January 2025

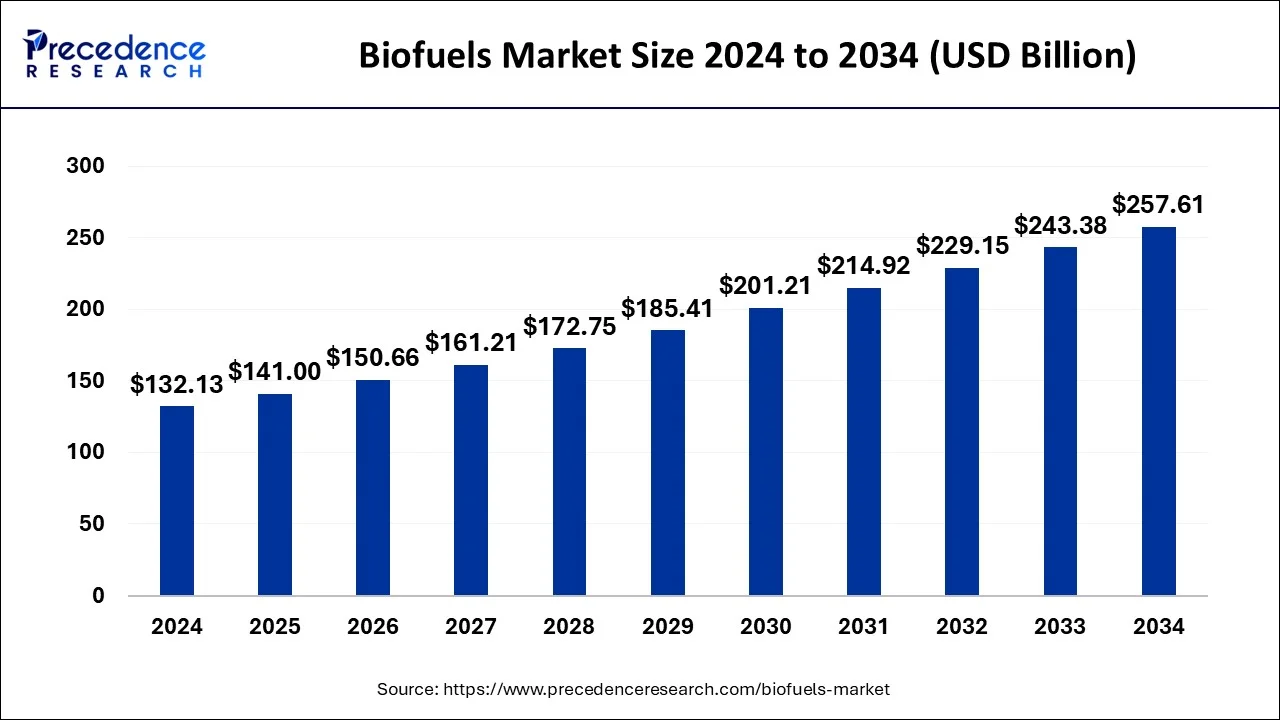

The global biofuels market size is calculated at USD 132.13 billion in 2024, grew to USD 141.00 billion in 2025, and is predicted to surpass around USD 257.61 billion by 2034, poised to grow at a CAGR of 6.9% between 2025 and 2034. The North America biofuels market size accounted for USD 50.20 billion in 2024 and is anticipated to grow at the fastest CAGR of 7.10% during the forecast year.

The global biofuels market size surpassed USD 132.13 billion in 2024 and is anticipated to reach around USD 257.61 billion by 2034, expanding at a CAGR of 6.9% over the forecast period from 2025 to 2034. Growing demand as environment-friendly fuel in road transportation, Rising awareness about use of renewables and rising focus on lowering greenhouse gas emission are major growth driver of biofuels market.

