August 2025

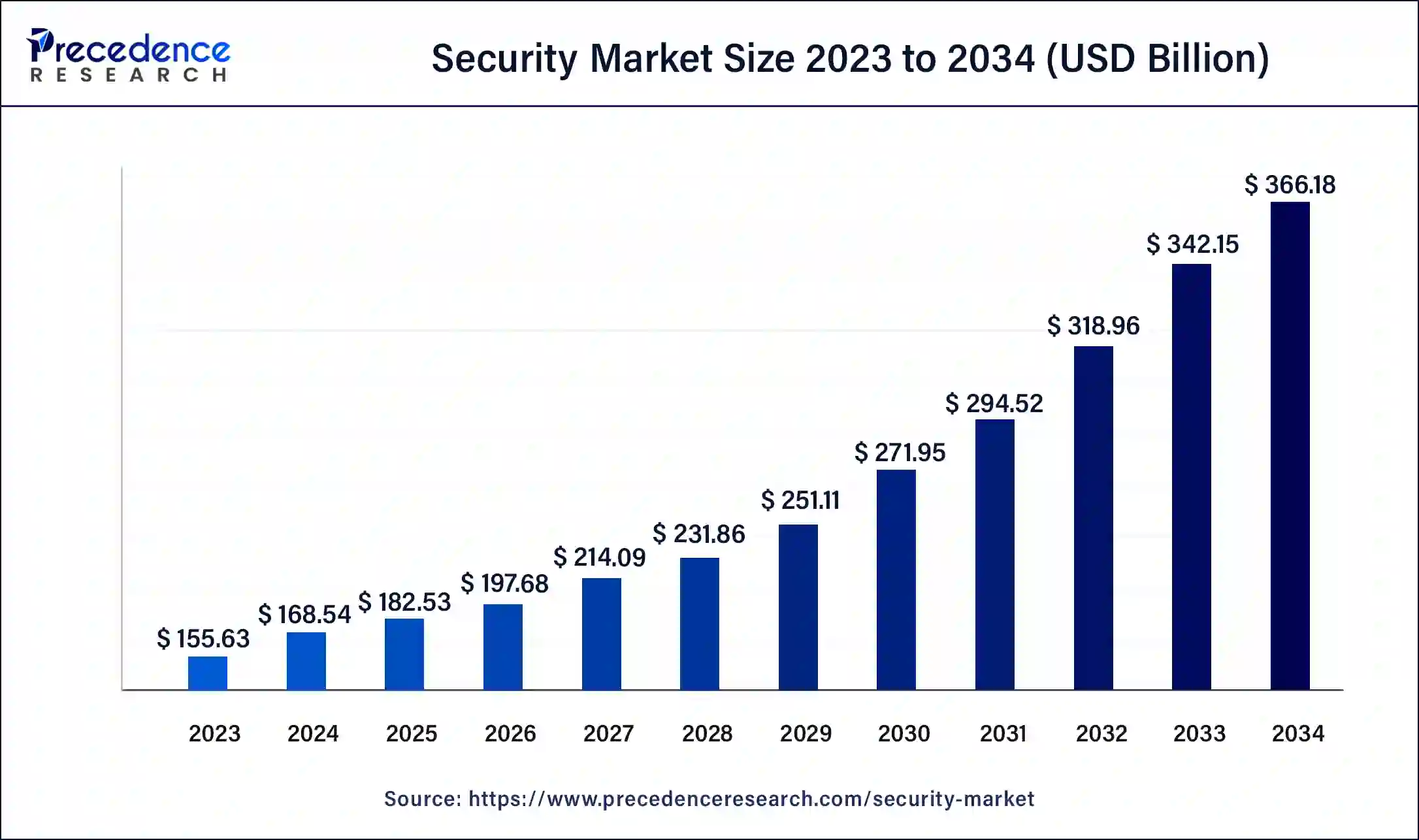

The global security market size accounted for USD 182.53 billion in 2025 and is predicted to reach around USD 366.18 billion by 2034, growing at a CAGR of 8.07% from 2025 to 2034.

