October 2024

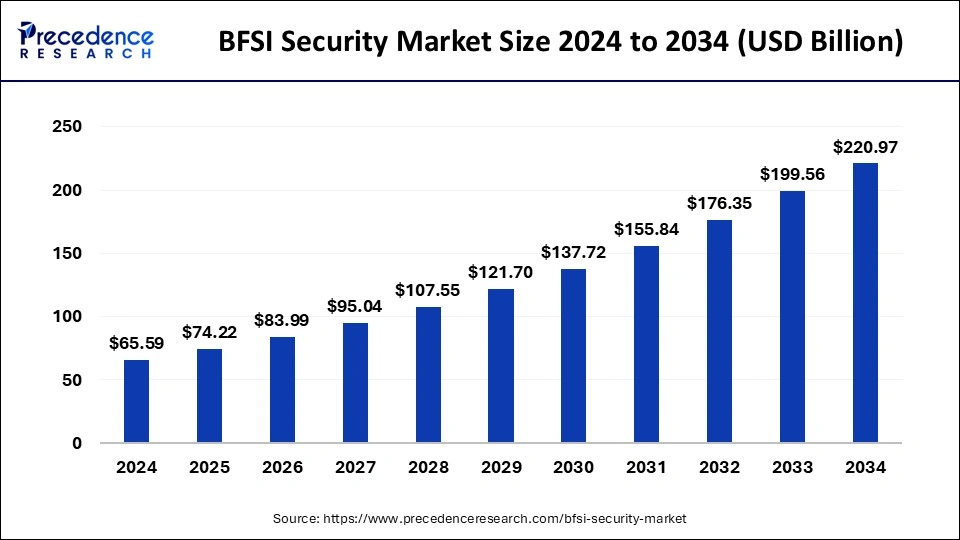

The global BFSI security market size is calculated at USD 74.22 billion in 2025 and is forecasted to reach around USD 220.97 billion by 2034, accelerating at a CAGR of 12.91% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global BFSI security market size accounted for USD 65.59 billion in 2024 and is predicted to increase from USD 74.22 billion in 2025 to approximately USD 220.97 billion by 2034, expanding at a CAGR of 12.91% from 2025 to 2034. The rising prevalence of cyber threats and customer data leakage drive the market's growth.

The BFSI industry is also considered to be the banking, finance, services, and insurance industry, as per consumer demands. The BFSI industry includes commercial banks, insurance banks, non-banking financial companies, and small financial institutions. Technological integration, such as digitization of artificial intelligence, blockchain, cyber security, and robotic process automation, contributes to the expansion of the BFSI industry. The rising population and the increasing awareness about the banking and insurance industry drive the customer base in the BFSI industry, driving the demand for enhanced security systems from the data protection that drives the growth of the BFSI security market.

| Report Coverage | Details |

| Market Size by 2034 | USD 220.97 Billion |

| Market Size in 2025 | USD 74.22 Billion |

| Market Size in 2024 | USD 65.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.91% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Physical Security, SeInformation Security, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digitization in the BFSI industry

The digitization in the BFSI industry enhances the work culture and the efficiency of the process. Digitization combines the most technologically advanced tools for increasing organizational efficiency and taking on multi-dimensional benefits. Digitization is a safeguard operational with customer relevance, effortless Omni-channel experience, and digital security. Digitization helps the consumer in various processes, such as faster services, onboarding of loans and their disbursements, and quick customer response. Digitization replaces the traditional tedious process of business credit applications with the digitized business credit application. With the help of digitization, companies are integrating the latest technologies to streamline the consumer experience by offering relevant insights to consumers. Thus, the adoption of digitization in the BFSI industry streamlines security as well as other processes.

