January 2025

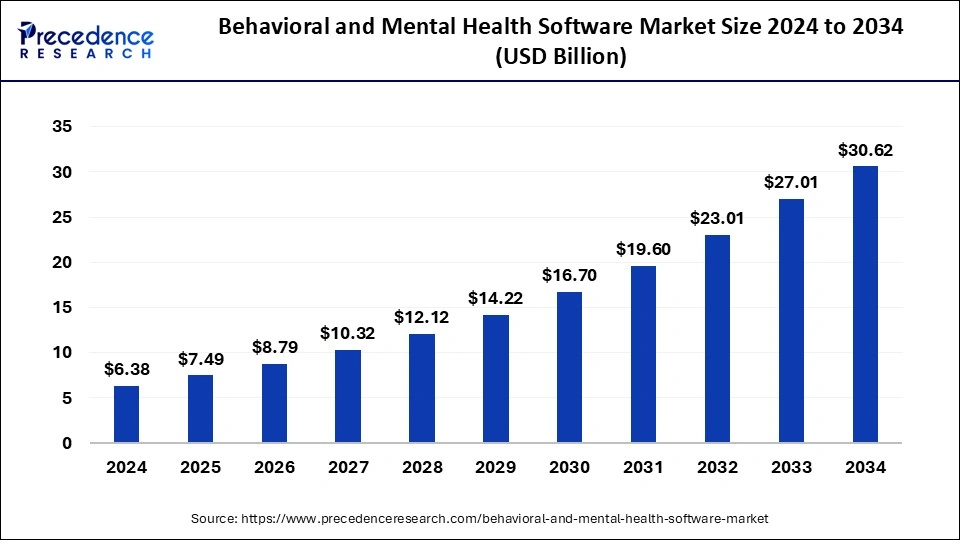

The global behavioral and mental health software market size accounted for USD 7.49 billion in 2025 and is forecasted to hit around USD 30.62 billion by 2034, representing a CAGR of 16.98% from 2025 to 2034. The North America market size was estimated at USD 2.68 billion in 2024 and is expanding at a CAGR of 17.00% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global behavioral and mental health software market size was calculated at USD 6.38 billion in 2024 and is predicted to increase from USD 7.49 billion in 2025 to approximately USD 30.62 billion by 2034, expanding at a CAGR of 16.98% from 2025 to 2034. The growing awareness of mental health among the people and supportive government policies for the mental well-being of the people are driving the growth of the behavioral and mental health software market.

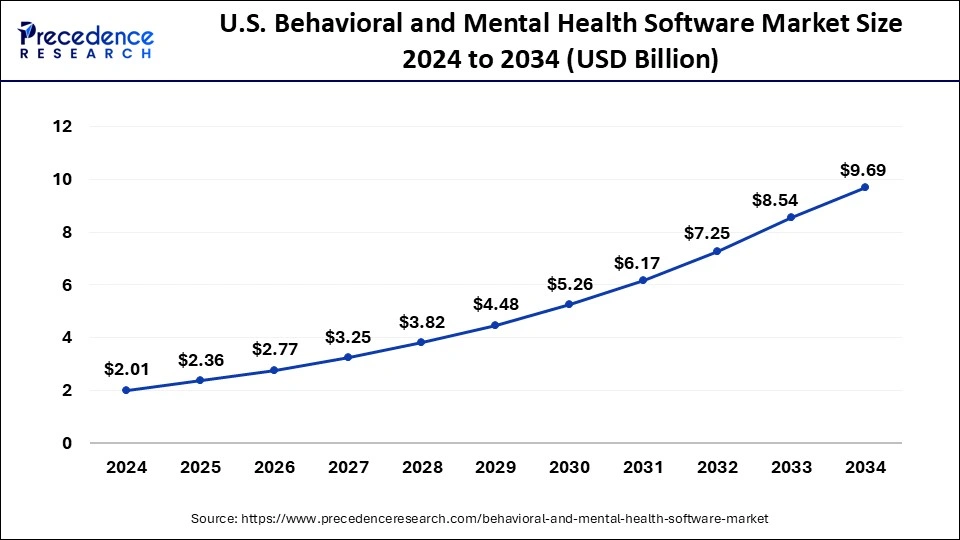

The U.S. behavioral and mental health software market size was exhibited at USD 2.01 billion in 2024 and is projected to be worth around USD 9.69 billion by 2034, growing at a CAGR of 17.03% from 2025 to 2034.