Security describes a collection of cybersecurity techniques that guard against unauthorized access to the data, computers, and networks that belong to an organization. It covers a variety of IT security topics, including network, web endpoint, cloud computing, user, and application security. By preventing hackers from accessing sensitive information, it helps to retain its integrity and confidentiality.

One of the key factors encouraging businesses to install cutting-edge security systems for preventing malicious threats and potential security breaches, which can have a significant negative impact on a company's financial health, is the rise in cybercrime and fraudulent activities. Additionally, IT security is widely used in the energy industry to fulfil the growing need for a consistent supply of power worldwide. In addition, medical businesses now rely on specialized information systems including electronic healthcare records (HER), e-prescribing, practice management assistance, clinical decision assistance, radiological information, and computerized physician order input. This raises the need for safeguarding the availability, confidentiality, and integrity of electronic data and assets against unauthorized access, use, and disclosure, consequently promoting market expansion.

The prevalence of illicit operations, terrorism, and fraudulent operations throughout the world, as well as strict government regulations, have prompted a surge in the use of security systems. Additionally, the growth of smart cities has increased the demand for security measures. The benefits of security systems include keeping information records, keeping an eye on what happens in business and residential regions, and arming countries to combat terrorism and external threats in various places. Due to the rising threat of terrorism and worldwide incursions, these systems are widely used in the military and defense end-use business.

For instance, in January 2022, the Securities and Exchange Board of India (SEBI), India's regulatory body for the securities and commodities markets, released a mobile app called Saathi for investor education. The app's objective is to inform users about the basic concepts behind the market for securities. Over the course of the projection period, factors including rising inter-border conflict and rising terrorism are anticipated to hasten industry expansion. In order to offer information access from desired places through either wireless or wired connectivity, manufacturers of security systems utilize a variety of cameras, including pan, rotation, and zoom cameras, that are connected to the internet.

For instance, American technology company Alarm.com announced Smart Arming in December 2022. This new version intelligently arms and disarms Alarm. com-powered home security systems based on the user's activities. Rapid systemic technology improvements have made live monitoring at remote and crucial sites possible with improved precision, such as the usage of security systems connected to the internet. Additionally, it has boosted the use of sophisticated security systems with superior product features and enhanced functionality. Additionally, the substitution of monitoring systems for the human labor formerly required to conduct crucial tasks in dangerous environments is anticipated to boost business expansion.

| Report Coverage | Details |

| Market Size in 2025 | USD 182.53 Billion |

| Market Size in 2026 | USD 197.68 Billion |

| Market Size by 2034 | USD 366.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.07% |

