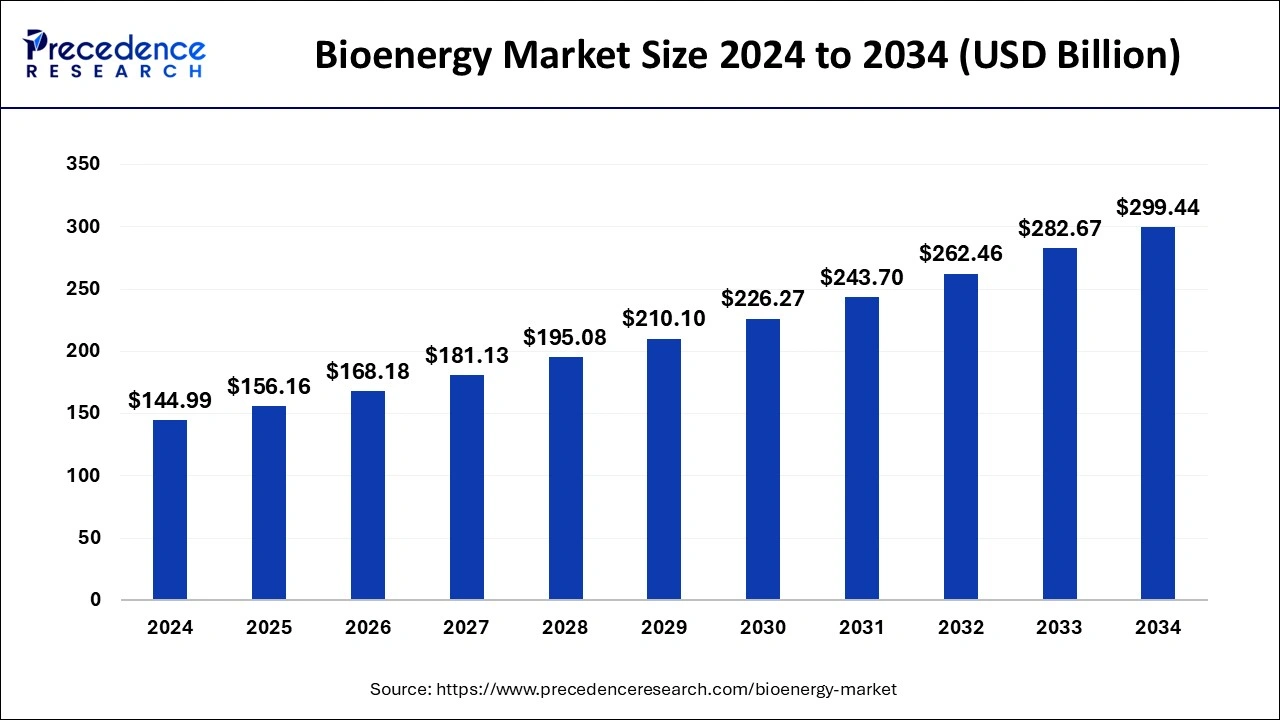

The global bioenergy market size is calculated at USD 156.16 billion in 2025 and is forecasted to reach around USD 299.44 billion by 2034, accelerating at a CAGR of 7.52% from 2025 to 2034. The North America bioenergy market size surpassed USD 66.70 billion in 2024 and is expanding at a CAGR of 7.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bioenergy market size was estimated at USD 144.99 billion in 2024 and is expected to surpass around USD 299.44 billion by 2034, growing at a CAGR of 7.52% during the forecast period 2025 to 2034.

