February 2025

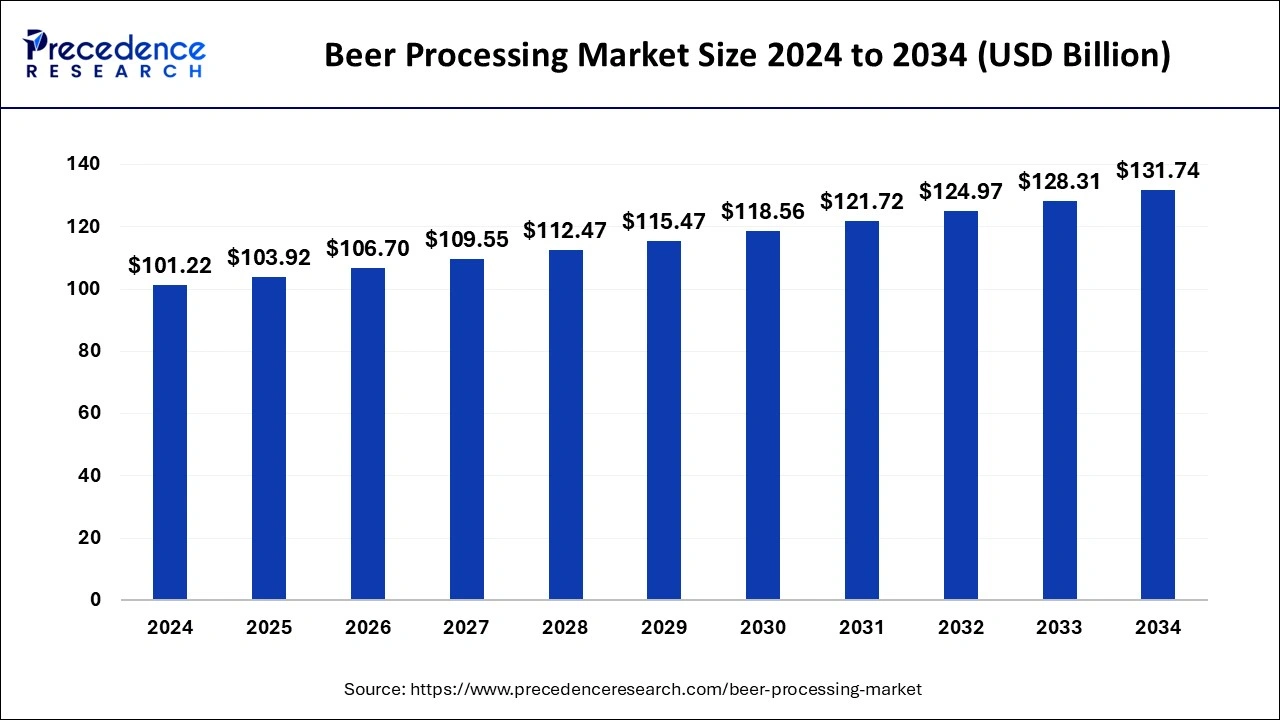

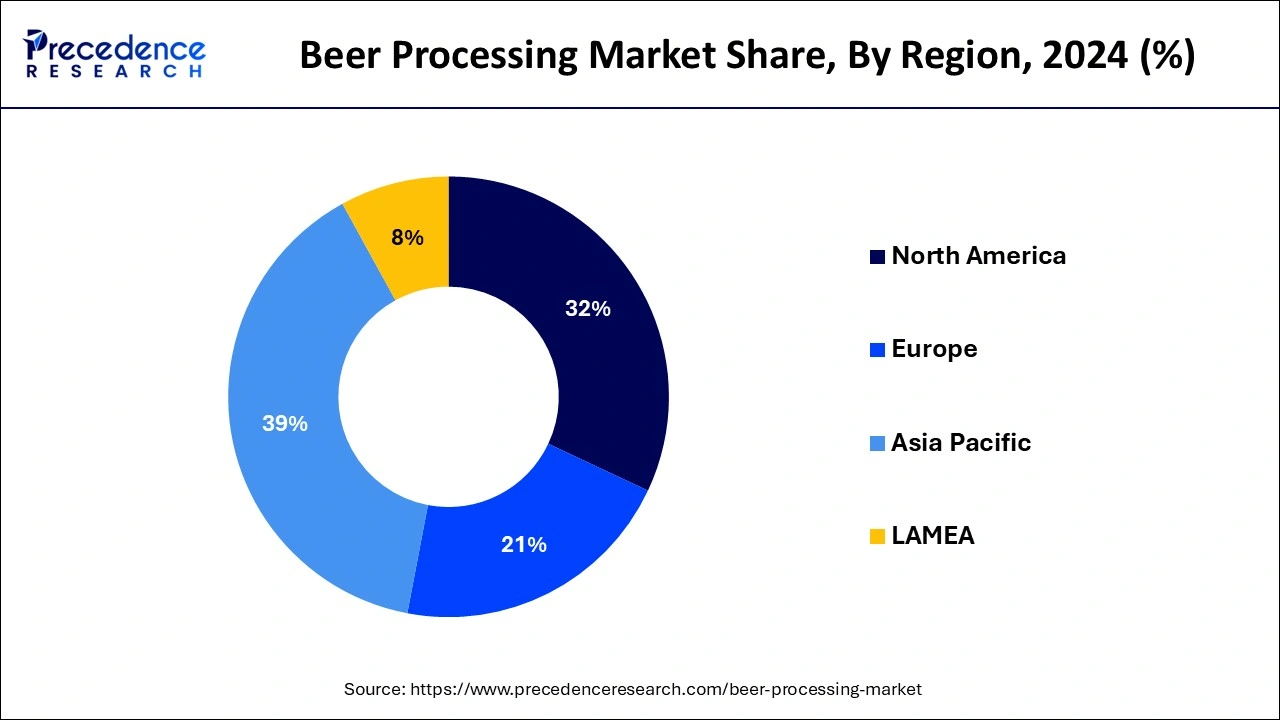

The global beer processing market size is accounted at USD 103.92 billion in 2025 and is forecasted to hit around USD 131.74 billion by 2034, representing a CAGR of 2.67% from 2025 to 2034. The North America market size was estimated at USD 39.48 billion in 2024 and is expanding at a CAGR of 2.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global beer processing market size was calculated at USD 101.22 billion in 2024 and is predicted to reach around USD 131.74 billion by 2034, expanding at a CAGR of 2.67% from 2025 to 2034. The global beer processing market is attributed to the increasing consumer demand for premium and craft beers during the forecast period.

Artificial intelligence technologies have started playing a major role in various industries, including the beer processing market. Research and development in this field are making progress into new industries and new tasks. The brewing industry is a major example. The brewing industry started off by using AI in its functions, such as supply chain and marketing. AI helped them to identify the target advertisements and the right audience. AI is used to collect real-time data on how people reacted to their creatives. The beer brewing procedure is seen as a mix of science and art. It allows the brewers to experiment with their recipes and develop the craft of beer brewing, while the infusion of AI in the process of brewing can add precision and take care of the scientific side.

