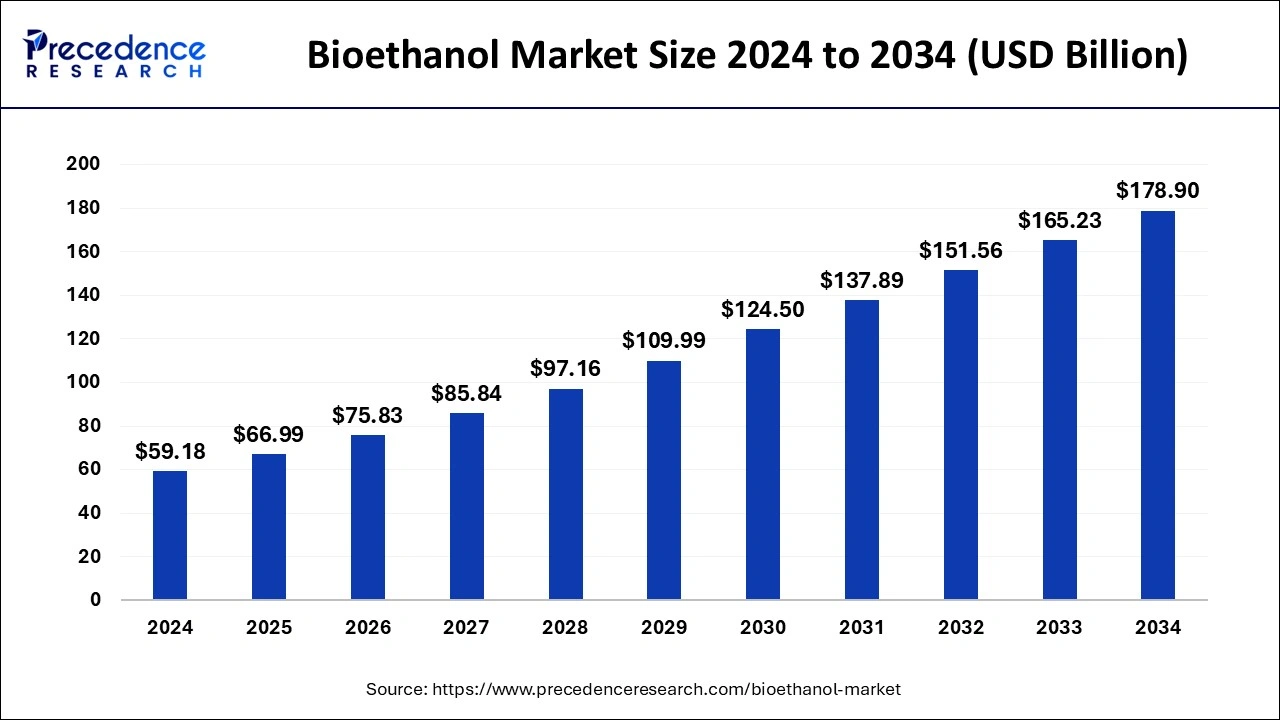

The global bioethanol market size is calculated at USD 66.99 billion in 2025 and is forecasted to reach around USD 178.9 billion by 2034, accelerating at a CAGR of 11.70% from 2025 to 2034. The North America bioethanol market size surpassed USD 21.30 billion in 2024 and is expanding at a CAGR of 11.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bioethanol market size was estimated at USD 59.18 billion in 2024 and is anticipated to reach around USD 178.9 billion by 2034, expanding at a CAGR of 11.70% from 2025 to 2034.