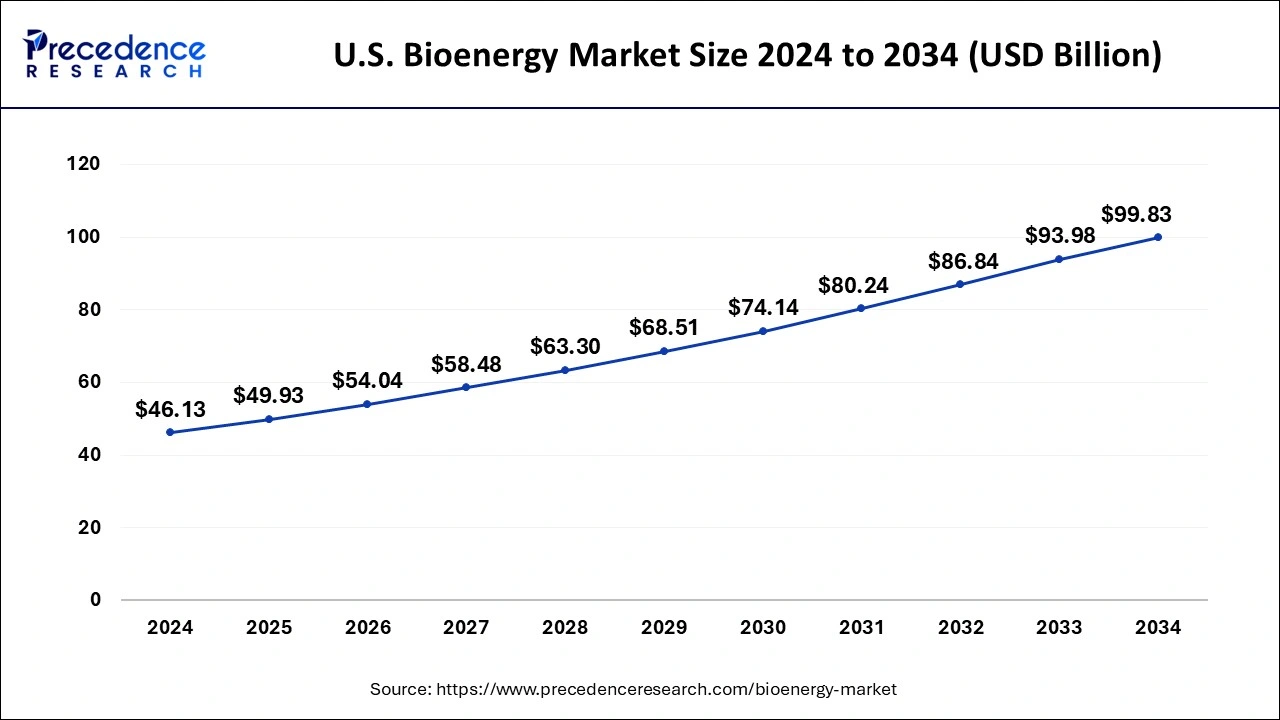

The U.S. bioenergy market size was estimated at USD 46.13 billion in 2024 and is predicted to be worth around USD 99.83 billion by 2034, at a CAGR of 8.03% from 2025 to 2034.

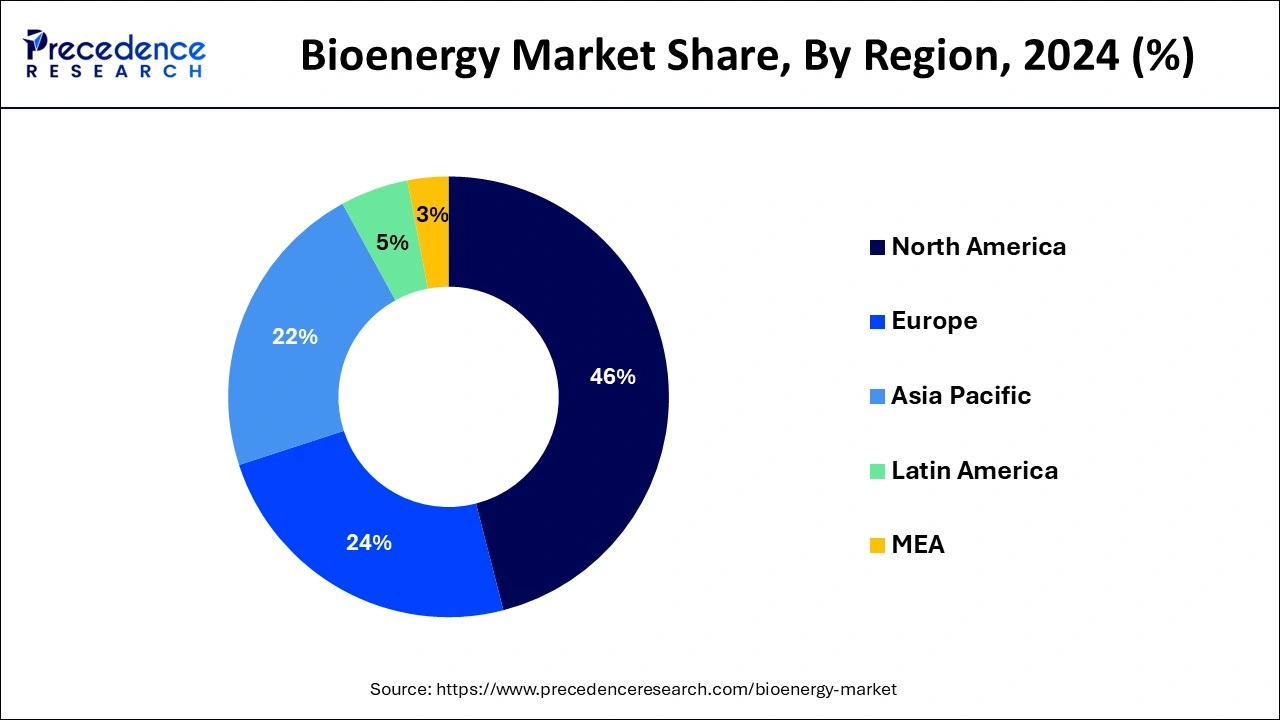

North America dominated the bioenergy market with revenue share of 46% in 2024. The U.S. dominated the bioenergy market in North America region. The factors such as rising investments in infrastructural development and energy projects, expansion of the energy industry, and growing initiatives by key market players towards the growth of the bioenergy market are supporting for the expansion of the bioenergy market in North America region.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. Many of the countries and states of Asia-Pacific region do not have proper sources for the generation of electricity. The demand for electricity in such regions is driving the demand for bioenergy in the Asia-Pacific region. In addition, increase in investments in research and development by government is also contributing towards the growth and development of the bioenergy market.

