January 2025

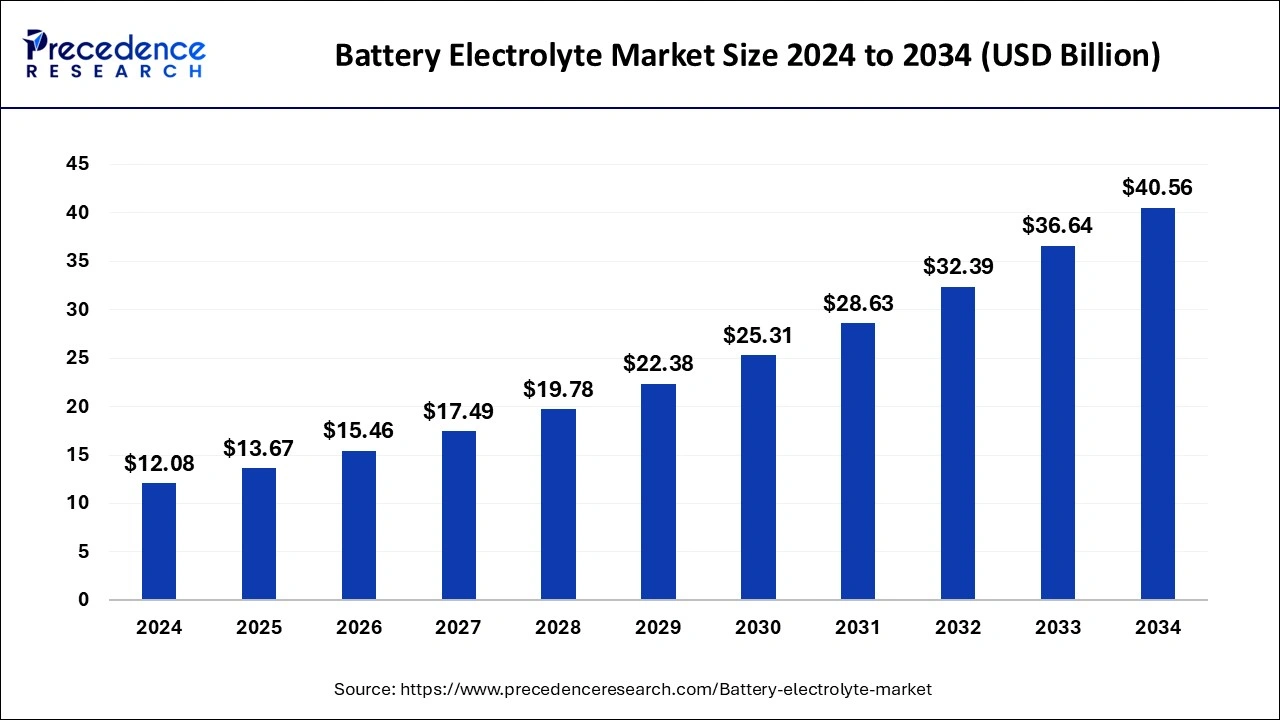

The global battery electrolyte market size is calculated at USD 13.67 billion in 2025 and is forecasted to reach around USD 40.56 billion by 2034, accelerating at a CAGR of 12.88% from 2025 to 2034. The Asia Pacific battery electrolyte market size surpassed USD 4.78 billion in 2025 and is expanding at a CAGR of 13.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global battery electrolyte market size was estimated at USD 12.08 billion in 2024 and is predicted to increase from USD 13.67 billion in 2025 to approximately USD 40.56 billion by 2034, expanding at a CAGR of 12.88% from 2025 to 2034. The market is driven by fastest growing adoption of electric vehicles due to climatic changes concerns and rising demand for energy storage systems with adoption of renewable energy. These factors exponentially affecting the markets growth globally.