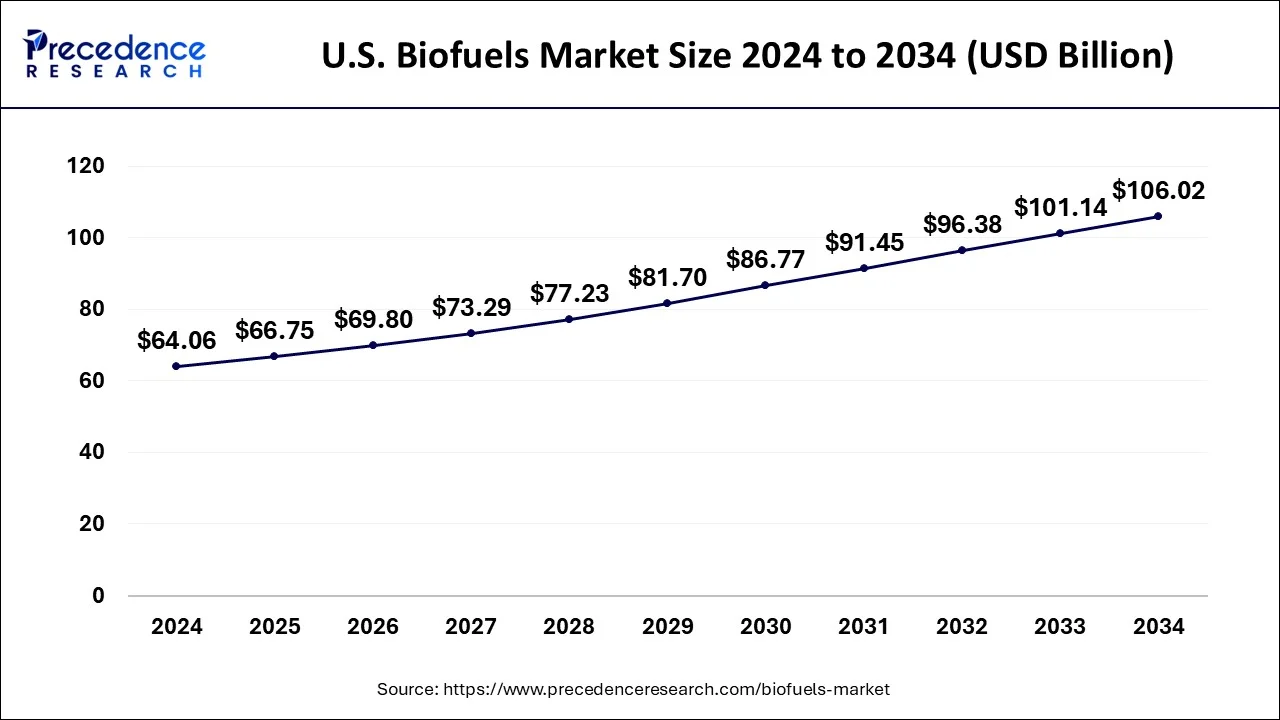

The U.S. biofuels market size accounted for USD 64.06 billion in 2024 and is projected to be worth around USD 106.02 billion by 2034, poised to grow at a CAGR of 5.17% from 2024 to 2034.

