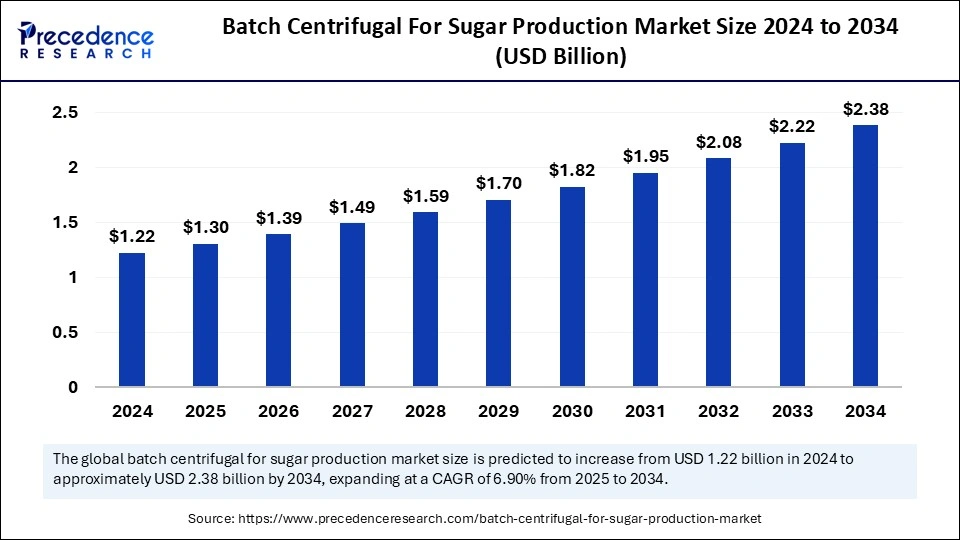

The global batch centrifugal for sugar production market size is calculated at USD 1.30 billion in 2025 and is forecasted to reach around USD 2.38 billion by 2034, accelerating at a CAGR of 6.90% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global batch centrifugal for sugar production market size accounted for USD 1.22 billion in 2024 and is predicted to increase from USD 1.30 billion in 2025 to approximately USD 2.38 billion by 2034, expanding at a CAGR of 6.90% from 2025 to 2034. The batch centrifugal for sugar production market growth is driven by the increased focus on developing sustainable and energy-efficient manufacturing practices, growing demand for sugar and sugar-based products as well as rising appeal for food tourism with emerging economies.

Integration of Artificial Intelligence in batch centrifugal processes used for sugar production can assist in enhancing operations with improved efficiency, increased yields and reduced energy costs leading to maximum profitability for sugar mills. Developing AI and machine learning algorithms by considering several factors such as constraints in production, availability of resources and demand forecasts which can further help in optimizing resource allocations, improving production schedules and batch formulations altogether resulting in reduced environmental impact with optimized waste generation and resource usage as well as for enhancing quality of products.

AI algorithms can be utilized for predicting the amount of sugarcane ready for harvesting, pest and disease detection, in monitoring quality metrics for cane juice and implementing smart agricultural solutions along with precision farming.

Batch centrifugals are crucial in the massecuite processing stage sugar production for separation of sugar crystals from molasses (mother liquor) after crystallization, thereby providing high-quality “A” sugars. They allow better control of washing process while minimizing breakage of crystals leading to streamlined separation and enhanced purity of sugar during the massecuite processing stage. These centrifuges help in meeting the expectations of consumers and meeting the industry standards is further expanding the batch centrifugal for sugar production market.

The increased demand and consumption of sugar across the globe, increased focus of manufacturers on developing extensive product portfolios to cater the diverse client needs, ongoing research on developing advanced batch centrifugals, implementation of sustainable practices, emerging new players in developing areas expanding sugar production capacities and growing utilization of sugar in food, beverages and pharmaceutical products as well as in various other industries is fostering the market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.38 Billion |

| Market Size in 2025 | USD 1.30 Billion |

| Market Size in 2024 | USD 1.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.90% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising global sugar demand

Increased global demand for refined sugar, burgeoning sugar consumption rates, rising disposable incomes and growing culinary tourism are driving the growth of the batch centrifugal for sugar production market. According to a report published by the Foreign Agricultural Service (FAS) of the U.S. Department of Agriculture (USDA) in November 2024, the global sugar production rate is estimated to reach 186.6 million metric tons owing to the increased production in China, emerging markets in India and surge in exports from Thailand.

Moreover, the need for efficient and high yield sugar production techniques, advancements in batch centrifugal systems with enhanced energy efficiency and automation as well as increased operational yields with reduced costs is driving investments and adoption of these systems among sugar producers. Centrifugation technology companies are focusing on developing innovative technologies and improving client service which further drives the market growth.

High upfront investments and upkeep costs

Although the sugar production industry is flourishing, the batch centrifugal for sugar production market growth is restrained owing to the high initial capital investments required for building manufacturing facilities adherent to the stringent government regulations. Costs associated with complex operations, fluctuating market prices of raw materials and equipment upgrading costs can impact production costs and affect the lucrativeness of businesses.

Furthermore, maintenance of batch centrifugal and other equipments to sustain the production efficiency and quality can be costly especially for small scale sugar manufacturers while keeping up with global climatic changes, trade policies and fluctuating market trends which can potentially restrain the market growth.