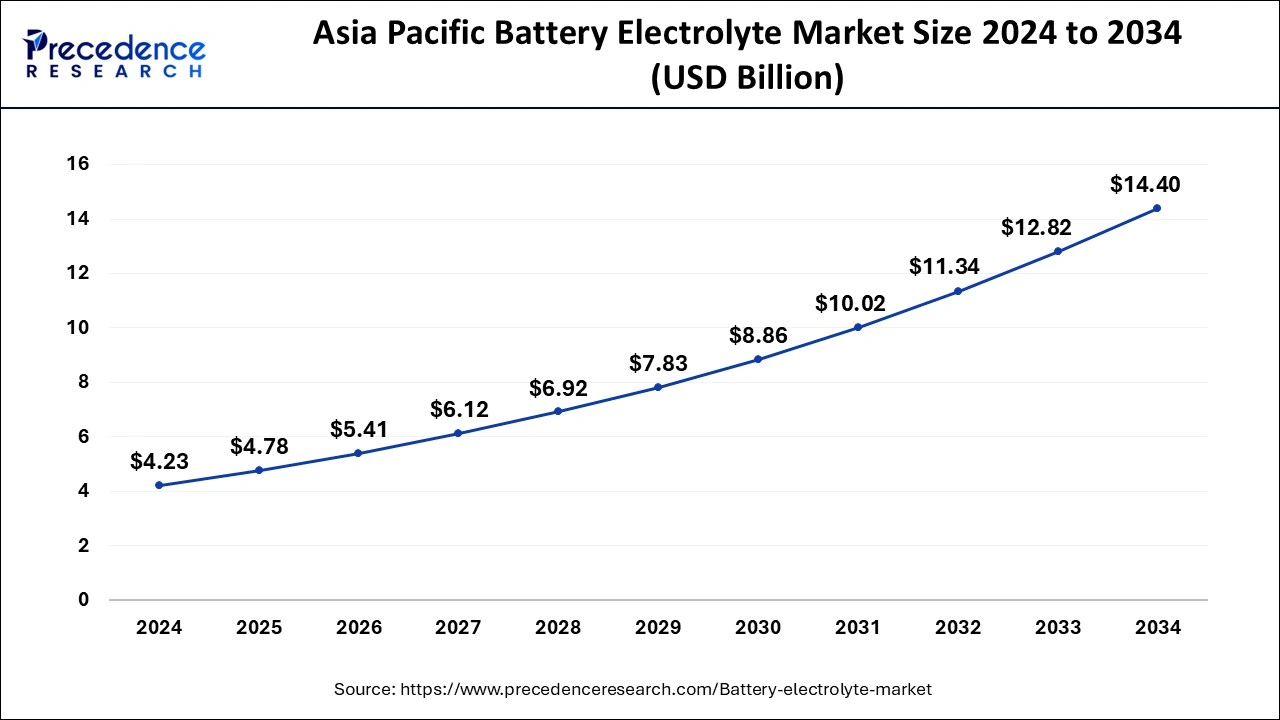

The Asia Pacific battery electrolyte market size was estimated at USD 4.23 billion in 2024 and is predicted to be worth around USD 14.40 billion by 2034, at a CAGR of 13.03% from 2025 to 2034.