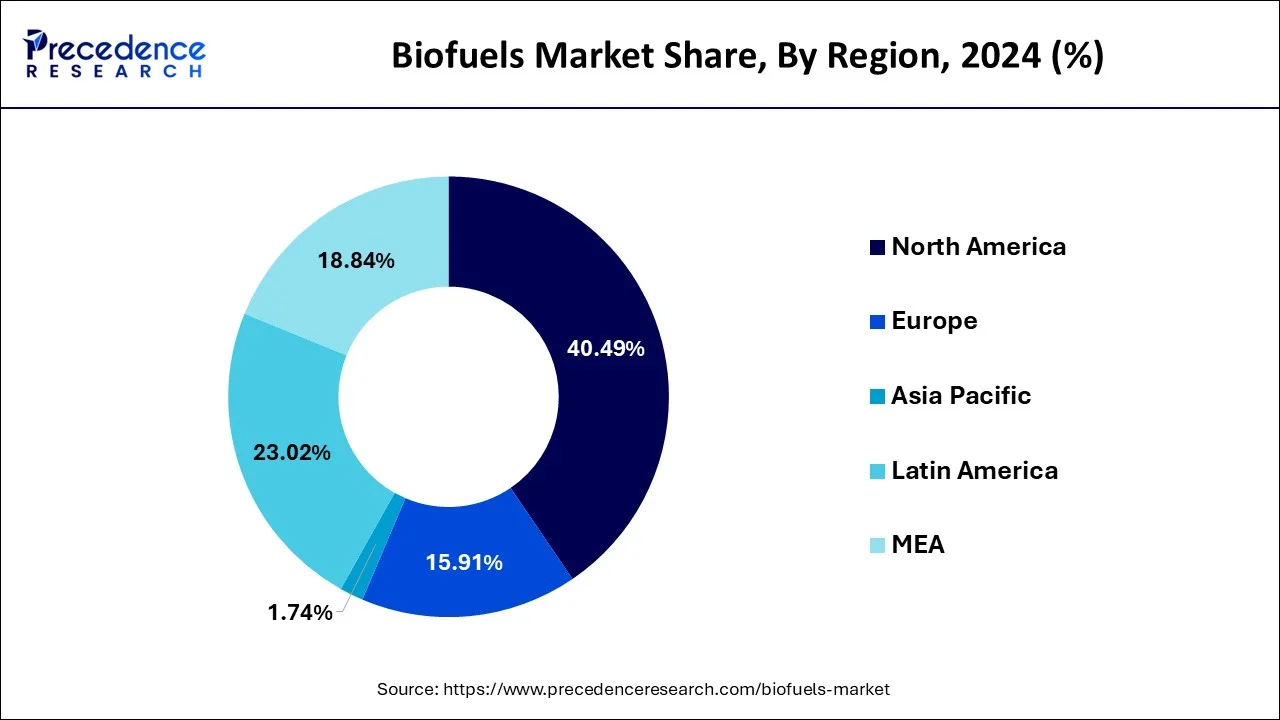

The research report covers key trends and prospects of biofuels products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. Geographically, biofuels market is conquered by North America owing to favorable government mandates for the biofuel production, coupled with the availability of abundant feedstock for the production of biofuels in the countries of this region, especially in the United States.

Asia-Pacific is anticipated to witness the rapid growth rate on account of increasing research and development investment by major market players and increasing awareness regarding use of renewables in the region. Also, growing focus on the application of the government regulations in order to reduce the green-house gases is another factor anticipated to propel growth of the target industry in the countries of the Asia Pacific.

Emerging applications of the biofuels are projected to generate lucrative growth opportunities for the major players operating in the global biofuel market. Biofuels are going to use as affordable and reliable jet fuels. The biofuels researchers and scientists have discovered production method which helps to produce jet fuel easily from the biomass. Further, technological advancements in the biofuel industry have reduced the cost of the biofuels which is among major factors used to replace the use of fossil fuels. In addition to this the introduction of newer feedstock for the production of the biofuels is another factor expected to support growth of the target industry in the near future. Also, emerging countries across the globe are focusing on increasing biofuel production in order to reduce GHG emission is creating opportunities in the target sector.

The global demand for biofuels is projected to surge by 41 billion litres, or 28%, over the period from 2021 to 2034. This substantial growth is driven by a variety of factors, including recovery from the Covid-19 pandemic and strong government policies. Let's delve into the specifics of this anticipated expansion and explore the regional dynamics shaping the biofuel market. In the United States and Europe, policies are particularly supportive of renewable diesel, also known as hydrogenated vegetable oil (HVO) in Europe. The demand for this fuel type is expected to nearly triple, driven by stringent environmental regulations and incentives for cleaner fuel alternatives. This growth underscores the critical role of policy frameworks in shaping fuel markets. China developed green technologies for methanol for maritime applications based on biomass gasification to produce 50,000 tons, by 2024.

Top Countries to Consume Biofuel:

| Region/Country | Consumption of Biofuel in 2022 | Policies and Projections |

| Europe | About 20 billion litres | The Renewable Energy Directive (RED II) mandates that 14% of the energy used in transport should come from renewable sources by 2030. |

| India | About 3 billion litres | The Indian government is pushing for a 20% ethanol blend (E20) by 2025, with current blending levels around 10%. |

| China | About 5 billion litres | The country has ambitious plans to expand ethanol use in gasoline, aiming for E10 (10% ethanol) nationwide. |

| United States | About 40 billion litres | The Renewable Fuel Standard (RFS) mandates significant biofuel blending in transportation fuels. |

| Report Highlights | Details |

| Market Size in 2024 | USD 132.13 Billion |

| Market Size by 2034 | USD 257.61 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.9% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel Type, Feedstock Type, and Regional |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Government Support

Multiple government bodies across the globe, especially from the emerging economies are focused on the development of policies that can support the overall development and demand for biofuels. As advanced biofuels become more popular, multiple industries are seen to adapt government policies to seek fundings and overall support, overall promoting the growth of the biofuels market. For instance, the Indian government has set a target of 5% biodiesel blending in diesel by 2030. Whereas a target of 20% bioethanol blending in petrol by 2025 or 2026 has also been set by the Indian government.