The bioenergy is generated by using different sources such as biomass, biofuel, organic waste, and biogas. These wastes are easily available in the market. Thus, these biowastes are utilized largely for the generation of bioenergy. As a result, the surge in demand for clean and green energy is driving the growth of the global bioenergy market over the projected period.

The factor such as implementation of favorable and stringent government regulations and guideline is contributing towards the expansion and development of the global bioenergy market. Moreover, the growing demand for renewable sources of energy is creating demand for bioenergy in the market globally. In addition, it has been noticed that the usage of bioenergy helps in the cost reduction and expenses for electricity generation. This factor is driving the growth of the global bioenergy market.

One of the primary factors driving the growth of the global bioenergy market is rising environmental and energy security issues. To save the environment with the adverse effects of global warming, the government agencies are constantly striving for the surge in the usage of the bioenergy all over the globe. Several nations are looking for alternatives to traditional energy sources because fossil fuels are limited and energy is obtained by them. Thus, bioenergy is widely used in every vertical of industries.

Bioenergy is quickly becoming one of the most popular alternatives to traditional energy sources, helping to diversify the fuel and energy mix and reduce reliance on global petroleum industries and sectors. This type of fuel is very expensive as compared to biofuels or bioenergy. That’s the reason, the government and private organizations have started utilizing bioenergy on a large scale.

| Report Coverage | Details |

| Market Size in 2025 | USD 156.16 Billion |

| Market Size by 2034 | USD 299.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.52% |

| Largest Market | North America |

| Base Yearx | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Feedstock, By Product, By Application, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Furthermore, bioenergy reduces a country’s reliance on trade of crude oil, which advantages countries with less or no reserves. As bioenergy and biofuel is sourced from local feedstock, government of developed and developing countries are incentivizing landowners and producers to produce biomass feedstock, which increase the rate of bioenergy production on a large scale at a rapid pace. As a result, all these factors are boosting the growth of the global bioenergy market during the forecast period.

The major factors and key market trends for bioenergy such as increased investment in bioenergy sectors is driving the growth and development of the global bioenergy market. The government agencies and private companies are collaborating with each other for the growth of the bioenergy market.

Furthermore, corporate organizations and government of developed and developed regions around the world are boosting their involvement in biofuel production through specific loans and subsidies. This has prompted suppliers to build plants with significant biofuel production capacity. While the bioenergy market is still in its infancy, these patterns of large-scale investment will attract more organizations and aid in the growth of the global bioenergy market over the forecast period.

The major market players are trying to acquire largest market share in the bioenergy market. For this, they are collaborating and partnering with government agencies for the bioenergy generation. Some of the key market players are collaborating or signing deals with International Energy Agency (IEA). This helps them to capture huge market share all around the globe. In addition, the technological developments and innovative technologies are helping market players for the generation of bioenergy effectively and efficiently without putting extra efforts. Thus, this is leading to market expansion.

The solid biomass segment dominated the bioenergy market in 2024. The solid biomass is largely used in Asia-Pacific and LAMEA regions. This type of bioenergy is utilized for multipurpose such as heating water and cooking. In addition, the government is providing incentives for the use of renewable energy sources, which is driving the segment growth.

The biogas segment is fastest growing segment of the bioenergy market in 2024. The government of developed and developing regions is providing tax rebates and subsidies for the installation of biogas plants. This factor is boosting the growth of the biogas segment.

In 2024, the wood and woody biomass segment dominated the bioenergy market. The large amount of wood is available all around the world. The factors such as easy and wide availability of trees, increased rate of production of electricity, and rising government initiatives for the growth of the bioenergy market are propelling the growth of the segment.

The agricultural waste segment, on the other hand, is predicted to develop at the quickest rate in the future years. The waste that is generated due to agricultural activities is known as agricultural waste. It has been observed that every year around 14% of the agricultural waste is being utilized in the production of bioenergy.

The heat generation segment dominated the bioenergy market in 2024. More than 50% of the bioenergy is utilized for the generation of heat. The underdeveloped and developing regions are mainly using bioenergy for this purpose only, which is propelling the growth of the global bioenergy market.

The transportation segment is fastest growing segment of the bioenergy market in 2024. The bioenergy is applicable for the transportation purpose. This is attributed to the increase in the demand and need for electricity as well as urbanization and industrialization.

By Product Type

By Feedstock

By Application

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client