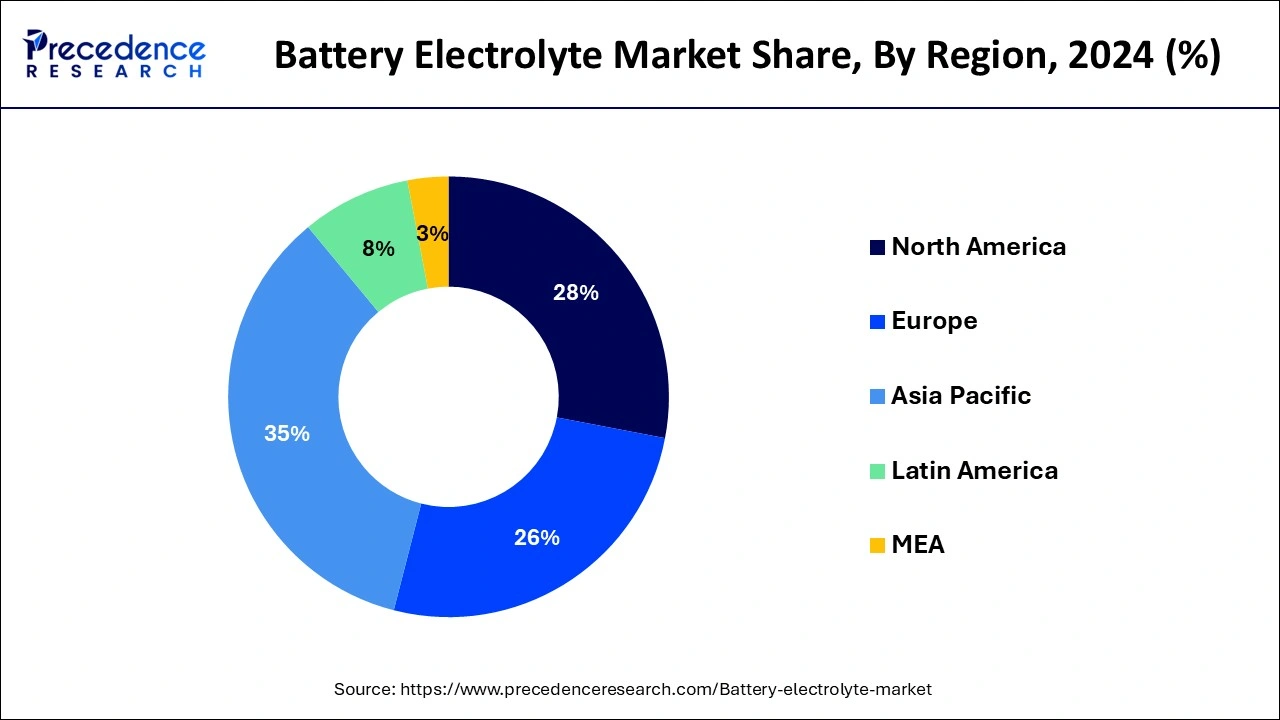

Asia Pacific led the battery electrolyte market, propelled by an influence of factors driving energy storage demand and technological innovation. Primarily, the rapid urbanization and industrialization across nations like China and India, coupled with an increasing population, have escalated the need for reliable and sustainable energy solutions. This surge in demand includes various sectors such as automotive, electronics, and renewable energy, thereby fuelling the adoption of advanced battery technologies like lithium-ion batteries, which heavily rely on electrolytes.

Furthermore, the region's robust economic growth and increasing disposable income levels are driving the sales of electric vehicles (EVs) and portable electronic devices, further amplifying the demand for high-performance batteries and electrolytes.

Moreover, supportive government policies and initiatives aimed at reducing carbon emissions and promoting renewable energy sources are accelerating the adoption of energy storage solutions in the Asia Pacific region.

Additionally, the Asia Pacific region is witnessing significant investments in research and development, leading to advancements in electrolyte formulations and battery technologies. Collaborations between industry players, academic institutions, and government bodies further catalyse innovation in this space.

Hence, with its growing population, expanding economy, supportive regulatory environment, and increasing investments in technology, the Asia Pacific region stands as a vibrant and fast-growing market for battery electrolytes, poised to play a pivotal role in the global energy storage landscape.

North America expected to grow at the highest CAGR during the forecasted years. Growth of this region is due to the presence of major key players in the countries such as US and Canada and the manufacturers in these countries. In the US and Canada, the battery electrolyte market is witnessing dynamic trends driven by several factors shaping the battery electrolyte market.

The increasing adoption of electric vehicles (EVs) in both countries is propelling the demand for advanced battery technologies, including electrolytes. As governments implement stricter emission regulations and provide incentives for electric vehicle adoption, the need for high-performance batteries with improved energy density and longevity grows, stimulating the electrolyte market.

the emphasis on renewable energy integration in the power sector is driving investments in grid-scale energy storage projects. As the US and Canada strive to transition towards cleaner energy sources, energy storage solutions play a crucial role in stabilizing the grid and managing intermittent renewable energy generation. This trend fuels the demand for electrolytes suitable for large-scale energy storage systems, such as lithium-ion batteries.

Moreover, ongoing research and development efforts in electrolyte technology are leading to innovations in formulation and performance. Solid-state electrolytes, offer enhanced safety and energy density compared to traditional liquid electrolytes, driving their adoption in various applications.

Additionally, supportive government policies and initiatives promoting clean energy and technological innovation further stimulate market growth. In both the US and Canada, incentives, grants, and funding programs aimed at advancing energy storage technologies create favourable conditions for electrolyte manufacturers and encourage collaboration between industry stakeholders.