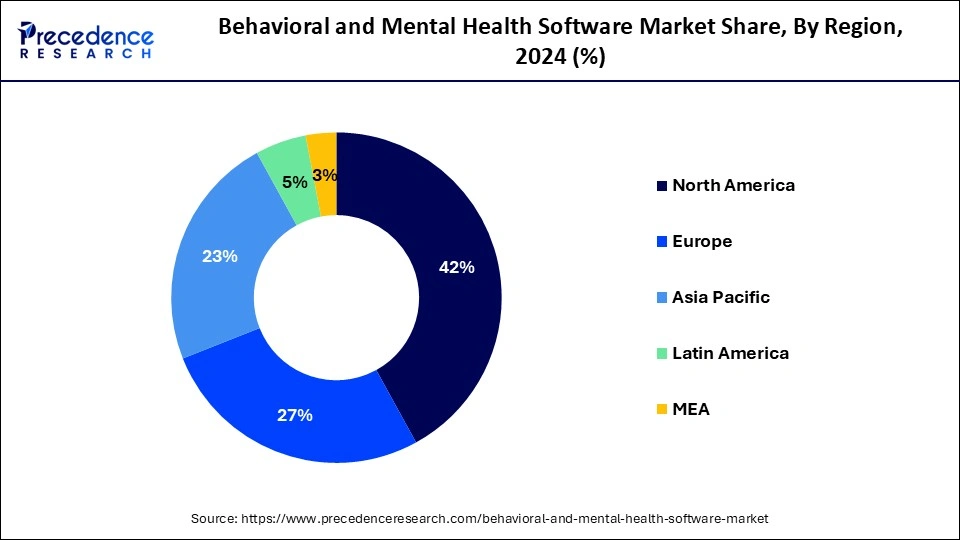

North America dominated the behavioral and mental health software market share of 42% in 2024. The growth of the market in the region is attributed to the rising technological advancements in the healthcare infrastructure and the rising economic development in countries like the United States and Canada, which are increasing the per capita income and surging the expenditure in healthcare. The rising cases of mental health disorders and the increasing awareness among people for the treatment of mental health disorders are driving the growth of the market. Additionally, the supportive government policies favoring the mental well-being of individuals are boosting the growth of the market across the region.

Asia Pacific is expected to witness significant growth in the market during the forecast period in the behavioral and mental health software market. The growth of the market in the region is expected to increase due to the rising population, increasing investment, and supportive policies for the development of healthcare infrastructure. The rising cases of mental health disorders due to stressful lifestyles, environmental challenges, etc., are driving the cases of mental health illness that drive the demand for behavioral and mental health software. The expansion of applications like telehealth is further propelling the growth of the behavioral and mental health software market in the region.

Behavior and mental health software is commonly referred to as an application that looks after people's mental health. It is designed to maintain and support mental well-being. The behavior and mental health software and applications may be supported on gadgets like tablets, smartphones, and computers. The mental health application provides a wide range of functionalities and features for assisting people or the person suffering from the condition in managing their mental health. Mental health apps can support valuable insights for professionals in therapy or counseling practices. It is also used to track and monitor the progress of clients, allowing easy access and communication between clients and professionals.

The increasing adoption of software management tools for patient healthcare, government funding for the treatment of mental reforms, and the increasing number of psychiatry hospitals and facilities are collectively contributing to the growth of the behavioral and mental health software market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.98% |

| Market Size in 2025 | USD 7.49 Billion |

| Market Size by 2034 | USD 30.62 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Applications, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Development of telehealth

The rising adoption of telehealth is highly contributing to the growth of the market. Telehealth allows individuals to access mental health services in the comfort of their homes, without any transportation or break from work. It is considered for long-term treatment plans, though it enables the safer and more convenient option for in-person appointments. Telehealth can be accessed from devices like smartphones, tablets, etc., by combining digital tools with smartphone apps; the users can also take advantage of guided medications, mood tracking, and self-help resources, which drive mental well-being. Thus, all these factors are driving the growth of the behavioral and mental health software market.

Data security issues

Growing trends of digitalization across various industries have been observed over the past few years. As cloud storage and processing of data has become widely accepted, cases of data breaches have been observed worldwide. In the behavioral and mental health software market that involves sensitive and private data, lacking cyber security and data theft have become significant concerns. The increasing cases of data infringements, cybercrimes, and data leakage are hampering the growth of the market by creating distrust among consumers and other end users. Thereby, such security concerns act as a major restraint for the behavioral and mental health software market.

Personalized or custom-made behavioral and mental health software

Personalized or custom-made behavior and mental health software provide many benefits to the professionals as well as the patient. Personalization allows user experience, which drives the consumer experience, increasing engagement. It designed efficient features to incorporate the advanced functionalities and features that meet the specific demands of mental health challenges. This feature provides valuable insights and resources to support the users and empower them in their mental health journey. Thus, the rising demand for custom-made mental health apps or software opens up a potential opportunity for the behavioral and mental health software market.