Cost of the services

The high cost of implementing advanced security software and solutions is a major constraint for small and medium-sized firms looking to adopt comprehensive security systems in the BFSI (Banking, Financial Services, and Insurance) sector. This financial barrier limits the growth of the BFSI security market, as many smaller firms may not have the resources to invest in such advanced security measures. As a result, finding cost-effective solutions that still provide robust protection is crucial for broader market adoption. Overcoming this barrier could involve developing more affordable security options tailored to the needs and limitations of small and medium firms in the BFSI security market.

Emerging trends in the BFSI security

The prevalence of cyber threats in the BFSI industry is growing continuously, and BFSI industries are adopting the major emerging trends to minimize threats like cyberattacks, frauds, data leakage, etc. Some technologically advanced tools revolutionalize the security process in the financial sector: the adoption of artificial intelligence in fraud detection, reliability on advanced blockchain systems, secure access service edge (SASE) solutions, latest regularity technologies (Regtech), digital-only banking, zero trust adoption, and payments innovations are the major advancements in the cybersecurity system in the banking and insurance sector. All these cyber security advancements help safeguard sensitive data and systems from external attacks, protect identity, manage vulnerability, and protect data privacy. The adoption of these technologies in security management enhances the growth opportunity in the BFSI security market.

The video surveillance segment dominated the BFSI security market with the highest market share in 2023. The growth of the segment is attributed to the rising advancements in the BFSI industries and the rising adoption of video surveillance for security purposes in banking and insurance companies, which are driving the expansion of the segment. It is used in the banking and insurance industry's infrastructure. Video surveillance is used to secure and intrude on-premises. Video surveillance systems include components like display units, recorders, cameras, monitors, transmission equipment, and control systems.

Technological advancements in video surveillance for better service and rising market participation in video surveillance manufacturing are driving the growth of the BFSI security market. Video surveillance is deployed to monitor operations and vandalism and prevent theft, accidents, and damage to property to increase situation awareness and public safety.

The encryption software segment is expected to grow at the fastest rate during the forecast period. The growth of the segment is attributed to the rising threat of data leakage that drives the demand for the software encryption segment. Encryption software is highly adopted by the banking and insurance sector for the prevention of unauthorized access and the protection of data associated with customer and transactional data. The integration of smart technologies in encryption software enhances the process of identifying unauthorized data and helps prevent sensitive data. Encryption software is used to prevent data from hackers and spying entities from hacking the personal or transactional data of customers in the banking and insurance industry. Some of the major types of encryption software tools are BitLocker, LastPass, VeraCrypt, AxCrypt, HTTPS Everywhere, Boxcryptor, Bitwarden, and NordLocker. The technological advancements in encryption software are driving the expansion of the encryption software segment in the BFSI security market.

The banking sector held the largest market share in 2023 and is expected to grow with the fastest CAGR during the forecast period. The growth of the segment is attributed to the rising adoption of technological advancements like digitization, artificial intelligence, and others in the banking sector, which are driving the growth of the BFSI security market. The rising BFSI industry due to the increasing global population and the rising income in the population has led to the higher adoption of the banking sector and the increasing ratio of customer data that demands efficient security systems for the prevention of data security of the customer data that drives the growth of the security systems in the banking sector.

North America led the BFSI security market with the largest market share in 2023. The growth of the market in the region is increasing due to the early adoption of technologies in the banking and insurance industries that are driving the growth of the market. The increasing presence of the major market players in countries like the United States and Canada is boosting the growth of the market. The technological advancements in surveillance and the software tools in the security system in the banking and insurance sector, as well as the rising investments in research and development activities in the advancements in security enhancements, drive the growth of the BFSI security market in the region.

Asia Pacific is expected to witness the fastest growth in the market during the forecast period. The growth of the market in the region is expected to increase due to the rising population of countries like China and India, which led to the increasing demand for the banking and insurance sector and the demand for enhanced security systems for customer data protection, which drives the growth of the market. The rising investments in research and development activities in the development of technologies in the security system drive the expansion of the BFSI security market in the region.

By Physical Security

By Information Security

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

February 2025

December 2024