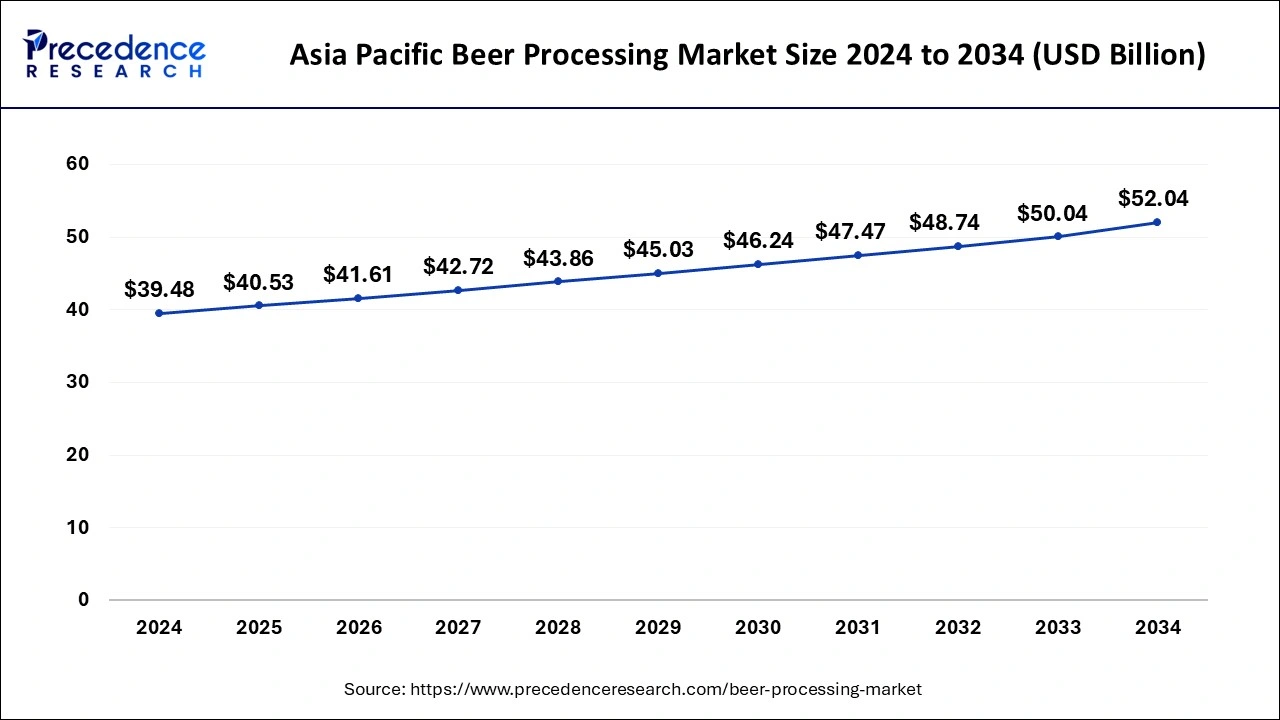

The Asia Pacific beer processing market size was exhibited at USD 39.48 billion in 2024 and is projected to be worth around USD 52.04 billion by 2034, growing at a CAGR of 2.80% from 2025 to 2034.

Asia Pacific dominated the beer processing market in 2024. The market growth in the region is attributed to the rising awareness among consumers about low and no-alcohol beer and the increasing number of microbreweries in the region. The U.S. and Canada are the major countries that dominated the market growth in the region. In addition, the growing popularity of e-commerce platforms and the rising technological advancements are further anticipated to enhance the market growth in the U.S.

North America is expected to grow at the fastest rate in the beer processing market during the forecast period. The market growth in the region is attributed to the increasing personal disposable income, changing lifestyle, increasing expansion and growth of the beverages industry, and rising westernization and urbanization. China, India, Japan, and South Korea are the fastest-growing countries driving the region's market growth. The rising technological advancements, such as the IoT-enabled quality control measures and the adoption of automated brewing systems, are expected to drive the growth of the market in China.