The battery electrolyte market is experiencing robust growth, driven by the rising demand for energy storage solutions across various industries such as automotive, electronics, and renewable energy. With increasing adoption of electric vehicles and grid-scale energy storage systems, the demand for advanced electrolytes is on the rise. Additionally, technological advancements in electrolyte formulations, such as lithium-ion and solid-state electrolytes, are enhancing battery performance and safety standards. Moreover, supportive government initiatives promoting clean energy solutions further propel market expansion. However, challenges related to raw material availability and stringent regulatory norms may hinder market growth. Overall, the battery electrolyte market is poised for steady growth as industries prioritize sustainable energy storage solutions.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.88% |

| Market Size in 2025 | USD 13.67 Billion |

| Market Size by 2034 | USD 40.56 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Electrolyte Type, By Battery Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for energy storage

The primary driver for the battery electrolyte market is the accelerating demand for energy storage solutions across various industries. This demand is fuelled by the increasing adoption of electric vehicles (EVs) and grid-scale energy storage systems worldwide. As governments and industries shift towards sustainable energy solutions, the need for efficient and reliable battery technologies becomes paramount. Advanced electrolytes play a crucial role in enhancing battery performance, safety, and longevity, driving their demand in the market. Additionally, ongoing research and development efforts aimed at improving electrolyte formulations, such as lithium-ion and solid-state electrolytes, contribute to market growth by unlocking new possibilities for energy storage applications.

Cost volatility

One significant restraint facing the battery electrolyte market is the challenge of raw material availability and cost volatility. The production of advanced electrolytes requires specific raw materials such as lithium, cobalt, and nickel, which are essential components of lithium-ion batteries. However, the extraction and processing of these raw materials are often concentrated in a limited number of countries, leading to supply chain vulnerabilities.

Additionally, concerns regarding ethical sourcing practices and environmental sustainability further complicate the procurement of raw materials, as stakeholders increasingly demand transparency and accountability throughout the supply chain. Addressing these challenges requires collaboration across industry stakeholders to diversify supply sources, improve recycling and resource efficiency, and develop alternative materials with reduced environmental impact.

Sustainable and eco-friendly electrolyte materials

The significant opportunity for the battery electrolyte market lies in the development of sustainable and eco-friendly electrolyte materials. With increasing environmental concerns and the push towards a low-carbon economy, there is a growing demand for electrolytes derived from renewable sources or those with minimal environmental impact. Manufacturers have the opportunity to innovate and commercialize bio-based electrolytes, recycled electrolytes, or electrolytes made from abundant and non-toxic materials. By offering sustainable alternatives, electrolyte manufacturers can cater to the evolving preferences of consumers and businesses alike, tapping into a niche market segment and positioning themselves as leaders in environmental stewardship within the battery industry.

The gel type segment accounted for largest share of the battery electrolyte market. However, the electrolyte segment has divided into three types, solid, liquid and gel. Rising demand for gel polymer electrolytes is one of the significant factors to considered for markets growth. Gel polymer electrolytes (GPEs) are a type of electrolyte material used in batteries and electrochemical devices. They consist of a polymer matrix, typically a cross-linked polymer, infused with a liquid electrolyte. This combination offers several advantages, including enhanced safety, flexibility, and improved electrochemical performance.

GPEs provide efficient ion transport while minimizing the risks associated with leakage or flammability, making them suitable for various applications, from portable electronics to electric vehicles. Their versatility and ability to be tailored for specific requirements make gel polymer electrolytes a promising solution for advancing battery technology.

While the solid electrolyte segment emerging as a fastest growing segment of the market. this segment growth is related due to, solid electrolytes offer significant advantages over traditional liquid electrolytes, including enhanced safety, stability, and higher energy density. With rising demand for safer and more efficient battery technologies in various industries, such as automotive and electronics, solid electrolytes are gaining traction. Their ability to enable next-generation batteries with improved performance and longevity positions the solid segment as a key driver of market growth.