Decreased investments in the biofuels sector

In 2019, investments in liquid biofuels production capacity fell by roughly 30%, owing mostly to changes in China, where ethanol production facility investments were half compared to the previous year. To limit rivalry for maize production and ensure food security, China has put a stop to the extension of its 10% ethanol blending mandate across the country. Because 10% blending is still being implemented in some new provinces, investment in China could pick up in 2020, bolstered by new facilities already under construction.

In the United States and Brazil, policy-driven investment in ethanol-producing facilities has persisted. The Renewable Fuel Standard (RFS2) is the primary federal policy framework that encourages the use of biofuels in the United States. The new RenovaBio scheme in Brazil is driving growth. However, due to falling gasoline demand, shutdowns of biofuel production capacity in the United States and Brazil in 2020 are projected to restrict near-term interest for additional investments.

Technology Advancements in Biofuels

One of the world's most essential energy sources is petroleum oil. More than 70% of all petroleum fuel is used in the transportation industry. Because of the rapid increase in petroleum use, it is predicted that the world would run out of petroleum oil by 2070–2080. Due to greenhouse gas emissions (GHG), which include CO2 and other harmful gases including methane, carbon monoxide, and chlorofluorocarbons, its overuse has raised worries about health and global warming. By 2040, greenhouse gas emissions are expected to reach over 43 billion metric tonnes. As a result, complementary power options that are easy to get, renewable, and availability are required.

Biofuels are being developed as a replacement for petroleum since they are nontoxic, sulfur-free, and biodegradable, and they come from renewable sources. Biofuels are classified into four kinds based on the feedstock: 1st, 2nd, 3rd, and 4th generation biofuels. The first generation of biofuels is made from oil-based plants, sugar, and starch yields. The development of genetically modified yields has continued to rise since their introduction in 1996–1997. The first generation of biofuels contributes to the nutrition and fuel debates, however, the second generation biofuel obtained from sustainable lignocellulosic biomass lowers food safety concerns. Second-generation biofuels are non-food outputs derived primarily from agricultural and woodland wastes. Algae-based 3rd generation biofuels can be produced on a massive scale, absorb CO2, and are relatively simple to refine, earning them a lot of attention. Engineered cyanobacterial development is used in the fourth generation of biofuels, which is a novel and fast-expanding field.

Bioethanol Segment Reported Foremost Market Stake in 2024

The bioethanol segment recorded the prime market share in the global biofuels market by type in 2024. The rising use of bioethanol as an environment-friendly fuel in automotive applications in order to lessen global greenhouse gas emissions is a primary factor driving the growth of the bioethanol segment. Other factors such as increasing investment in research and development are projected to increase the usage of ethanol over the estimated period. Bioethanol's greater octane rating than ethanol-free gasoline raises the compression ratio of an engine, increasing thermal efficiency. Bioethanol fireplaces are also fueled with it. Because it is flueless and does not require a chimney, it is ideal for home use.

The biodiesel fuel type segment is predicted to rise at a noteworthy CAGR during the forecast time frame due to new product launches in the near future. Biodiesel is a biodegradable, renewable fuel made in the United States from vegetable oils, animal fats, or restaurant grease. Biodiesel satisfies the Renewable Fuel Standard's biomass-based diesel and total advanced biofuel requirements. Renewable diesel, commonly known as "green diesel," is not the same as biodiesel.

Biofuels Market Revenue, By Fuel Type, 2021-2023 (USD Billion)

