85% from 2025 to 2034.

Asia Pacific Bakery Processing Equipment Market Trends

Asia Pacific held the largest share of the market in 2024, driven by increasing disposable incomes, urbanization, changing dietary habits, and the preference for convenience food. There is an increasing trend of automation and technology adoption, especially in emerging countries like China and India. In addition, the growing demand for healthier bakery products supports market growth.

India is expected to lead the market in Asia Pacific due to the growing Western culture and increasing fast-food consumption, boosting the demand for various types of bread. With rapid urbanization and changing consumer lifestyles, the demand for convenience food is increasing. Automated and advanced processing equipment is in high demand because of the need for mass production of bakery goods.

The bakery sector in China is growing rapidly. A rapid shift toward packaged and ready-to-eat food items, like bread and cookies, contributes to market expansion. Moreover, Japan has an ever-increasing bakery culture supported by an increasing demand for artisanal bread and cakes. The rise in demand for gluten-free and low-sugar bakery products influences the market.

North America Bakery Processing Equipment Market Trends

North America is observed to be the fastest growing region in the upcoming period. Due to the busy lifestyle patterns, the consumption of ready-to-eat and convenience bakery products has increased. The region is known for technological innovations, leading to the development of advanced bakery equipment.

The U.S. is a major contributor to the market in North America. This is mainly due to the easy availability of advanced bakery processing equipment. There is a high focus on automation among commercial bakeries, boosting the adoption of sophisticated bakery processing equipment. Energy-efficient machinery and sustainability practices are gaining traction in this country, supporting market growth. Moreover, the presence of a well-established food processing industry, including large-scale bakeries, and the rising focus of regional market companies to develop new equipment drive market growth.

In Canada, the bakery processing equipment market is growing at a steady growth rate due to the increasing consumption of bakery products and innovations in production technologies. The market in Canada, compared to that of the U.S., is still comparatively small but is seeing steady growth due to a strong demand for premium and specialty bakery goods.

European Bakery Processing Equipment Market Trends

Europe is considered a significantly growing area for the bakery processing equipment market owing to its long-standing tradition of bakery products and a high consumption rate of artisanal bread, cakes, and pastries. The increasing demand for healthier bakery products, like low-carb and gluten-free, is likely to fuel the market growth. There is a strong emphasis on automation and sustainable practices, boosting the demand for energy-efficient equipment. The region also boasts both large and small and medium-sized bakeries, supporting regional market growth.

Germany is a significant player in the European bakery processing equipment market. The country’s deep-rooted baking tradition is a major factor contributing to market growth. Germany is the hub for manufacturing innovative bakery equipment with a main focus on automation and energy-efficient equipment. The U.K. is flourishing in the market. This is mainly due to the surge in demand for artisanal bakery products.

The bakery processing equipment market comprises a range of tools and machinery used in the production of bakery products. These tools and machinery automate and streamline production. Bakery processing equipment acts as a great means of lowering labor costs and optimizing production processes. This equipment includes mixers, ovens, slicers, and freezers, which are deployed for large-scale production of bread, cakes, cookies, and pastries. This equipment improves consistency, reduces human error, and increases production capacity by automating essential steps such as ingredient handling, mixing dough, managing fermentation, and ensuring uniform baking.

The bakery processing equipment market is experiencing significant growth due to the increasing consumer preference for convenience foods, like ready-to-eat, frozen, and packaged bakery products. There is a high demand for bakery products made from healthier ingredients. In addition, technological advancements led to the development of sophisticated bakery processing equipment that can optimize the production process, contributing to market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 28.38 Billion |

| Market Size in 2025 | USD 15.81 Billion |

| Market Size in 2024 | USD 14.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | China |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment , Application and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for Baked Goods

With the changing lifestyles and rapid urbanization, the demand for baked goods is increasing, which is a key factor driving the growth of the bakery processing equipment market. Consumers are increasingly seeking healthier and unique baked goods. Thus, several leading food manufacturing companies, such as Bimbo Bakeries USA and MondelÄ“z International, are expanding their product portfolio to cater to varying consumers’ demands. For example, recently, Bimbo launched Big Chunk Soft Baked Cookies, and MondelÄ“z introduced Baked Bites under the Chips Ahoy! Brand. Such new products depict the need for flexible and scalable bakery processing equipment to fulfill consumer demands and satisfy high-volume production needs.

Another market growth catalyst is the shift towards healthy baked products. Due to the growing consciousness about health and wellness, consumers are shifting toward healthy baked products that are low in sugar, gluten-free, and plant-based. This encourages manufacturers to invest in sophisticated processing equipment that can maintain the freshness of these healthy goods without compromising quality.

High Energy Consumption

Bakery processing equipment, including ovens, mixers, and proofers, consumes large amounts of energy. High energy consumption translates into higher electricity bills for bakeries, which impact their profitability. Moreover, maintaining and repairing advanced processing equipment is costly. This high operational cost factor creates barriers for small bakeries, discouraging them from adopting bakery processing equipment and limiting the growth of the market.

New-Generation Bakery Processing Equipment

An opportunity for the worldwide bakery processing equipment market lies in the development of the next-generation bakery processing machinery. Automation, energy efficiency, and smart technologies are changing bakery operations. Next-generation bakery processing equipment allows for more production and less operating cost. For example, the use of AI-driven ovens can optimize baking conditions by automatically adjusting temperature, ensuring product consistency, and reducing energy consumption.

The rising demand for more energy-efficient bakery processing equipment creates immense opportunities in the market. Bakery equipment manufacturers are introducing energy-efficient ovens and heating systems, which are intended to cut down on power consumption while maintaining the quality and consistency of baked goods. The transition toward energy efficiency further enables food manufacturers to reduce emissions and support sustainability.

The oven & proofers segment dominated the bakery processing equipment market with the largest share in 2024, as they are indispensable when it comes to baking. The rise in demand for baked goods, such as bread, cookies, cakes, and pastries, also supported segmental dominance. Ovens play a crucial role in the mass production of bakery goods. Oven is widely used in large bakeries in baking as it maintains texture, flavor, aroma, and appearance of baked products. Within the general context of food safety, the oven plays an important role in ensuring that pathogens are eliminated from food, making them a vital piece of equipment in the baking process.

The molders & sheeters segment is anticipated to expand at the highest CAGR during the projection period. Molders & sheeters are important for certain types of baked goods. They flatten the dough by passing it through rollers. Dough sheeters have variable speed options, making them handy for dough with different consistency. They are used to shape and form dough for bread and cookies.

The bread segment led the bakery processing equipment market by capturing the largest share in 2024. This is mainly due to the increased consumption of bread in regions like North America and Europe. Bread is considered a staple food consumed heavily in these regions. The variety of bread types, like whole wheat and white, and specialty types, such as sourdough, calls for multi-purpose bakery equipment that can handle a variety of dough. With busy lifestyles, the consumption of bread has increased, prompting manufacturers to invest in advanced equipment that can bake large batches of bread.

The pizza crust segment is expected to expand at a notable CAGR over the projected period, driven by rising demand for premium, healthier pizza options, including gluten-free and organic crusts. Mixers, sheeters, and ovens are commonly used in pizza crust production. The rising demand for ready-to-bake pizza dough is likely to support segmental growth. The rapid expansion of fast-food delivery platforms and the availability of specialized equipment, such as pizza dough rollers and pizza ovens, contribute to segmental growth.

By Equipment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

August 2024

November 2024