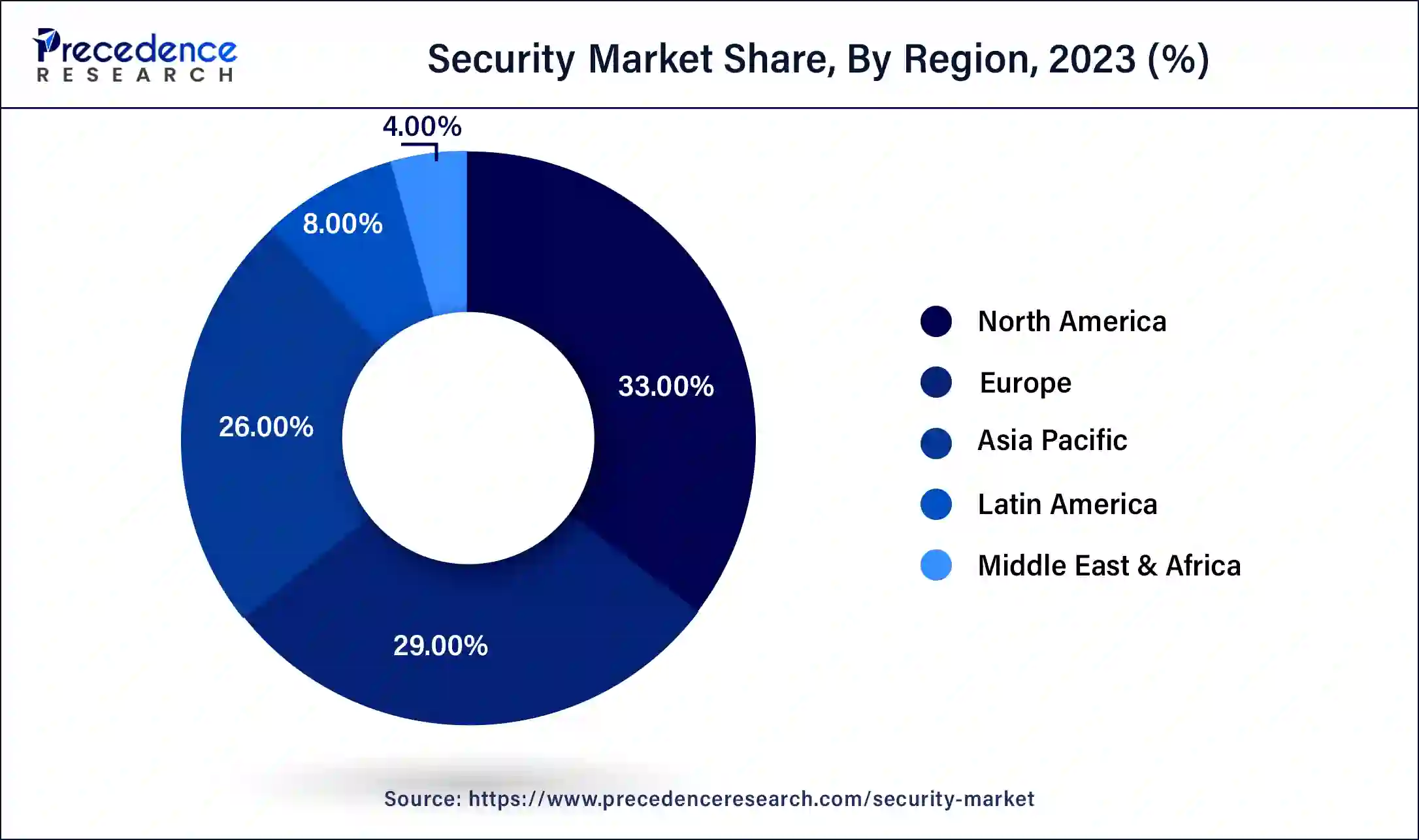

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System, Service, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in terrorism and illegal activities across the globe

The threat posed by transnational organized crime (TOC) to the security of the nation and the world is large and expanding, and it has serious repercussions for global public health, safety, democratic processes, and economic stability. Criminal networks are not only growing but also broadening their operations. As a consequence, dangers that were once separate and now have explosive and destabilizing repercussions, have converged. Demand for security products and services has frequently increased when terrorism and unlawful activity have increased. Governments, companies, and people often invest more in security measures to safeguard themselves and their possessions when societies confront increased security risks. High-profile terrorist acts and criminal activity may increase public awareness of security flaws and encourage people and organizations to take preventative measures to safeguard their assets and data. In response to security concerns, governments frequently commit additional funds to bolstering their security infrastructure, which may increase the requirement for security systems and technology. New and advanced security solutions are developed as technology advances.

High cost of security systems

Whether pick a wired or wireless security system will have a significant impact on the price and convenience of installation. Depending on where wish to install the wireless camera. Installing a wired system as opposed to a wireless one will normally cost two to three times as much. High-resolution cameras, infrared sensors, facial recognition software, and cloud storage are just a few examples of the sophisticated technology that is frequently used in advanced security systems. The expense of creating and maintaining these technologies might increase consumer costs.

A lot of security systems include monitoring services to keep an eye on your home constantly. The continuing staffing and infrastructure requirements for these monitoring services raise the total cost. Companies that spend in R&D to produce cutting-edge security solutions take their costs into account when determining the price of the finished product. Security system integration and installation might call for specialized knowledge and abilities. Businesses could charge more for expert installation and system setup.