The global beer processing market provides various advantages, such as cost reduction, production efficiency, and improved product quality through advanced techniques. An increase in consumer preferences for beer among alcoholic beverages and increasing disposable income. In addition, an increase in unprecedented growth in the youth population and a surge in female drinkers. Breweries can extend shelf life, customize beers for consumer preferences, and adopt innovative brewing methods. Eco-friendly and automation technologies enhance scalability and sustainability while ensuring safety and health standards. This trend is enhancing innovation in brewing equipment and techniques.

| Report Coverage | Details |

| Market Size by 2024 | USD 101.22 Billion |

| Market Size in 2025 | USD 103.92 Billion |

| Market Size in 2034 | USD 131.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.67% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material Type, Processing Method, Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising health consciousness

Consumers are seeking out healthier additives to traditional alcoholic beverages and becoming increasingly health conscious compared to wine and spirits. Beer, with its higher nutritional value and lower alcohol content, is benefiting from this trend. The increasing popularity of craft beers, which are integrated as being healthier than mass-produced beers.

In addition, beer can be consumed without the negative effects of alcohol. The increasing availability of low-alcohol and non-alcoholic beers is serving the needs of health-conscious customers who want to enjoy the taste of beer. Furthermore, the rising health consciousness among consumers and craft beer expansion is driving the beer processing market.

High maintenance costs and capital investments

High country investments have a long-term effect on product costs, which beer manufacturers don't like. Craft beer producers are required to invest significantly in various types of processing equipment. This installation requires regular maintenance and involves high costs, posing significant challenges to the growth of the beer processing market. Furthermore, due to the timely maintenance costs and high installation costs, replacing old machines has an impact on the company’s fixed cost structure.

The rising focus on automation and digitalization using big data and IoT

While increasing the capacity to switch between various processing operations, automation reduces labor costs in the beer processing market. The major purchasing factor for beer manufacturers is a growing demand for equipment automation. Robotic automation is used by beer manufacturers to reduce costs and improve efficiency and is the most recent advancement in beer processing technology. Robotic technologies are also used in packaging systems and beer manufacturing facilities.

Manufacturers in the beer processing market are searching for new machinery that can be easily adopted into the manufacturing process. In addition, digitalization and automation are the major draws for microbreweries with small facilities and limited manpower. Automation is hygienic and provides higher precision and faster processing, which is the major opportunity driving market growth. Furthermore, by collecting data, the Internet of Things (IoT) reduces waste at almost every step of a process, such as motion light levels, waste products, the volume of ingredients, weight, and other significant data points.