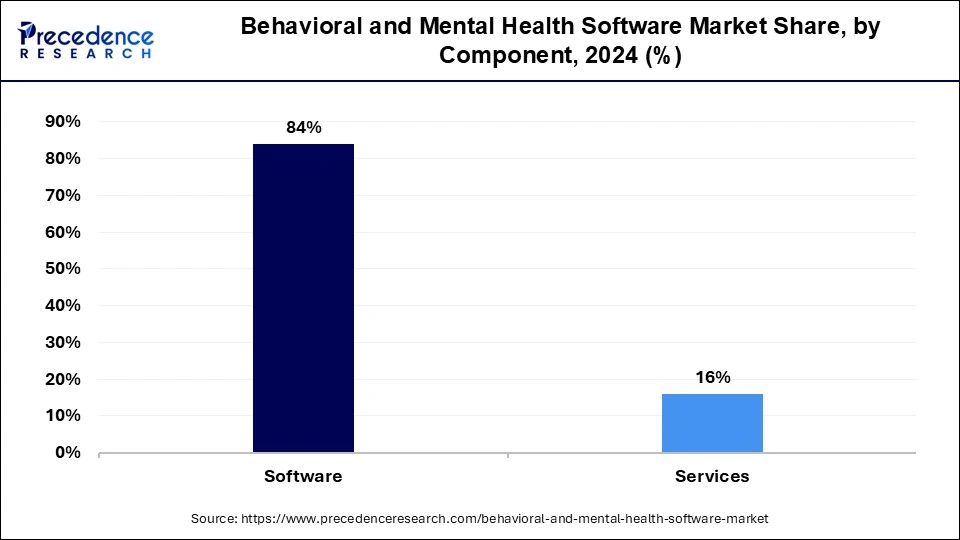

The software segment dominated the behavioral and mental health software market share of 84% in 2024. The growth of the segment is attributed to the rising adoption of software tools in the psychic clinics for streamlining the business and patient care functions. The rising demand for electronic solutions for managing administrative processes and clinical functionalities is driving the demand for the segment. Software solutions like electronic health record (HER) systems allow patients to access more data from anywhere. Behavioral and mental health software is also used to maintain and manage data like invoices, bed availability in hospitals, appointments, billing, etc., which is efficient in running the business smoothly.

Besides, the services segment is observed to expand at a significant rate during the forecast period. Behavioral and mental health software needs to evolve to meet changing regulatory requirements and technological advancements. Services providers offer updates and upgrades to ensure that the software remains relevant and effective. Compliance with healthcare regulations is often critical in such industries. Service providers offer assistance in ensuring that the software meets regulatory requirements.

The clinical segment dominated the behavioral and mental health software market in 2024. The rising consumption of behavioral and mental health software in clinical applications for various administrative services supports the segment’s expansion in the market. Behavioral and mental health software provides services like documentation, billing, claim filing, coding, appointment scheduling, etc. The cases of psychic conditions and the increasing number of patients are driving the demand for behavioral and mental health software in clinics for the management of data that accelerates the growth of the behavioral and mental health software market.

The administration segment is expected to grow at the fastest pace in the behavioral and mental health software market during the forecast period. The segment is further divided into managed care, RCM, payroll, and general ledger. The growth of the segment is attributed to the growing demand for the essential software application to view multiple providers in a single place. The rising adoption of RCM platforms, continuously changing reimbursement scenarios, and the rising cost of care are driving the demand for behavioral and mental health software in the administrative segment.

The private practices segment held the largest share in behavioral and mental health software market in 2024. The increasing number of cases of mental health conditions like anxiety, depression, and post-traumatic stress disorders in the population resulted in the increasing number of counselors or professionals providing the services in private, fueling the growth of the segment. Additional digital transformation in the healthcare sector has widely helped private practitioners to help the rising number of mental health cases in the population. The increasing lifestyle changes, eating and sleeping habits, and work stress resulted in increased cases of depression and anxiety in the population, and the rising awareness of mental health drove people to get help for mental health issues from professionals or private practitioners.

The hospitals segment is observed to witness the fastest rate of expansion during the forecast period. Many hospitals are affiliated with academic institutions, which conduct research and offer training in mental health care. These institutions require specialized software for research data management, training simulations and educational purposes. Hospitals typically served larger patient populations compared to individual practices, necessitating robust software solutions to manage the high volume of patient data and appointments efficiently.

By Component

By Applications

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2024