Sustainability Initiatives

With the expansion of sugar production capacities in various regions and increasing sugar demand across the globe is creating the need for developing sustainable practices for sugar production. The stringent regulations, various government initiatives for sustainable development, global trade policies as well as growing consumer demand for naturally sourced and organic sugars are pushing manufacturing companies for developing solutions such as launching climate agreements, observing sustainability across global supply chains, maintaining public transparency, sustainable sugarcane farming with crop rotations and integrated pest management (IPM) methods, water-saving and recycling technologies as well as production diversification.

Furthermore, development of energy efficient batch centrifugals for enhancing product purity is creating opportunities for market expansion.

The automatic centrifuge segment dominated the market with the largest share in 2024. The market growth of this segment is driven by the growing global sugar consumption, surging demand for refined sugar which require systematic and effective separation processes, increased dependability on indispensable centrifugal machines for sugar production and minimum loss of valuable sugar content with the automatic batch centrifuges which increases operational yield.

Furthermore, industries are actively implementing automated technologies such as advanced automated centrifuges for enhancing the product quality and for expanding sugar production capacity owing to their continuous operating and high-throughput capabilities.

The semi-automatic centrifuge segment is expected to witness lucrative growth during the forecast period. Semi-automatic batch centrifugal models provide a balance between the operator control and automation which leads to improved efficiency and reduced loss in sugar production processes. These machines help in maintaining process consistency, offer better control during the washing process, reducing labour costs and waste as well as increases the operational yield resulting in high quality sugar crystals.

Furthermore, ongoing technological advancements such as PLC (Programmable Logic Controller) control and enhanced drive systems, increased sugar demand across the globe and the growing preference of small scale manufacturers towards semi-automatic centrifuges offering cost-effective production methods with enhanced yield are the factors expanding the market growth of this segment.

The raw sugar segment held the largest market share in 2024. Raw sugar plays a pivotal role in the sugar production industry owing to the increased consumer demand for natural and minimally processed sugar products. Furthermore, utilization of raw sugar as a trading commodity for food and beverage, as a sweetener and for various industrials applications such as production of ethanol, as livestock feed and producing medications among others are driving the market growth.

Batch centrifugal machines assist in rapid and precise separation of sugar crystals from molasses, enabling continuous processing of sugar slurry while maintaining the quality leading to reduced sugar losses, increased operational yield and production of high-purity raw sugar.

The refined sugar is anticipated to show the fastest growth during the forecast period. Refined sugar which is also known as white or table sugar is widely used in various industries such as food and beverages as sweetener and preservative among others, in pharmaceuticals by using pharmaceutical- grade sucrose and glucose for enhancing taste of medications and vaccine stabilization as well as industrial applications such as production of bioplastics.

Additionally, factors such as rapid urbanization, changing dietary habits and increased consumption of sugar based products is driving the global sugar demand creating the need of implementing efficient and high-performance batch centrifugals for producing high-quality refined sugar products.

Asia Pacific dominated the global batch centrifugal for sugar production market with the largest share in 2024. The market growth is driven by the region’s increased focus on rapid industrialization and robust economic growth and rising consumer demand for refined sugar and sugar-based products owing to the large population base.

Additionally, growing emphasis of manufacturers on developing high efficiency batch centrifugals equipped with advanced drive technology and programmable logic controllers (PLCs) with optimized water usage and reduced energy consumption are enhancing the operational efficiencies and driving the market growth in the region. Furthermore, increased sugar production in key regional countries such as India, China, Japan and Thailand is creating the need for high-capacity batch centrifugals.

How is India Becoming a Powerhouse of Sugar Production?

India being one of the largest sugar producing country in the world dominates the Asia Pacific market. In 2024, India produced about 35.5 million metric tons of sugar accounting for 19% of global production which was stated in USDA’s November 2024 report. The market growth can be attributed to the favourable weather, increased production yields with the plantation of early maturing sugarcane varieties, increased research activities for improving sugarcane yields and recovery rates, increased influence of government on developing infrastructure such as transportation networks and storage facilities as well as restrictions on export for preventing price fluctuations and meeting the high domestic consumer demand especially during the festivals in the country.

Furthermore, supportive government initiatives such as promoting the production of ethanol from sugarcane and sugar through the Ethanol Blending Program, Interest Subvention Scheme for setting up ethanol plants and the Fair and Remunerative Price (FRP) policy for supporting farmers foster the batch centrifugal for sugar production market growth.

Latin America Sugar Production Trends

Latin America region is anticipated to witness lucrative growth in the market. The growing sugar production capacities of key countries such as Brazil, Mexico and others in the region is generating the need for efficient batch centrifugals for sugar production to meet the rising consumer demand for refined sugar. Furthermore, the rapid urbanization of various areas and increased adoption of automated and high-performance batch centrifugals for enhancing the production efficiency and quality by manufacturers is fostering the market growth.

Brazil dominates the Latin America region in batch centrifugal for sugar production market. The increased use of efficient and advanced batch centrifugal, presence of major market players and increasing sugar demand drives the market growth. According to the U.S. Department of Agriculture’s (USDA) Foreign Agricultural Service, Brazil accounted for 23% of global sugar production in 2024 by producing about 43 million metric tons.

North America is expected to see a notable growth in the global batch centrifugal for sugar production market. The growth of the region can be attributed to rising global sugar demand by consumers, robust infrastructure fostering innovation, blooming food and beverage industry, increased use in pharmaceuticals, rapid urbanization, advancements in batch centrifugal technologies, increased focus on implementing sustainable practices and shifting dietary preferences.

U.S. market is expected to grow significantly in the upcoming years owing to rising demand for sugar and sugar-laden products, continuous advancements in centrifugal technologies and increased influence of government bodies such as the U.S. Department of Agriculture (USDA).

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client