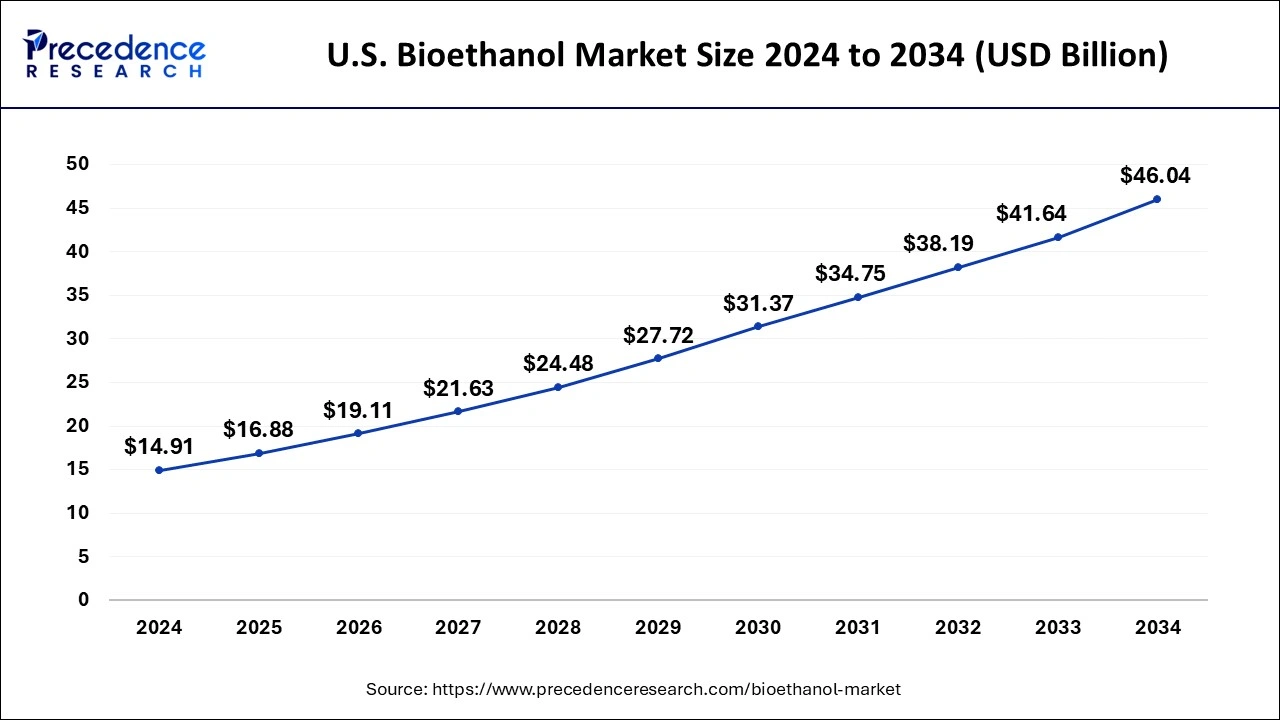

The U.S. bioethanol market size was evaluated at USD 14.91 billion in 2024 and is predicted to be worth around USD 46.04 billion by 2034, rising at a CAGR of 11.94% from 2025 to 2034.

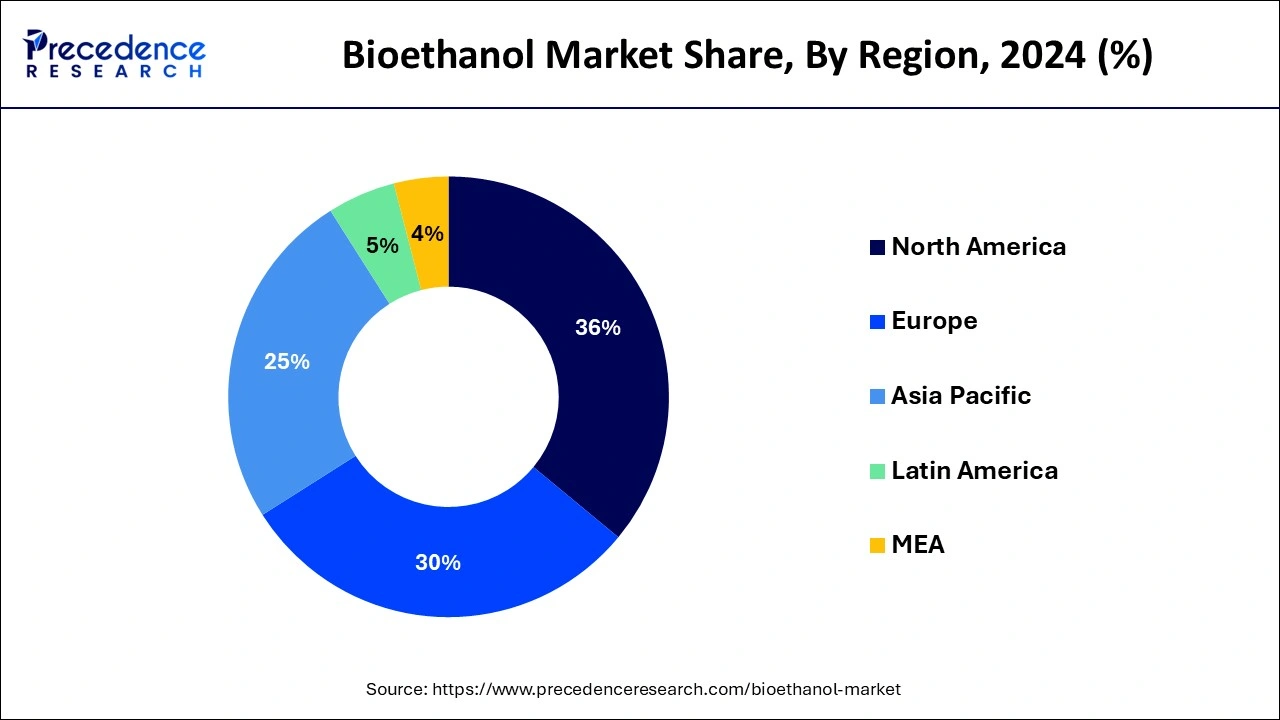

In 2024, North America had a 36% share of the global bioethanol market. Bioethanol is used as a replacement for normal gasoline due to the government's severe environmental laws. Technical advancements and the rapidly expanding vehicle sector are likely to considerably contribute to boosting demand in this area over the next 7 years.