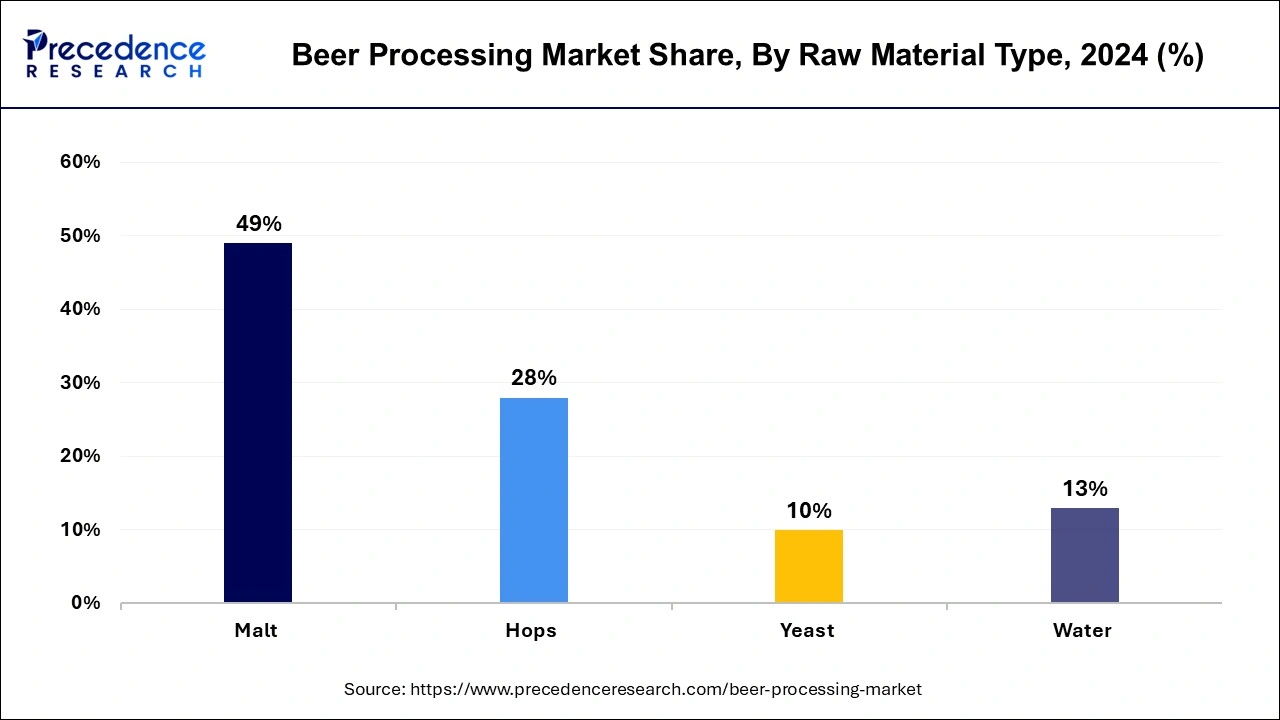

The malt segment dominated the beer processing market in 2024. The market is segmented into water, yeast, hops, and malt. The segment growth is attributed to the growing popularity of specialty malts and increasing demand for craft beers. In addition, the increasing consumer awareness of the health benefits and the increasing demand for beer, especially in developing countries, are growing the popularity of craft beers.

The hops segment is expected to grow at the fastest rate in the beer processing market during the forecast period. The segment growth is attributed to the increasing demand for aromatic and flavorful beers. The hops play an important part in the flavor. The flavor is adjusted by changing the temperature, time spent on different processes, and the proportions of ingredients. Without adding bitterness, extra hops can be added after the boiling process to flavor the beer. Some of the most widely used hops are Nelson Sauvin, Simcoe, Chinook, Centennial, Magnum, Amarillo, Mosaic, Cascade, and Citra.

The brewing segment held the largest beer processing market share in 2024. The market is segmented into packaging, filtration, maturation, fermentation, and brewing. The initial stage of brewing includes converting wort into beer. Brewing is the procedure of manufacturing beer. The process of brewing includes boiling, fermentation, cooling, hop addition, extract separation, mashing, milling, malting, and packaging.

The filtration segment is expected to grow rapidly in the beer processing market during the forecast period. The beer filtration system is one of the indispensable processes for the manufacturing of high-quality beer in the beer brewing process, which plays an important role in the sterility, color, and flavor of the beer. The beer filtration process majorly involves steam filtration process, compressed air/vent/gas filtration process, sterilization filtration process, trap filtration process, centrifuge seal water filtration process, boiler feed water filtration process, and incoming water filtration process.

The larger segment held the largest share of the beer processing market in 2024. The market is segmented into IPA, porter, stout, ale, and lager. Lagers are generally characterized by their low bitterness, crisp flavor, and light. They have a relatively low alcohol content and are typically fermented at low temperatures.

The ale segment is expected to grow significantly in the beer processing market during the forecast period. Ale is also a popular beer known for its higher alcohol content and full-bodied flavor. It has a more pronounced hop character and is fermented at warmer temperatures than lager.

The kegs segment dominated the global beer processing market in 2024. The market is segmented into kegs, cans, bottles, and draught. Their recyclability, portability and lightweight make them a preferred choice for customers seeking environmental sustainability and convenience. Kegs are known for their huge ability and capacity to maintain beer’s freshness. They offer cost-effective and efficient solutions for high-volume dispensing and distribution.

The cans segment is expected to grow at the fastest rate in the beer processing market during the forecast period. Cans are widely used for packaging both imported and domestic beers.

By Raw Material Type

By Processing Method

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

November 2024

September 2024