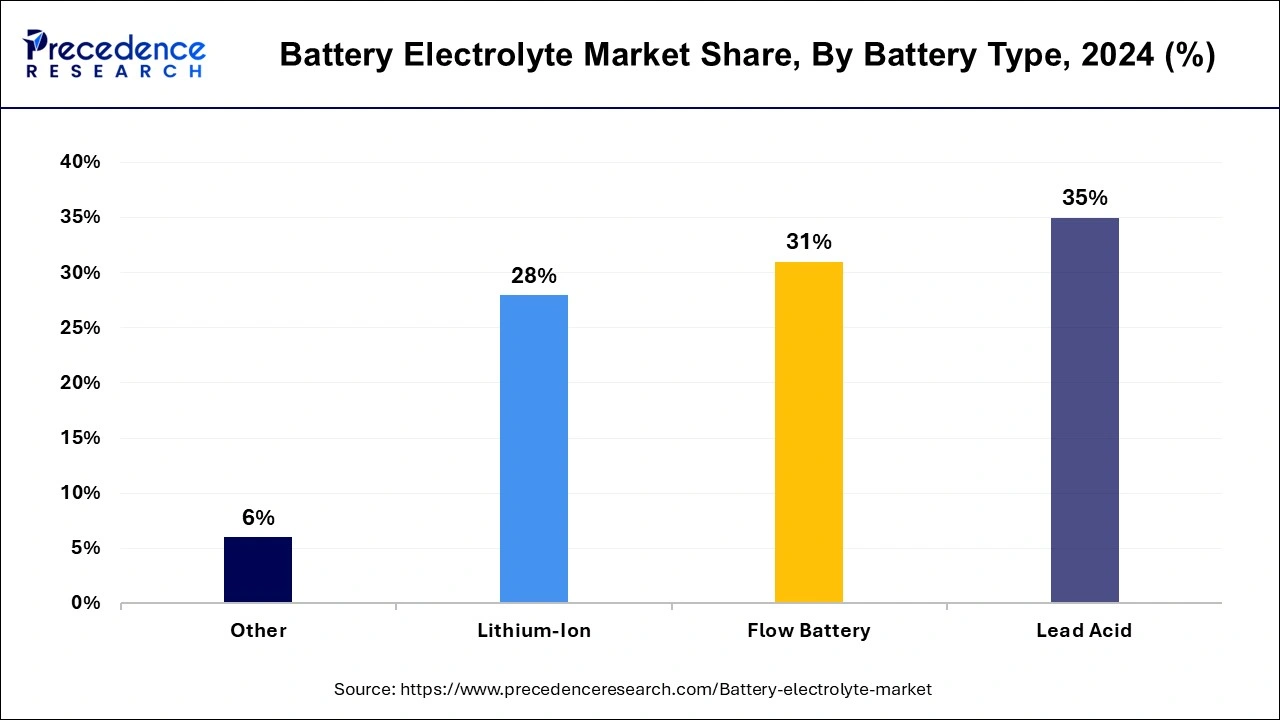

The lead acid segment stood as a dominating segment in the battery electrolyte market in 2024. Among battery types, the lead acid segment reigns as the dominant force in the battery electrolyte market. Lead acid batteries have a long-standing history and widespread use in automotive, industrial, and stationary energy storage applications. Their cost-effectiveness, reliability, and ability to deliver high surge currents make them indispensable for various sectors. Additionally, lead acid batteries are recyclable, contributing to their sustainability credentials. Despite advancements in other battery chemistries, such as lithium-ion, the lead acid segment maintains its stronghold due to its established infrastructure, affordability, and proven performance across diverse applications, ensuring its continued dominance in the market.

While the lithium-ion batteries segment is emerging as a fastest growing segment of the market witnessing with notable CAGR. Lithium-ion batteries have emerged as the fastest-growing segment in the battery market. Their unparalleled energy density, lightweight design, and long cycle life make them ideal for powering portable electronics, electric vehicles, and renewable energy storage systems. The exponential growth of electric vehicles and the increasing demand for energy storage solutions have propelled the rapid expansion of lithium-ion battery production. Moreover, ongoing research and development efforts continue to improve their performance, safety, and cost-effectiveness, further fuelling their adoption across various industries. With their versatility and promise for a sustainable energy future, lithium-ion batteries are poised to maintain their status as a leading force in the battery electrolyte market.

The automotive segment held the highest market share in 2024 led by the climate awareness campaigns, dominated the global market. In the battery market, the automotive segment stands out as the dominant force. With the global shift towards electric mobility, there's a surge in demand for batteries to power electric vehicles (EVs) and hybrid electric vehicles (HEVs). Automotive manufacturers are increasingly investing in battery technology to extend driving ranges and enhance vehicle performance. Additionally, government regulations mandating emissions reductions and the growing awareness of environmental sustainability are driving the adoption of electric vehicles. As a result, the automotive segment continues to lead the battery market, shaping the future of transportation towards electrification.

On the other hand, the energy storage segment emerged as the fastest growing segment in the market with the significant CAGR over the foreseen years. The energy storage segment is rapidly emerging as a pivotal force in the market. With the integration of renewable energy sources like solar and wind power into the grid, there's a pressing need for effective energy storage solutions to manage fluctuations in supply and demand. Battery energy storage system play a crucial role in balancing the grid, improving grid stability, and enabling the integration of renewable energy. As demand for reliable energy storage grows, this segment continues to expand, driving market growth.

By Electrolyte Type

By Battery Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

November 2024