Furthermore, the usage of bioethanol blends in automobiles is required in the USA and Canada. Aside from favourable biofuel regulations, the industry is being spurred forward by significant growth in corn-based production of bioethanol, increased crop yields, and a growing emphasis on energy efficiency.

Sugar cane molasses, starch crops, agricultural leftovers, and other discarded crops can all be used to make bioethanol. Manufacturers are focused on agricultural and forest leftovers, as well as energy crops such as miscanthus, switch grass, and sugarcane bagasse, for manufacturing. It may be used as a fuel both alone and in combination with other fossil energy. Bioethanol is a biodegradable, sustainable energy source produced from biomass by sugar fermentation and a chemical process. Because of its high-octane value as well as lower greenhouse gas emissions, bioethanol is an appealing alternative to traditional gasoline sources.

Fermentation, distillation, dehydration, and other industrial procedures are used in production. Bioethanol offers a variety of features, including physical stability, homogeneity, low viscosity, poor lubricity, anti-corrosiveness, and improved antiknock properties. Bioethanol's adaptability allows it to be utilised as a feedstock in the chemical industry, a fuel for generating power, a substitute for gasoline in road transport vehicles, and so on. Furthermore, one of the keys aims of the United Nations is to slow down and minimise global warming through the Sustainable Development Goals (SDG). Biofuels are critical in this regard. Furthermore, decreasing energy supplies and a greater emphasis on renewable energy sources are projected to drive market expansion. Due to its quick production rate and natural presence in the water, technological developments and increasing R&D to create ethanol from algae are predicted to enhance market demand, cutting production costs. Furthermore, because of the cheap prices relative to diesel and gasoline, usage will increase.

The COVID-19 epidemic has affected people's everyday life and changed the ethanol market needs for manufacturing usage in several nations. Despite these short-term repercussions, fuel ethanol requirements remain a viable option for future growth, and regional councils are working hard to promote market access in specific nations. As a result of the coronavirus pandemic, which is reducing gasoline usage and driving corn-based fuel off the market, some ethanol factories in the United States have reduced or reduced output. Governments have cut fuel needs as they encourage individuals to stay at home to prevent the COVID-19 outbreak.

Advanced technologies and expanding R&D for the manufacture of ethanol from algae are expected to drive market demand due to its quicker rate of production as well as natural occurrence in the sea, which lowers production costs. Growing environmental concerns about bioethanol production drive manufacturers' propensity, while blending rules from regulatory organizations such as the EPA (Environmental Protection Agency) and ample raw material availability drive market expansion. It is not necessary to change car engines since mixing ethanol with conventional gasoline promotes market expansion.

Bioethanol is composed of natural components that enable it to perform better than fossil fuels. Furthermore, combustion outcomes are more environmentally friendly than fossil fuels due to the absence of harmful sulphur and nitrogen molecules, and increased support for ecological arrangements is propelling market expansion. Aside from that, easing prohibitions on the sale of gasoline containing a high proportion of ethanol is rising the global market. Growing government initiatives to produce and use greener fuels are driving market expansion.

| Report Coverage | Details |

| Market Size in 2025 | USD 66.99 Billion |

| Market Size by 2034 | USD 178.9 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.70% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Feedstock, Fuel Generation, Blend, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits of bioethanol as compared to conventional fuel-

Increasing research and development activities

The transport end-use market sector of the bioethanol industry accounted for the biggest market share in terms of value and volume.

Bio-ethanol is used as a fuel and gasoline additive in the automobile and transportation industries. It is employed in combination with regular gasoline to power gasoline engines in cars. Bioethanol is less costly and less harmful to the environment than petroleum. To generate mixes that burn better efficiently and emit zero carbon dioxide, a little quantity of bioethanol is combined with pure gasoline. As a consequence, bioethanol fuel mixes are mandated in several nations throughout the world. As a result of the increasing usage of bioethanol with in transportation end-use industry, its market is growing.

The E-10 category had the greatest proportion of the bioethanol industry in 2024 and is expected to increase at a CAGR of 14.2% between 2025 and 2034. Blending bio-ethanol with conventional fuels improves their renewability. E10 is a gasoline mix that combines 90% ordinary unleaded fuel and 10% ethanol. Bioethanol is indeed a low-carbon biofuel that can help with transportation decarbonization. This may be put in the majority of new automobiles and light-duty diesel engines without modifying the engine or fuel system. Bioethanol consumption in the E10 sector is predicted to climb due to greater use in the automobile industry. To reduce global greenhouse gas (GHG) emissions, several governments in Europe and other areas have enforced the use of E-10 fuel mixes in cars. As a consequence, market for E-10 gasoline blends is increasing in a variety of end-use sectors, fueling market development.

By Application

By Feedstock

By Fuel Generation

By Blend

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client