Stringent industry standards and government regulations

Protecting user data and privacy has become a top priority due to the growing usage of linked devices and the Internet of Things (IoT) in security systems. Strict rules for the collection, processing, and storage of personal data are set out by regulations like the General Data Protection Regulation (GDPR) in the European Union and various regional data protection legislation. To protect people's right to privacy, a number of laws apply to the usage of surveillance cameras and video recording equipment. Laws frequently specify the locations and methods of surveillance, the duration of data retention, and who has access to the video footage. Access control systems may be governed by standards and laws to guarantee that only those with the proper authorization may access certain locations or information, particularly in critical infrastructure and government institutions.

Throughout the anticipated period, video surveillance will dominate the market for commercial security systems. The rising use of IP cameras reduced installation costs, making video monitoring more affordable. High-definition IP cameras also deliver a vastly better set of features. As a result, the market for video surveillance has expanded due to greater functions, from basic to sophisticated analytics, higher performance, and enhanced features, all of which are accessible at a lower price. The commercial security software market's "video surveillance software offering" is anticipated to have the quickest growth over the anticipated timeframe. Future usage of video surveillance systems is anticipated to rise due to features including better operational effectiveness and building security. These surveillance devices are affordable and aid in drawing attention to illegal activity.

The adoption of risk analytics products and services is anticipated to be influenced by a number of reasons, including expanding government compliance with strict industry regulation, increasing instances of data theft and security breaches, and growing complexity in company processes. Risk analytics software solutions are being adopted at a good rate on a global scale. These solutions are essential for producing insights that can be put into practice, empowering C-level managers to make wise choices. To address the issues with risk management, software solutions are provided, such as extract, transform, and load (ETL) tools, risk calculation engines, scorecard and visualization tools, dashboard analytical and risk reporting tools, and GRC software. Skilled professionals and professional services are the services available in the market. Throughout the forecast period, the services segment is expected to increase more quickly.

In 2024, the military & defense sector dominated the market and accounted for the highest revenue share of more than 26%. In the military & defense end-use market, security applications such as cameras high built-in programmable corrections, built-in processing of images, auto-exposure, and programmable exposure with accuracy are commonly used. The military & defense sectors of numerous countries have been compelled to build the finest security systems due to the rising threat of terrorism and international incursions. Additionally, law enforcement locations like jails, prisons, and other detention centers need to have a high degree of security to stop offenders from fleeing or committing crimes. For instance, the global release of the Border Intrusion Detection System was announced by the telecoms equipment company Vihaan Networks Ltd. (VNL) in March 2022. The firm offers intelligent border protection systems that use a variety of sensors to create a single, multi-layer security system that can detect, dissuade, delay, and prevent border invasions.