| Fuel Type | 2021 | 2022 | 2023 |

| Biodiesel | 30.63 | 30.63 | 34.53 |

| Bioethanol | 79.32 | 79.32 | 89.45 |

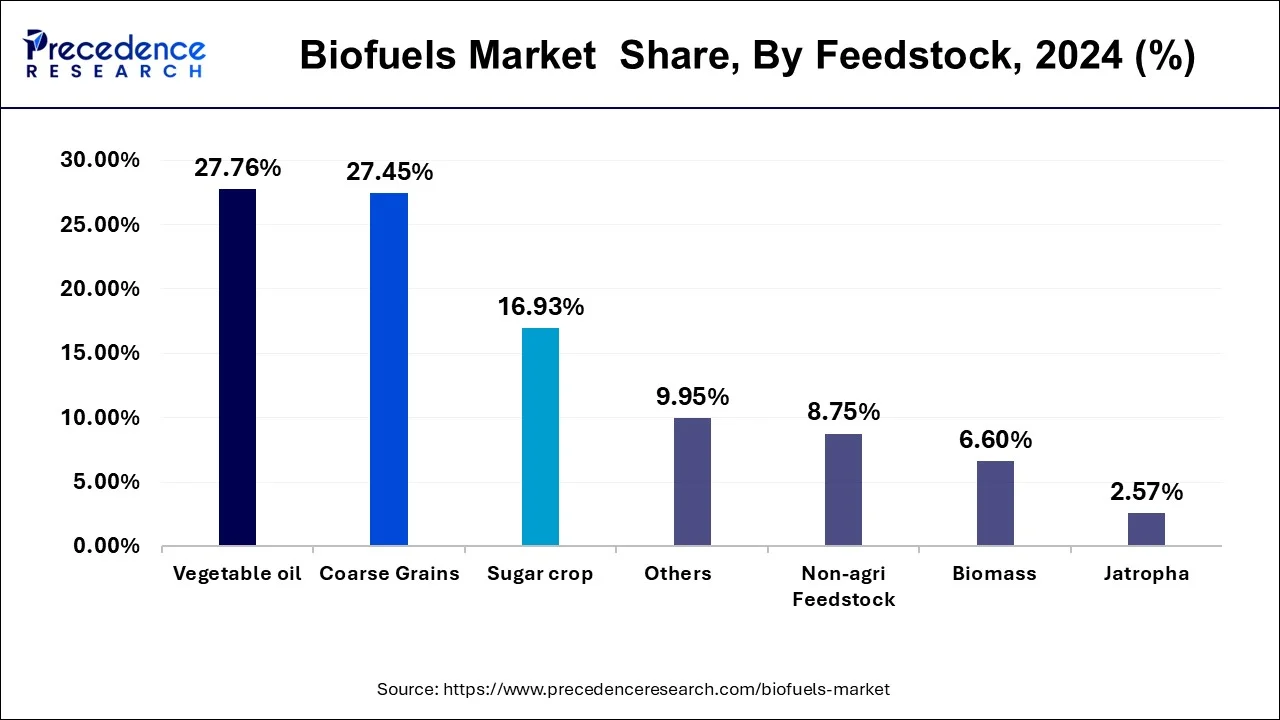

Vegetable Oil is Projected to Dominate the Feedstock Segment of Biofuels Market Revenue

The global market is segregated into coarse grain, sugar crop, vegetable oil, jatropha, and molasses. The vegetable oil feedstock segment is expected to dominate in terms of revenue over the forecast time frame. The growth is attributed to the benefits offered by vegetable oil such as low manufacturing costs and easy processing due to its low saturated fat contents. These factors are primarily responsible for the greater market share of vegetable oil in the feedstock segment of the biofuels market.

Although ethanol output is substantially larger, biodiesel production has increased at a faster rate since 2010, more than tripling between 2010 and 2015. Biodiesel now accounts for around 3% of all diesel fuel sold. In today's gasoline, 10% ethanol is incorporated into the majority of the blends.

The jatropha segment is observed to grow at the fastest CAGR of 13.1% during the forecast period. Jatropha seeds contain a relatively high oil content, typically ranging from 30% to 40%. This makes jatropha oil a potentially attractive feedstock for biodiesel production, as it can yield a significant amount of biofuel per hectare of cultivation. Jatropha is known for its ability to thrive in arid and semi-arid conditions, making it well-suited for cultivation in regions with limited water availability. Additionally, jatropha plants are relatively resistant to pests and diseases, reducing the need for chemical inputs and lowering cultivation costs.

Biofuels Market Revenue, By Feedstock, 2021-2023 (USD Billion)

| Feedstock | 2021 | 2022 | 2023 |

| Coarse Grains | 30.64 | 32.21 | 34.03 |

| Non-agri Feedstock | 9.33 | 10.03 | 10.84 |

| Biomass | 7.05 | 7.58 | 8.18 |

| Vegetable oil | 30.73 | 32.44 | 34.42 |

| Sugar crop | 18.72 | 19.77 | 20.98 |

| Jatropha | 2.34 | 2.74 | 3.19 |

| Others | 11.16 | 11.70 | 12.34 |

By Fuel Type

By Feedstock

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025