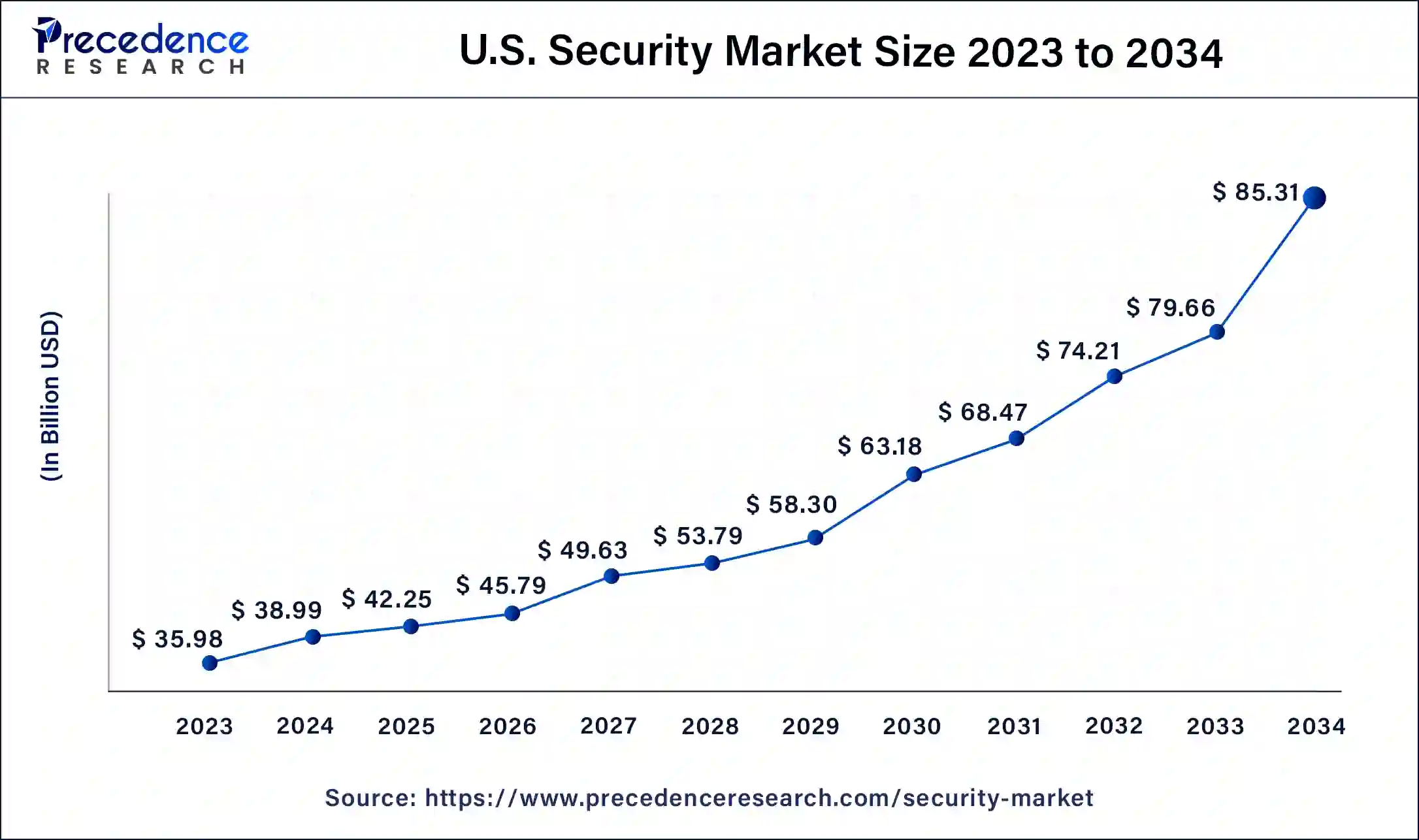

The U.S. security market size was valued at USD 42.25 billion in 2025 and is expected to cross around USD 85.31 billion by 2034, growing at a CAGR of 8.15% from 2025 to 2034.

In 2024, North America led the sector and generated a larger portion of worldwide revenue. This high percentage can be linked to the increasing terrorist activity and incursion in the area. Due to its advantages of remote access, optimized power usage, etc., monitoring systems are becoming increasingly important in a variety of applications, which is what is driving the market. The North American market is anticipated to develop as a result of an increase in security breaches, real-time responses to risks and threats, and the rise of big data.

For instance, as part of its drive to improve the services provided to people, IDEMIA Identity & Security North America announced in November 2021 a cooperation with the Mississippi Department of Public Safety to introduce Mobile ID to the state's inhabitants.

Europe is expected to grow significantly in the security market during the forecast period. The growing digitalization and geopolitical tension are increasing the need for national security. Therefore, to deal with the growing cyber attacks, the use as well as the demand for security systems is increasing. This, in turn, is increasing the development to provide new security solutions along with the integration of AI technologies. Furthermore, these developments are being supported by the investment provided by the government as well as regulatory bodies. Thus, this is promoting the market growth.

By System

By Service

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2025

July 2025

October 2025

May 2025